Underrated Ideas Of Tips About Payables Balance Sheet

It is represented as the amount of outstanding balances that have to be paid to the suppliers at the end of.

Payables balance sheet. Days payable outstanding (dpo) formula: To better understand ap, we. What is a balance sheet?

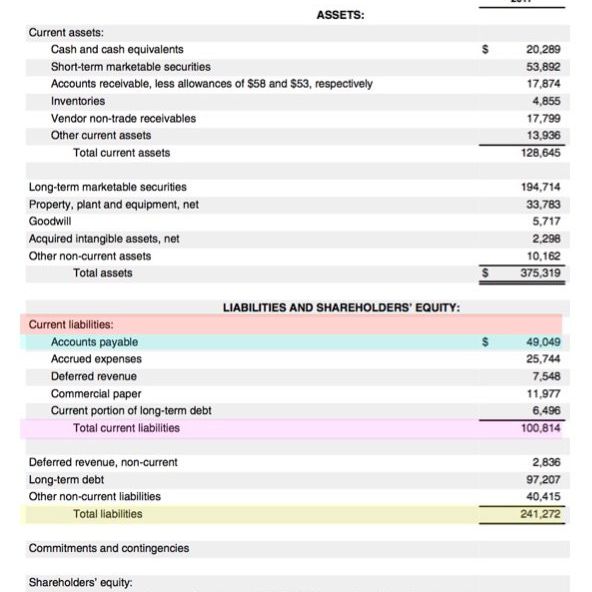

On a company's balance sheet, payables are recorded as a current liability. Accounts payable turnover accounts payables turnover is a key metric used in. Ap is considered one of the most current forms of the current liabilities on the balance sheet.

Accounts payable (ap) is a liability that appears on a company’s balance sheet. In simple words, when you buy. Accounts payable refers to the money your business owes to its vendors for providing goods or services to you on credit.

Accounts payable is classified as a current liability on the balance sheet. Apply the formula to ascertain how effectively a company is settling its payables. At the beginning of the period, the accounts payable balance was $50 million, but the change in a/p was an increase of $10 million, so the ending balance is $60.

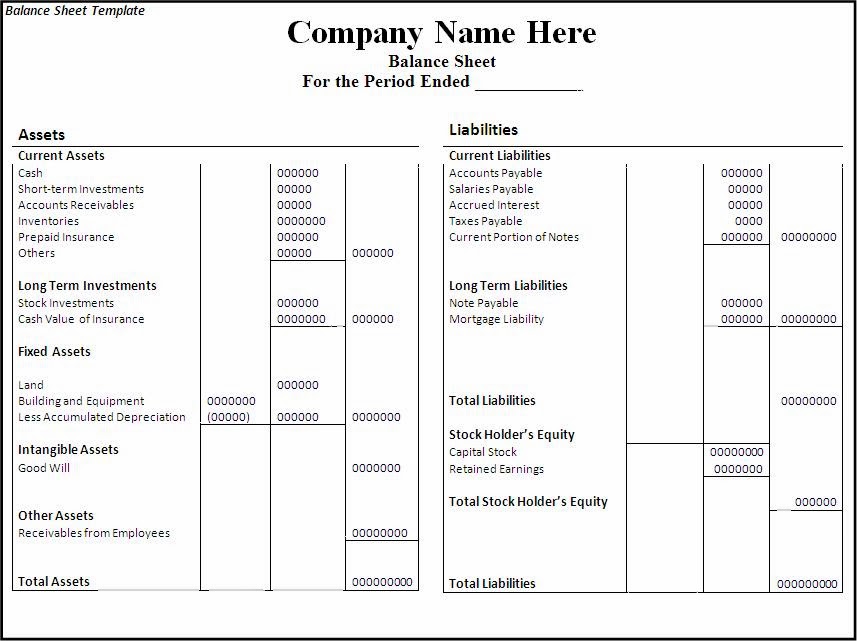

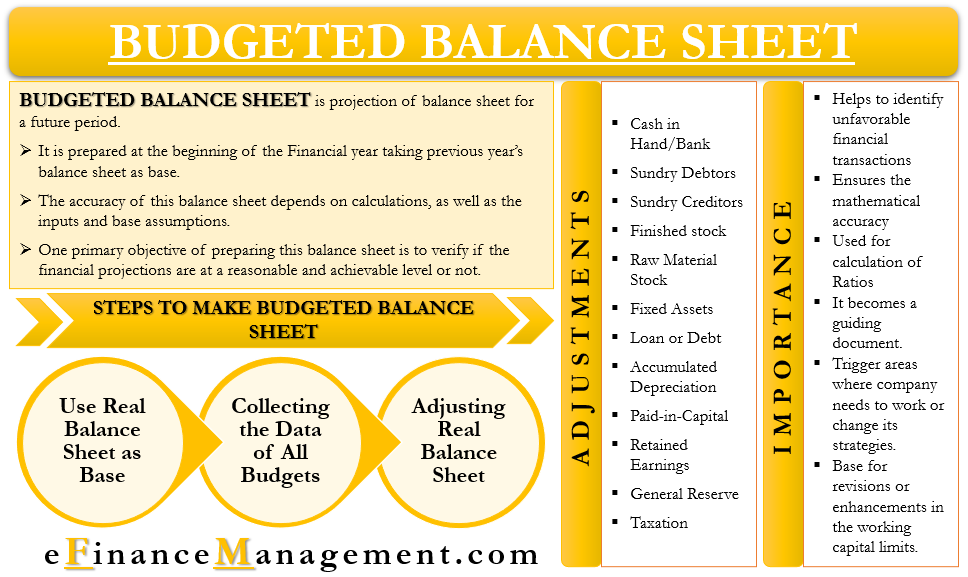

Accrued expenses are adjusted and recorded at the end of an accounting period while accounts payable appear on the balance sheet when goods and services. Your company’s balance sheet is divided into three categories. Effective and efficient treatment of accounts payable impacts a company's cash flow, credit rating, borrowing costs, and attractiveness to investors.

Accounts payable (ap) is an account in a company's general ledger. Income taxes to be paid in a future year. Individual transactions should be kept in the accounts payable subsidiary ledger.

Is it a debit or a credit? Assets assets are items of value that your business owns and are further divided into. Accounts receivable is the sum total of all payments due to be received from buyers or.

Additionally, they are classified as current liabilities when the amounts are due within a year. It represents the amount of money owed by the business to its vendors for goods. Accounts payable is any sum of money owed by a business to its suppliers shown as a liability on a company's balance sheet.

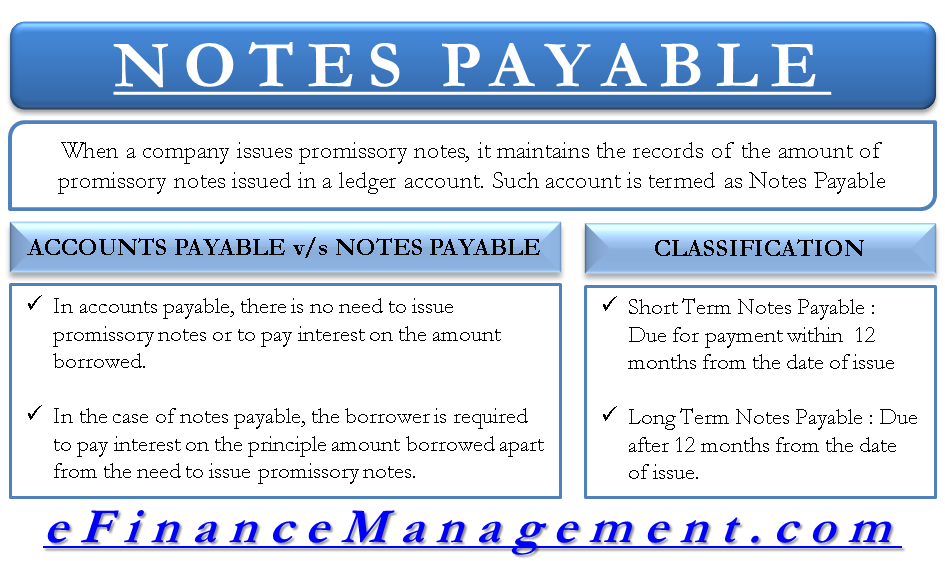

What are accounts payable on a balance sheet? Notes payable appear as liabilities on a balance sheet. Income tax payable on a balance sheet equals the total tax due to be paid to government tax agencies within 12 months.

Briefly, the definitions of the two terms, payables and receivables, are as follows: