Cool Tips About Balance Statement Example

This article will provide a quick overview of the.

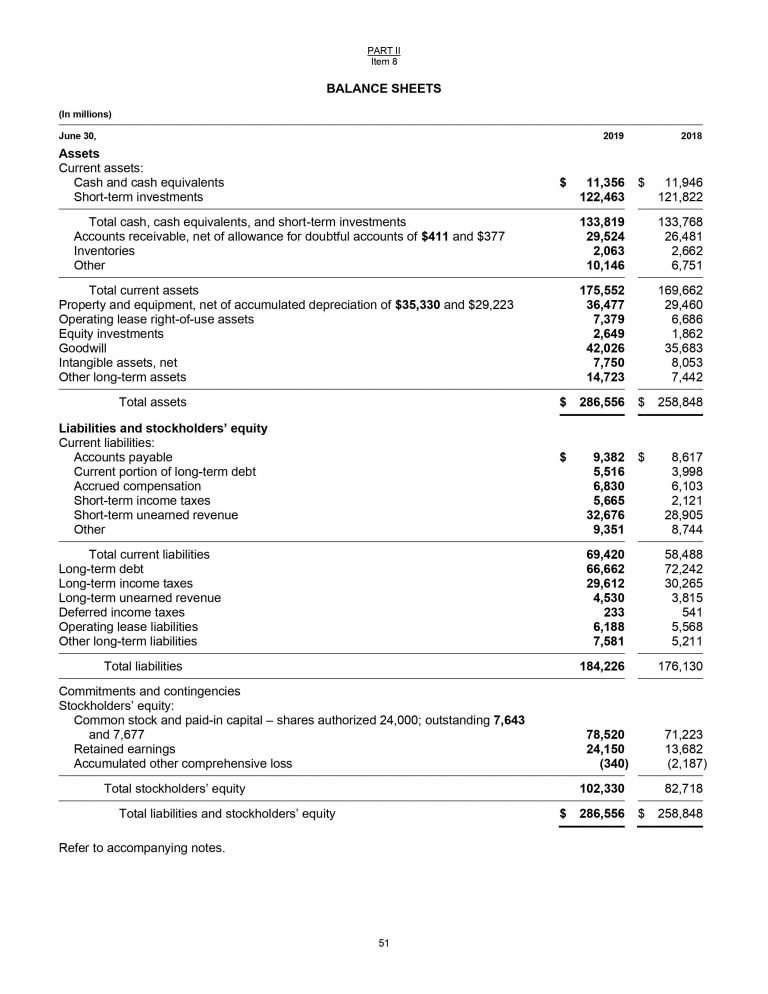

Balance statement example. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. You can check your credit card balance over the phone, online, or mobile app.

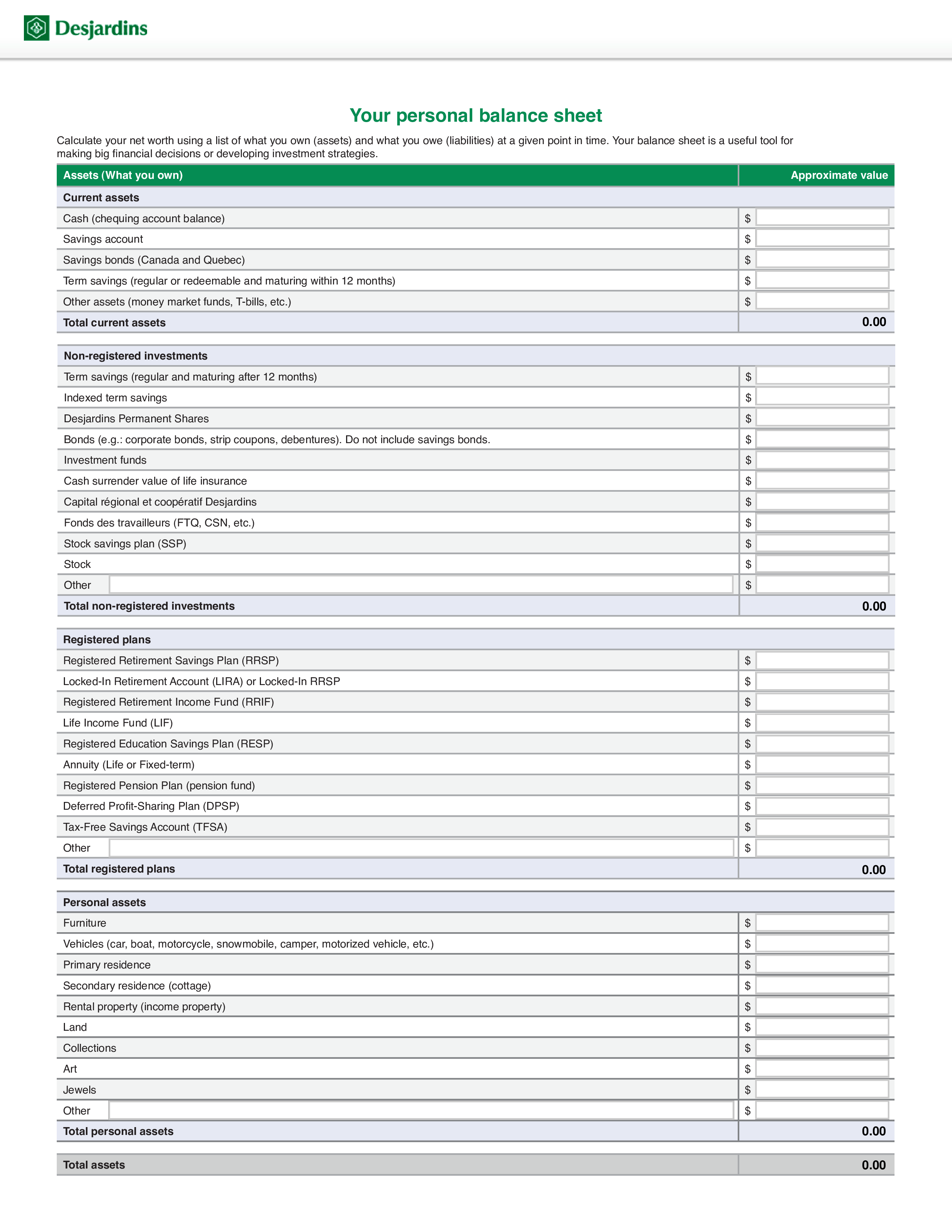

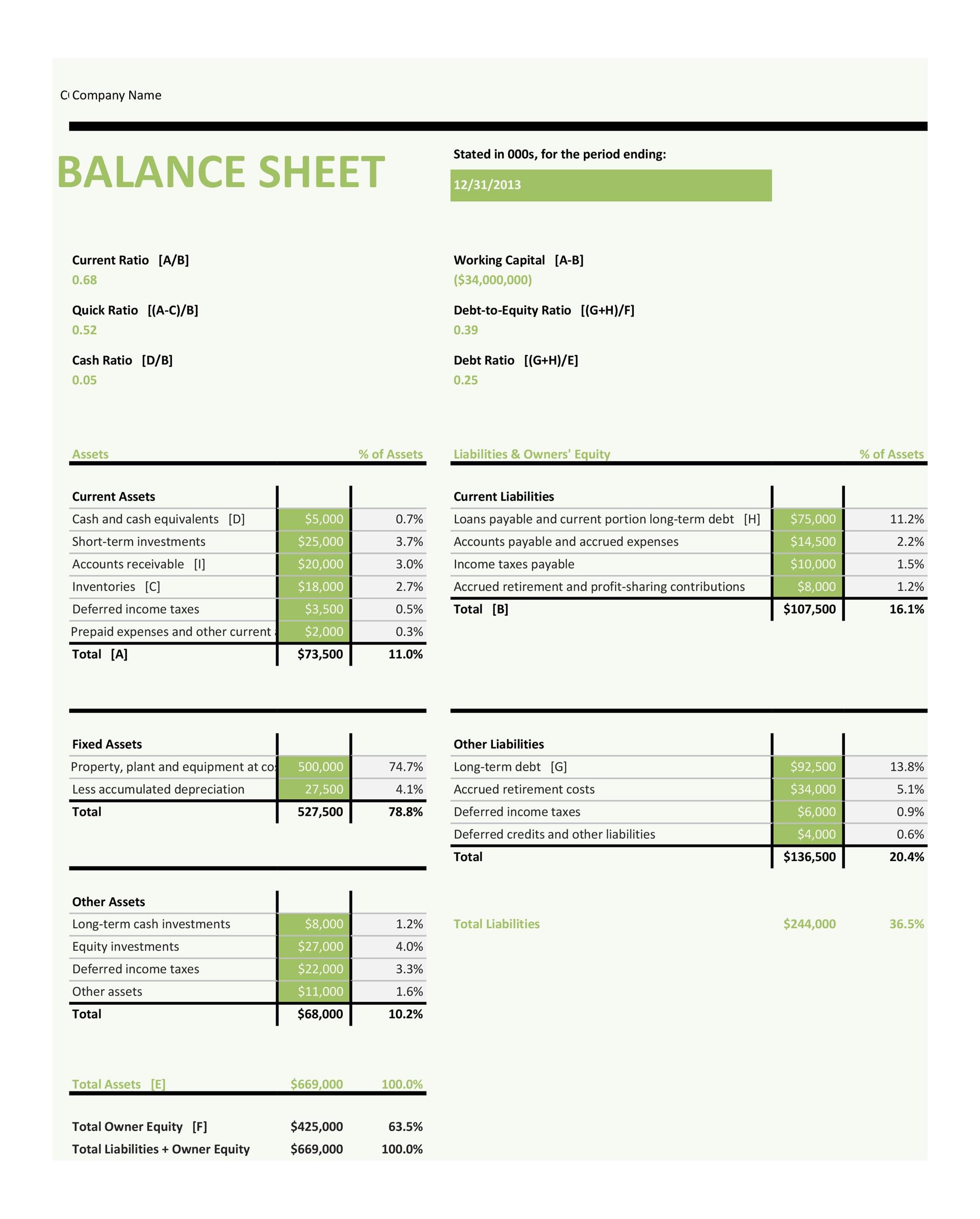

The different risk levels will mean more or less regulation. This balance sheet sample shows different accounts reported and the layout of the document. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Including a balance sheet in your business plan is an essential part of your financial forecast, alongside the income statement and cash flow statement. Keep a close eye on your credit card balances to avoid overspending. It can also be referred to as a statement of net worth or a statement of financial position.

Below is an example of a balance sheet of tesla for 2021 taken from the u.s. The inventory has increased by 20% from 15,623 in. Click below to download a free sample template of each of these important financial statements.

Overall, a balance sheet is an important statement of your company’s financial health, and it’s important to have accurate balance sheets available regularly. How to read and use it by james chen updated dec 15, 2023 frequently asked questions how are financial statements connected to each other?. The first line presents the name of the company;

In the account form (shown above) its presentation mirrors the accounting equation. Like any other financial statement, a balance sheet will have minor variations in structure depending on the organization. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

Thus, it is also called statement of financial position. Assets = liabilities + equity. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

The statement of stockholder's equity, often called the statement of changes in equity, is the second financial statement prepared in the accounting cycle. This balance sheet compares the financial position of the company as of september. With the account form it is easy to compare the totals.

Example #1 company a inc explanation the first column relates to the current year & the second column for last year is given for comparison purposes. The balance sheet is split into two columns, with each column balancing out the other to net to zero. As you can see, it starts with current assets, then the noncurrent, and the total of both.

The two sides must balance—hence the name “balance sheet.”. Increasing your liabilities) or getting money from the owners (equity). Once approved, these will be the world’s first rules on.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)