Beautiful Work Info About Trial Balance All Entries

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

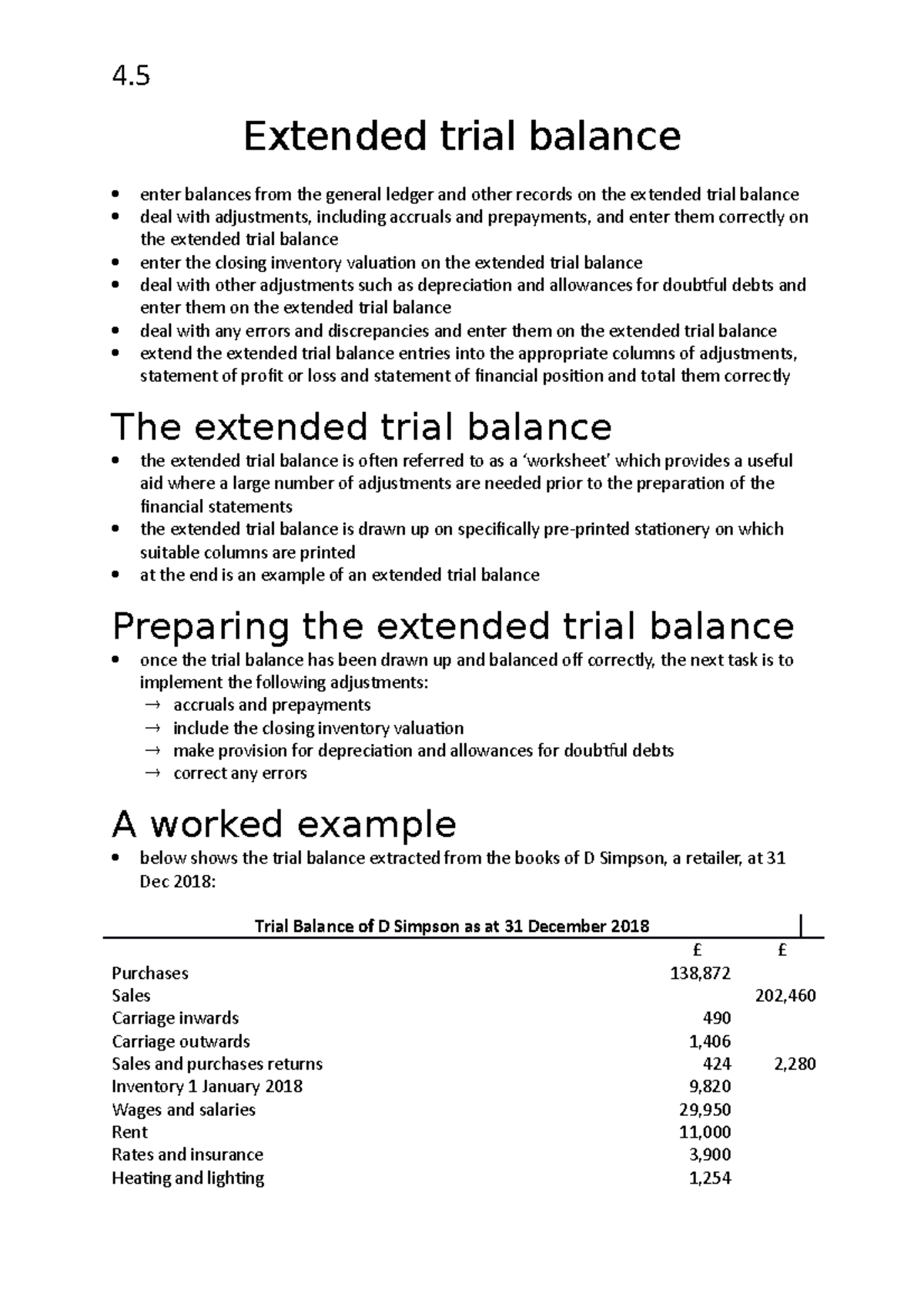

Trial balance all entries. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; Home resources technical skills accounting articles trial balance trial balance a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in creating financial statements. It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct.

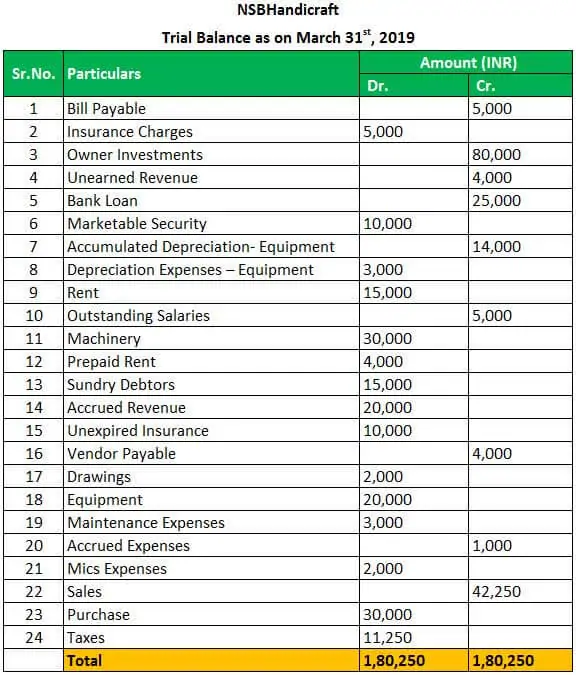

For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown wi. The balances are usually listed to achieve equal. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other.

The total dollar amount of the debits and credits in each accounting entry are supposed to match. The tb does not form part of double entry. The announcement came one day after a new york judge ordered trump and the trump organization to pay over $355 million as part of a civil fraud case.

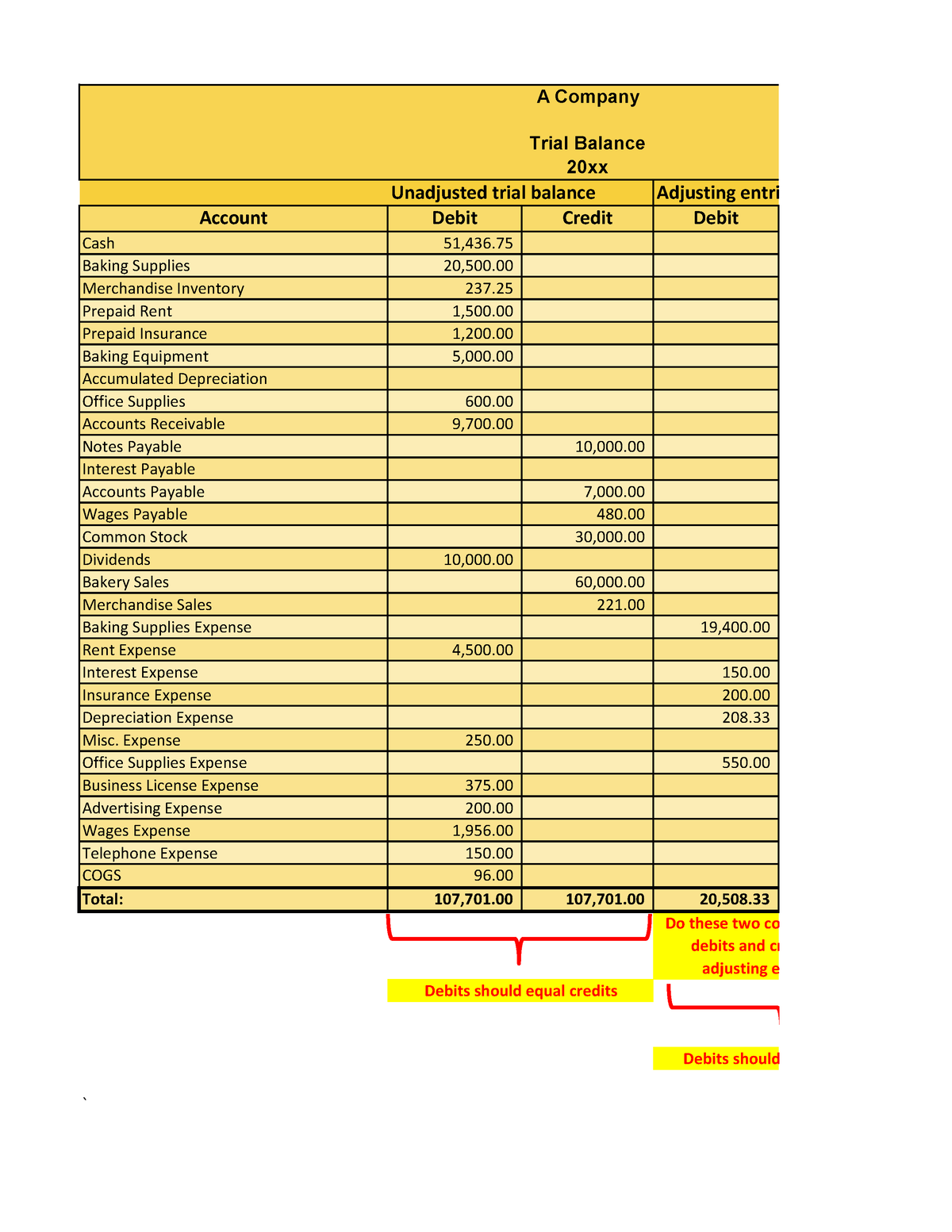

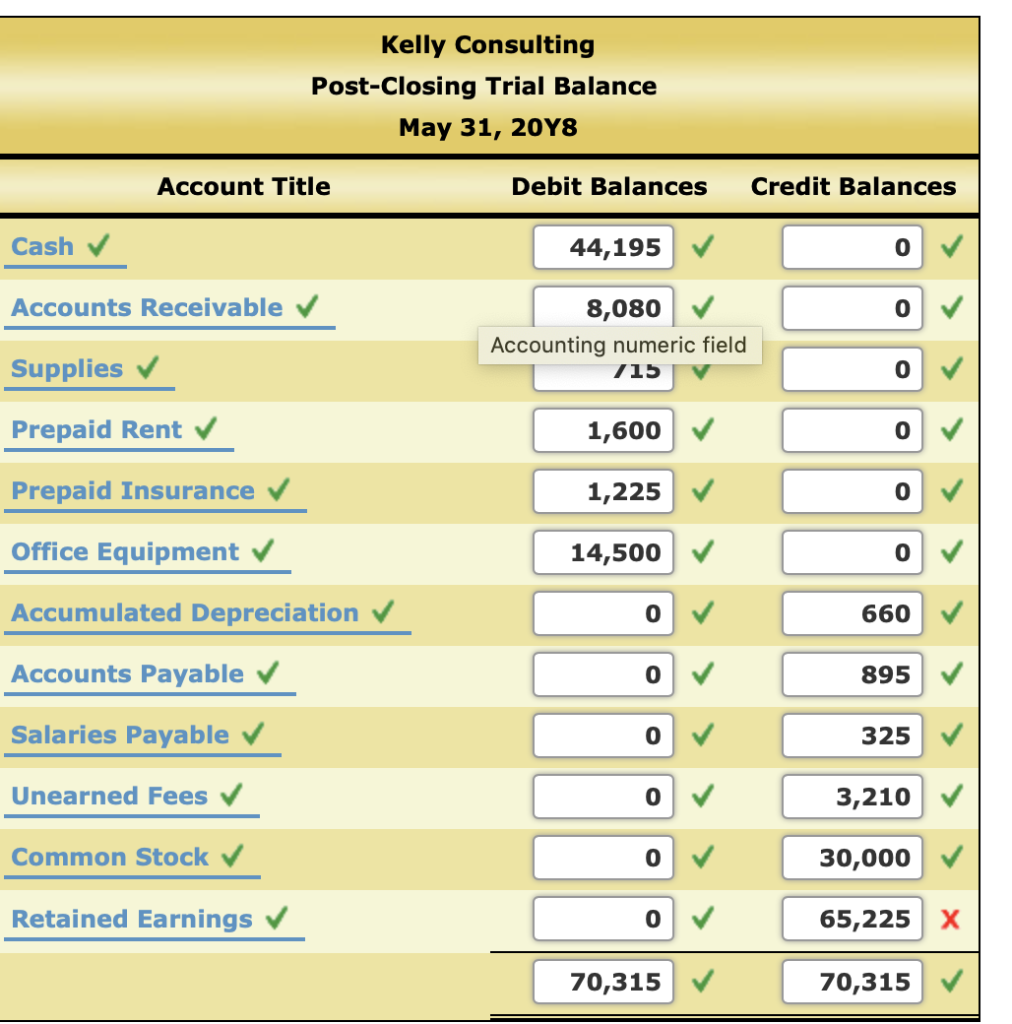

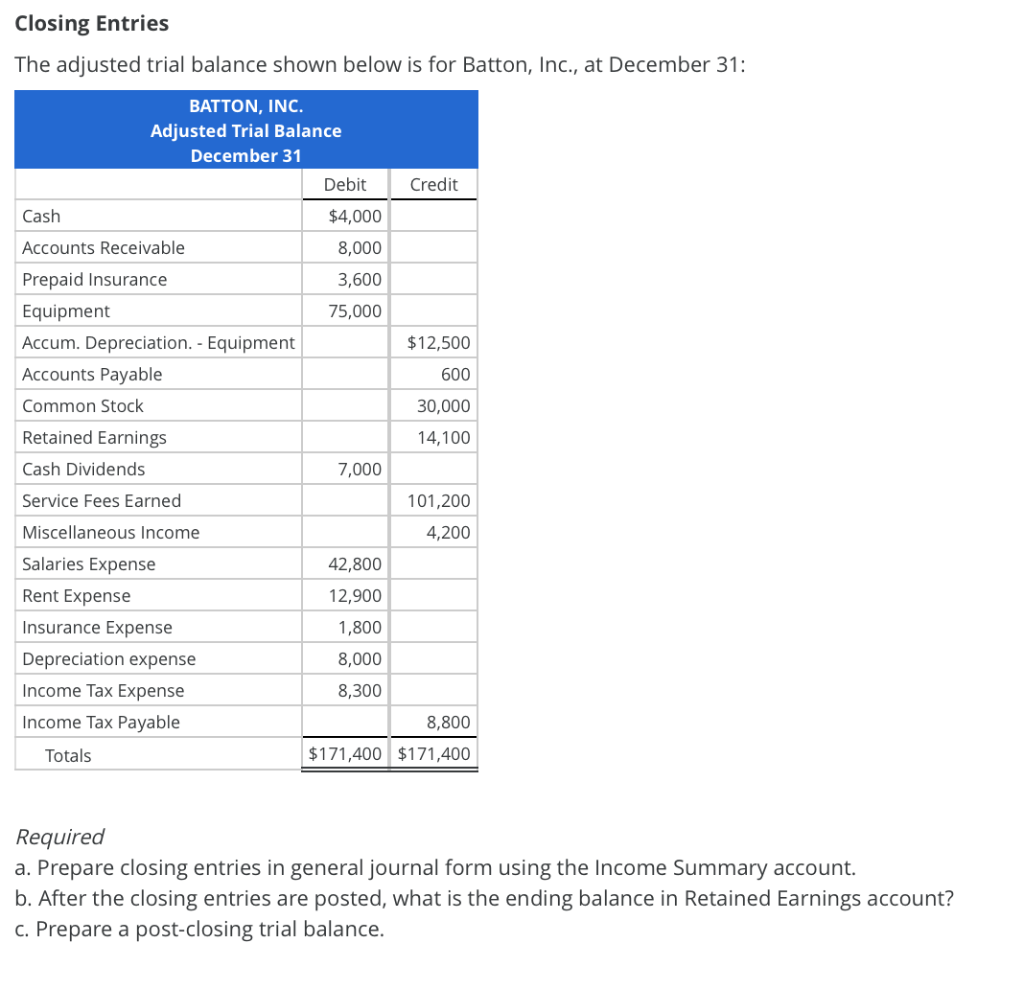

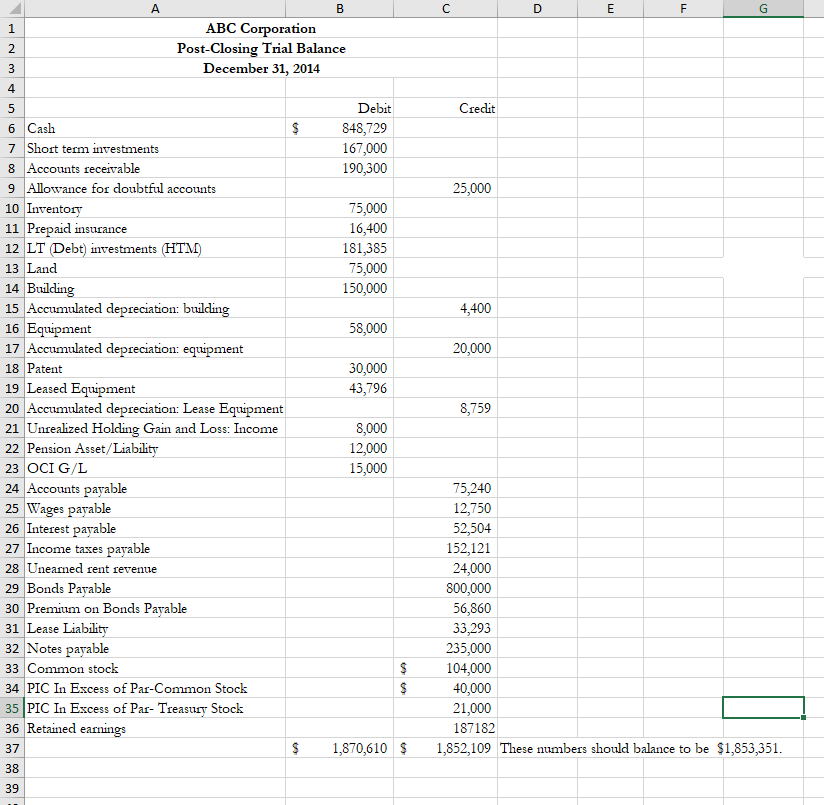

The goal is to confirm that the sum of all debits equals the sum of all credits and identify whether any entries have been recorded in the wrong account. The word “post” in this instance means “after.” you are preparing a trial balance after the closing entries are complete. The form and content of a trial balance is illustrated below, using the account numbers, account names, and account balances of big dog carworks corp.

The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries. A trial balance is an internal document that lists all the account balances at a point in time. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,.

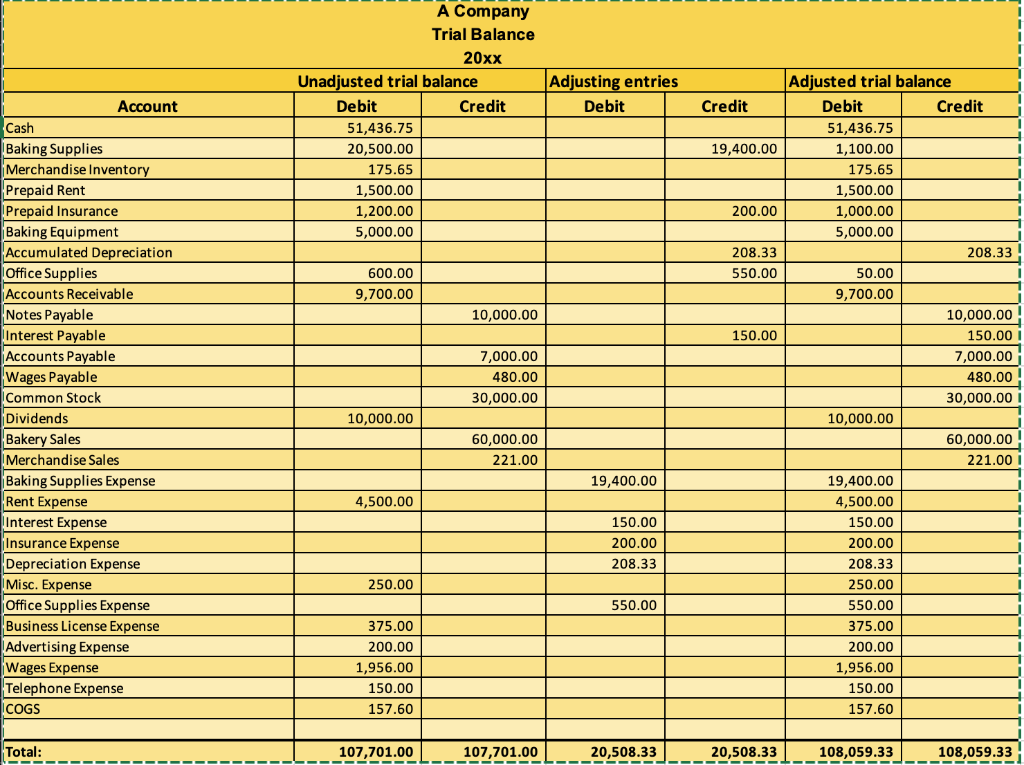

It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period. Understanding the components of a trial. Example of a trial balance document

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

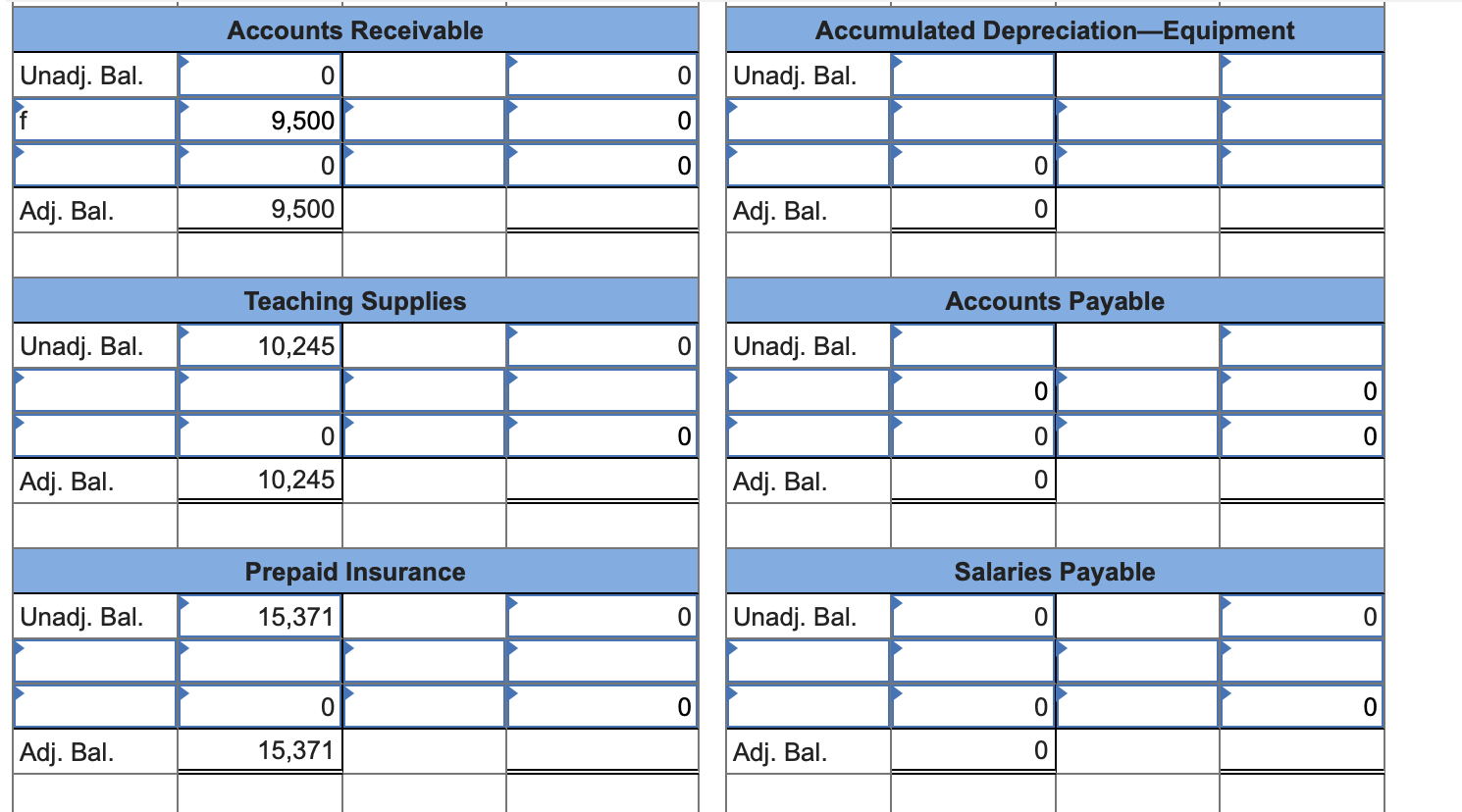

The result is a report that shows the total debit or credit balance for each account, where the grand total of the debits and credits stated in the report sum to zero. An adjusted trial balance is a listing of the ending balances in all accounts after adjusting entries have been prepared. Trial balance has a tabular format that shows details of all ledger balances in one place.

This is done to determine that debits equal credits in the recording process the trial balance is the first step toward recording and interesting your financial results. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Reports april 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts.

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. A trial balance lists the ending balance in each general ledger account. A trial balance, sometimes abbreviated to tb, is a list of all the account balances in the accounting records on a particular date.