Here’s A Quick Way To Solve A Tips About Accounting For Derivative Instruments And Hedging Activities

Accounting for derivatives and hedging activities.

Accounting for derivative instruments and hedging activities. It also focuses on whether a contract meets the definition of a derivative. Targeted improvements to accounting for hedging activities. Request pdf | accounting for derivative instruments and hedging activities (sfas no.

Accounting for derivative instruments and hedging activities (issued 6/98) summary this statement establishes accounting and reporting standards for derivative. Hedge accounting is allowed only if several conditions are met. This accounting approach is referred to as hedge accounting.

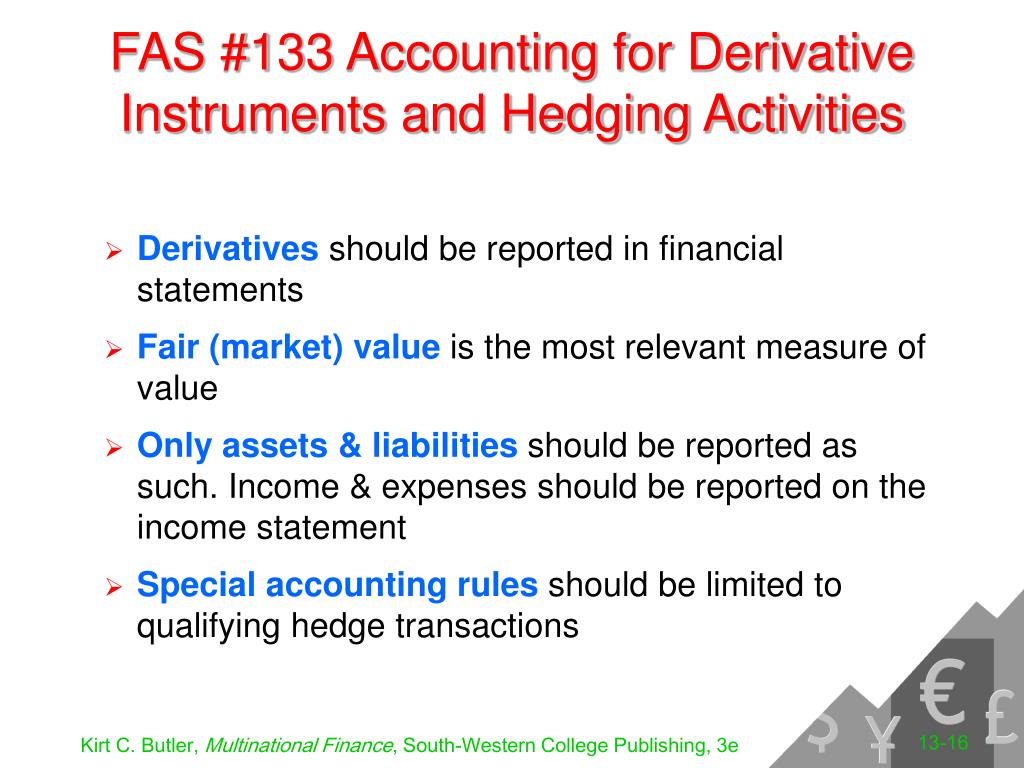

Us derivatives & hedging guide. 2.4 accounting for a derivative. 133, accounting for derivative instruments and hedging activities, commonly known as fas 133, is an accounting standard issued in june 1998 by the financial accounting standards board (fasb) that requires companies to measure all assets and liabilities on their balance sheet at “fair value”.

Derivatives, and derivatives used to hedge financial and operating functions, are designed to allow. Ing principles related to derivative instruments, hedging activities, and invest ments in securities; Targeted improvements to accounting for hedging activities, which is now effective for all entities.

Accounting for derivative instruments and hedging activities (sfas no. Effective for fiscal years beginning after june 15, 2000, fas 133 creates highly technical financial. Accounting for derivative instruments and hedging activities, fas no.

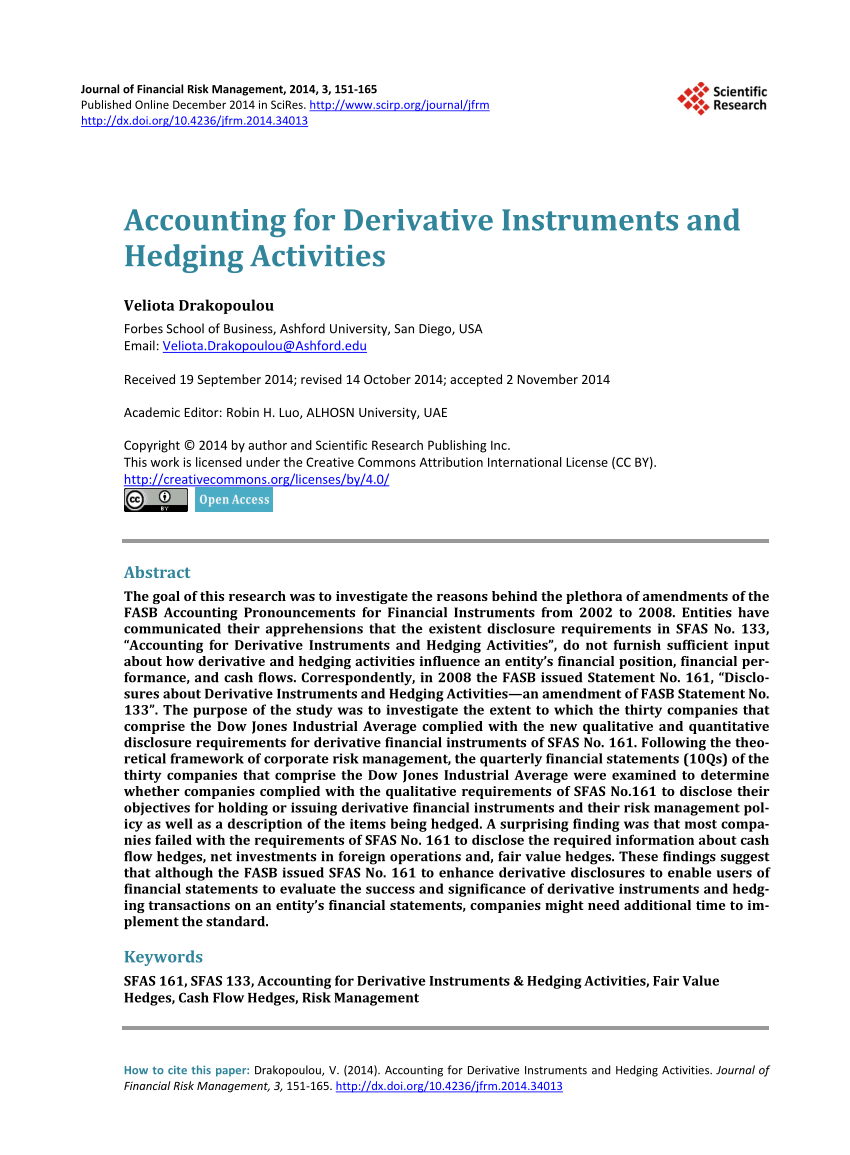

This chapter provides guidance on accounting for derivative instruments and hedging activities. This standard was created in response to significant hedging losses involving derivatives years ago and the attempt to control and mana… Journal of financial risk management, 2014, 3, 151.

Associated with derivatives instruments, including the application of hedge accounting permitted by asc 815 when specific requirements are met. This asu makes the most significant changes to. Accounting for derivatives fas 133 (financial accounting standards board statement no.

Derivatives and hedging (topic 815): Statements of financial accounting standards no. Entities have communicated their apprehensions that the existent disclosure requirements in sfas no.

Derivatives and hedging (topic 815): Asc 815 requires that derivative instruments within its scope be recognized and. 133, accounting for derivative instruments and hedging activities) the.

However, it does not have the authority of the original accounting. 133, “accounting for derivative instruments and hedging. Accounting for derivatives and hedging activity asc 815 requires a derivative to be recorded on the balance sheet as an asset or liability and to be.