Supreme Info About State The Meaning Of Trial Balance

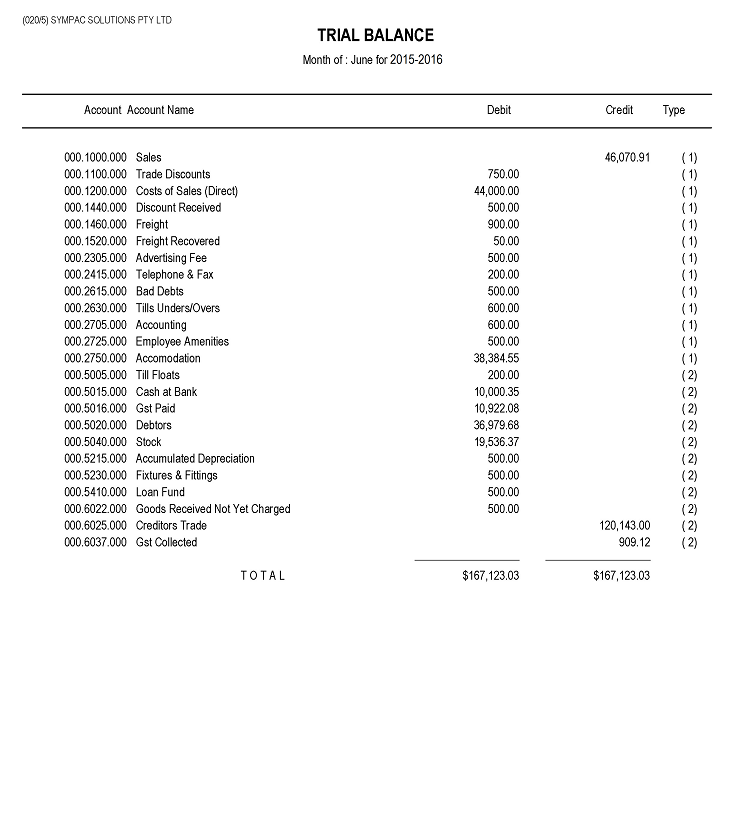

Trial balance is a statement of debit and credit balances taken out from all ledger accounts including cash book.

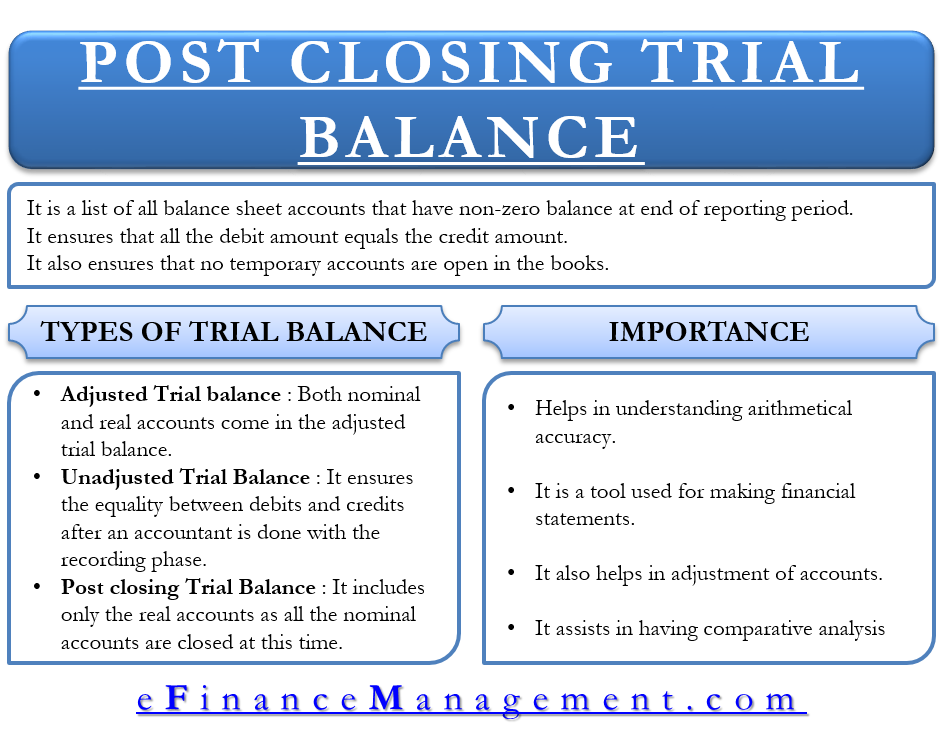

State the meaning of trial balance. A trial balance is a list of all accounts in the general ledger that have nonzero balances. This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account. What is a trial balance?

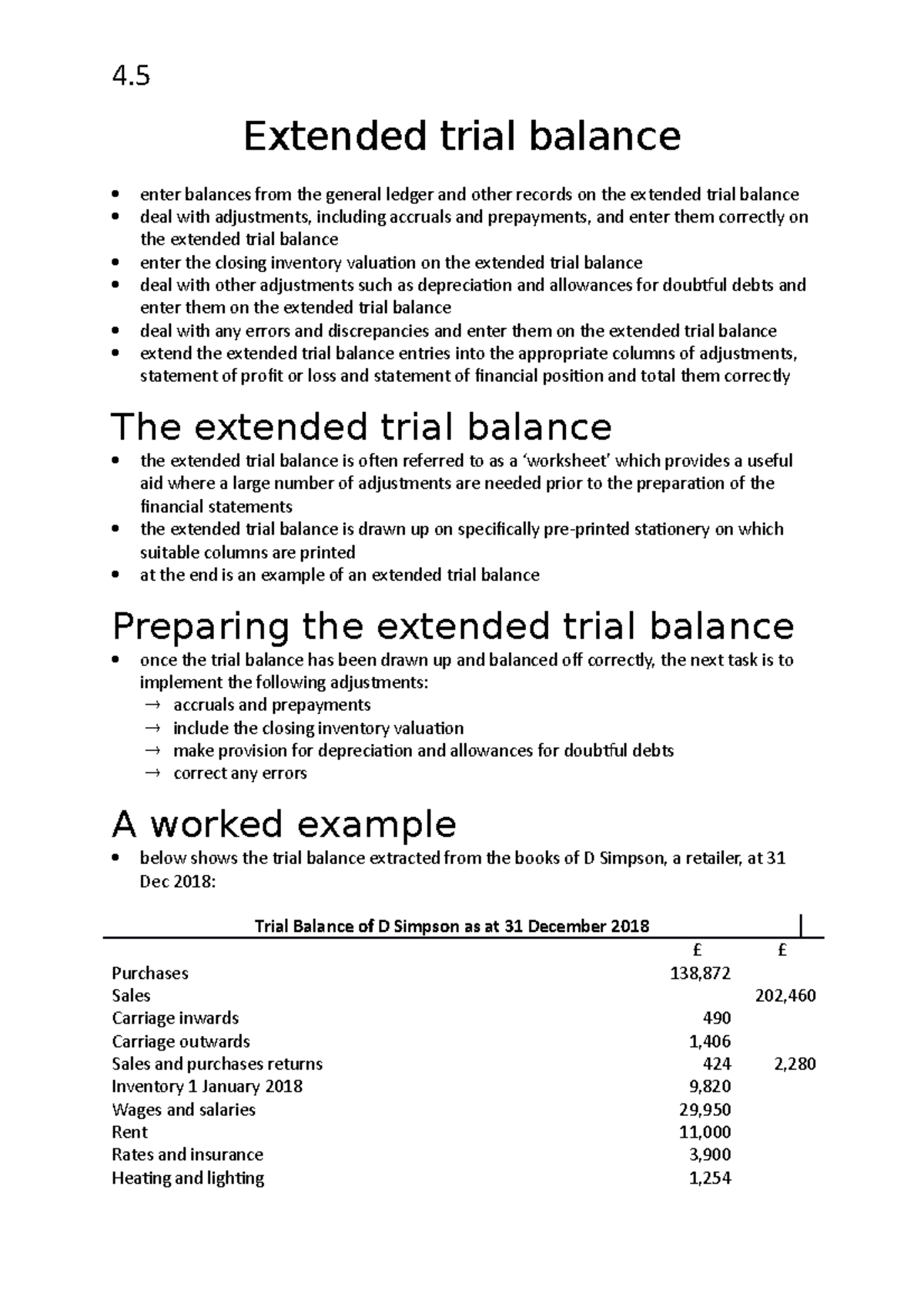

Trial balance plays an essential tool in checking the arithmetical accuracy of posting ledger accounts, assisting the accountant in preparing the financial statements, proceeding with audit adjustments, etc. A trial balance is a statement showing the balances, or total of debits and credits, of all the accounts in the ledger with a view to verify the arithmetical accuracy of posting into the ledger accounts. The trial balance is an accounting report that lists the ending balance in each general ledger account.

All the ledger accounts (from your chart of accounts) are listed on the left side of the report. A balanced trial balance ascertains the arithmetical accuracy of financial records. A trial balance is a statement showing the balances or total of debits and credits, of all the accounts in the ledger with a view to verify the arithmetical accuracy of posting into the ledger accounts.

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. Usually, in the trial balance instead of showing the individual accounts of the debtors and creditors, we show. Trial balance is the steppingstone for preparing all the financial statements such as trading and profit & loss account, balance sheet etc.

This means that it states the ending balance for each asset, liability, equity, revenue, gain, and loss account in an accounting system. Personal, real and nominal accounts are considered for preparing the trial balance. A trial balance tallies when the total of the debit column is equal to the total of the credit column.

Generally, it is prepared at the end of an accounting year. To put it simply, a trial balance is a detailed list of all the nominal ledger (general ledger) accounts contained in the ledger of a business. Understanding the components of a trial.

Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. This statement comprises two columns: It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct.

The total of debit amounts shall be equal to the credit amounts. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. A trial balance is an accounting report that states the ending balance in each general ledger account.

A balance sheet is a statement that represents the financial. The balances are usually listed to achieve equal. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

Trial balance helps a professional accountant to balance or check both debit and credit items of income, expenses, assets, and liabilities. The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. A company prepares a trial balance.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)