Fine Beautiful Tips About Private Company Balance Sheet

In this post, we provide a primer on the nature and usefulness of private sector balance sheets:

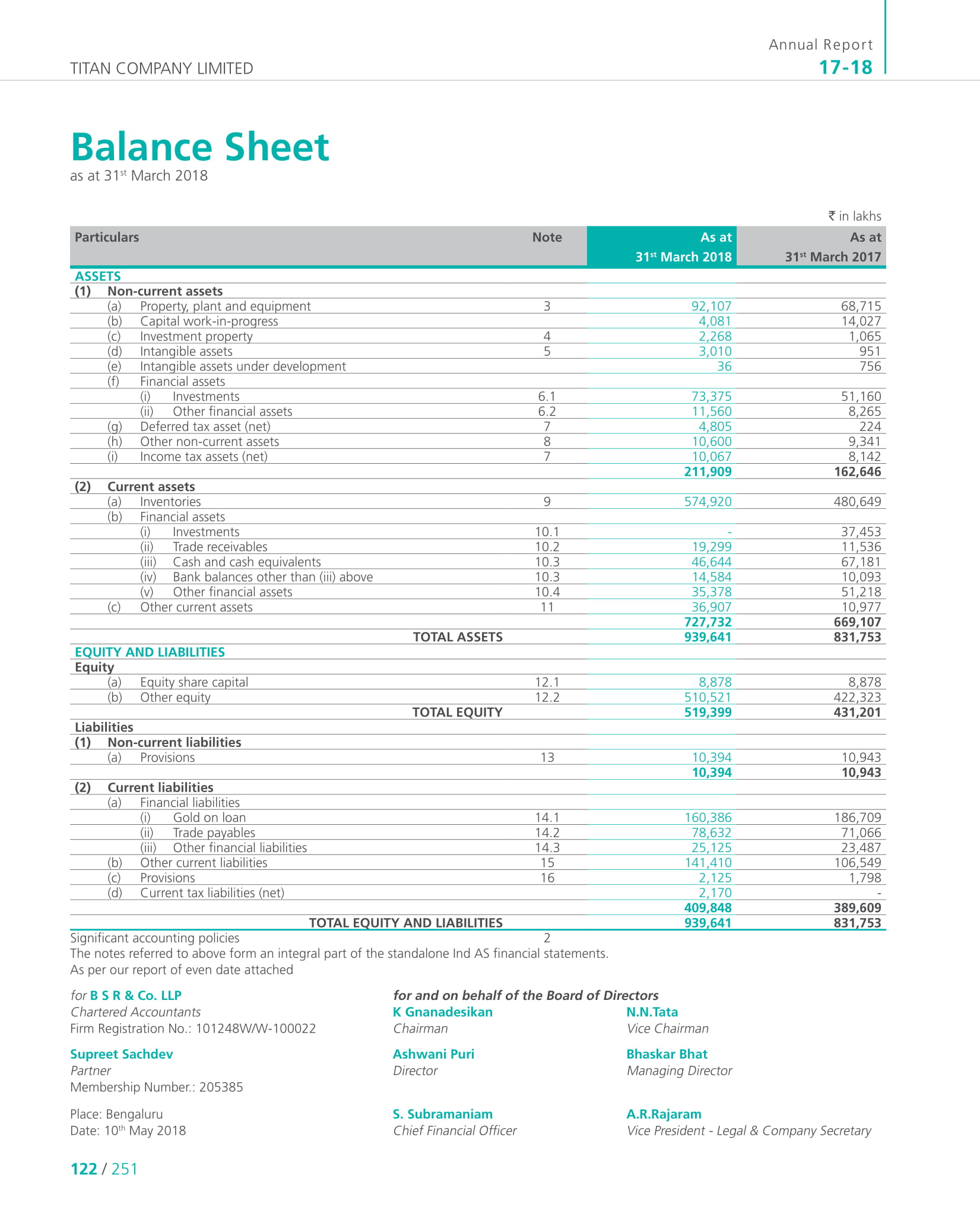

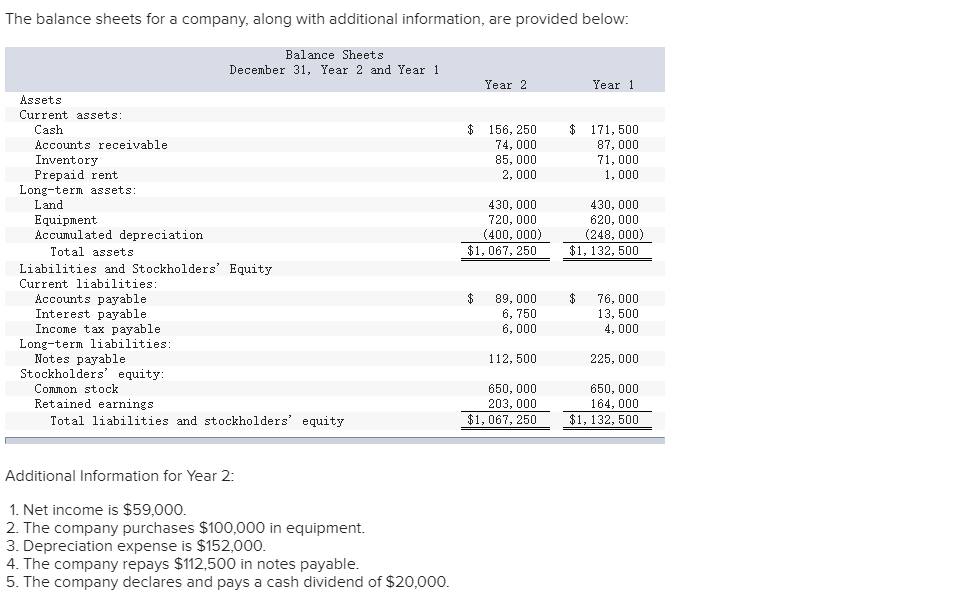

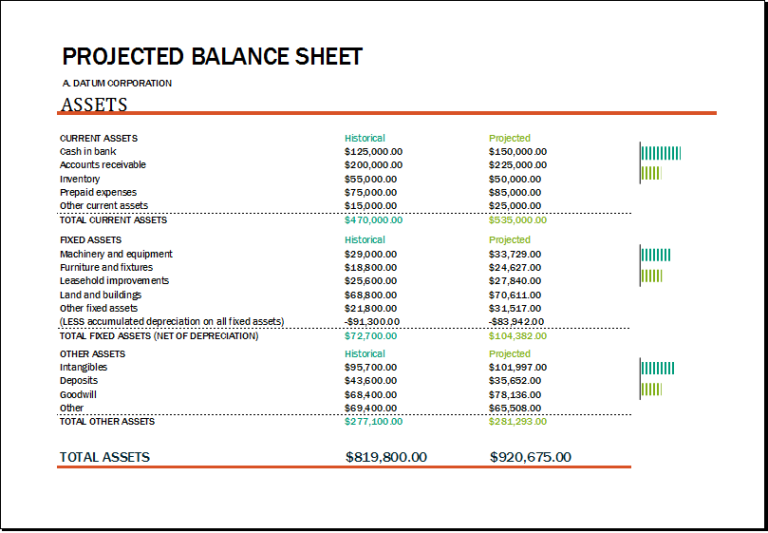

Private company balance sheet. The balance sheet is based on the fundamental equation: Dividend paid for the year (including dividend distribution tax) (675.00) (375.00) balance carried to balance sheet 12,218.19 10,078.96 capital & finance during the year under review, the company has not allotted any equity shares. A balance sheet summarizes your firm’s current financial worth by showing the value of what it owns (assets) minus what it owes (liabilities).

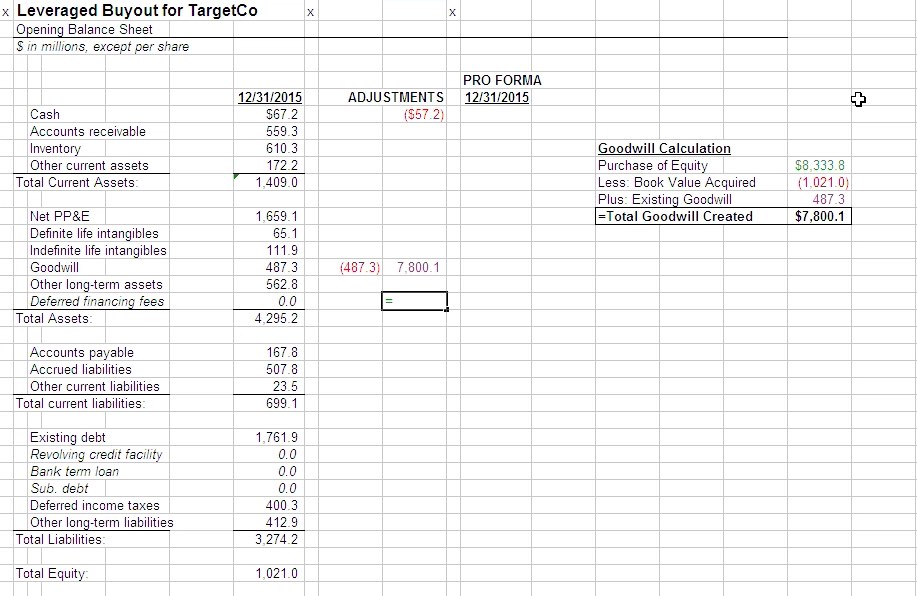

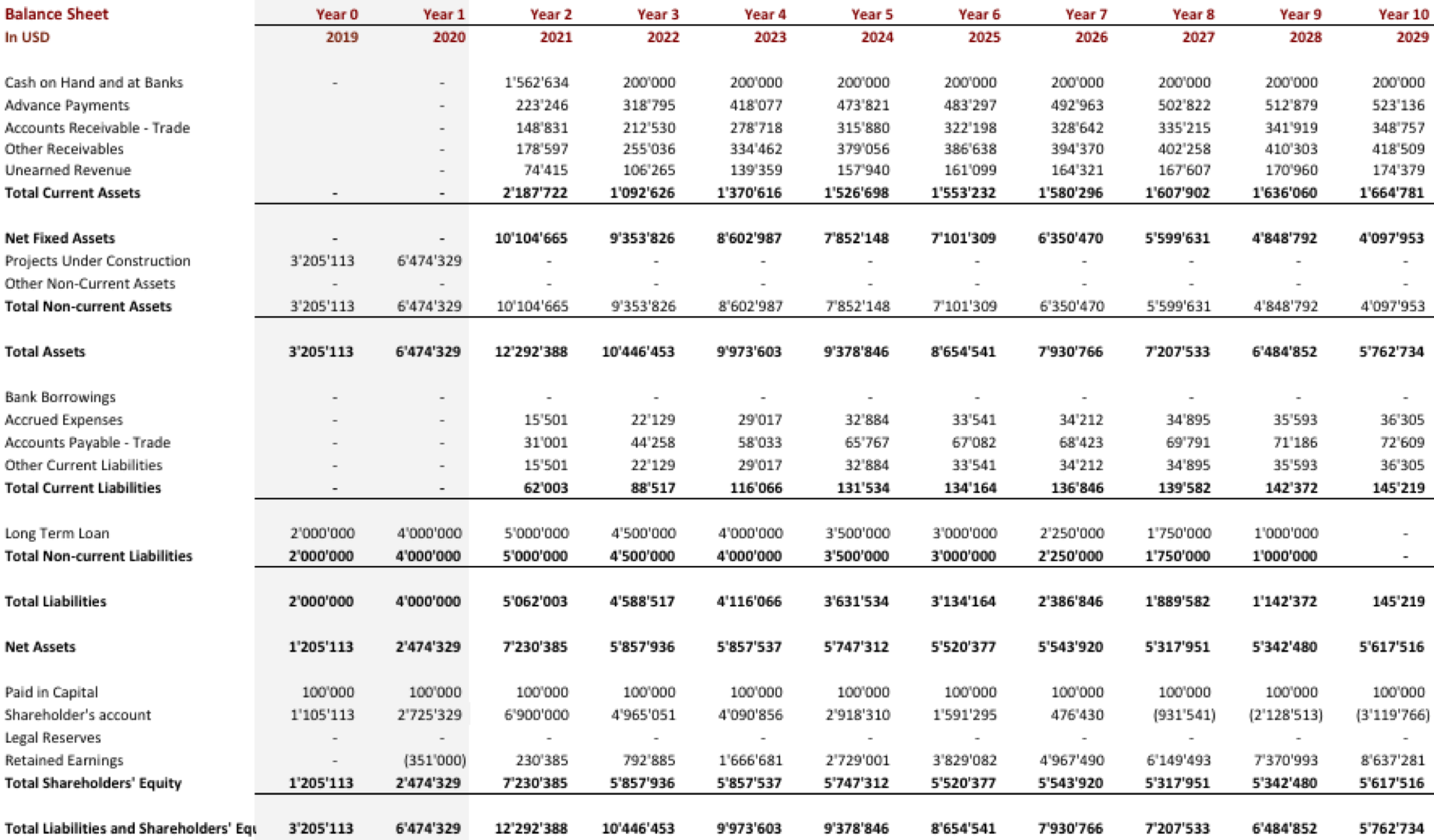

On average, total liabilities for this group increased by 184% (i.e., almost tripled) between 2007 and 2020/2021. Those of households, nonfinancial firms, and financial intermediaries. The balance sheet shows a company’s assets, liabilities, and shareholders’ equity.

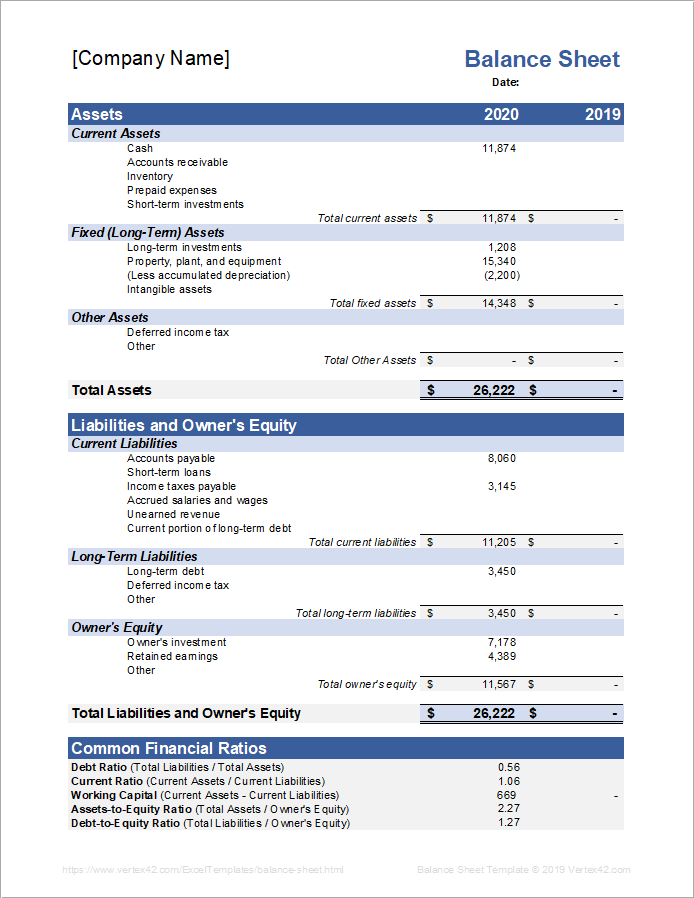

Get the latest financials in minutes. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It can be understood with a simple accounting equation:

As a result, asc 842 changes the definition of a lease. Using this template, you can add and remove line items under each of the buckets according to the business: Follow the steps below to prepare this.

Staying on track with the new lease accounting standard, asc 842. Balance sheets serve two very different purposes depending on the audience reviewing them. At the very beginning, write ‘balance sheet’ in some merged cells in a larger font size.

Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. The balance sheet is based on the fundamental equation: A company’s balance sheet is a financial record of its liabilities, assets and shareholder’s equity at a specific date.

Free cash flow before m&a and customer financing € 4.4 billion; In a horizontal format, assets and liabilities are presented descriptively. The balance sheet, together with the.

For g7 countries, the increase was 159%. A company’s balance sheet is one of the most important financial statements it produces—typically on a quarterly or even monthly basis (depending on the frequency of reporting). It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity.

It can also be referred to as a statement of net worth or a statement of financial position. Assets = liabilities + equity. A company’s balance sheet is a snapshot in time.

A balance sheet provides a summary of a business at a given point in time. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.the main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. Publications such as forbes will typically maintain a list of the largest.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)