Favorite Tips About Companies With Best Balance Sheets 2020

5 growth stocks with strong balance sheets.

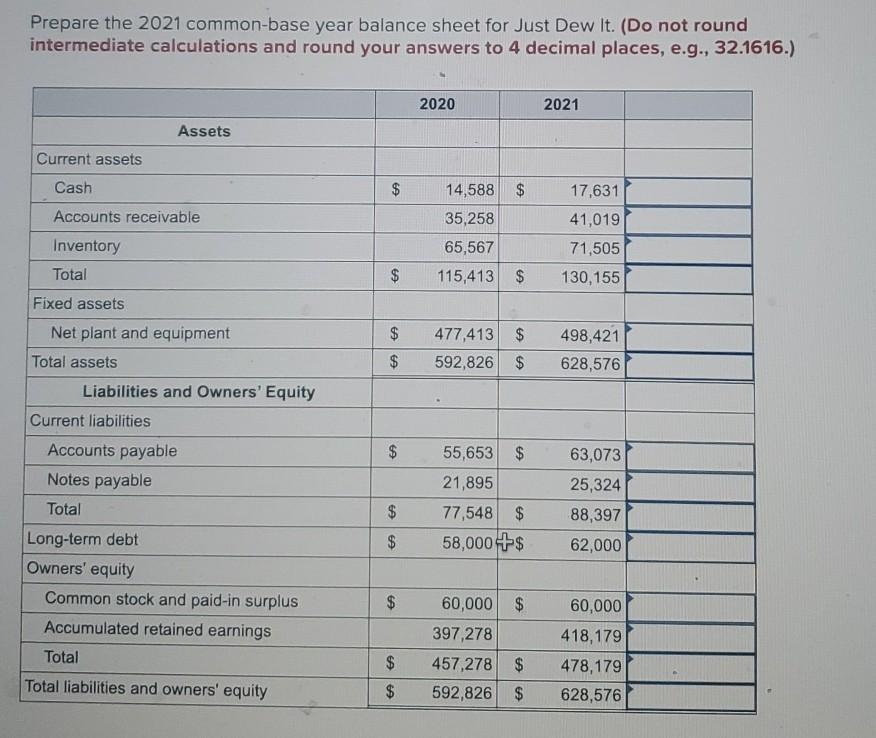

Companies with best balance sheets 2020. A company with a strong balance sheet is antifragile.. To make my balance sheet powerhouses list, a company must: Experts extracted 7 stocks from the list of 220 zacks rank #1 strong buys that has beaten the market more than 2x over with a stunning average gain of +24.3%.

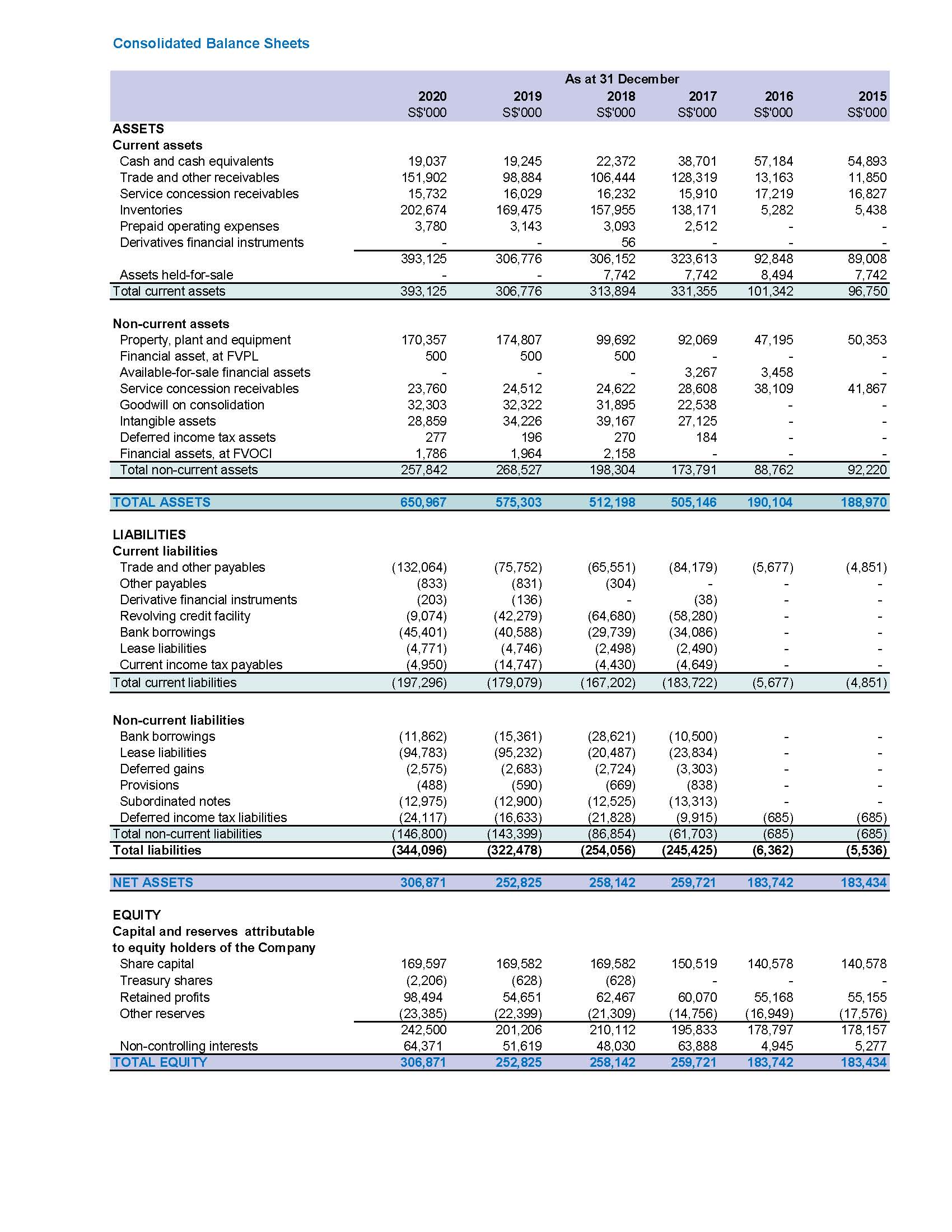

2 significant accounting policies, judgements and estimates; Down over 70%, 3 growth stocks with fortress balance sheets to. Growth investing street notes stocks with solid balance sheets have been 2020 winners.

It's going to be pretty obvious that one of the biggest and most successful companies in the world like apple isn't. Ago if you’re talking strictly balance sheets, googl has almost no debt and a ridiculous amount of cash / cash equivalents on hand. These 3 top 100 stocks to buy all.

It’s already started, with sales jumping 17% in the five weeks ended october 5, 2020, from a year earlier. Cisco systems, inc. The motley fool has the following options:

Those gains should continue as shoppers stock up and. By teresa rivas oct 28, 2020, 7:15 am edt. Statement of changes in equity;

Bank of america: Bluevine is a fintech company with banking services provided by coastal community bank. Buy these 13 cheap stocks that have unexpectedly strong finances, making them great bets for the next phase of the rally.

Best balance transfer credit cards. · have debt no more than 10% of the company’s net. The latest data points to the fact that the u.s.

Except for 2021 and 2022, the convertible debt market has been bustling as companies try to improve their balance sheets. The market is down on growth stocks, but these companies can deliver fantastic returns. · have a market value of $5 billion or more.

List of the top public companies ranked by net assets on balance sheet. Economy is rapidly getting back on track. The latest ism data shows.

Here are four such companies worth your consideration. Cnq has increased shareholder payouts for the last 23 consecutive years thanks to its superior balance sheet and earnings growth visibility. They will be again in 2021.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)