Unique Info About Types Of Liabilities On Balance Sheet

Depreciation is a financial accounting method used to allocate the cost of tangible assets over t.

Types of liabilities on balance sheet. There are two main categories of balance sheet liabilities: The balance sheet includes things owned (assets) and things owed (liabilities). Provisional balance sheet format.

This is a list of what the company owes. Your balance sheet consists of two main categories: Another popular balance sheet format a company, provisional balance sheets have the same information as any other balance.

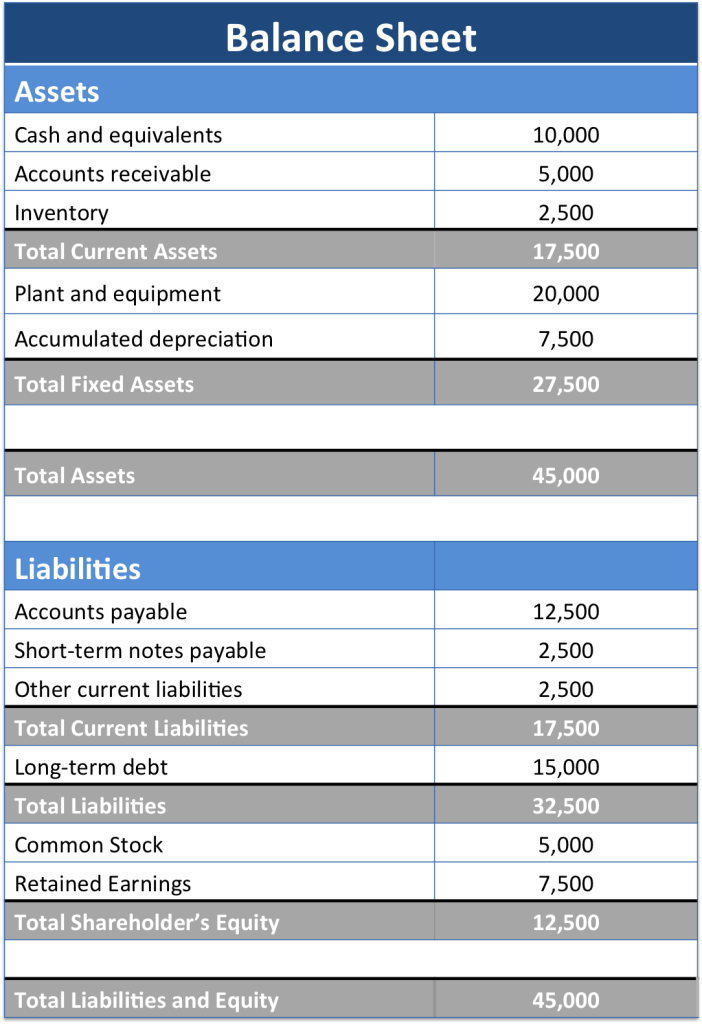

Types of balance sheets what is balance sheet format in excel? Example#1 the company reports total assets of rs 120000 at the time of closing of the accounting year, accounts payable 40000, shareholder equity 60000 and creditor 40000 and supplier 50000 and the company having. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

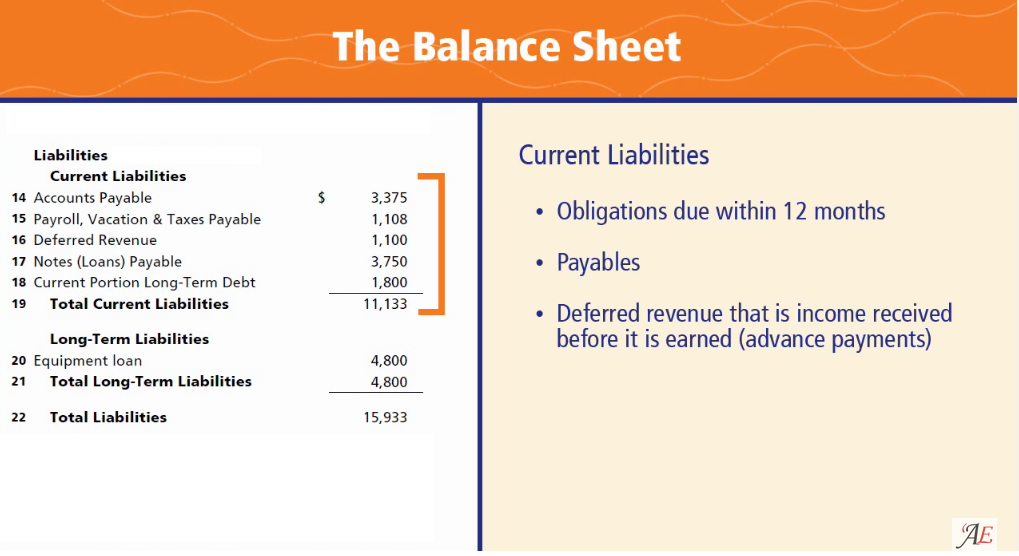

What are the different types of liabilities on the balance sheet? We classify liabilities into three main categories: Most companies will have these two line items on their balance.

Assets minus liabilities equals owners’ equity. The two categories of liabilities that can be found on a balance sheet are: Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued.

The most common liabilities are usually the largest like accounts payable and bonds payable. Equity how does a balance sheet work? Assets are the items your company owns that bring in income or provide a future benefit.

You can learn about the. A balance sheet, or compilation of stocks, is a statement of the values of the assets owned at a specific time and the financial claims, or liabilities, held by other units.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)