Who Else Wants Info About Business Financial Ratios

These short topic videos make understanding.

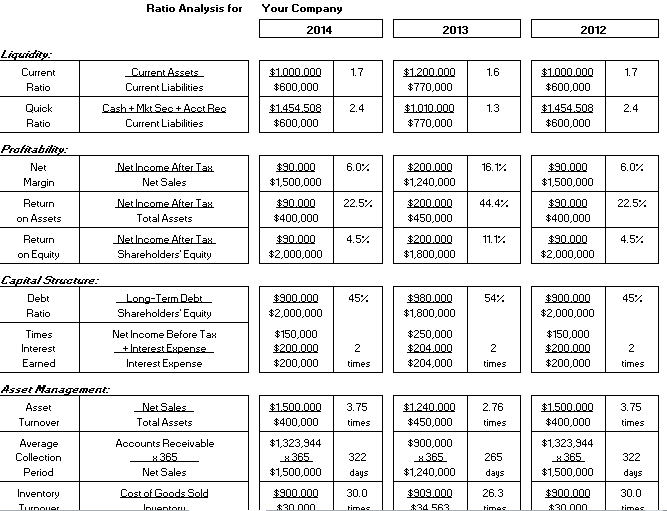

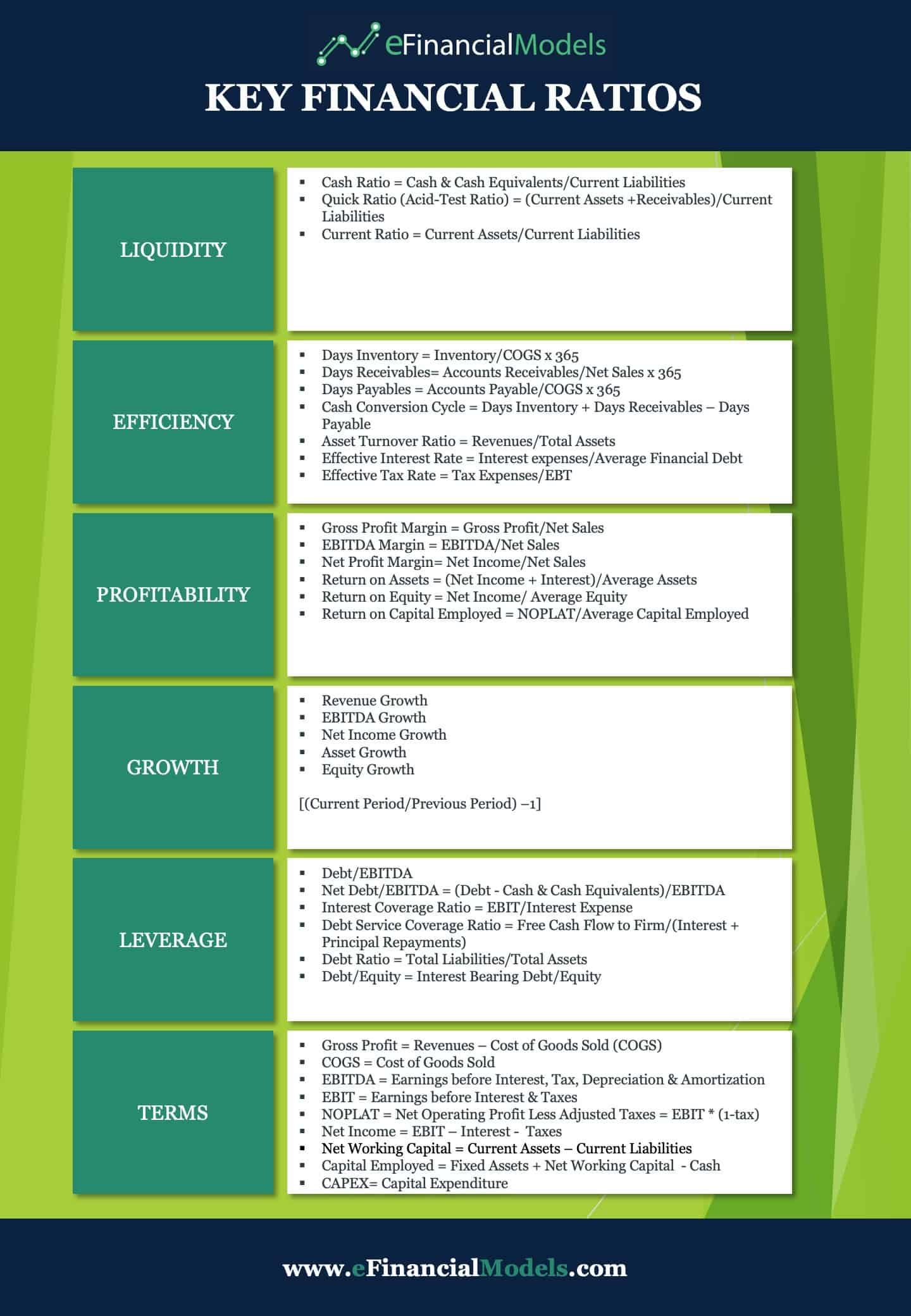

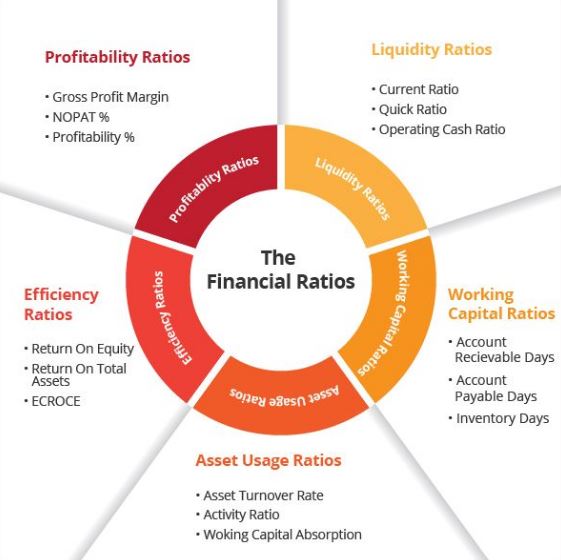

Business financial ratios. Leverage ratiosmeasure the amount of capital that comes from debt. Learn how to use key financial ratios to evaluate, compare, and conduct fundamental analysis of companies and industries. On 16 feb 2024, dpm and finance minister lawrence wong delivered the budget 2024 statement in parliament.

To begin, obtain the company’s most recent income statement and balance sheet. Corporate finance ratios are quantitative measures that are used to assess businesses. Corporate finance ratios, often referred to as financial ratios, are metrics that provide an analytical perspective on the financial condition and operational results.

They are mainly used by external analysts to. Businesses use financial ratios to determine liquidity, debt concentration, growth, profitability, and market value. Financial tools liquidity ratios.

Wharton has regained its position as the world’s leading provider of mbas in 2024, according to the latest ft ranking of the top 100 global business schools. These ratios are used by financial analysts, equity research analysts, investors, and. Why are financial ratios so important?

5% (good), 20% or higher (excellent). These ratios are used by financial analysts, equity research analysts,. The power of perspective.

Cash flow to debt (net income + depreciation) ÷ total debt = cash flow to debt ratio small businesses make money every month but still have cash flow. A financial ratio is a measure of the relationship between two or more components on the company’s financial statements. A sustainable and increasing return on equity.

Common leverage ratios include the following: These ratios give you a quick and. Return on assets ratio (%) = (net profit ÷ total assets) × 100.

In other words, leverage financial ratios are used to evaluate a company’s debt levels. Read more financial ratios are numerical calculations that illustrate the relationship between one piece or group of data and another. Corporate finance ratios are quantitative measures that are used to assess businesses.

Ratio analysis refers to the analysis of various pieces of financial information in the financial statements of a business. They are calculated by comparing two or more financial values to. The key to unlocking your potential and the potential earnings of your business lies in perspective.

A financial ratio is a metric usually given by two values taken from a company’s financial statements that compared give five main types of insights for an. Financial ratios are essential tools used for analyzing and understanding the financial health of a business. The debt ratiomeasures the relative amount of a company’s assets that are provided from debt: