Ideal Info About Calculate Ratios From Balance Sheet

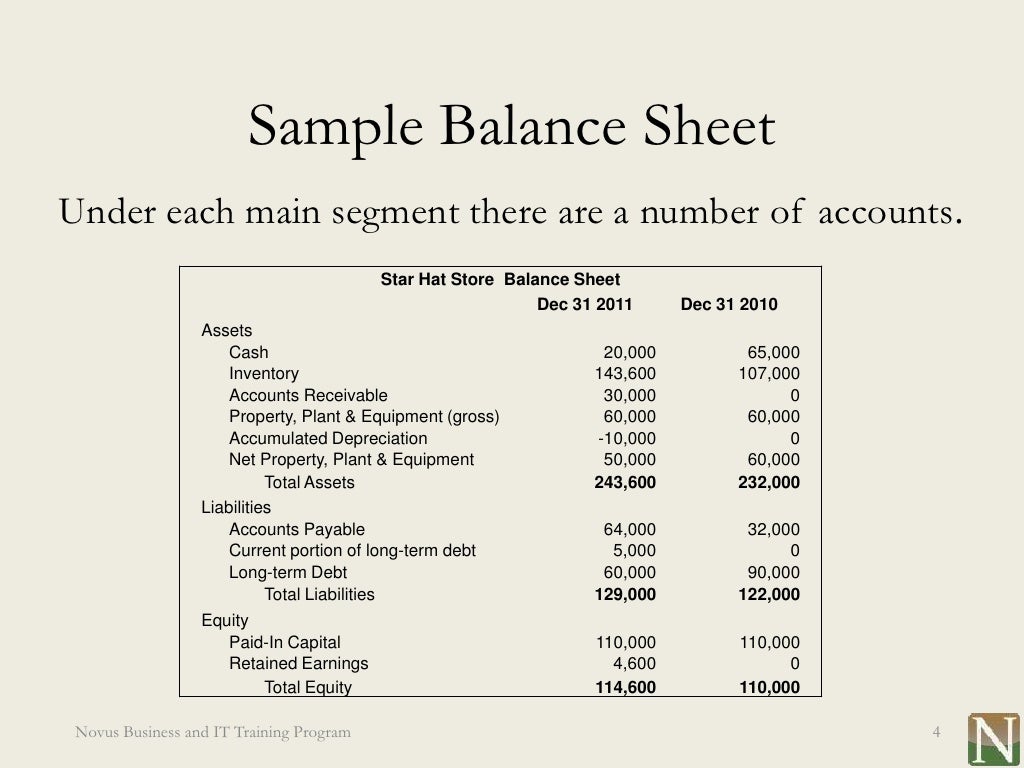

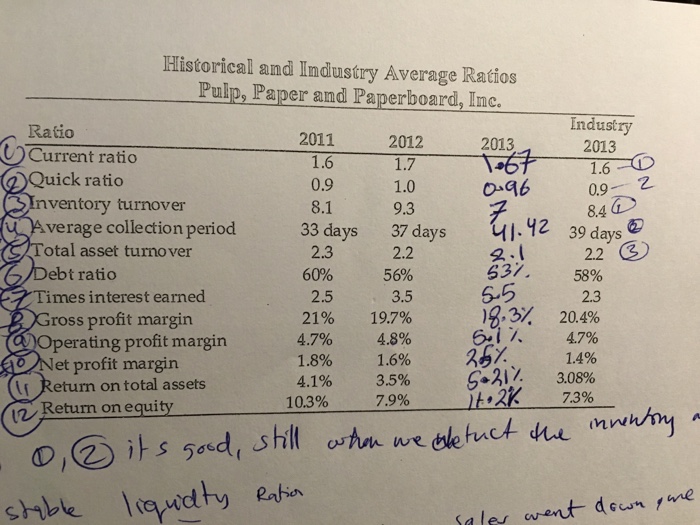

The information it contains can be used to derive a number of ratios that can be used to infer the liquidity, efficiency, and financial structure of a business.

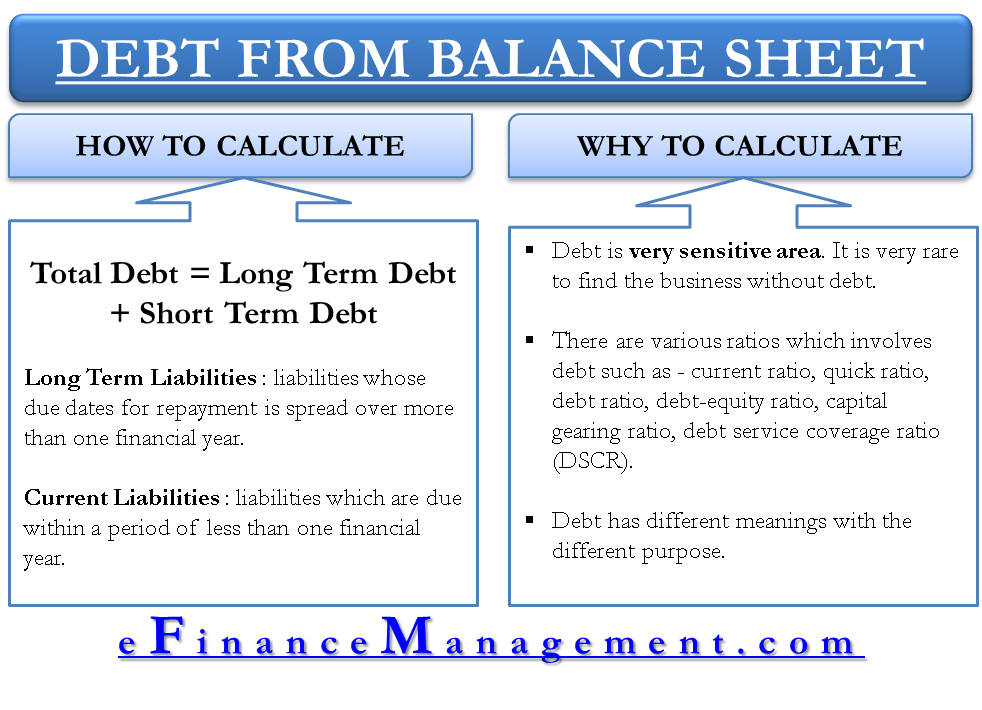

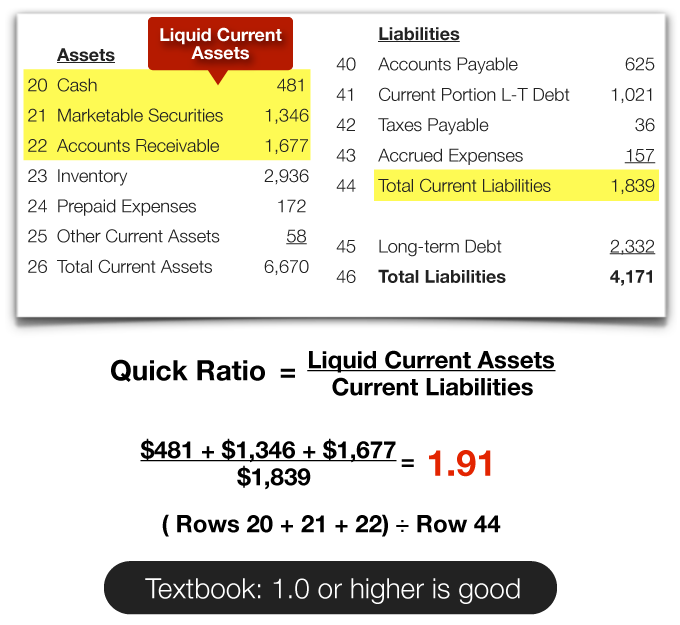

Calculate ratios from balance sheet. Leverage ratios → leverage ratios, much like liquidity ratios, are meant to ensure that the company can continue to operate as a “going concern”, i.e. The corporation's quick ratio as of december 31 is calculated as follows: Balance sheet is the financial.

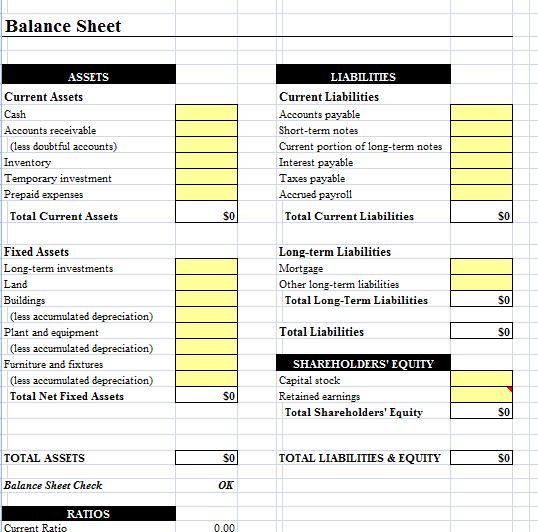

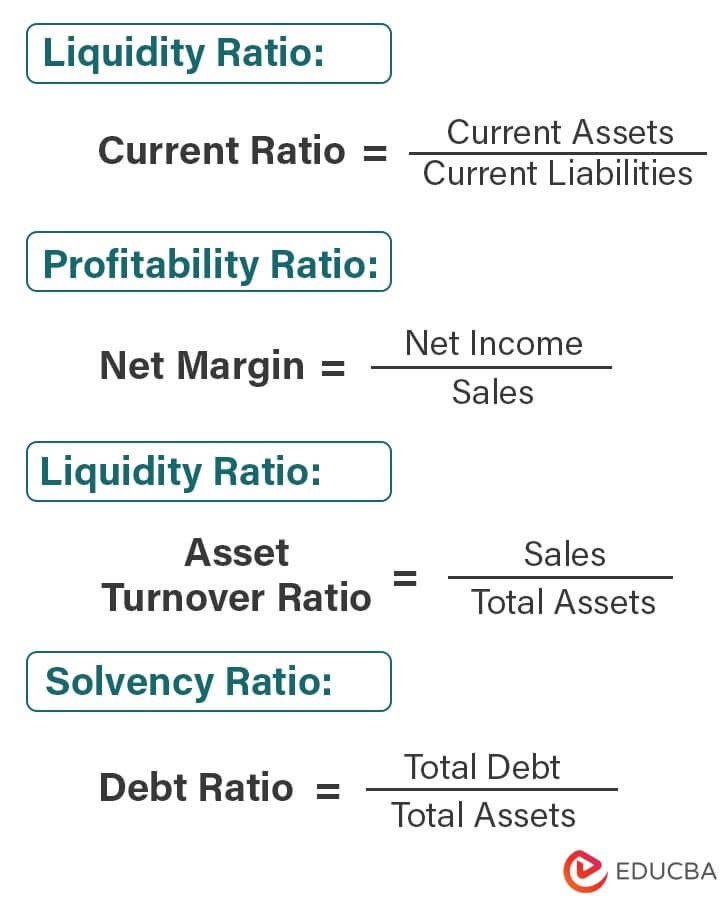

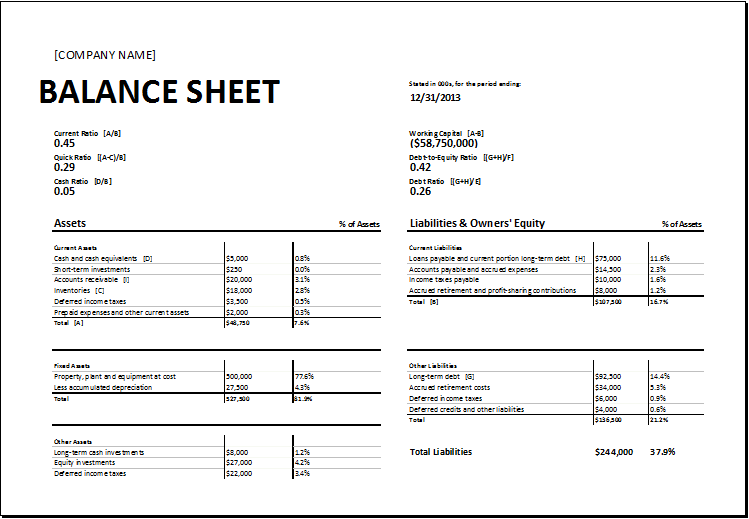

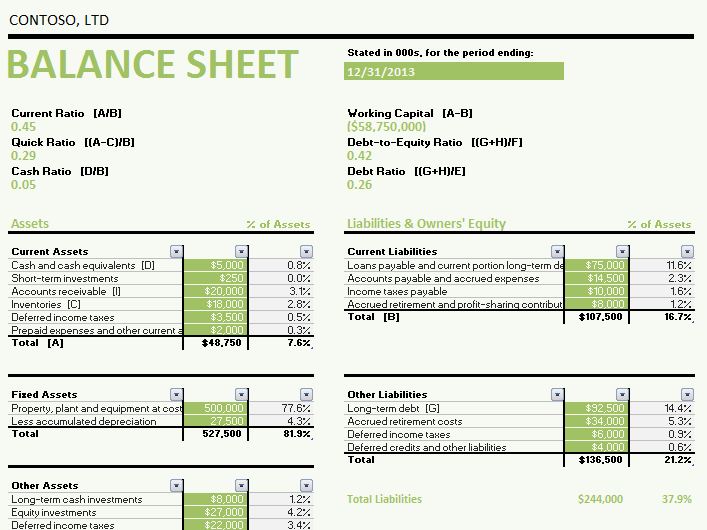

To get your current ratio, divide your current assets by your current liabilities. Components of assets, liabilities and shareholders equity in their calculation. To calculate your debt to asset ratio, look at your balance sheet and divide your total liabilities by your total assets.

The balance sheet current ratio can be found by dividing a company's total current assets in dollar by its total current liabilities in dollars. How to calculate balance sheet ratios written by gocardless last editedjun 2022 — 2 min read how the balance sheet equation works calculating the ratios from a business’s balance sheet may seem like a dry and academic exercise, but it is incredibly valuable. Profitability ratios show the ability to generate income.

The increase in margin was driven by. The current ratio is calculated by dividing the current assets by current liabilities. Current ratio = current assets / current liabilities current ratio example:

It indicates the overall operational performance of the company. Providing a complete interpretation of a company's results quantitatively, balance sheet ratios are used to compare two items on the balance sheet or analyze balance sheet items. Investopedia / katie kerpel how balance sheets work the balance sheet provides an overview of the state of a.

Definition and examples of balance sheet formulas Liquidity ratios show the ability to turn assets into cash quickly. Us$15.5b (up 33% from fy 2023).

This criterion compares the current assets and the current liabilities of a company. This means your debt to asset ratio is 40 percent: The overreliance on debt is by far the most common cause of financial distress (and filing for bankruptcy) among corporations.

The ratios calculation includes various types of balance items, such as cash, inventory,. Investments + accounts receivable) / current liabilities Ratio #10 receivables turnover ratio

How is the balance sheet used in financial modeling? The balance sheet ratios calculator is used in analysis of financial statements through the consideration of ratios that underscore the relationships in the balance sheet and the income statement. After all, that’s what analysts, proprietary traders, and institutional investors do.

Solvency ratios show the ability to pay off debts. Current ratio = current assets / current liabilities current ratio example There are three types of ratios derived from the balance sheet:

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

![Download [Free] Balance Sheet with Ratios Format in Excel](https://exceldownloads.com/wp-content/uploads/2021/09/Balance-Sheet-Template-Feature-Image.png?v=1685413421)