Can’t-Miss Takeaways Of Info About P&l Account Proforma

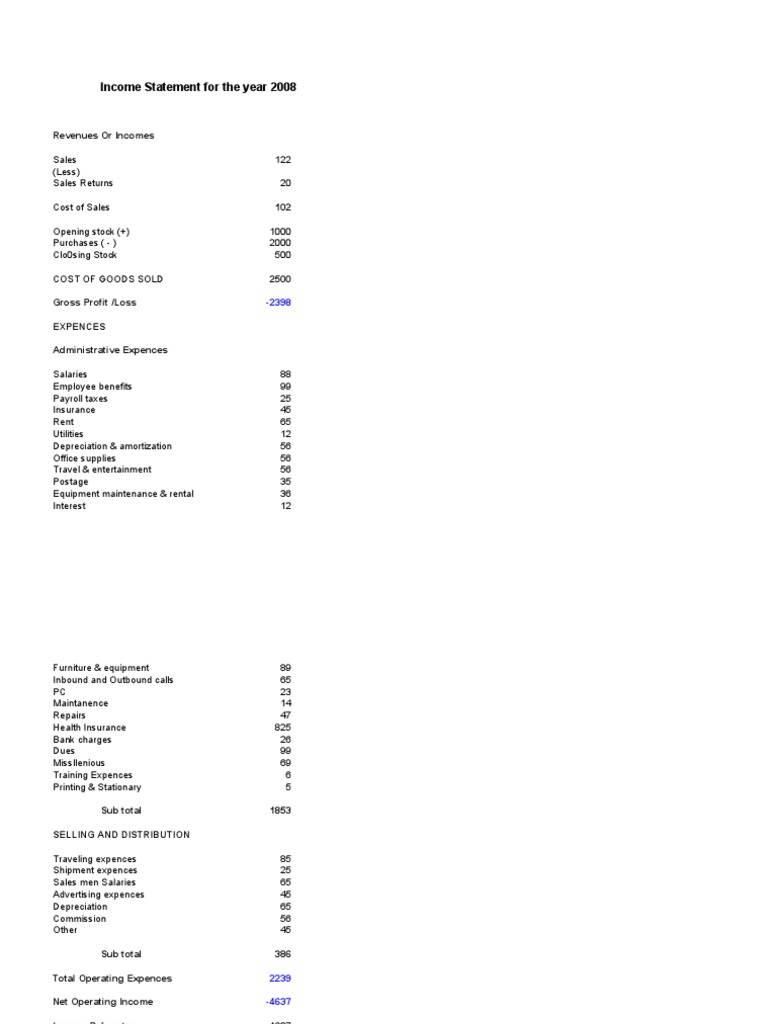

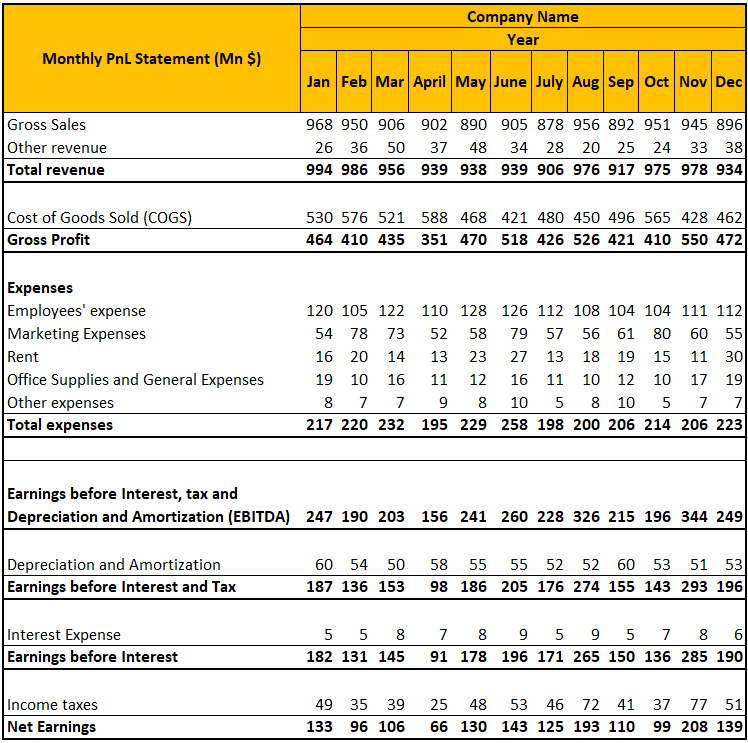

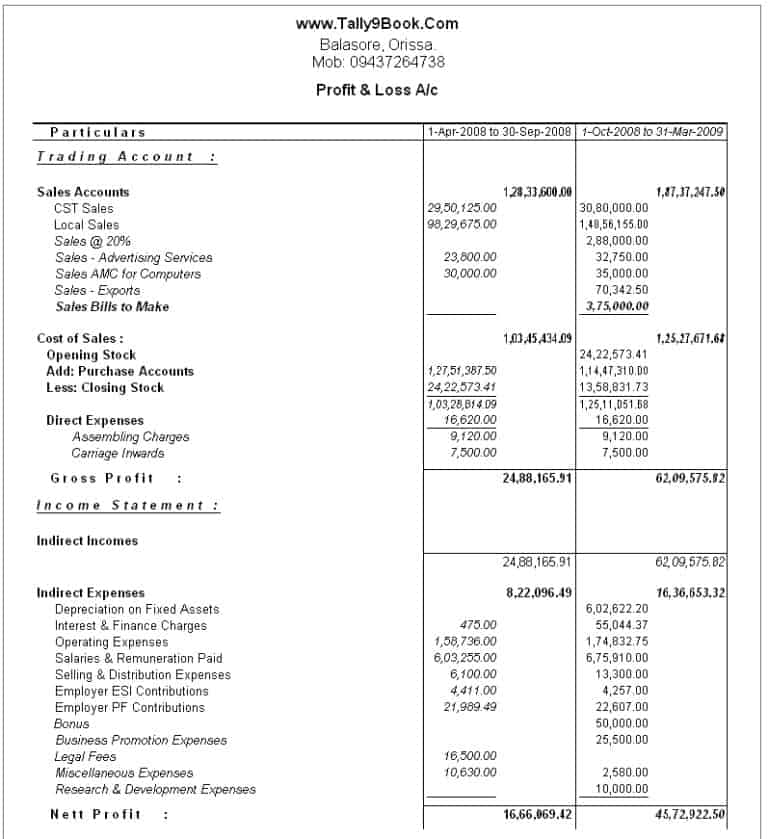

The profit and loss abbreviated as the p&l statement is a financial statement that summarizes the revenues, the costs, and the expenses that are being incurred.

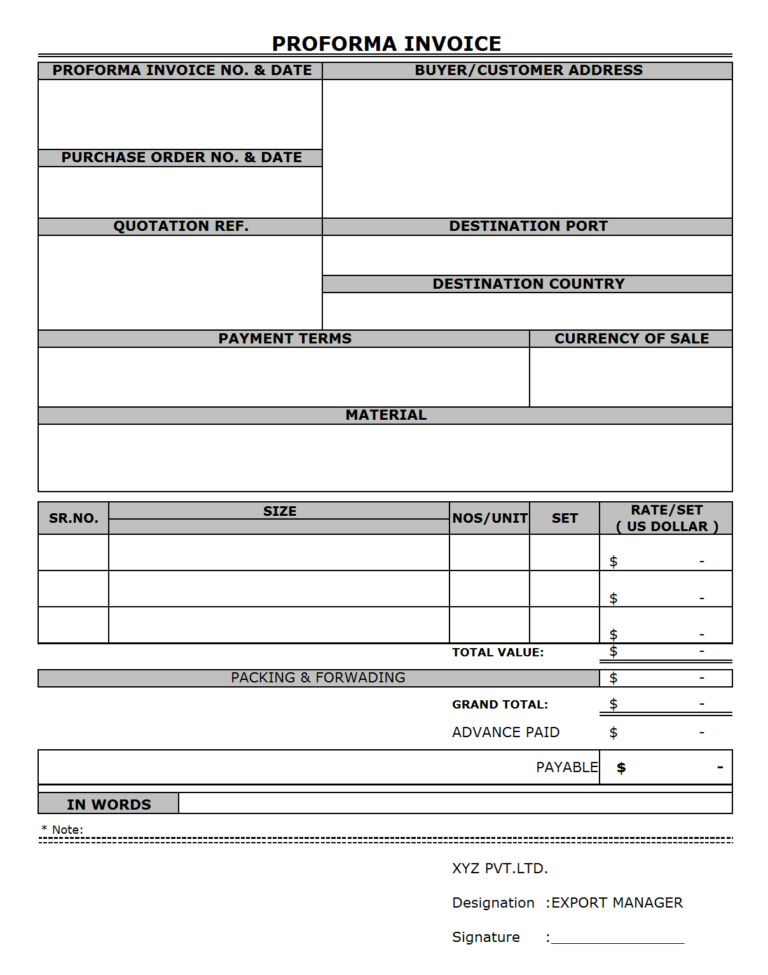

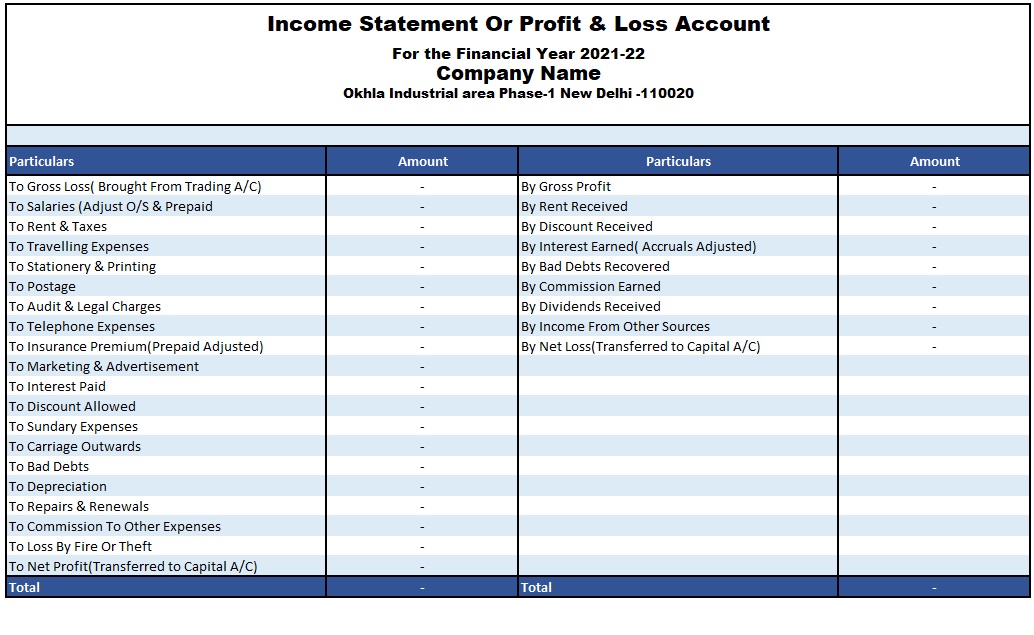

P&l account proforma. Download cfi’s free profit and loss template (p&l template) to easily create your own income statement. They’re a way for you to test out situations you think. Profit and loss account is made to ascertain annual profit or loss of business.

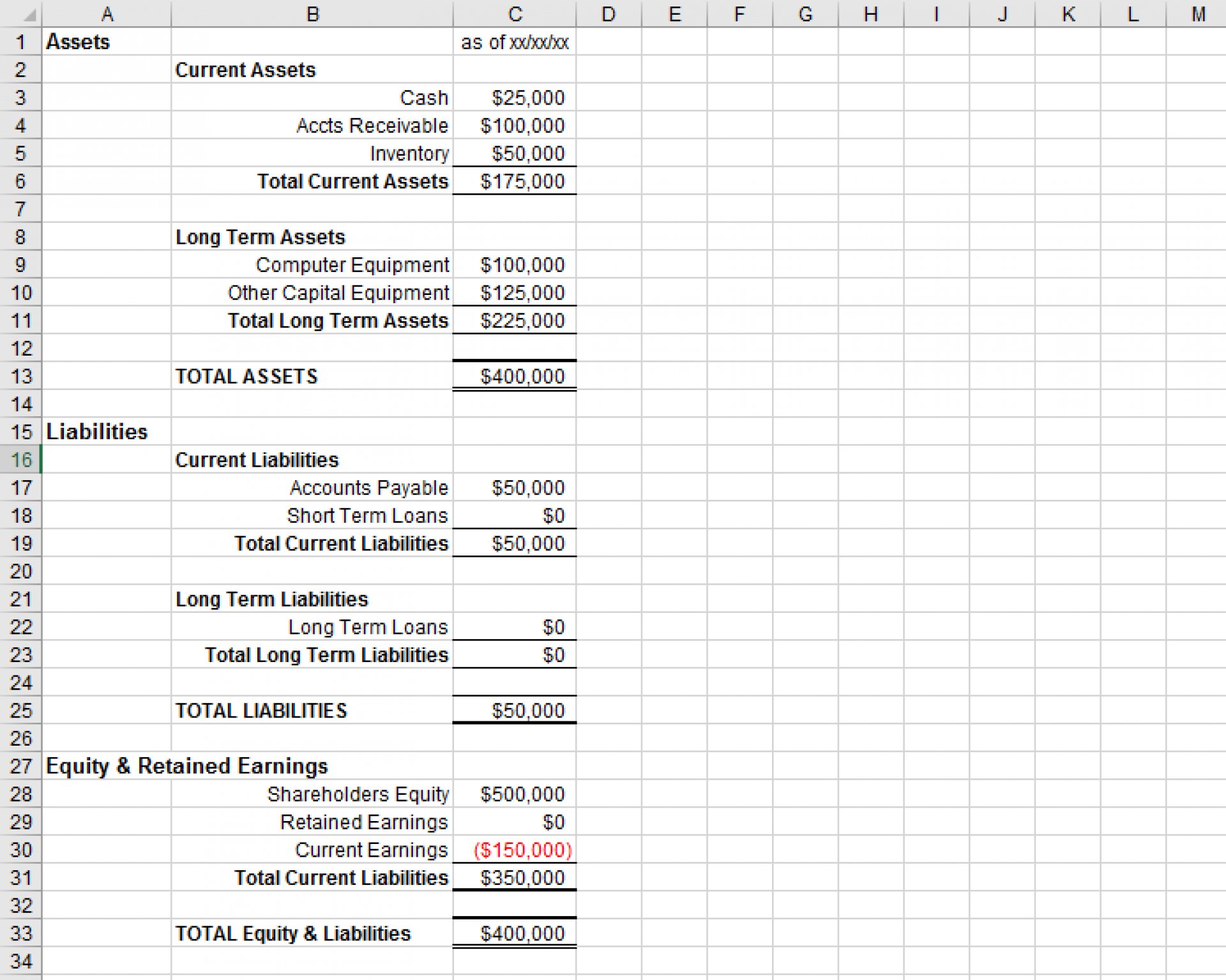

After downloading the excel file, simply enter your own information in. When it comes to accounting, pro forma statements are financial reports for your business based on hypothetical scenarios. It provides insight into several details of the entity, including efficiency of the management,.

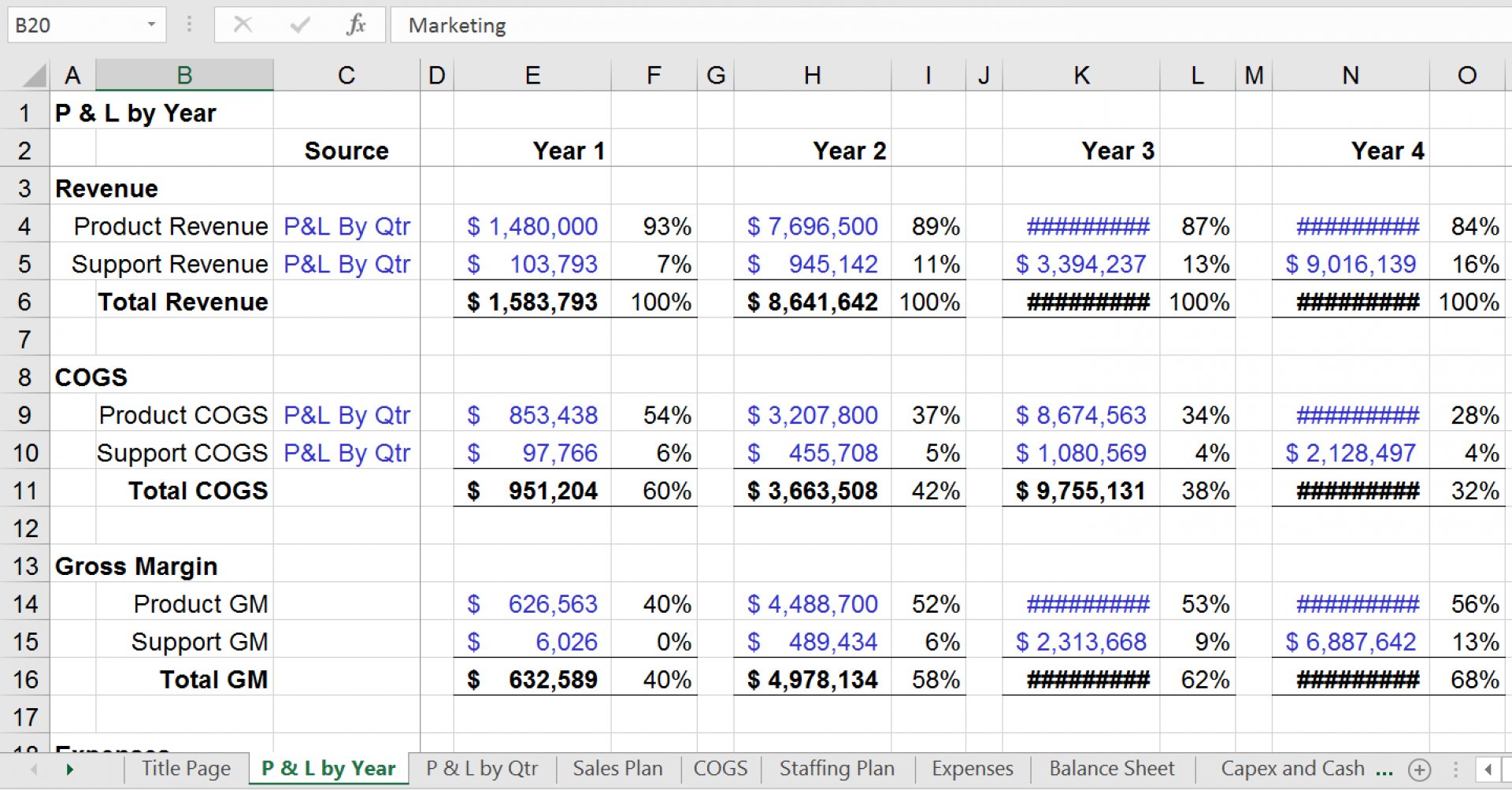

Individual energy projects are often evaluated using p&l and cash flow statements that jointly are known as the pro forma. unlike the p&l and cash flow statements for a. A p&l statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. Profit and loss account or.

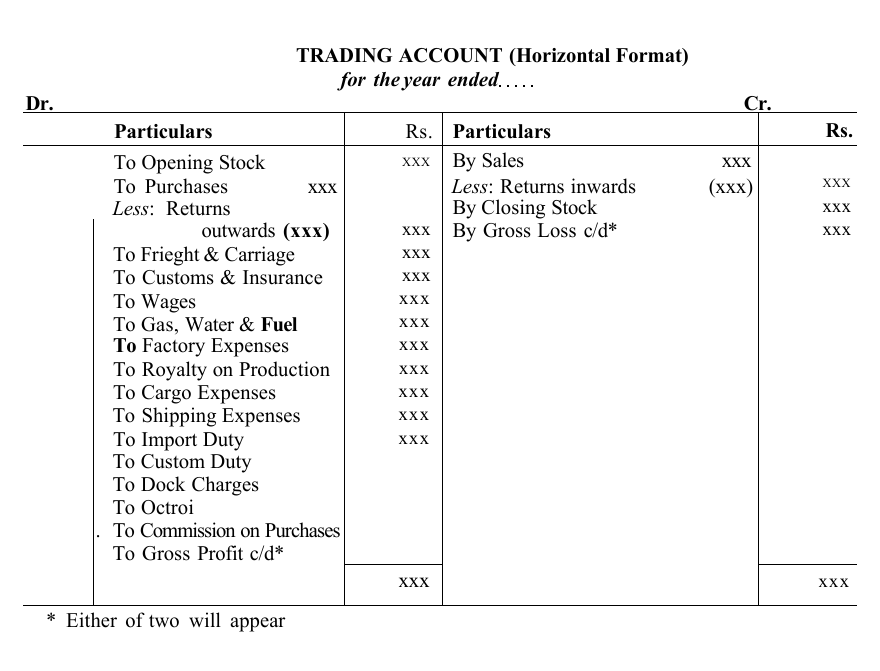

The freshbooks profit and loss template is simple to use. The single step profit and loss statement formula is: Trading account used to find the gross profit/loss of the business for an accounting period:

Only indirect expenses are shown in this account. This profit and loss (p&l) statement template summarizes a company’s income and expenses for a period of time to arrive at its net. A p&l statement compares company revenue against expenses to determine.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. All the items of revenue and expenses whether. The spending of the company on the rent was $6,000,.

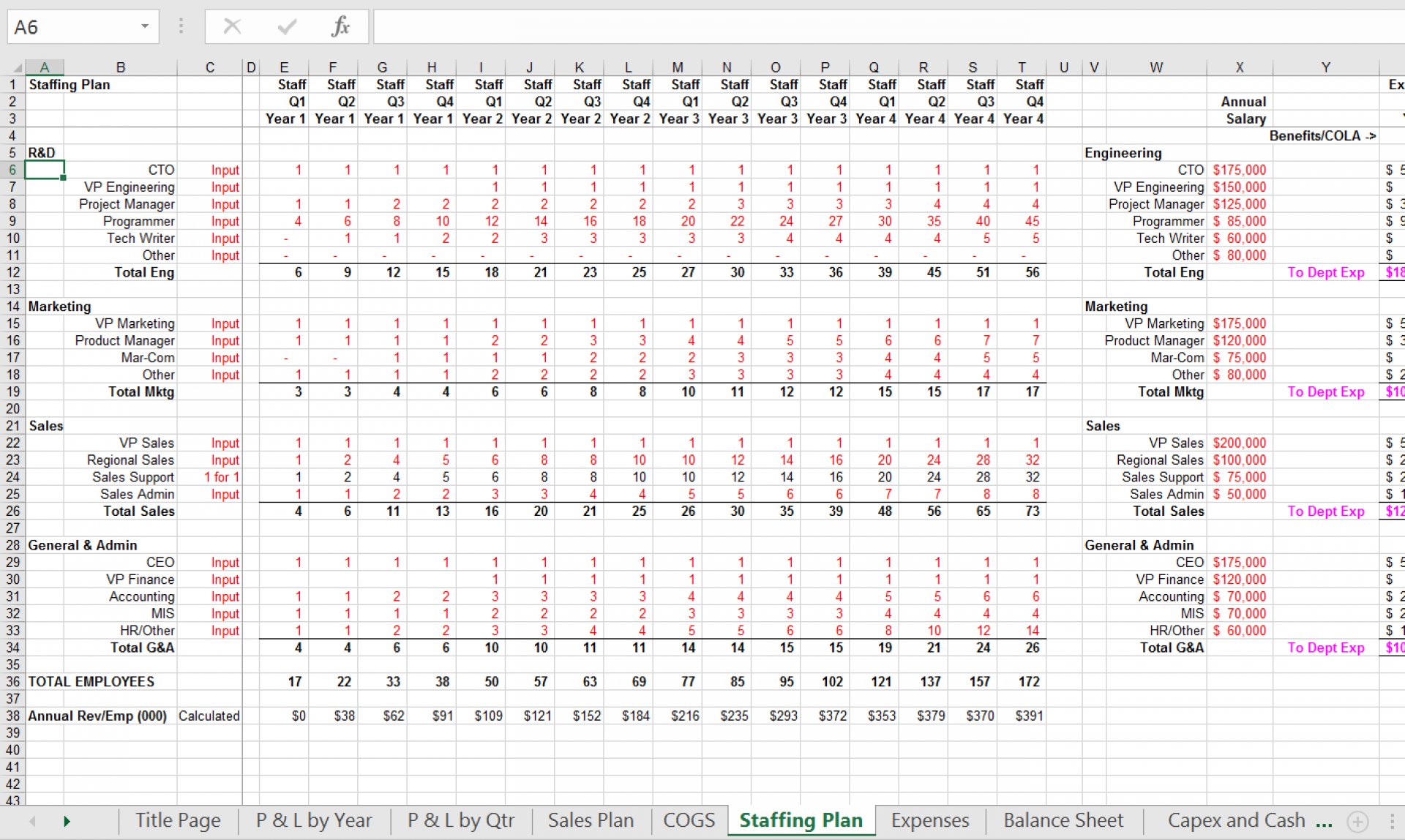

Profit and loss (p&l) statement template. Pro forma income statements, also called pro forma profit and loss (pro forma p&l), are projections based on your past income statements. Download the form in google sheets, google docs,.