Real Tips About Earnings Per Share On Balance Sheet

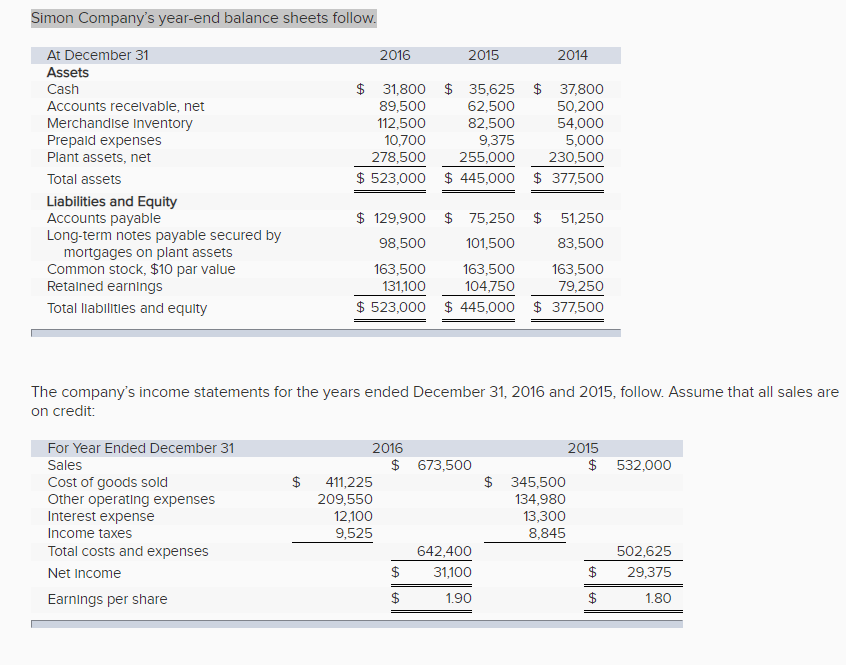

The earning per share (eps) is the ratio between a company’s net income and its weighted average number of common shares outstanding.

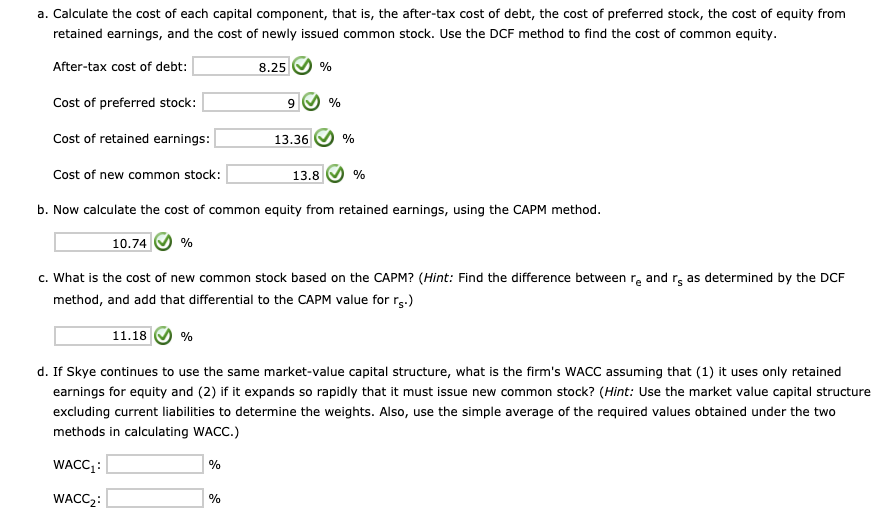

Earnings per share on balance sheet. Earnings per share (eps) is a key metric used to determine the common shareholder’s portion of the company’s profit. Eps helps you understand if investing in a company is profitable. The formula looks like this:

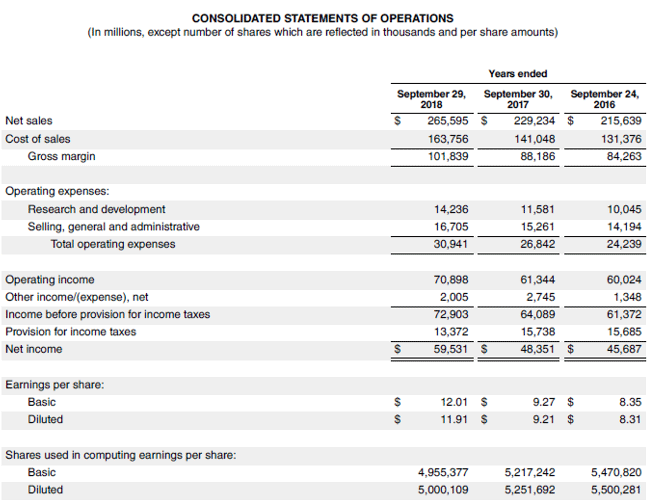

Basically, earnings per share shows you how much money each shareholder made for each of her shares. Basic earnings per share (eps) do not factor in the dilutive. Company b also had earnings of $10,000, but with 10,000 shares outstanding, which equals an eps of $1 ($10,000 ÷ 10,000 = $1).

You can practice the calculation by using the example above. For instance, continuous eps growth. Basic earnings per share is a rough measurement of the amount of a company's profit that can be allocated to one share of its stock.

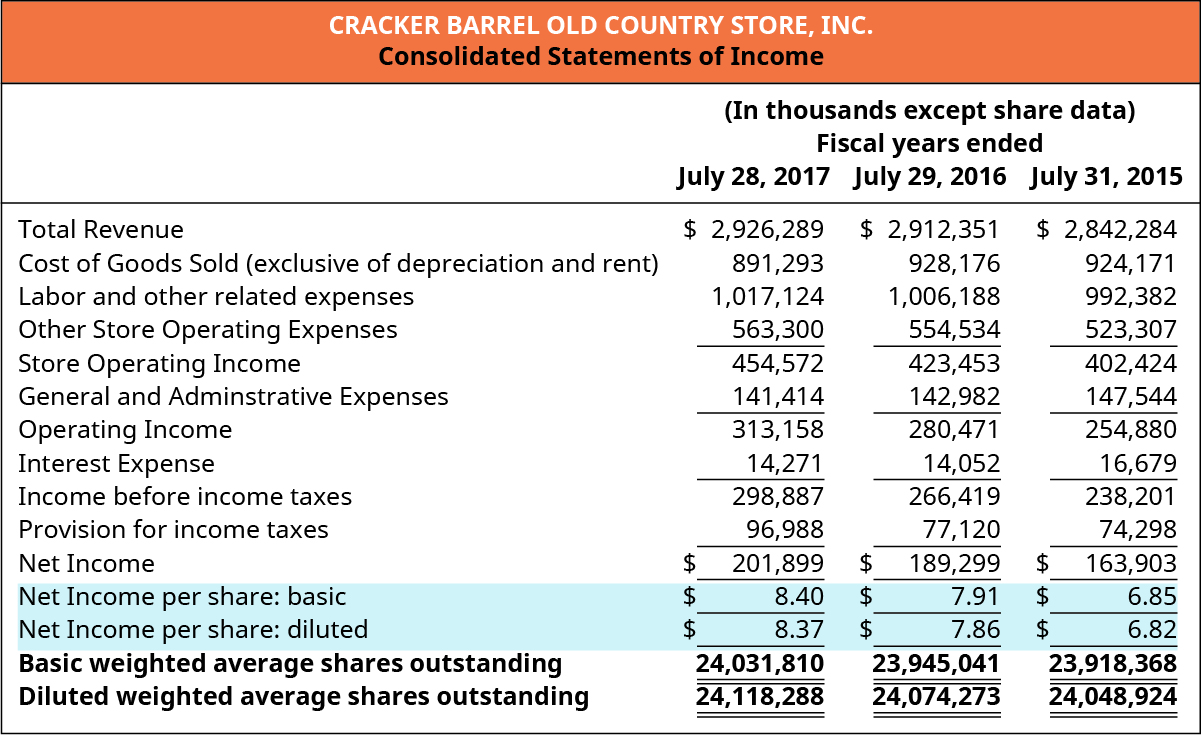

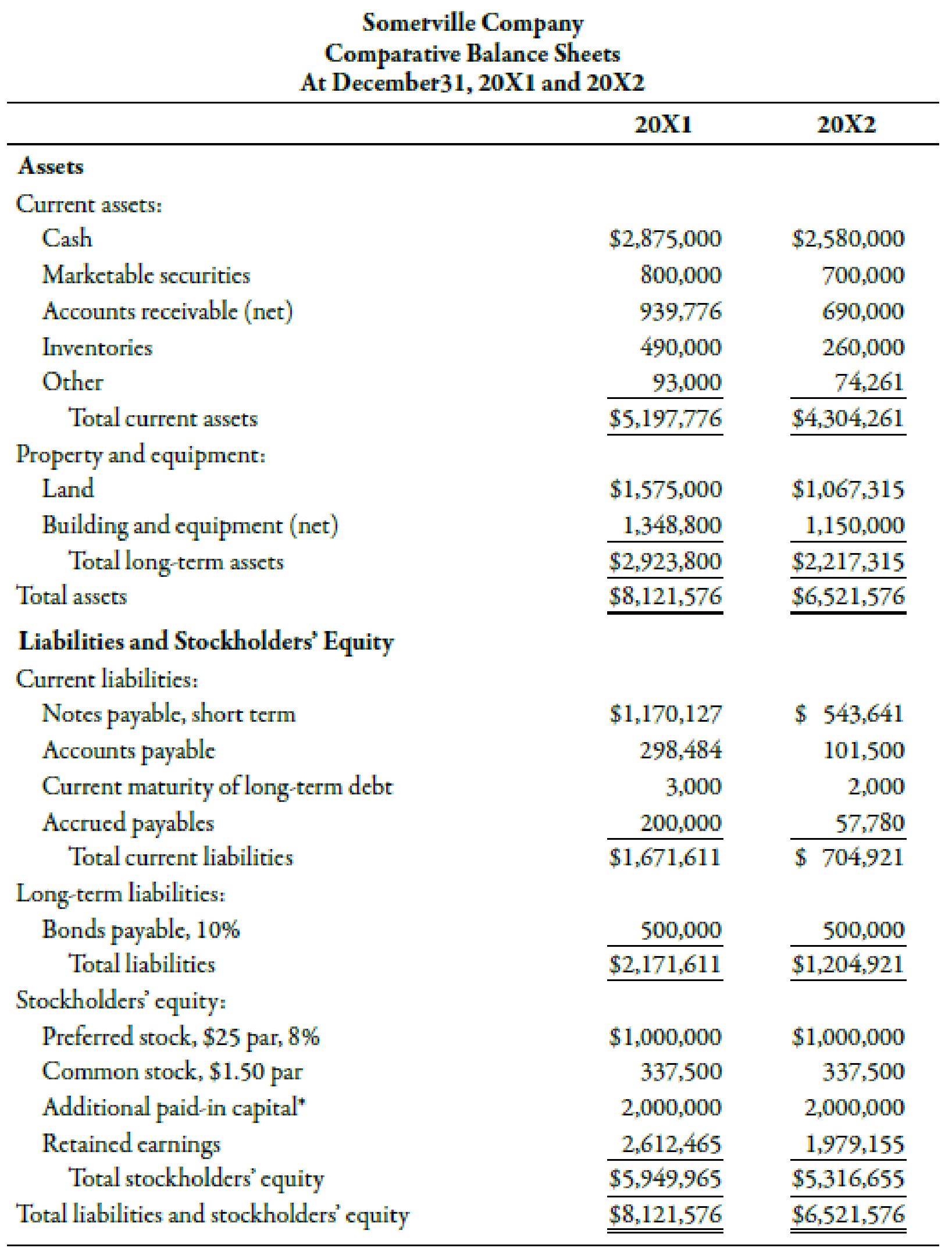

When calculating the eps, you’ll need the company’s balance sheet and income statements to find the common shares,. Crocs brand grew across all regions and channels, highlighting the power of our strategy and disciplined execution. The consensus estimate of earnings is pegged at $3.51 per share, higher than the guided range.

Divide by the average between the current period and prior period common shares outstanding. Below are two versions of the earnings per share formula: Eps measures each common share’s profit allocation in relation to the company’s total profit.

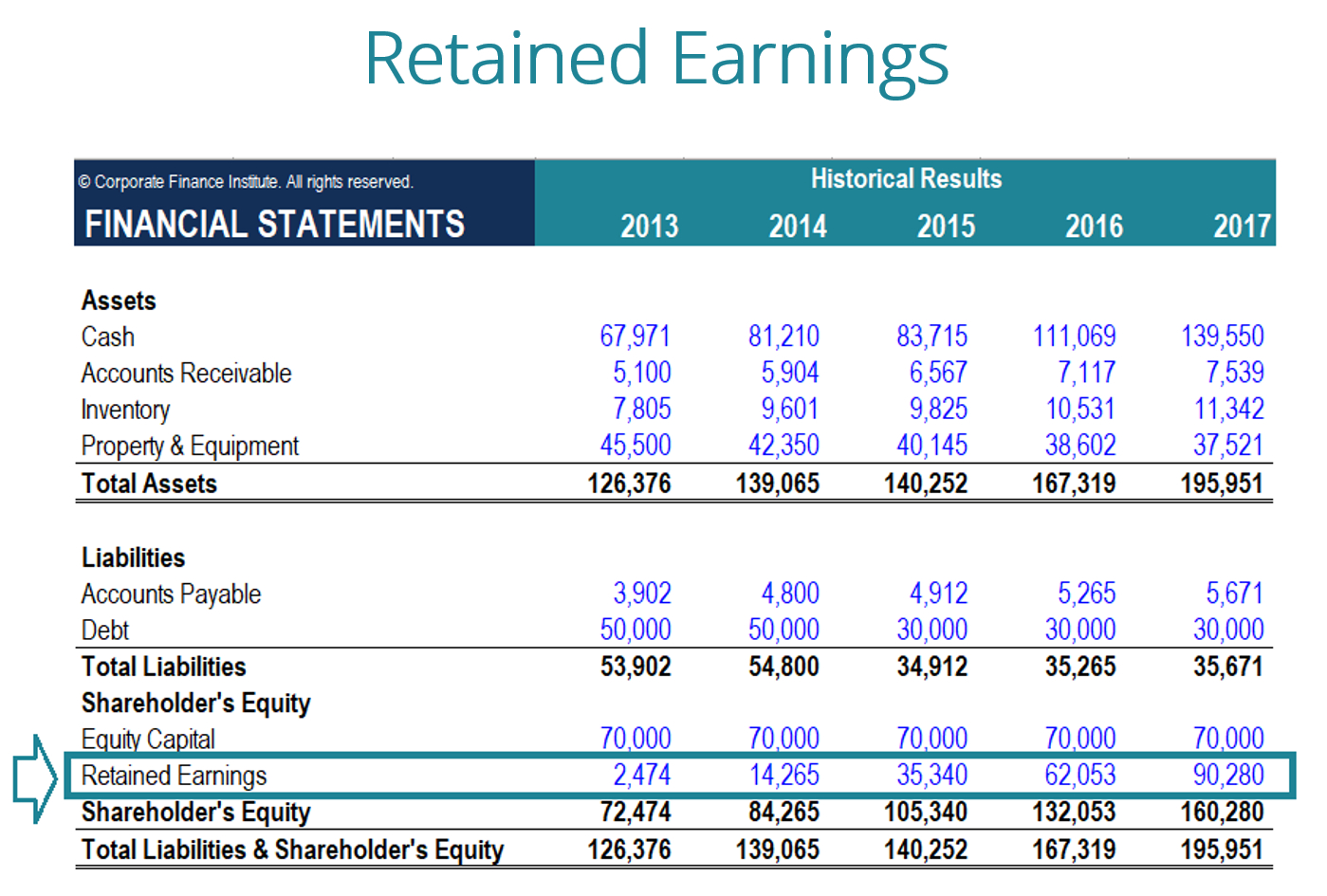

Calculating earnings per share. Both the balance sheet and income statement are needed to calculate eps. Link to net earnings in the applicable period.

Axa enters its new strategic plan in a position of strength. Adjusted earnings per share of $0.29 compared to $0.18 per share adjusted ebitda of $234 million, an increase of $76 million full year 2023 highlights versus prior year. Earnings per share (eps) is a company's net profit divided by the number of common shares it has outstanding.

Eps equals the difference between net income and. After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000 accumulated depreciation, for a net book value of $32,000. Basic earnings per share:

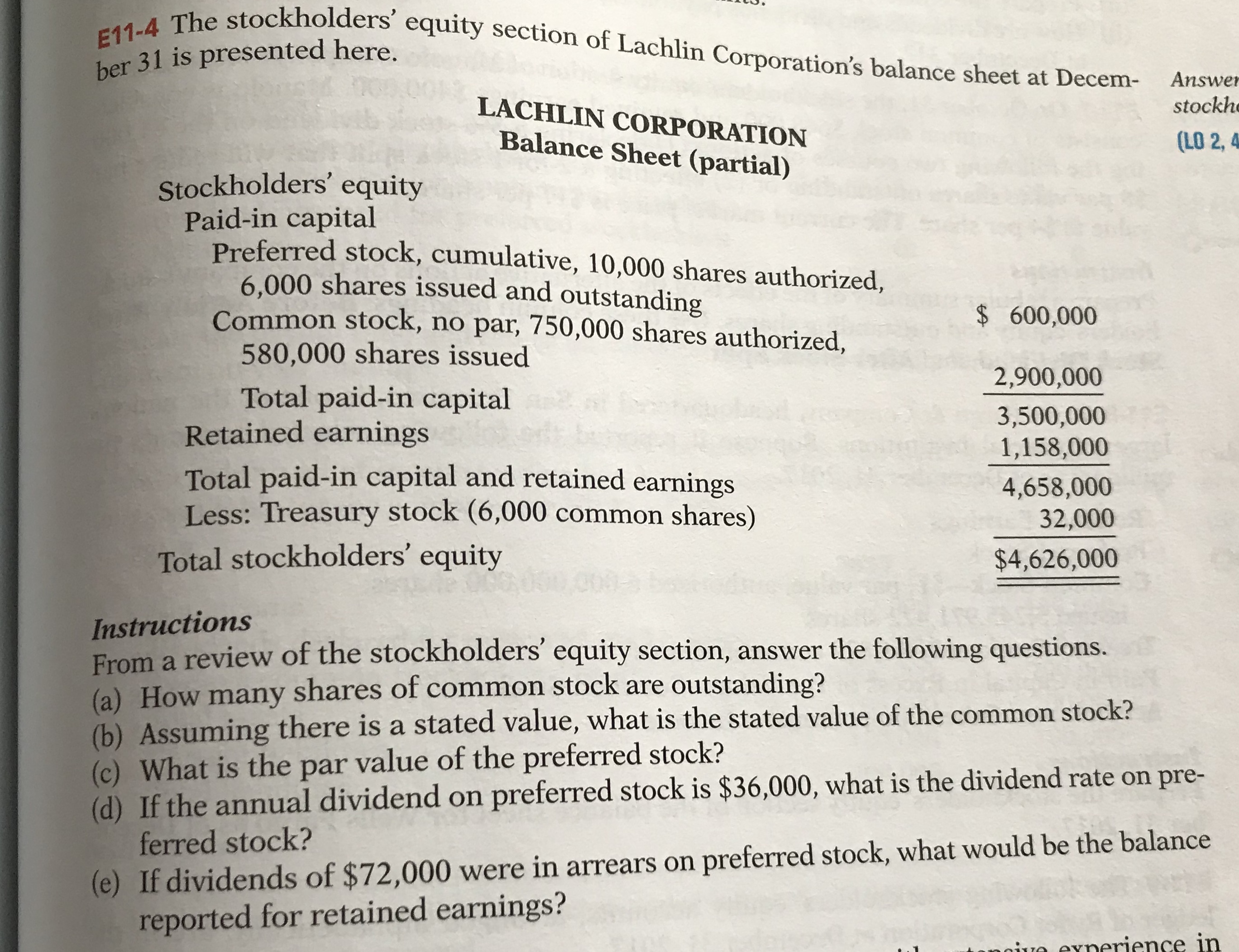

Balance sheet and cash flow. The balance sheet provides details on the preferred dividend rate, the total par value of the preferred stock, and the number of common shares. As the nation’s largest retailer and private employer, walmart often serves as a barometer for how consumers feel about their finances and.

They are recorded as owner's equity on the company's balance sheet. Earnings per share formula. Earnings per share is the profit a company earns for each of its outstanding common shares.