Fantastic Info About Financial Ratios For Investment Decisions

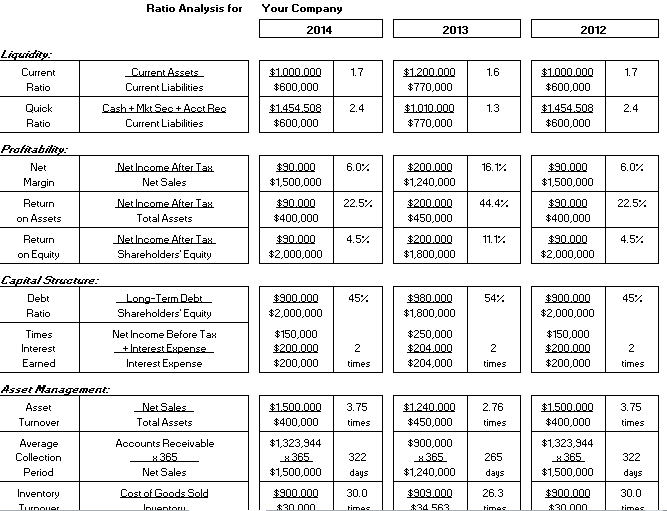

By analyzing these ratios, investors can assess a company’s profitability, liquidity, solvency, and efficiency, and determine whether it is a good.

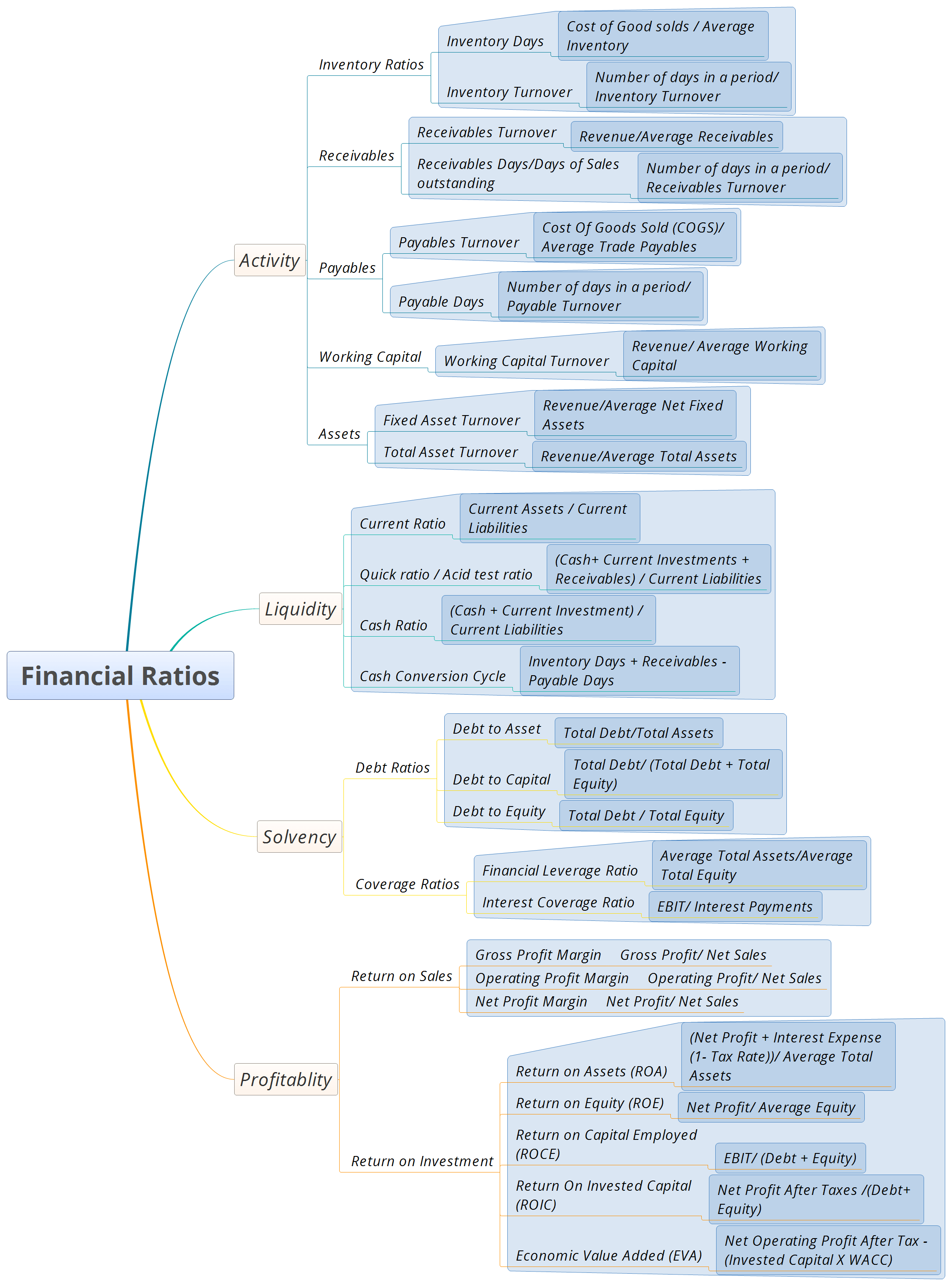

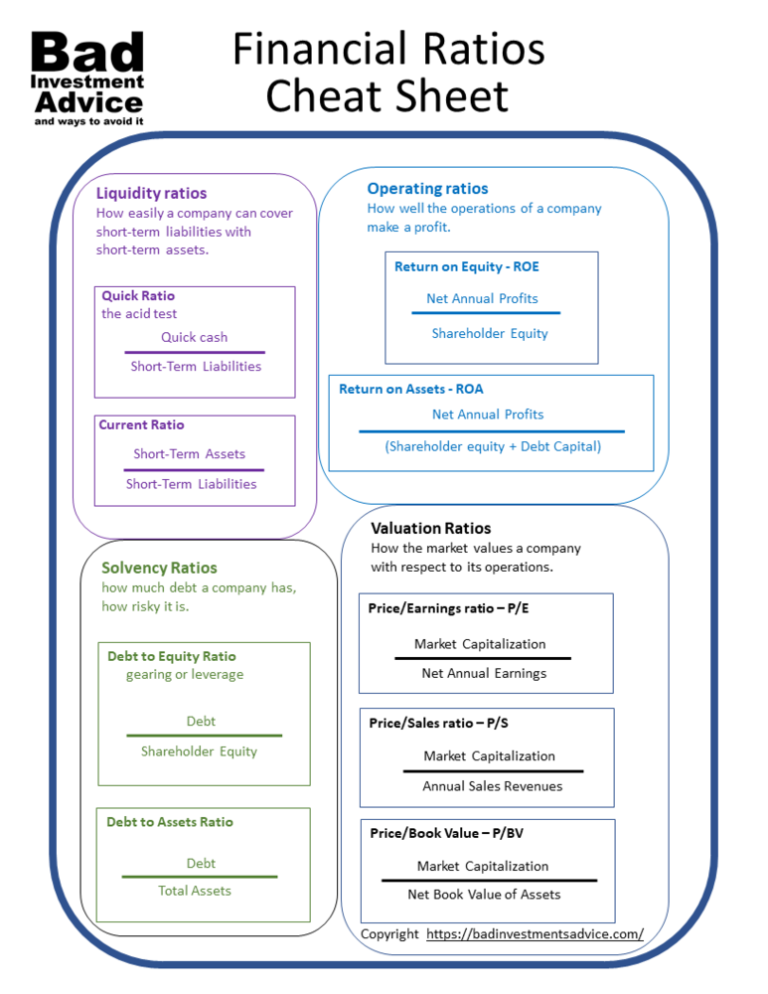

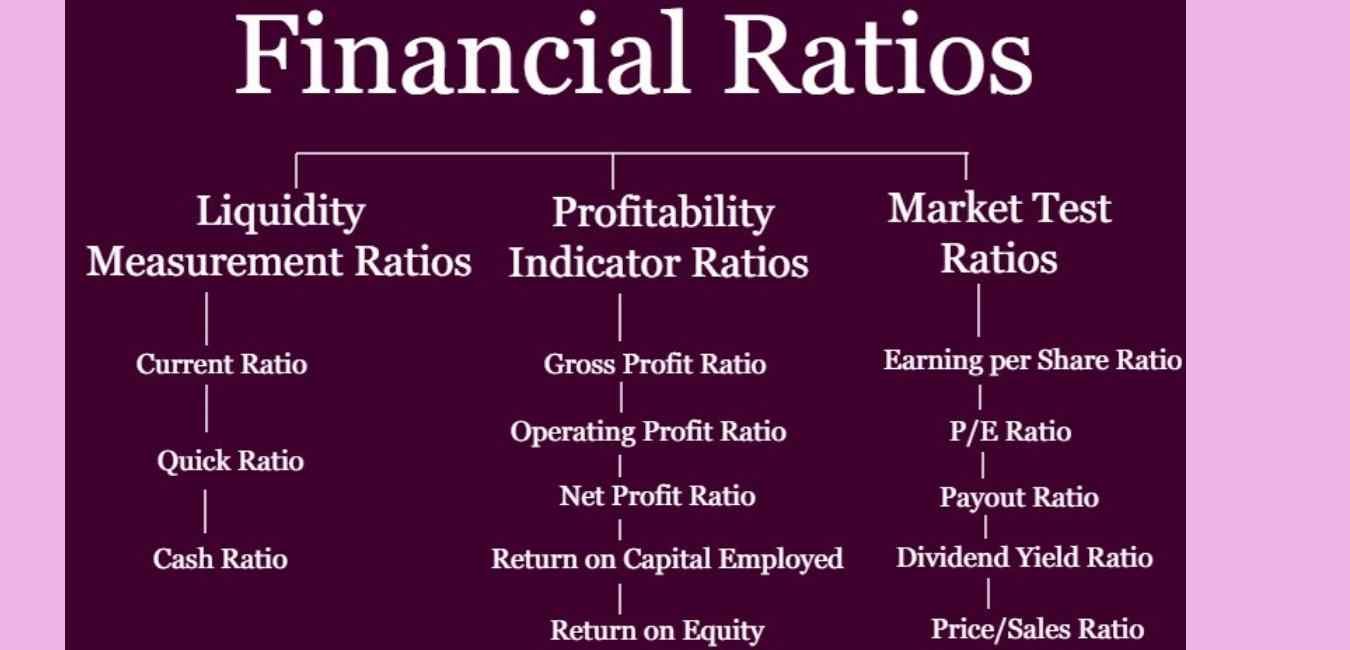

Financial ratios for investment decisions. Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. What are the main uses of financial ratios? Financial ratios are grouped into the following categories:

Profitability is a key aspect to analyze when considering an investment in a company. Updated on january 13, 2022 reviewed by jefreda r. The study found that financial ratios are used by data users when making decisions related to investment and lending.

Write down specific financial goals and timelines. There are many financial ratios, and they evaluate things like debt levels, liquidity, returns, profitability and value among other things. Assessing company strength and performance:

Various ratios can be used to assess a company’s growth, sales, profits, efficiency, and The results of the study also revealed the interest of lenders in debt and. Assessing the health of a company in which you want to invest involves measuring its liquidity.

It depends on how much depth of perspective you need. When deciding about an investment, shareholders draw comparisons between different companies to determine the suitable investment for them, depending on their lookout. The certainty of the reliance on the use of financial ratio analysis in making investment decisions by potential investors still remained a mystery.

Financial ratios provide a numerical representation of a company’s financial state by comparing different figures in its financial statements. Analysis of financial ratios serves two. Guide to financial ratios profitability ratios.

For added confidence, a combination of ratios and tools can provide a more complete picture of potential investments. This has to do with the choice of. What financial ratio measures risk?.

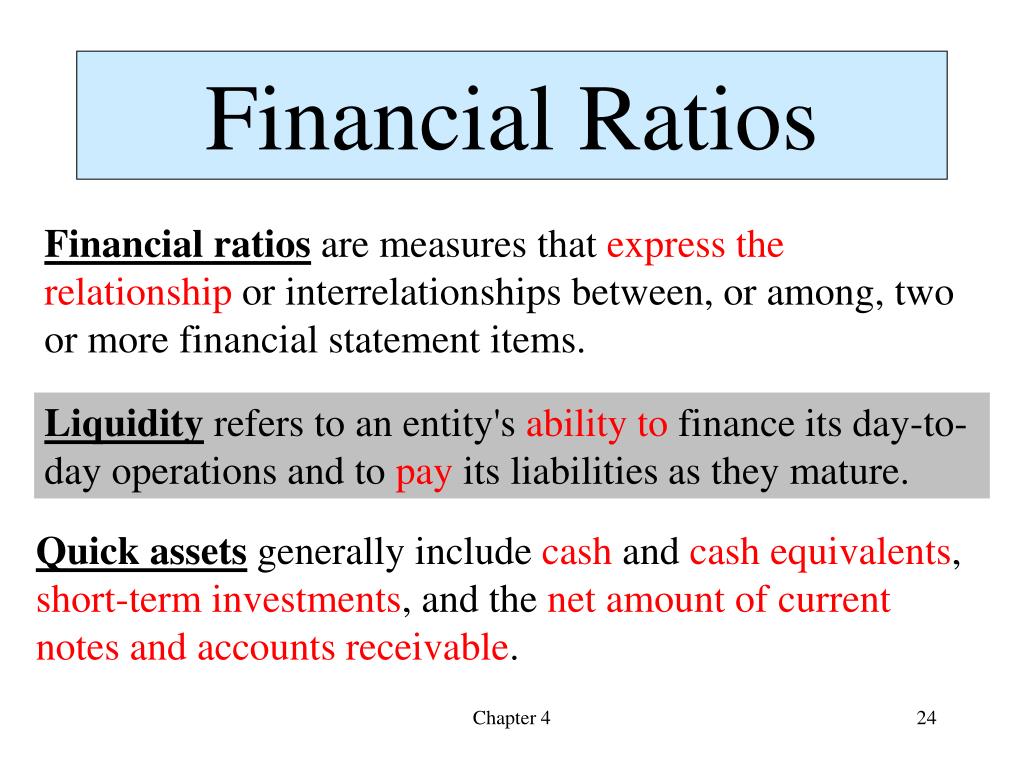

Read more financial ratios are numerical calculations that illustrate the relationship between one piece or group of data and another. Liquidity relates to how quickly a company can repay its debts. Figuring out a stock's value can be as simple or complex as you make it.

It's another measure of liquidity. From stock ratios to investor ratios, our expert guide walks you through 20 of the most important financial ratios to analyze a company. [relinking]introduction financial ratios are a numerical representation of a company's financial position, financial health, and performance that can be compared to other companies to determine future trends and prospects.

These ratios provide valuable insights into a company’s… Open an account 2 interactive brokers low commission rates start at $0 for u.s. Financial analysis using ratios is just one step in the process of investing in a company’s stock.