Matchless Info About Capital Wip In Balance Sheet

A firm in the south of england recorded wip on their balance sheet in a haphazard and inaccurate way.

Capital wip in balance sheet. It consists of products that the company has partially completed. During its local operations, our client capitalises elements of costs on the balance sheet as wip representing the completion and delivery of each phase of the. Wip in the balance sheet was an amorphous mass of transactions and recently the accountant had got into trouble because he found some wip which should.

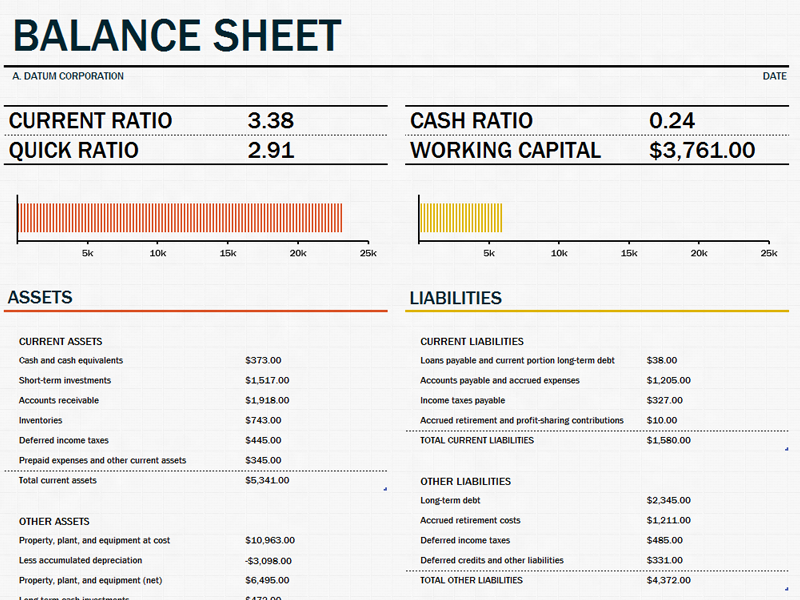

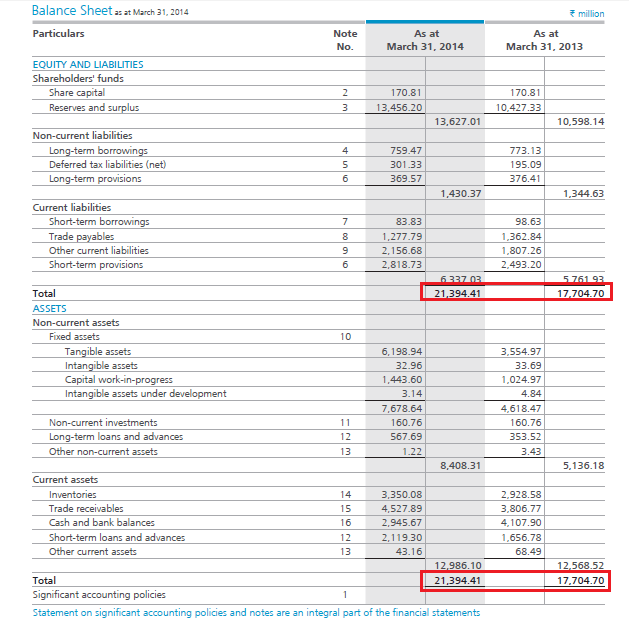

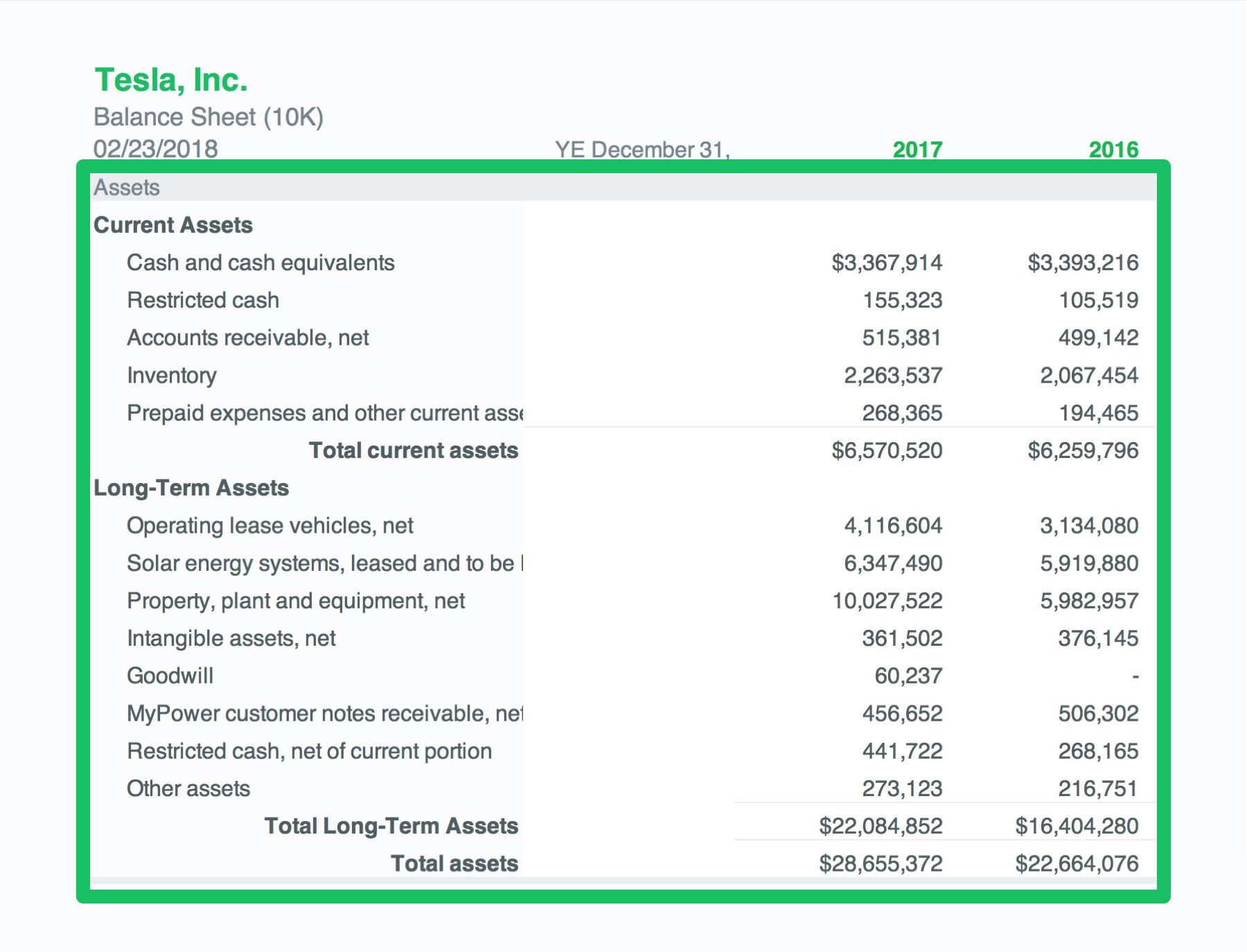

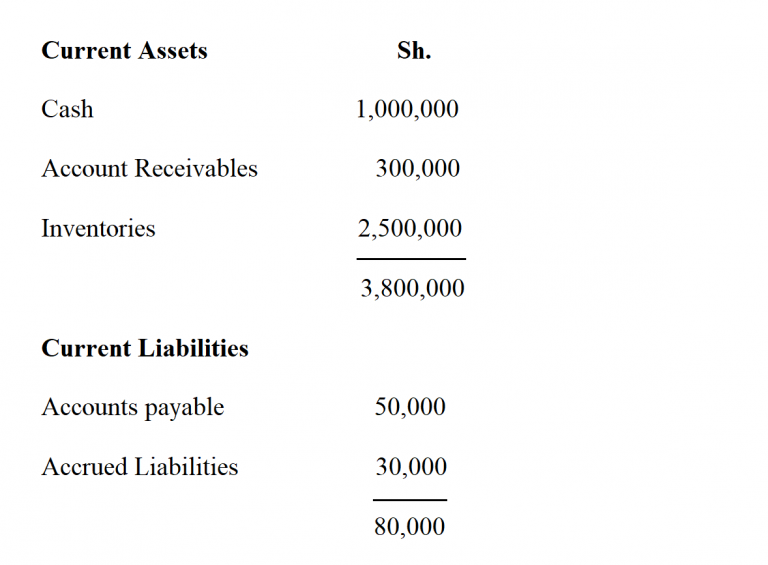

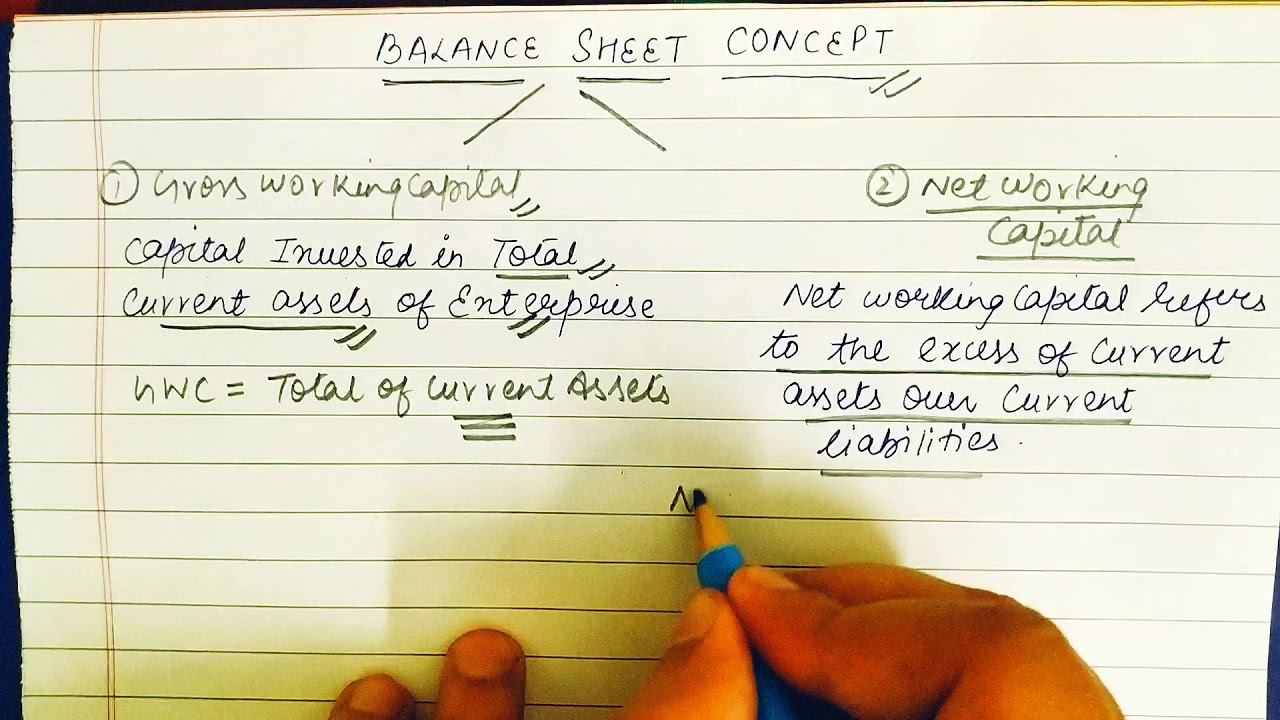

Capital work in progress, or cwip, is an asset account on the balance sheet. Wip appears on the balance. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time.

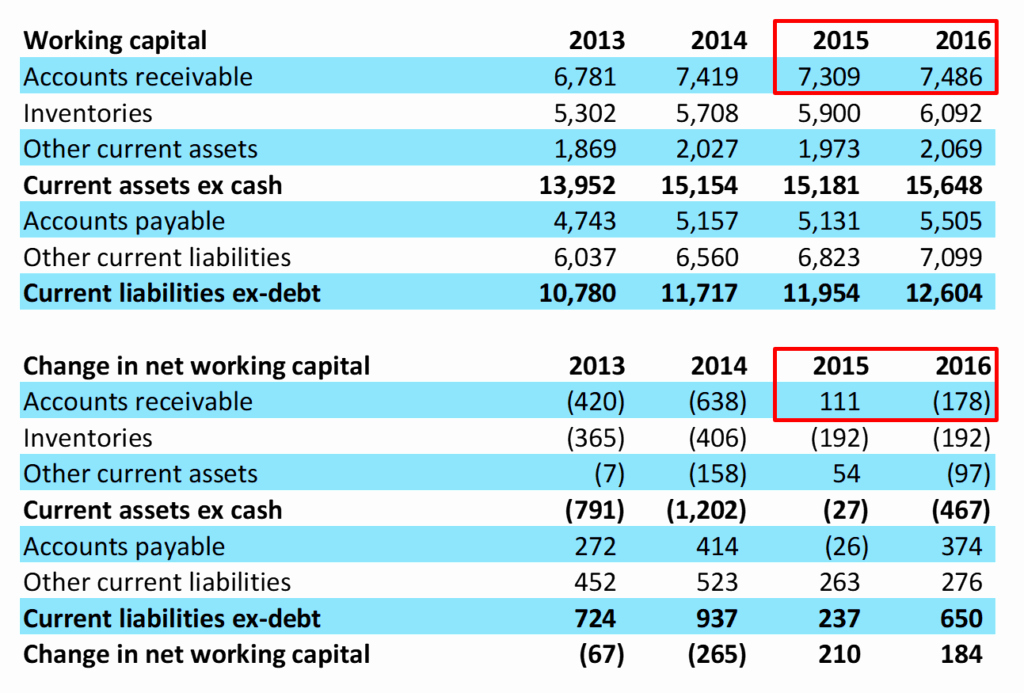

The wip (work in progress) report — often referred to as the wip schedule — serves as a fundamental financial document that offers an overview of the costs incurred. Wip stands for “work in progress” and refers to any partially complete inventory not yet ready to be sold to customers. The value wip is booked and recorded at bears no resemblance to the value of the work done or to the cost of doing the work.

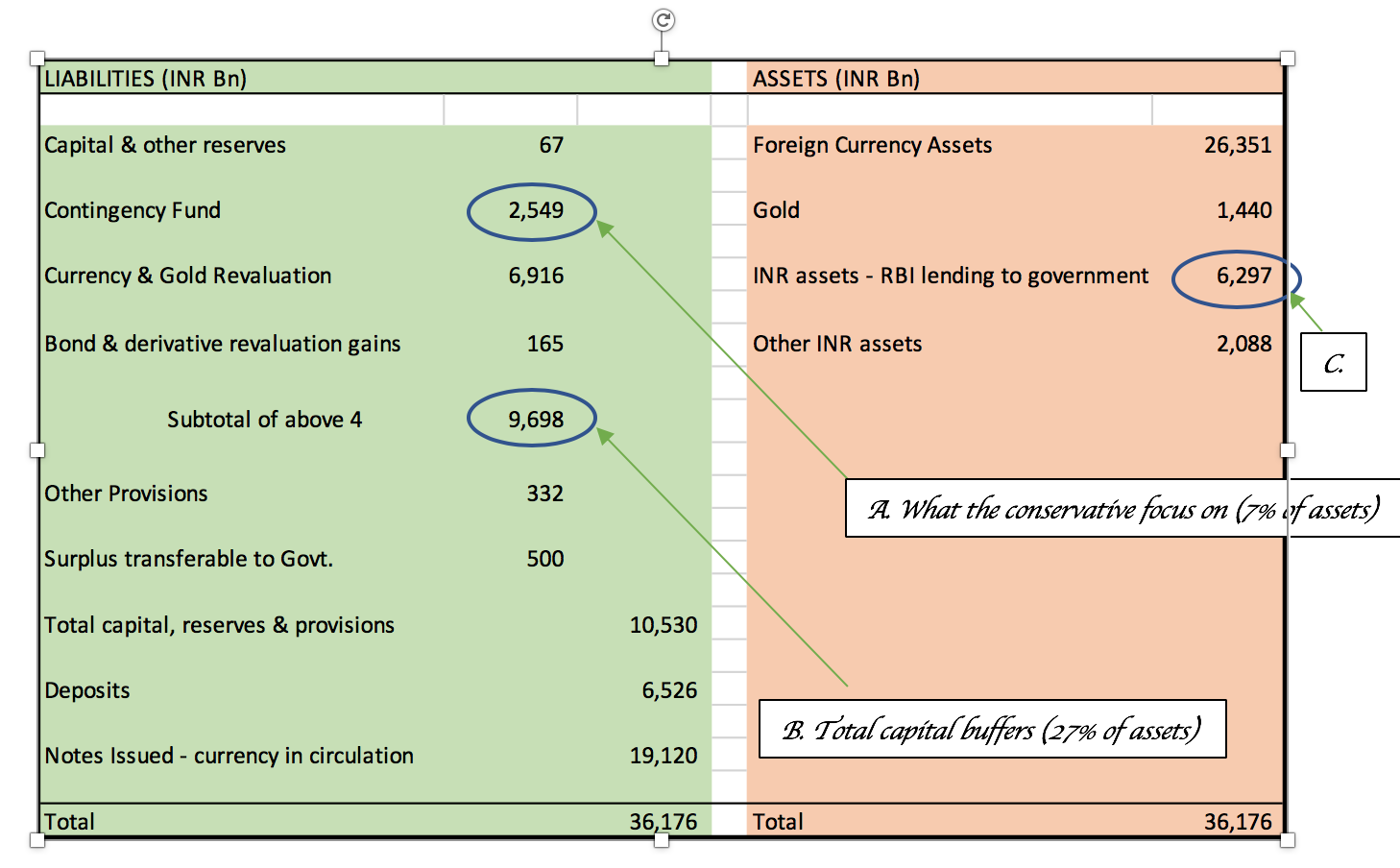

Wip not billed out is not removed from. Let us relook at the balance sheet in its entirety: As you can see in the above, the balance sheet equation holds for arbl’s balance sheet, asset =.

This account is to be shown separately in the balance sheet below the fixed asset. At the wip stage, these inventory items. However, labor expenses appear on the balance sheet as well, and in three notable ways:

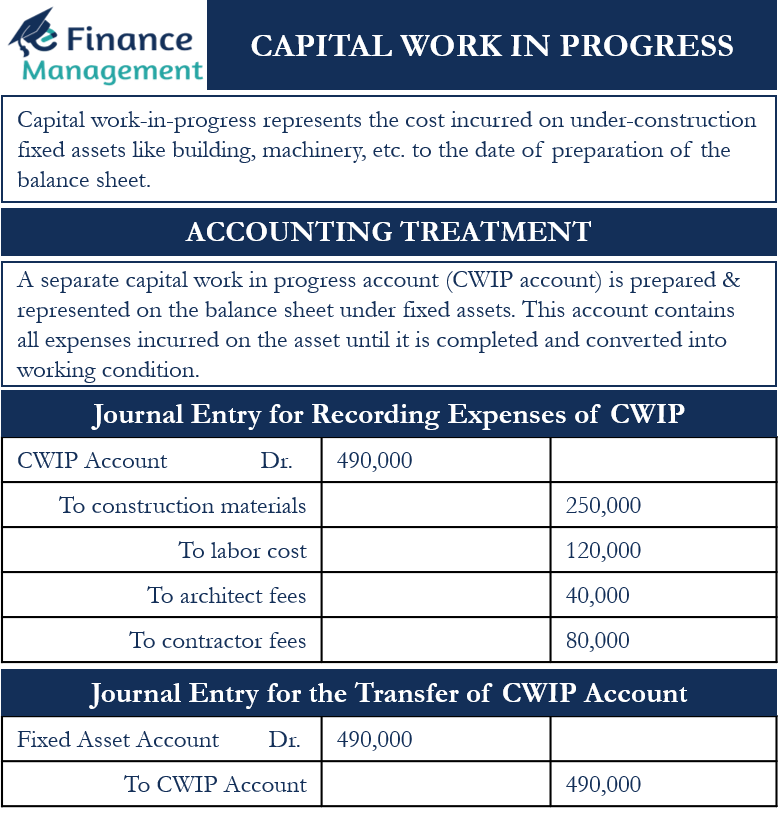

Work in progress inventory is accounted for as an asset on a company's balance sheet, similar to raw materials or inventory. Capital work in progress account contains all expenses incurred on the asset until it is.