Smart Info About Less Expenses Income Statement

When we compile these reports, we don’t use debits and credits.

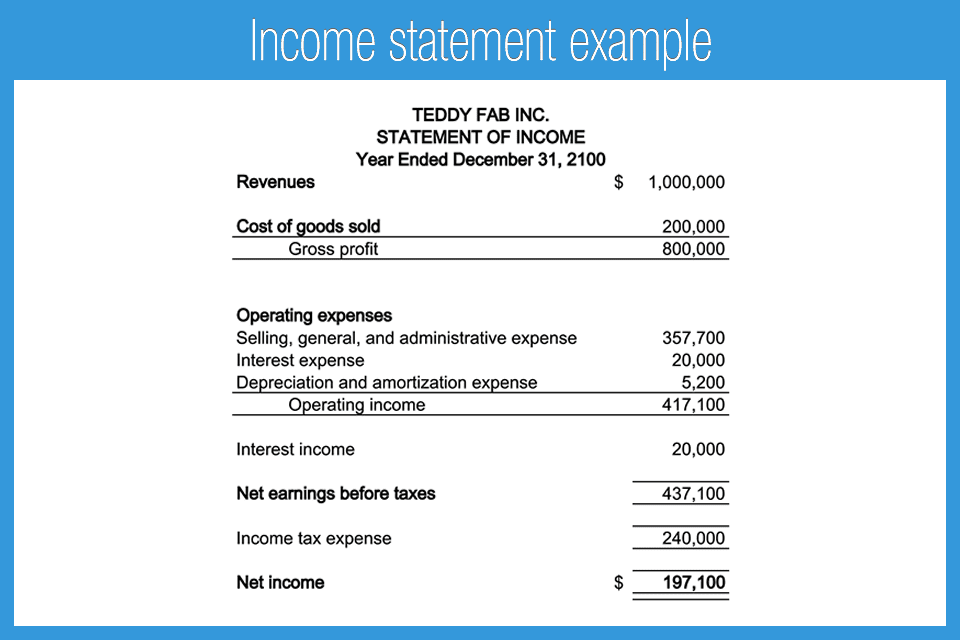

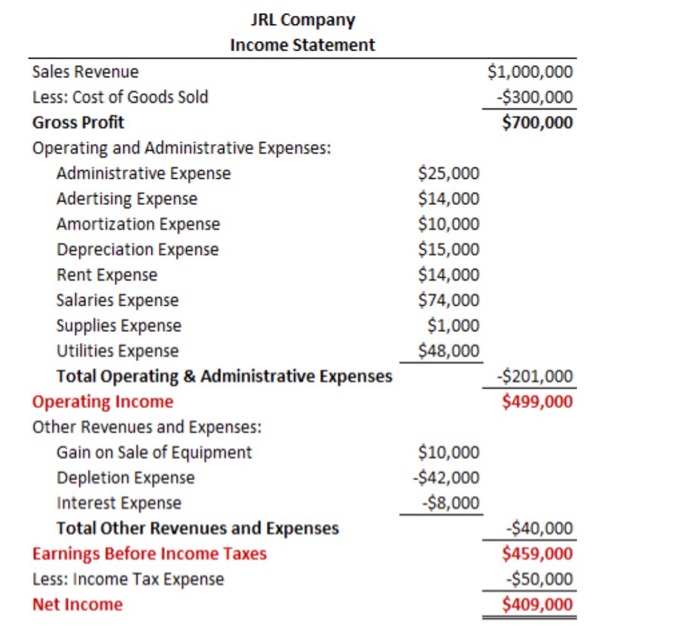

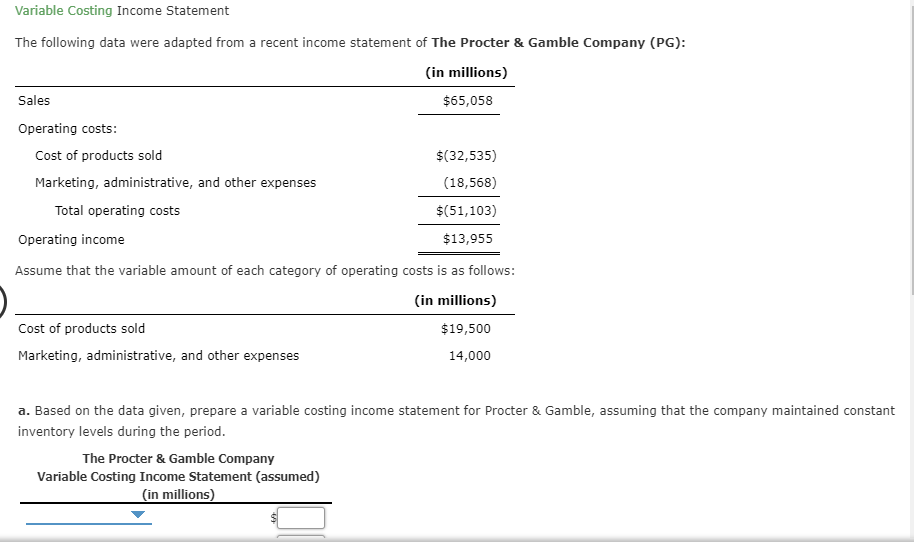

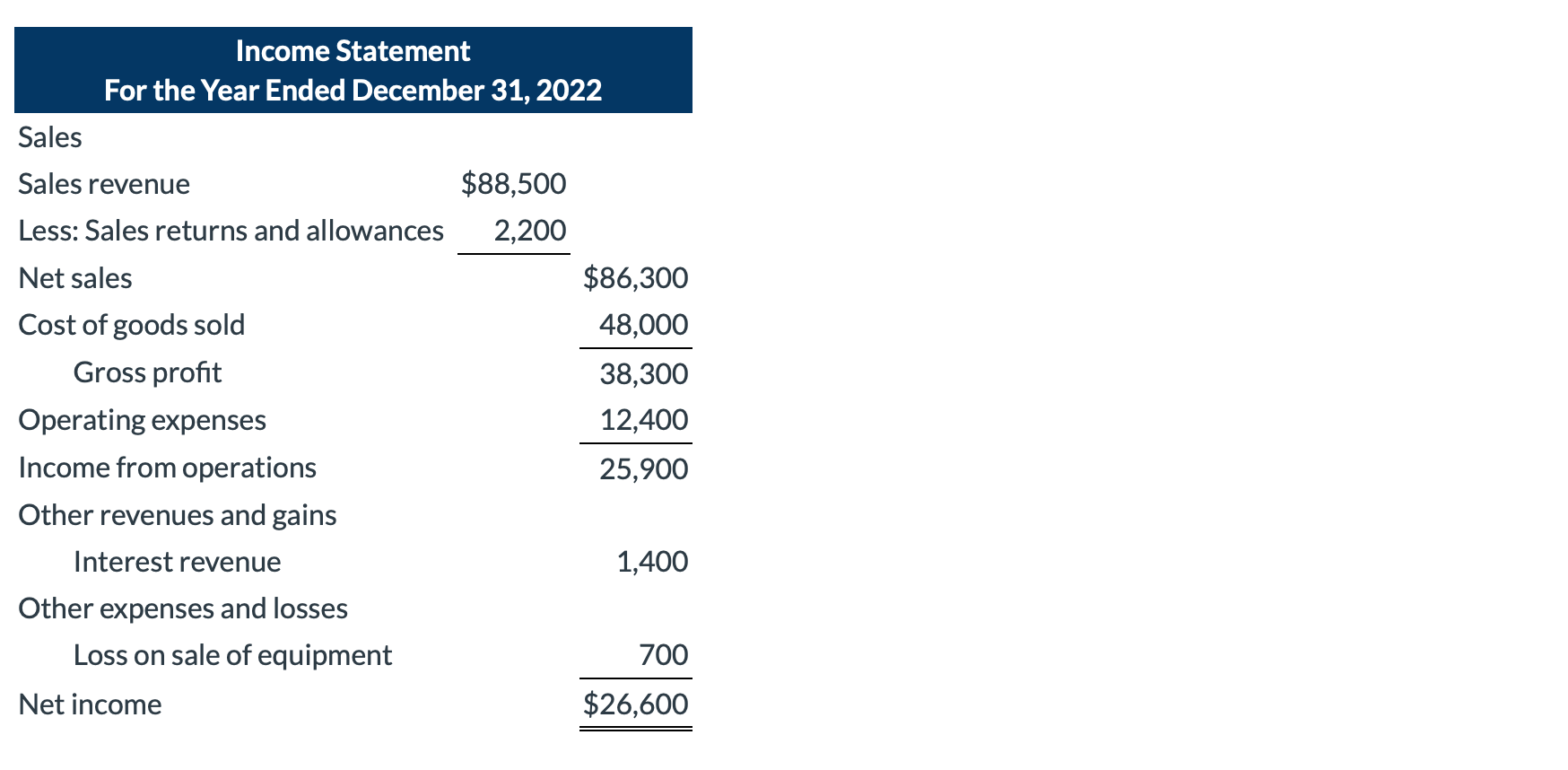

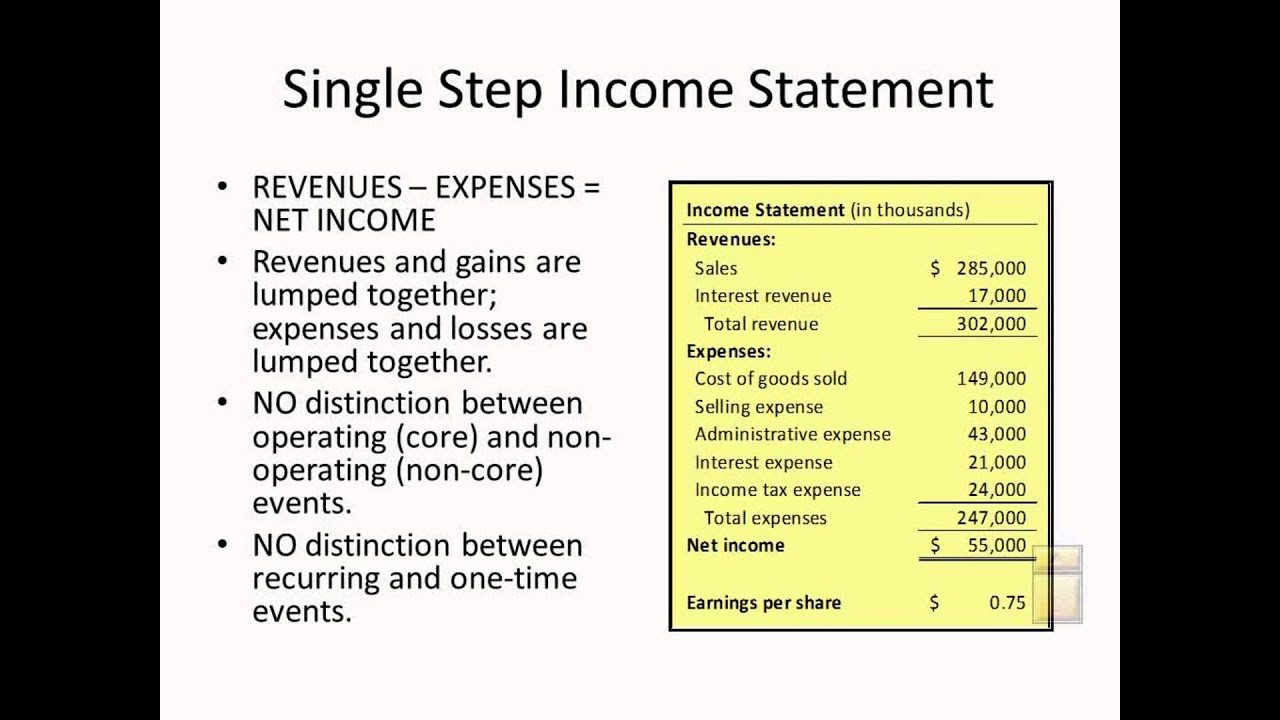

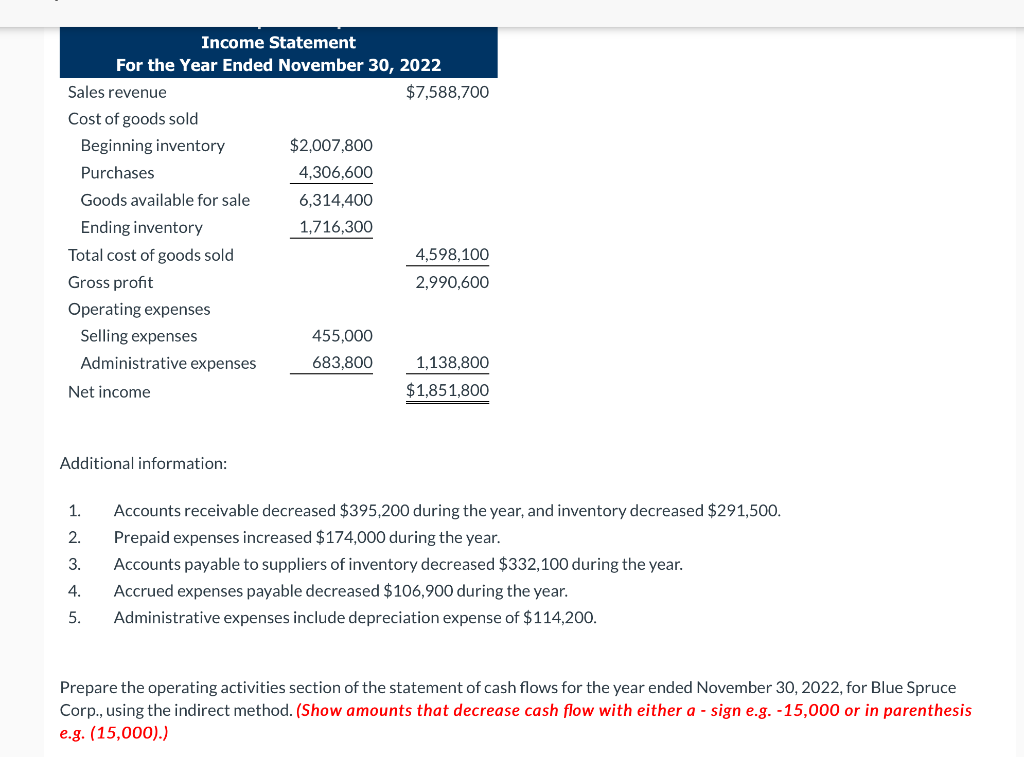

Less expenses income statement. An income statement might use the cash basis or the accrual basis. Key takeaways gross profit is total revenue minus the expenses directly related to the production of goods or the cost of goods sold (cogs). It shows your revenue, minus your expenses and losses.

If you file on paper, you should receive your income tax package in the mail by this date. The extent to which assets (for example, aging. Revenue, expenses, gains, and losses.

Revenues minus expenses is equal to net income. An income statement is a financial statement that shows you how profitable your business was over a given reporting period. How much money a business took in during a reporting period.

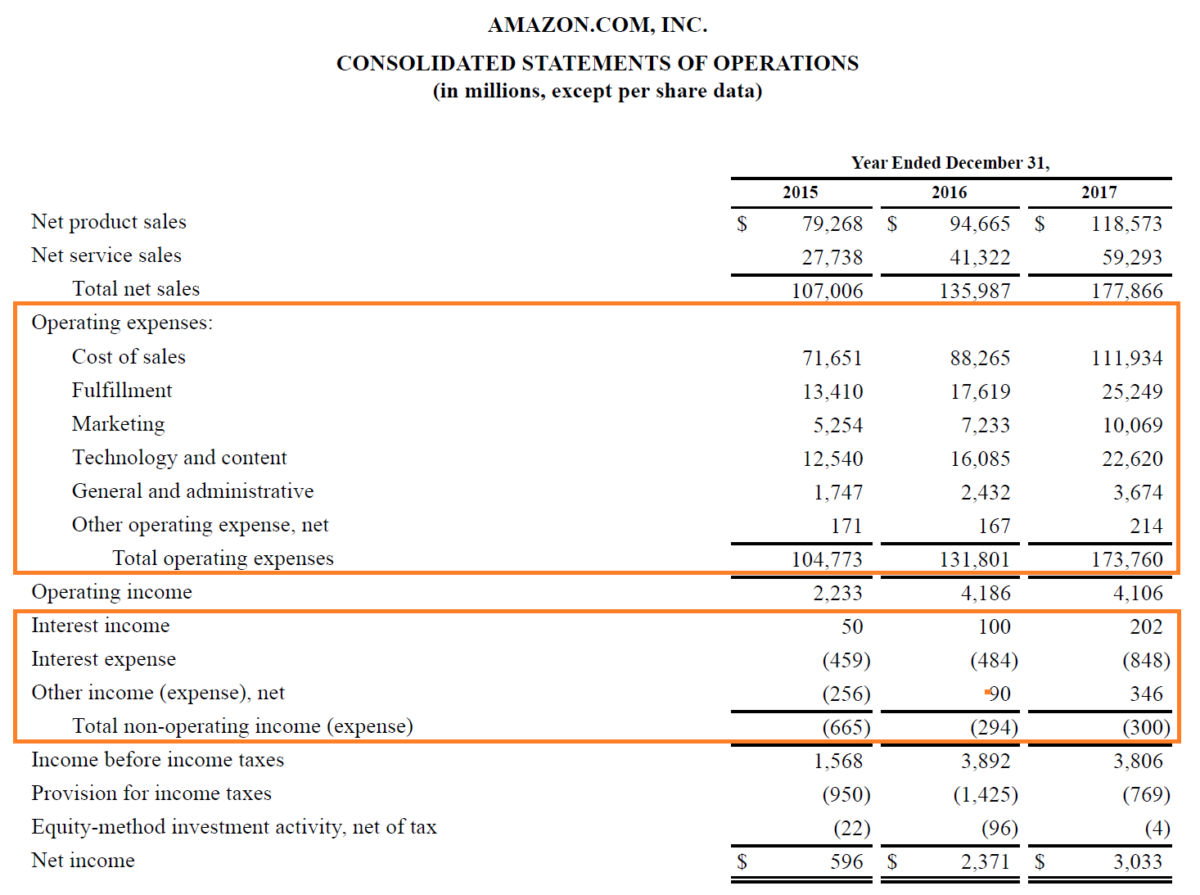

If revenue is higher than expenses, the company is profitable. Nonoperating revenues and expenses appear at the bottom of the income statement because they are less significant in assessing the profitability of the business. The income statement is also sometimes referred to as.

The income statement, also known as the profit and loss (p&l) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a. $20,000 net income + $1,000 of interest expense = $21,000 operating net income. The amounts are assumed and contents are simplified for illustration purposes.

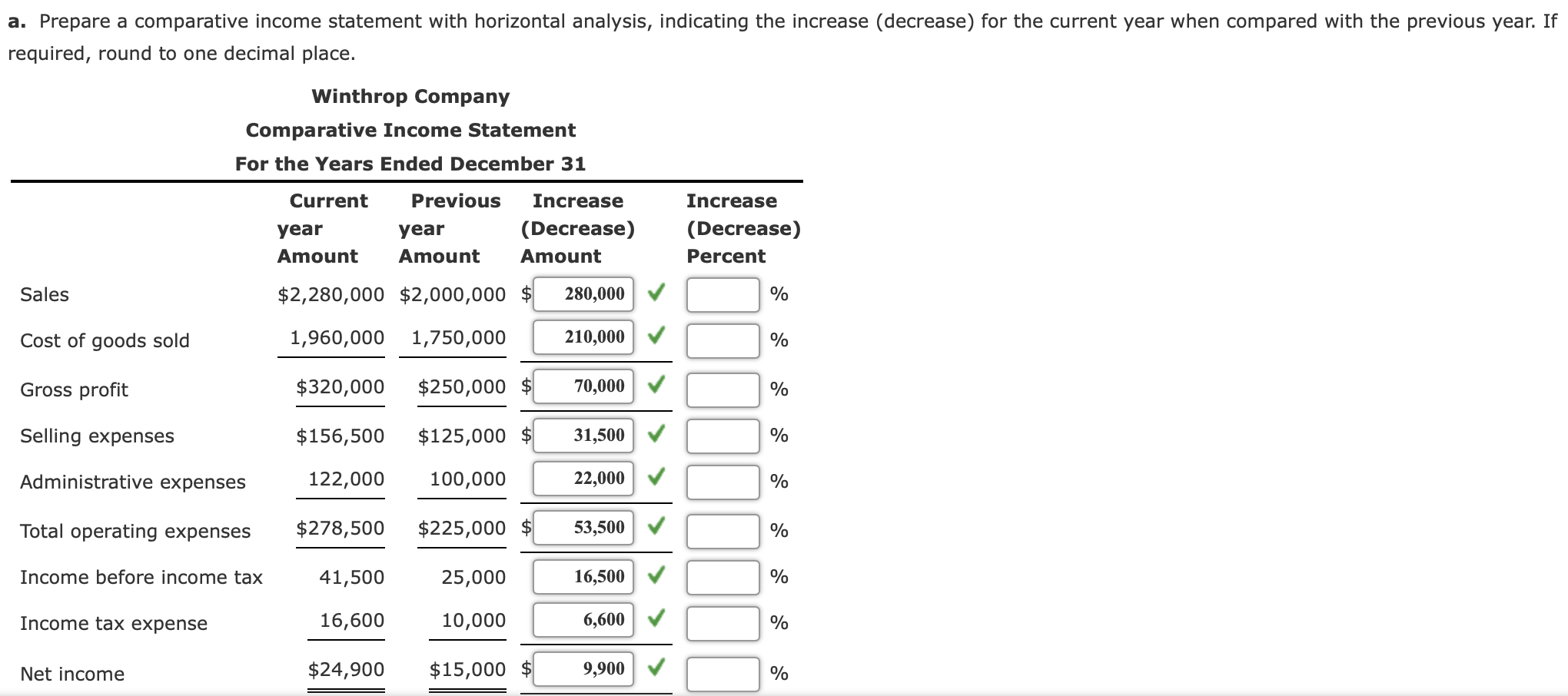

Of £110,000 has been made. January 19, 2024 income statement reports show financial performance based on revenues, expenses, and net income. The basic equation underlying the income statement, ignoring gains and losses, is revenue minus expenses equals net income.

Division of net income by the total number of outstanding shares; The income statement is a key financial report which shows a company’s sales (or revenue) less expenses for the period in question. It is prepared usually at the end of the year.

An income statement is another name for a profit and loss statement (p&l). By regularly analyzing your income statements, you can gather key financial insights about your company, such as areas for improvement or projections for future performance. The income statement is a useful way to see how a company makes money and how it spends it.

Revenue minus expenses equals profit or loss. Net income is revenues less expenses (see the highlighted accounts on the adjusted trial balance above). The retailer's july income statement will recognize the expense cost of sales $6,000 as necessary to earn the $10,000 in sales.

How to read and understand income statements as a small business Income statement also known as profit and loss statement is a financial report shows the income earned and expenses incurred in generating the income in particular time period. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi).

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)