Casual Info About Financial Statements With Adjustments Examples

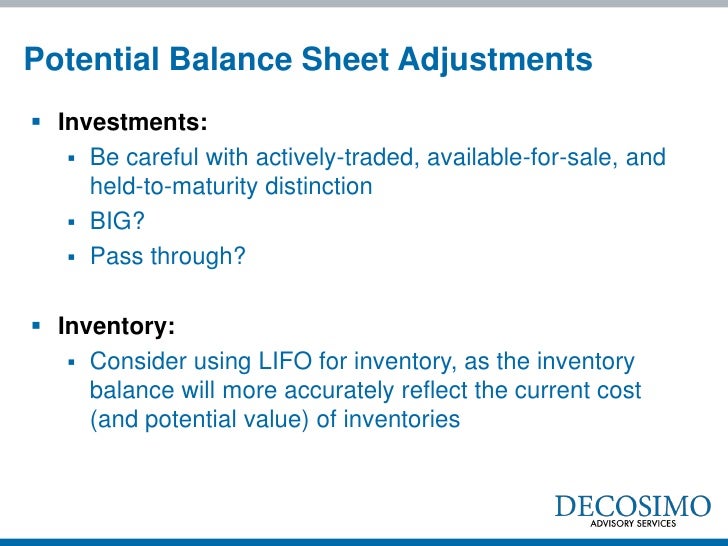

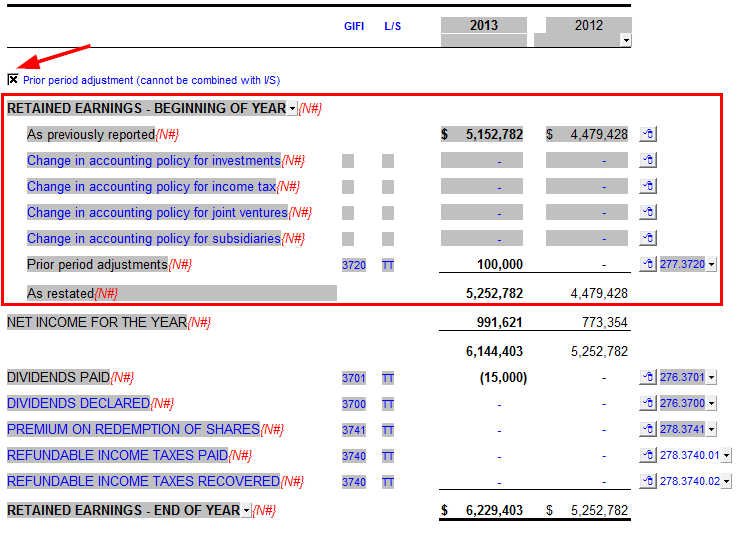

Analysts frequently make adjustments to a company’s reported financial statements when comparing those statements to those of another company that uses different accounting methods, estimates, or assumptions.

Financial statements with adjustments examples. 2,000 and create a provision of 5% of sundry debtors. Financial accounting (fa) adjustments to financial statements. Show on the assets side (usually under the head current assets) example.

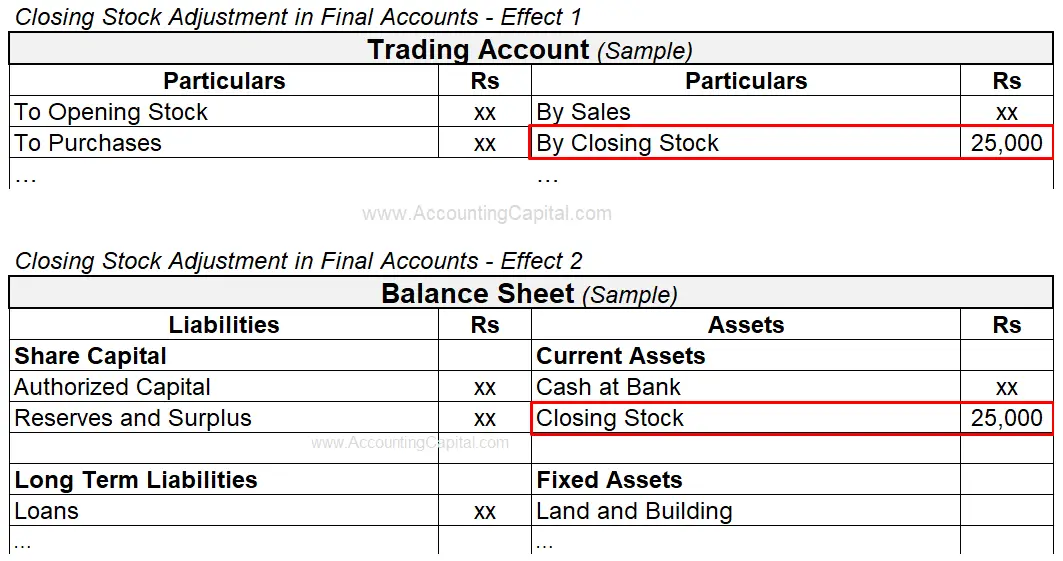

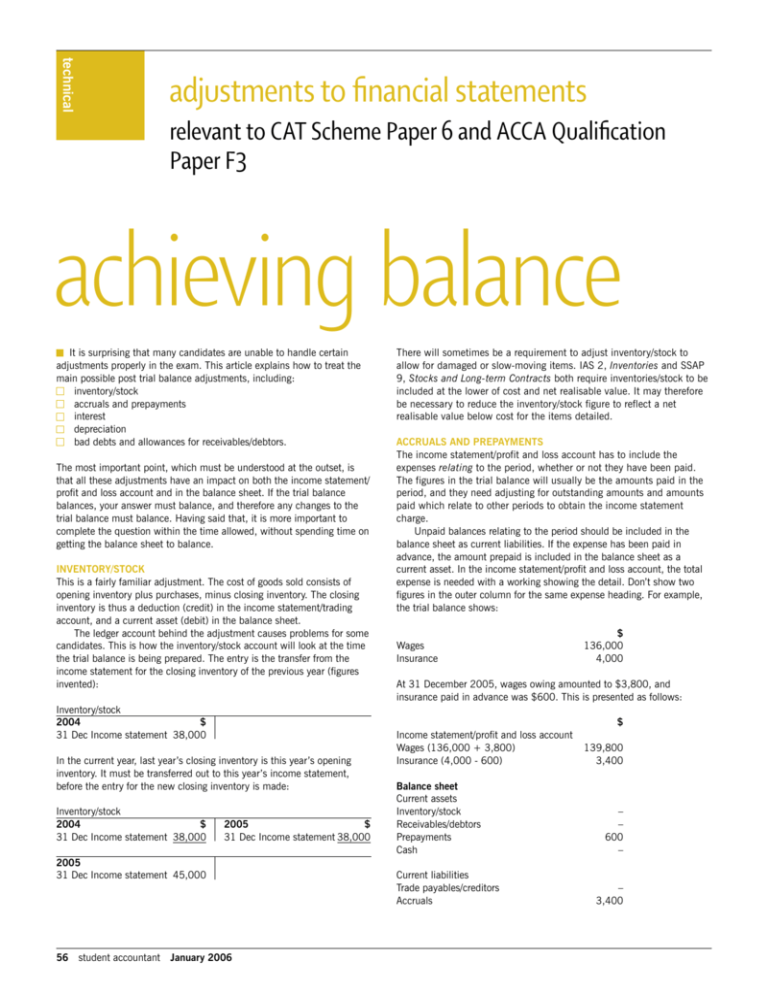

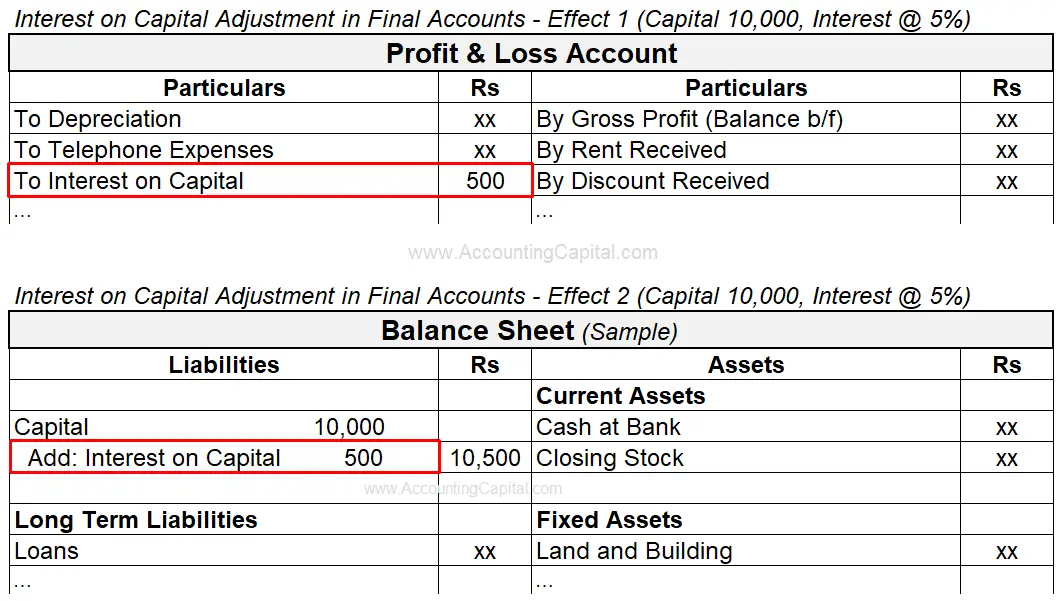

Five basic adjustments, like closing stock, outstanding expenses, prepaid expenses, accrued income, and unearned income are discussed below. In such a case, two effects will take place: Tips for making adjustments be thorough;

An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows. A new york judge has ordered donald trump and his companies to pay $355 million. Let’s say a company has five salaried employees, each earning $2,500 per month.

Rent has been paid up to 31st may, 2017. Adjustments include those related to investments, inventory, property, plant, and equipment; Expenses that should not be removed and cannot be adjusted;

When the salaries are paid for a month a journal entry is passed and then posted to the salaries account in ledger. Preparing financial statements is the seventh step in the accounting cycle. The financial statements must remain up to date, so an adjusting entry is needed during the month to show salaries previously unrecorded and unpaid at the end of the month.

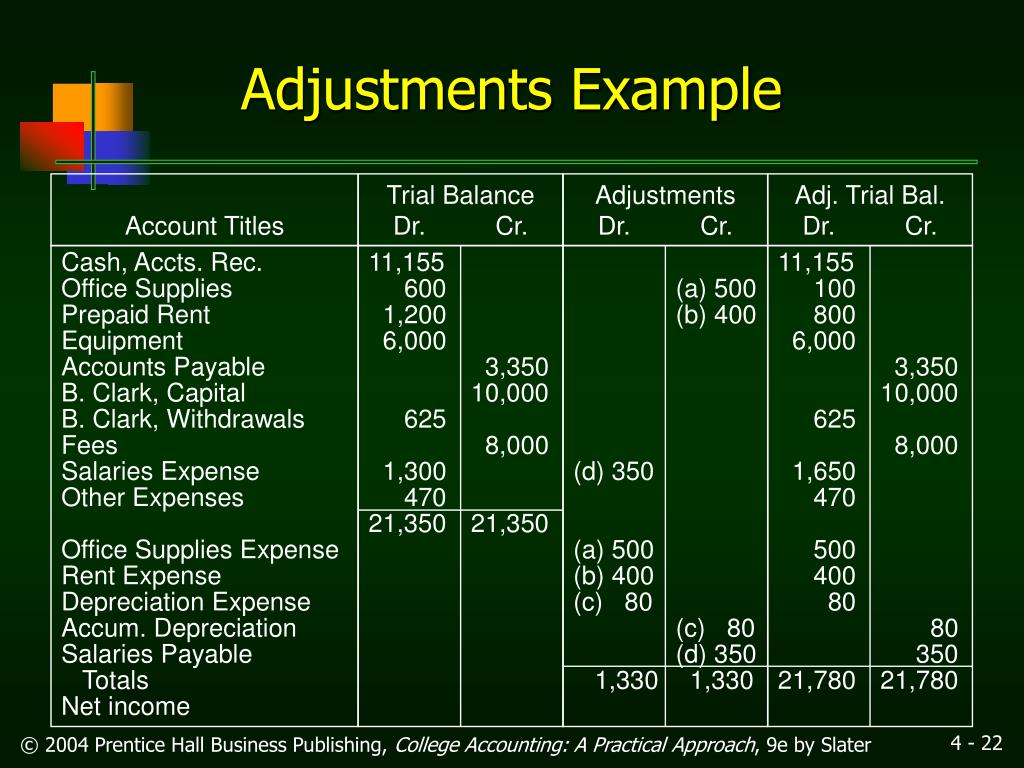

Once you have prepared the adjusted trial balance, you are ready to prepare the financial statements. We make comprehensive adjustments to complete sets of financial statements and then compute ratios based on adjusted financial statements. Need for adjustments suppose, a firm follows accounting year from april to march.

Use the financial information from the previous financial statements to. Below are the examples of adjusting journal entries. Preparing financial statements is the seventh step in the accounting cycle.

List of adjustments that might be adjustable; Adjustments that are generally not allowed or cannot be adjusted; When a new york judge delivers a final ruling in donald j.

The period under consideration is, say, april 20×1 to march 20×2. 16, 2024 updated 9:59 a.m. Even though errors may seem minute and simple to the person preparing the financial statements, the information reported on the.

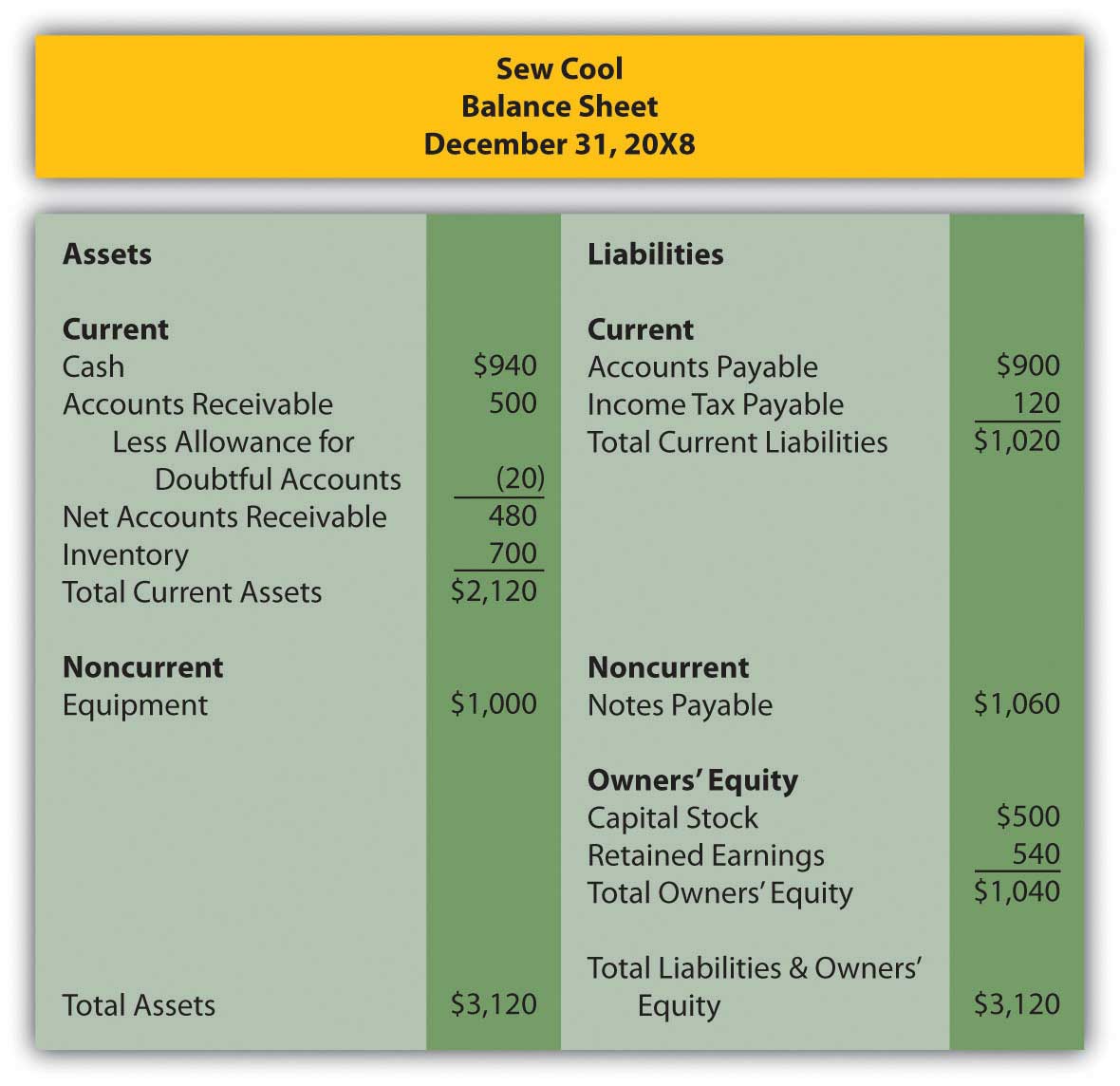

Shown as an asset on the assets side of the balance sheet. Dk goel solutions for class 11 accountancy chapter 22 financial statements with adjustments. I) closing stock closing stock is the stock of goods which remains unsold at the end of the accounting year.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)