Real Info About Cash Receipts From Customers Flow

Add or subtract cash flow from investing and financing activities

Cash receipts from customers cash flow. Acquisition of subsidiary x, net of cash acquired ( 550) purchase of property,. Cash paid to suppliers and employees ( 27,600) cash generated from operations. It is also raising selected.

Deduct cash payments to suppliers, employees, and other operating expenses; Cash flow statement direct method; Santander has announced it will increase all residential and buy to let fixed rate mortgages for new customers from tomorrow.

A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. Cash flow from operating activities. The cfs highlights a company's cash management, including how well it generates.

The board of directors of ingersoll rand inc. Cash flows from operating activities : Calculate cash flow from operating activities;

(a) cash receipts from the sale of goods and the rendering of services; (d) cash payments to and on behalf of employees; Interest received interest paid group 3:

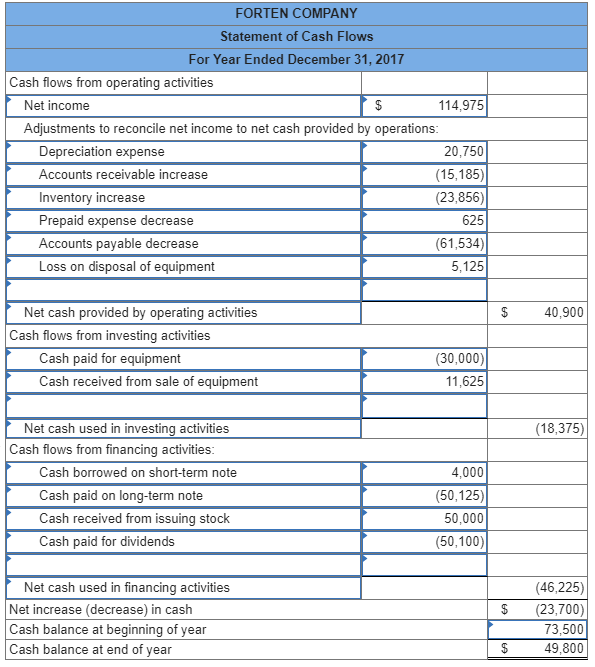

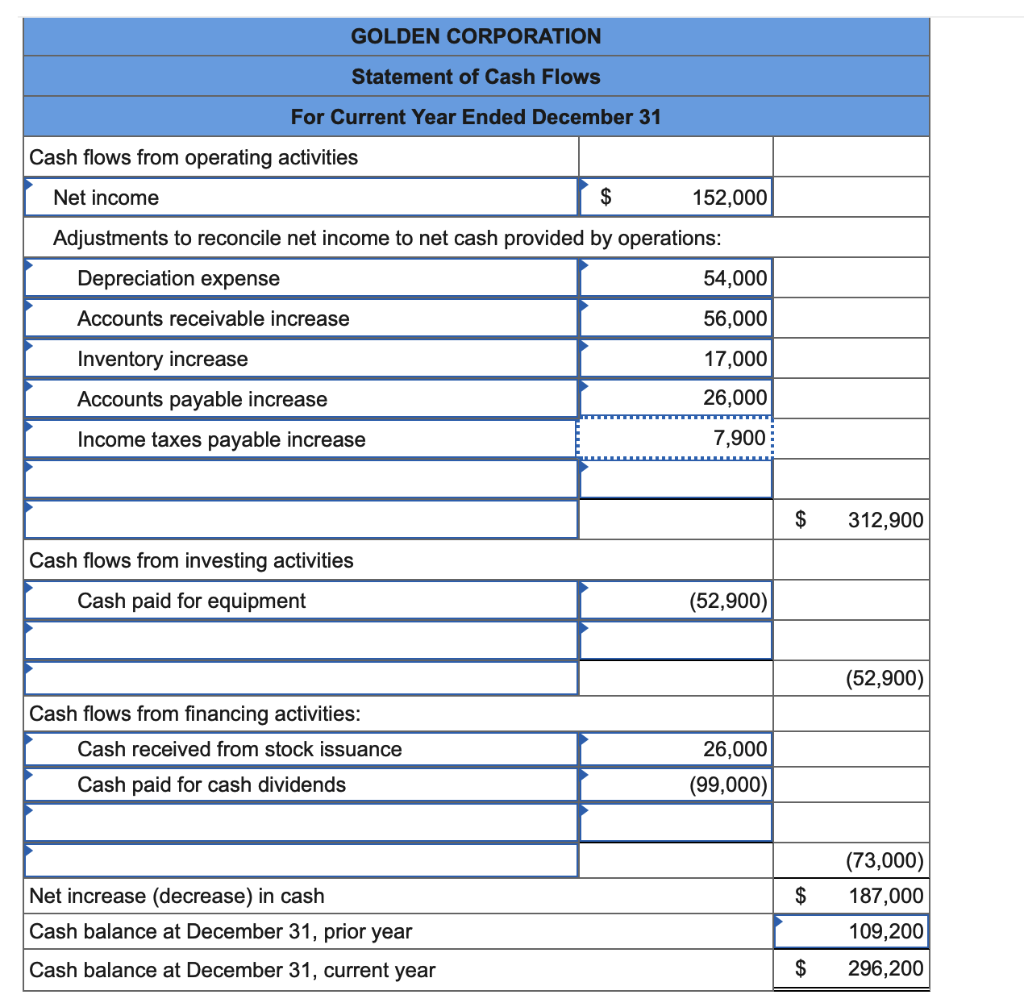

The cash flow statement provides information about a company’s cash receipts and cash payments during an accounting period. Examples of cash flow statement. Cash flow from operating activities:

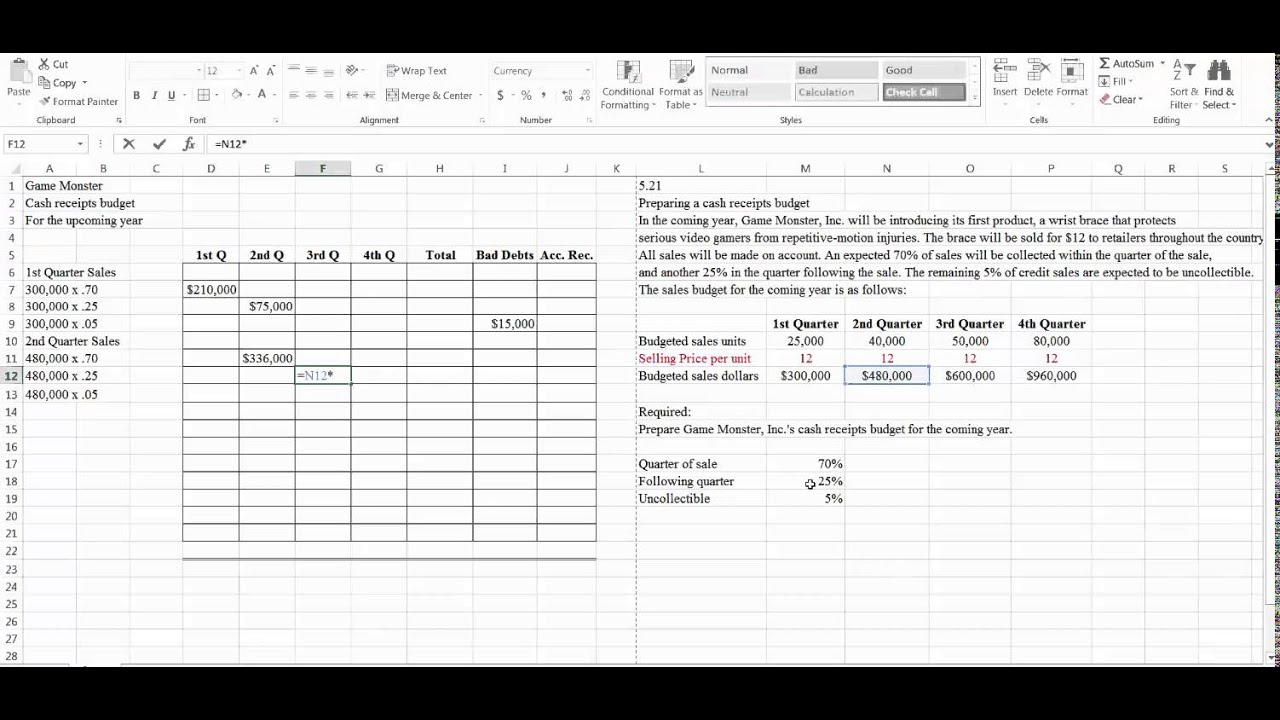

To clarify the concept of a cash flow statement, here are two examples: Cash flows are usually calculated as a missing figure. The cash budget is the combined budget of all inflows and outflows of cash.

Rates will increase by as much as 0.34%. Read more, cash payments, cash expenses,. It should be divided into the shortest time period possible, so management can be quickly made aware of potential problems resulting from fluctuations in cash flow.

Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. The second is the indirect method which reconciles profit before tax to cash generated from operating profit. This information is needed to make fundraising and investment decisions.

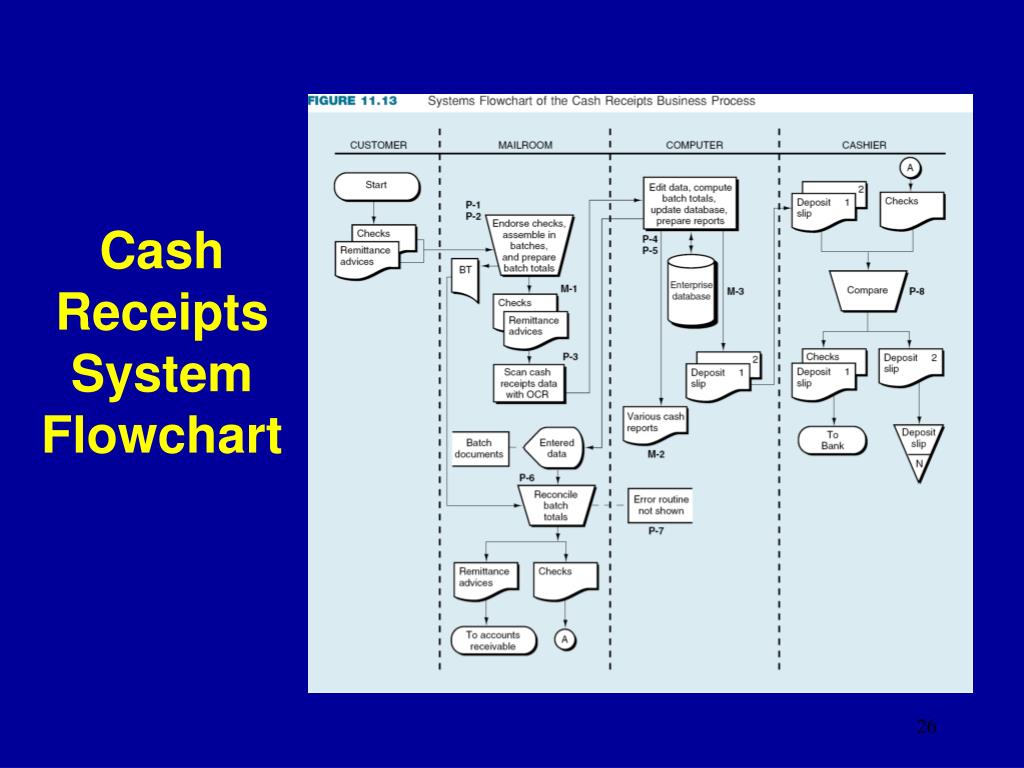

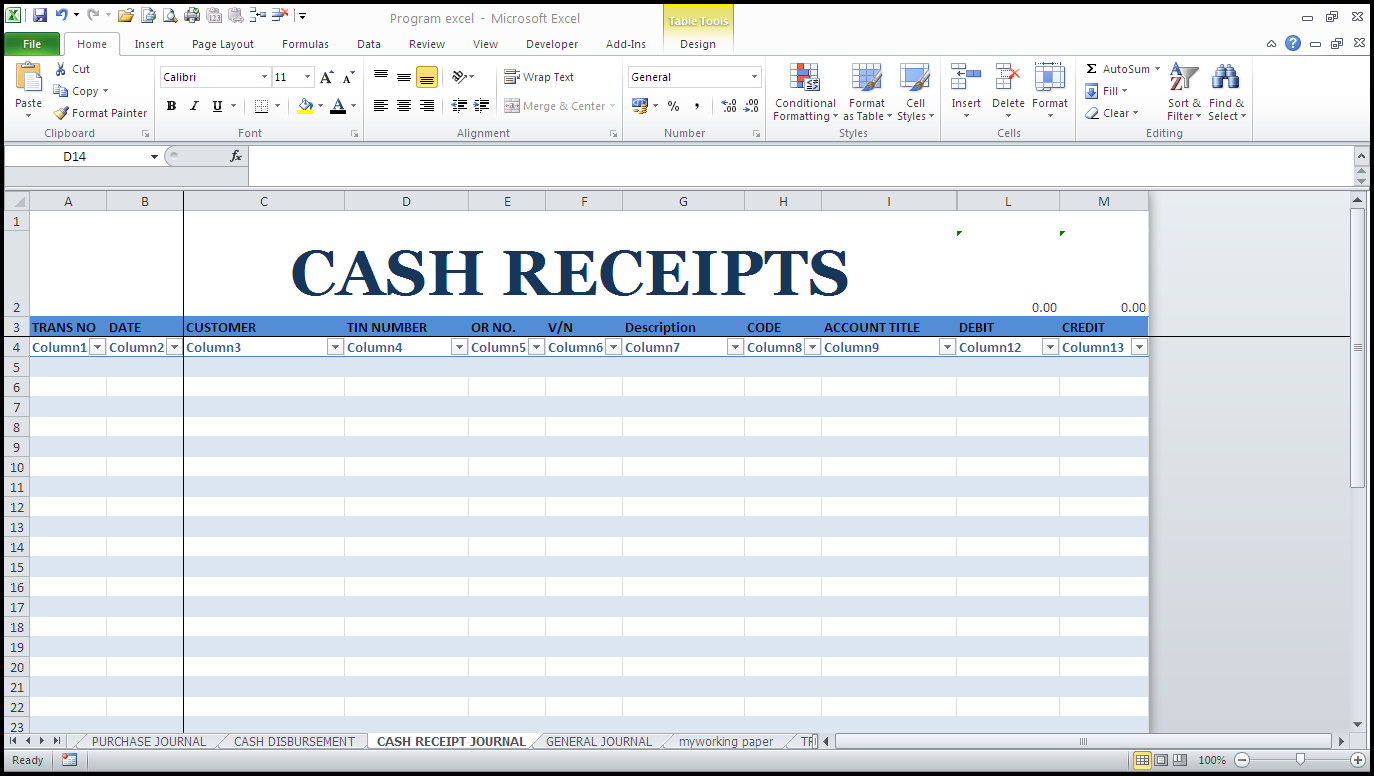

Cash flows are either receipts (ie cash inflows) and so are represented as a positive number in a statement of cash flows, or payments (ie cash outflows) and so are represented as a negative number in a statement of cash flows. The cash flow forecast can be divided into two parts: Level 0 data flow diagram 2.0 update account receivable 1.0 process payments customers remittance slips bank accountants receivable ledger 3.0 prepare reports management credit and collections cash receipt reports aged trial balance remittance slips deposits slips, cash, endorsed checks remittance received by mail.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)