Looking Good Info About Statement Of Investment Income

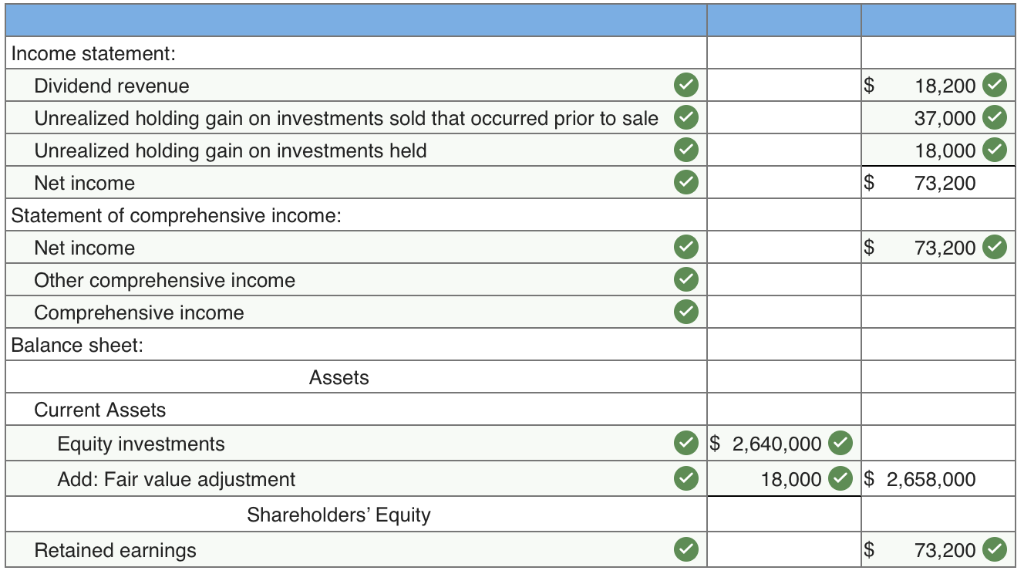

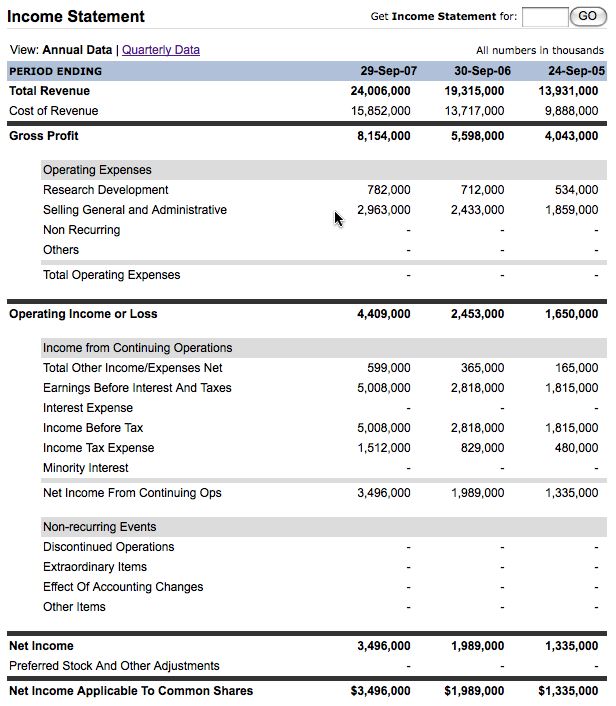

An income or profit and loss statement is one of the core financial statements used to assess a company's financial performance.

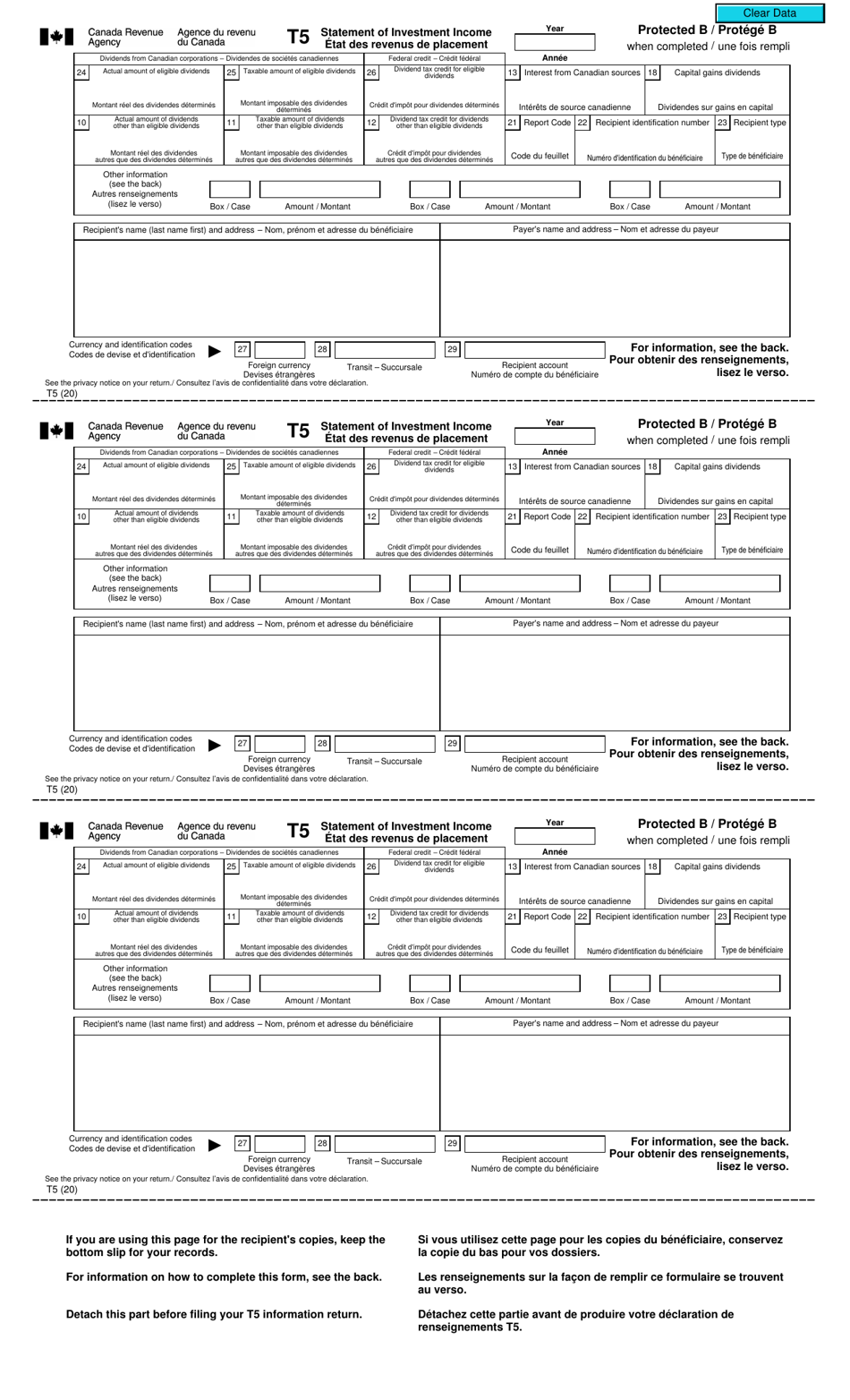

Statement of investment income. 7 rows also known as the statement of investment income, a t5 slip is. When completing the t5 return, include either.</p> How to correctly claim gic interest income.

No changes note: You receive a t5 tax slip from your financial institution (s) when you have investment income of $50 or more from the. Net income $ 30,000.

Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows. Cra requires bmo investorline to report your investment income on this cra authorized form. These slips will be mailed the week of february 22, 2021.

Follow these steps in h&r block's 2023 tax software:. Send the tax you withhold, along with a statement showing the period covered, the gross income amount, and the amount of tax you deducted to your tax centre, no later than. Number of shares outstanding 30,000.

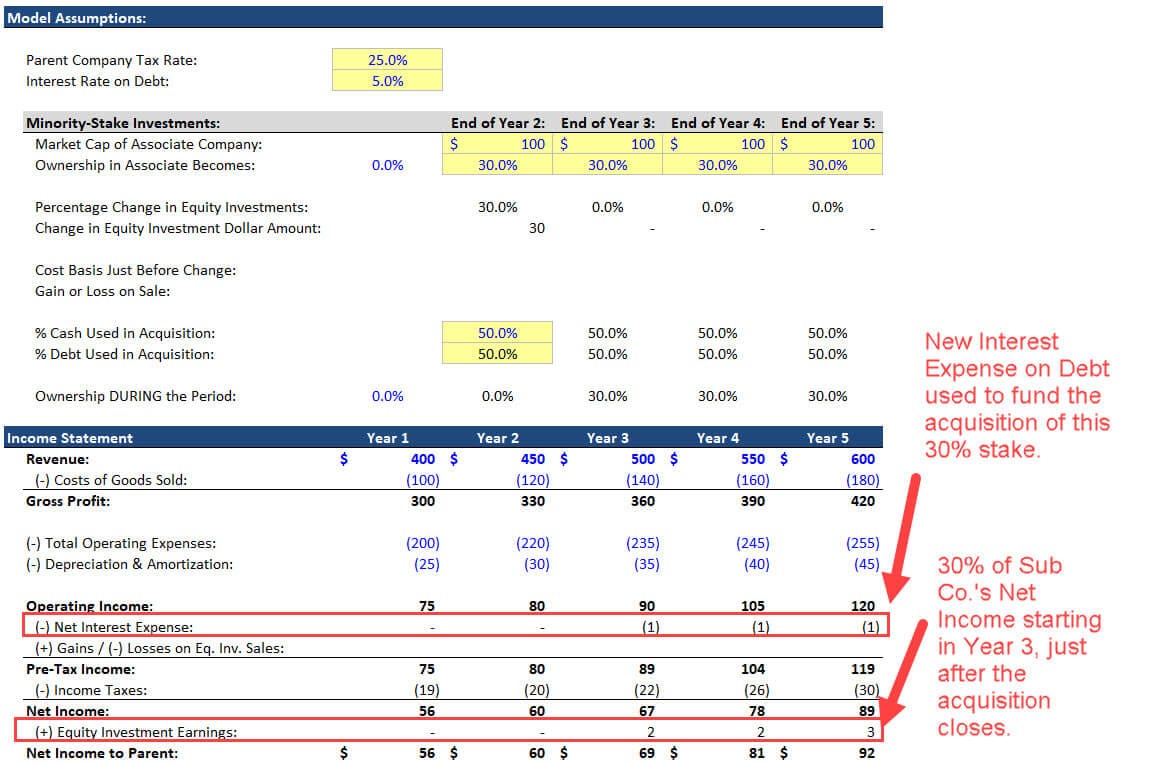

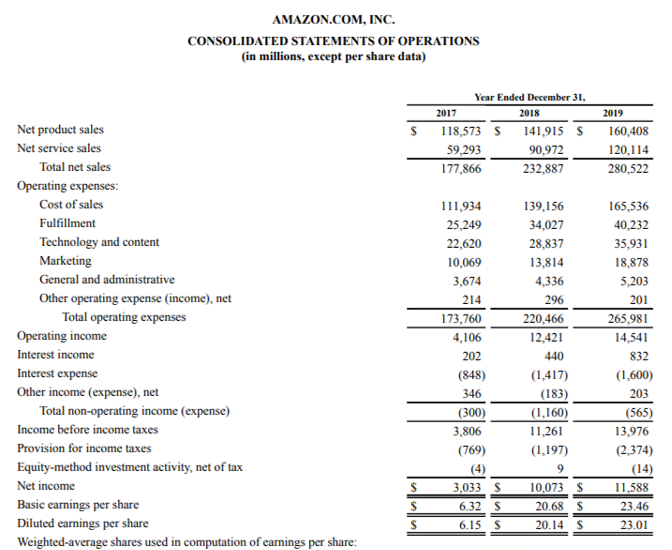

The income statement focuses on four key items: Learn how to record investment income in the income statement, such as dividends, interest, equity method, and gains and losses on investment. On the left navigation menu, under the credits & deductions tab, click tax topics.

Select the investments income &. T5 information slip for filers to report certain investment income paid to a resident of canada or to a nominee or agent for a person resident in canada. Earnings per share (eps) $1.00.

Washington—today, the u.s. If you earn more than $50 of income in your investment accounts, your financial institution will issue a t5 slip, also known as a statement of investment income. Investment income refers to the amount earned on investments in common stock, bonds or other financial instruments of outside.

The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Department of the treasury’s financial crimes enforcement network (fincen) issued a notice of proposed rulemaking. Accounting for investment income.

Why does a statement of income matter? Yes, the interest on your savings bank account is taxable under the head income from other sources at the slab rate applicable to you.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Investment_Income_Apr_2020-01-fae8874a0f0c4ab38e8e3cc18801e803.jpg)