Fabulous Info About Capital Expenditure On Income Statement

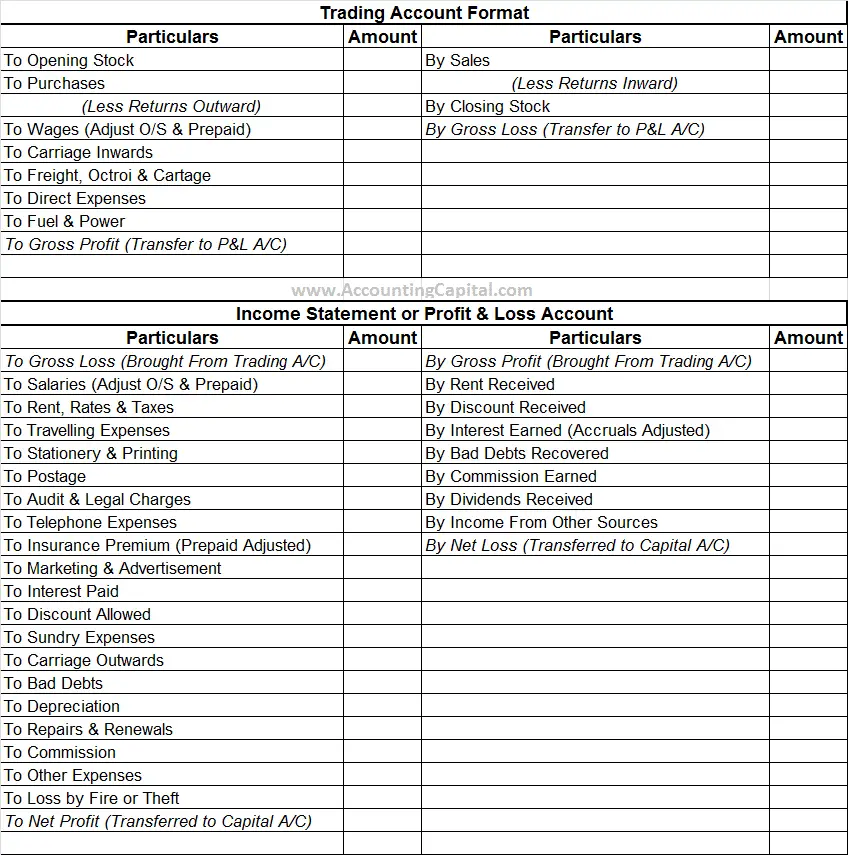

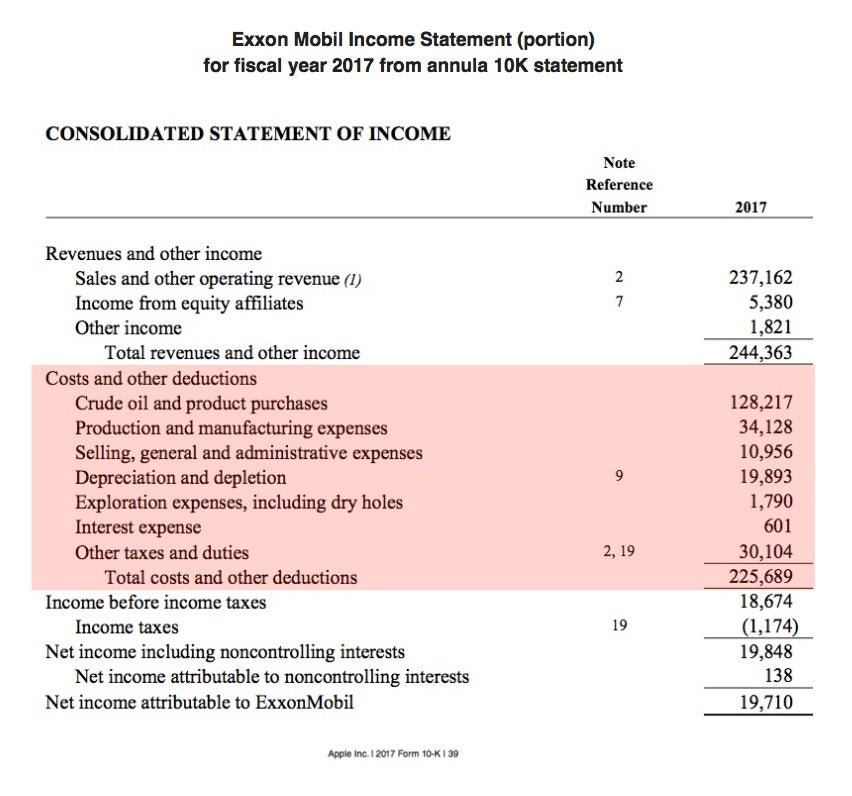

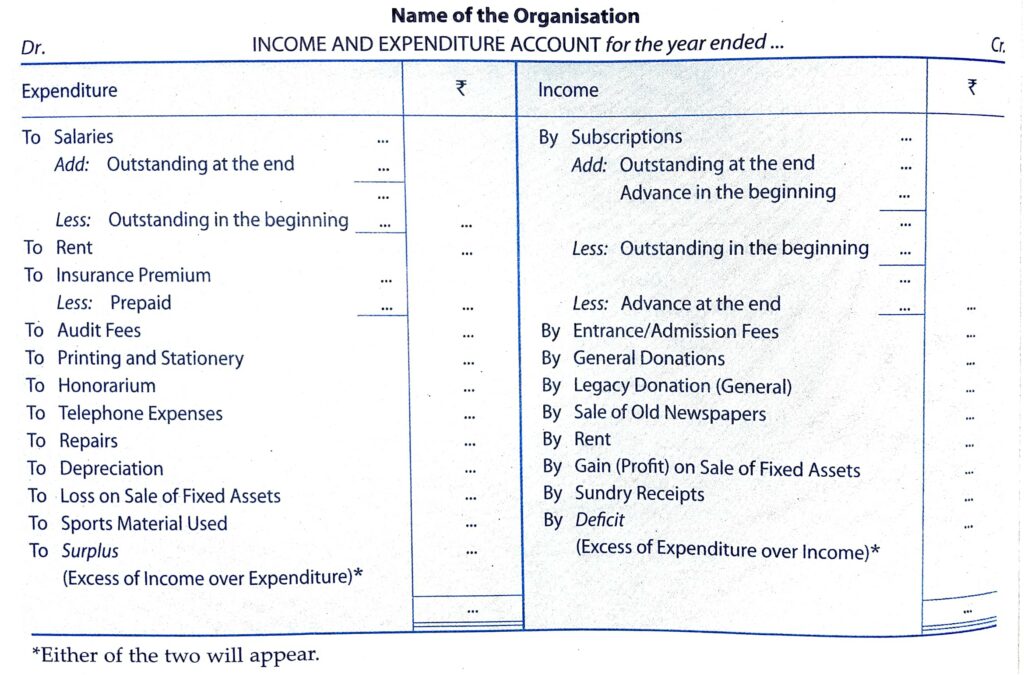

Operating expenses show up on the income statement, and thus reduce profit.

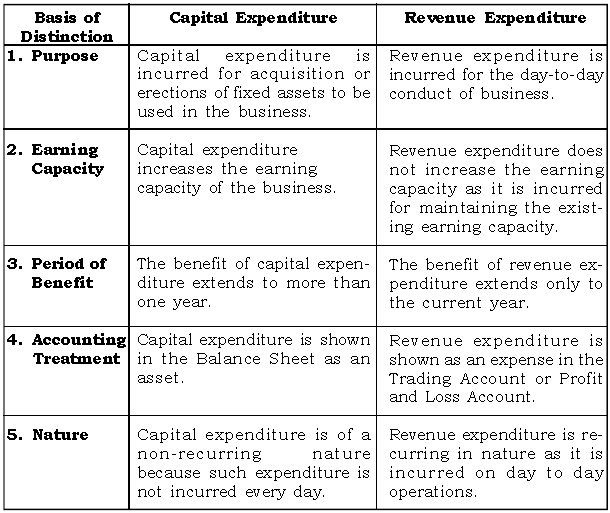

Capital expenditure on income statement. The actual cost of a capital expenditure does not immediately impact the income statement, but gradually reduces profit on the income statement over the asset’s life. Share capital expenditure (aka capex) is an important figure to accountants, investors, entrepreneurs, and financiers alike. Capital expenditures are distinct from more common costs called operating expenses (opex).

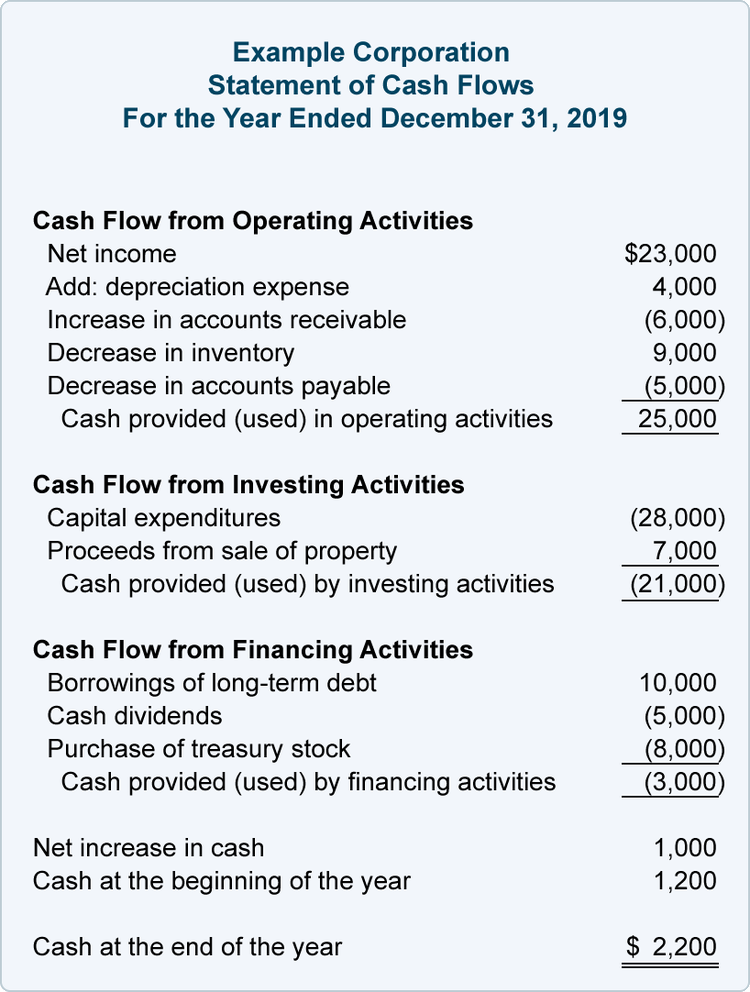

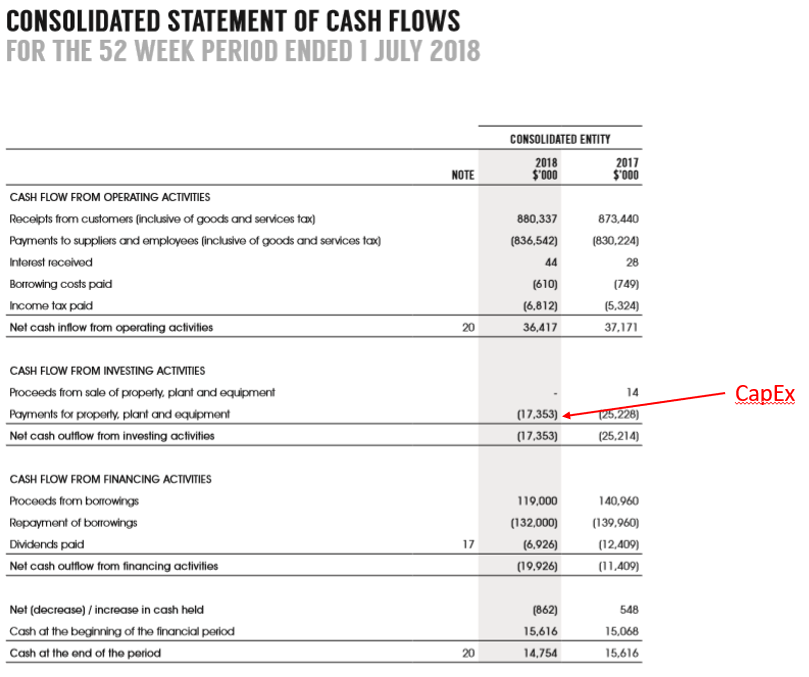

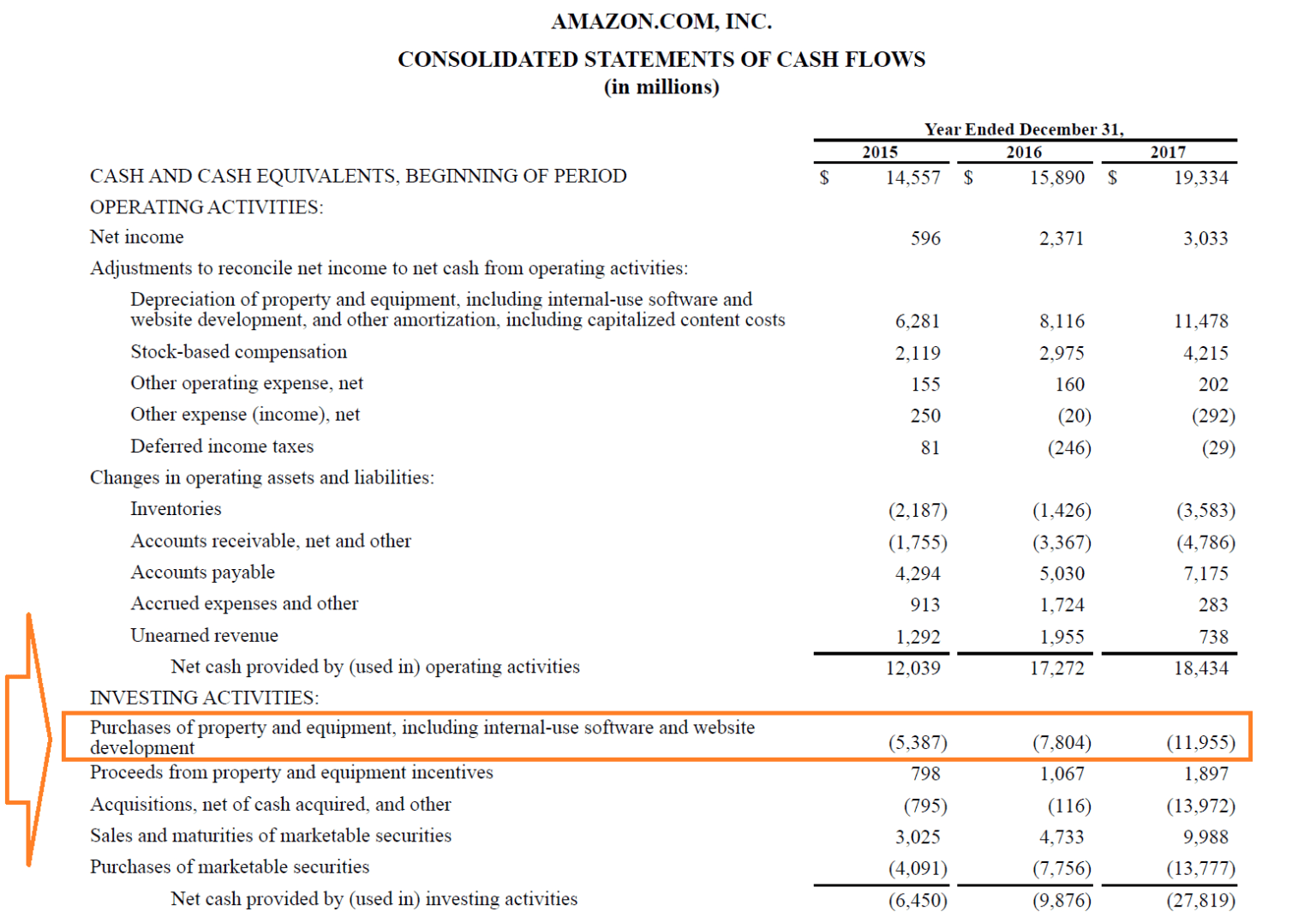

Capex formula the current period pp&e can be calculated by taking the prior period pp&e, adding capital expenditure (capex), and subtracting depreciation. While capital expenditures are not directly reported on the income statement, you can indirectly identify them by examining related expenses. Using the flower shop example, although the purchase price of the van is not recorded on the income statement for that year, ancillary costs such a gas, auto insurance,.

Table of contents what is capital expenditure (capex)? Only the depreciation of a piece of capital. Capex is any money that you invest in either acquiring, improving or maintaining your fixed assets.

If depreciation is separated out on the income statement and you don't have access to the cash flow statement, you can still determine the net capital. These are recurring payments that can be deducted from your income. Capex is usually going to get included in your cash flow.

There are often purchases related to a capex, that do in fact, immediately affect an income statement, depending on the type of asset acquired. A capex does not directly affect income statements in the year of a purchase, but for each subsequent year for the expected useful life of the asset, the.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-02-0538cfc8437b4b2ba4724c9443c6d393.jpg)