Ace Info About Balance Sheet Revenue And Expenses

It can also be referred to as a statement of net worth or a statement of financial position.

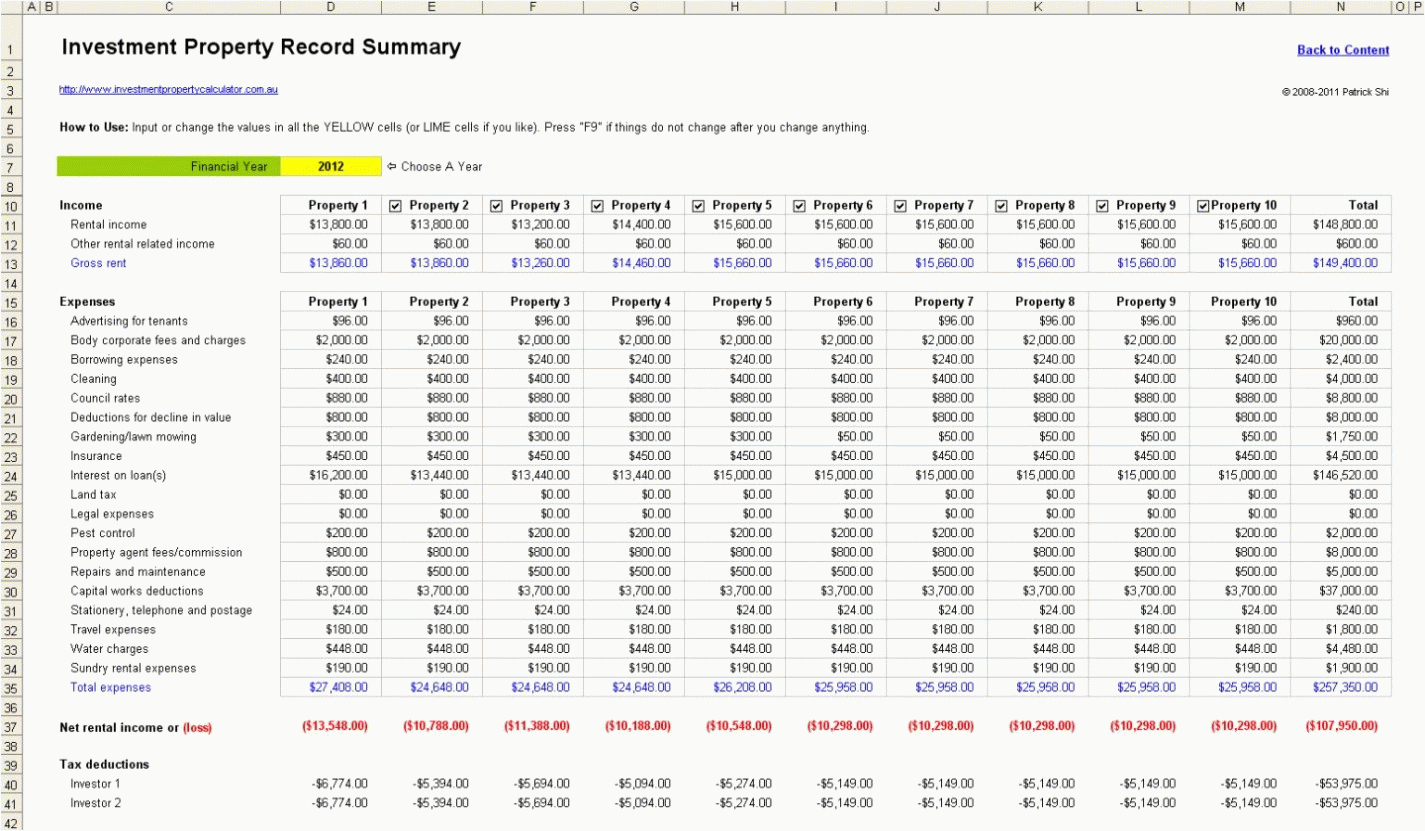

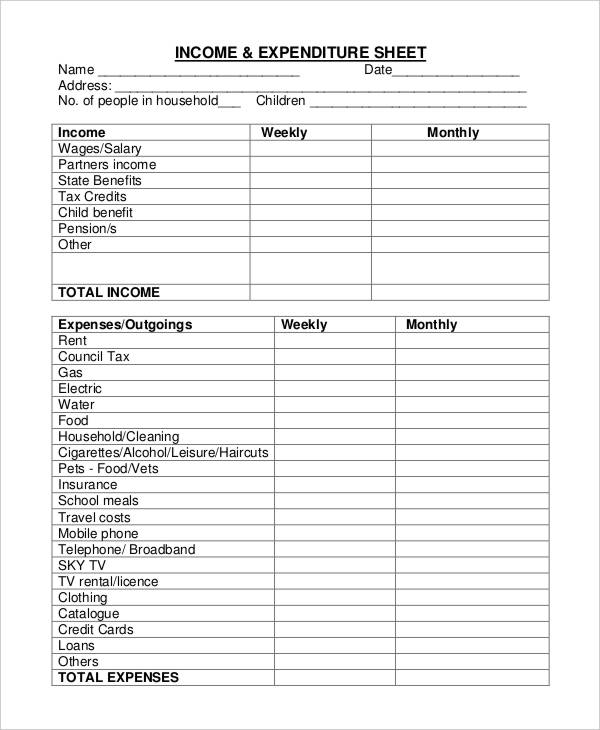

Balance sheet revenue and expenses. Balance sheets show the value of a company at a specific point in time. The income statement provides a summary of a company’s revenues, expenses, gains, and losses for a specific period, such as a quarter or a fiscal year. Expenses are deducted from a company’s revenue to arrive at its profit or net income.

Balance sheet cash flow; In short, expenses appear directly in the income statement and indirectly in the balance sheet. All revenue and expense accounts are closed since they are temporary.

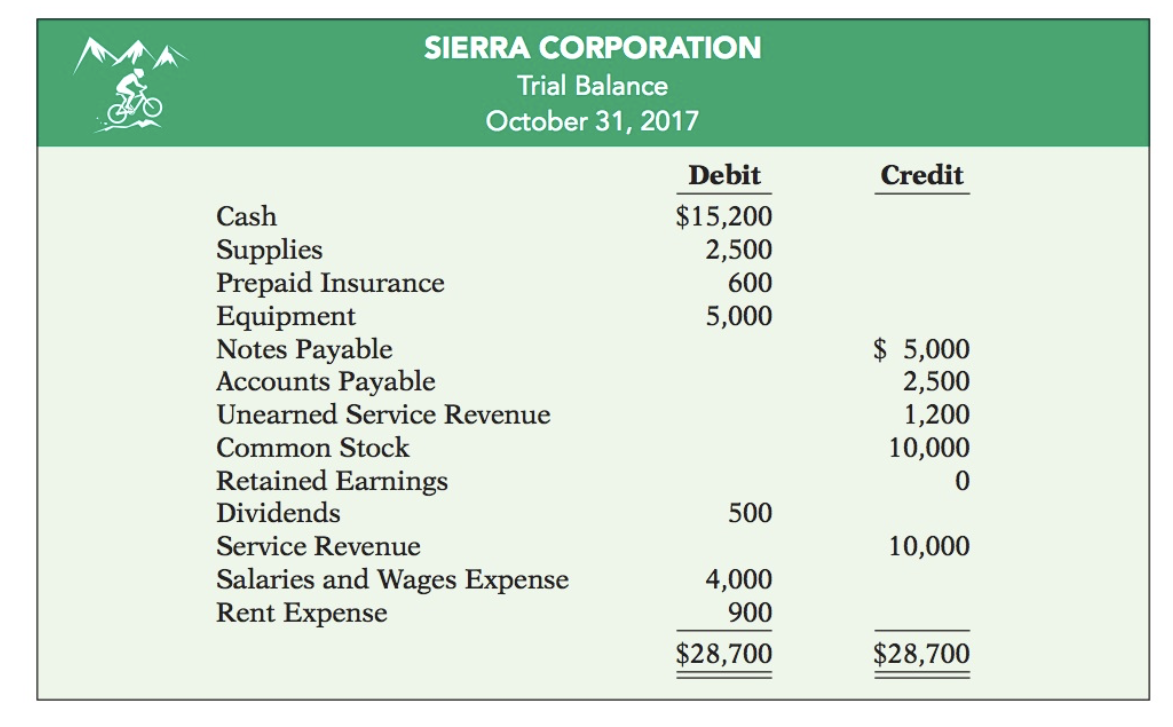

Total revenues are $10,240, while total expenses are $5,575. An income statement tallies income and expenses; On the other hand, the income statement offers a dynamic view of a company’s profitability over a particular period, showcasing its revenue, expenses, and net income.

Revenue recognition principle according to the revenue recognition principle in accounting, revenue is recorded when the benefits and risks of ownership have transferred from seller to buyer or when the delivery of services has been completed. When a company earns revenue that had been prepaid by a customer, th. All revenues the company generates in excess of its expenses will go into the shareholder equity account.

The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, highlighting its financial position. Most of a company's expenses fall into the following categories: Sales, general and administrative expenses;

Increases and decreases in cash: For example, financial statements issued for the month of december will contain a balance sheet as of december 31 and an income statement for the month of december. There are two main parts to an income statement:

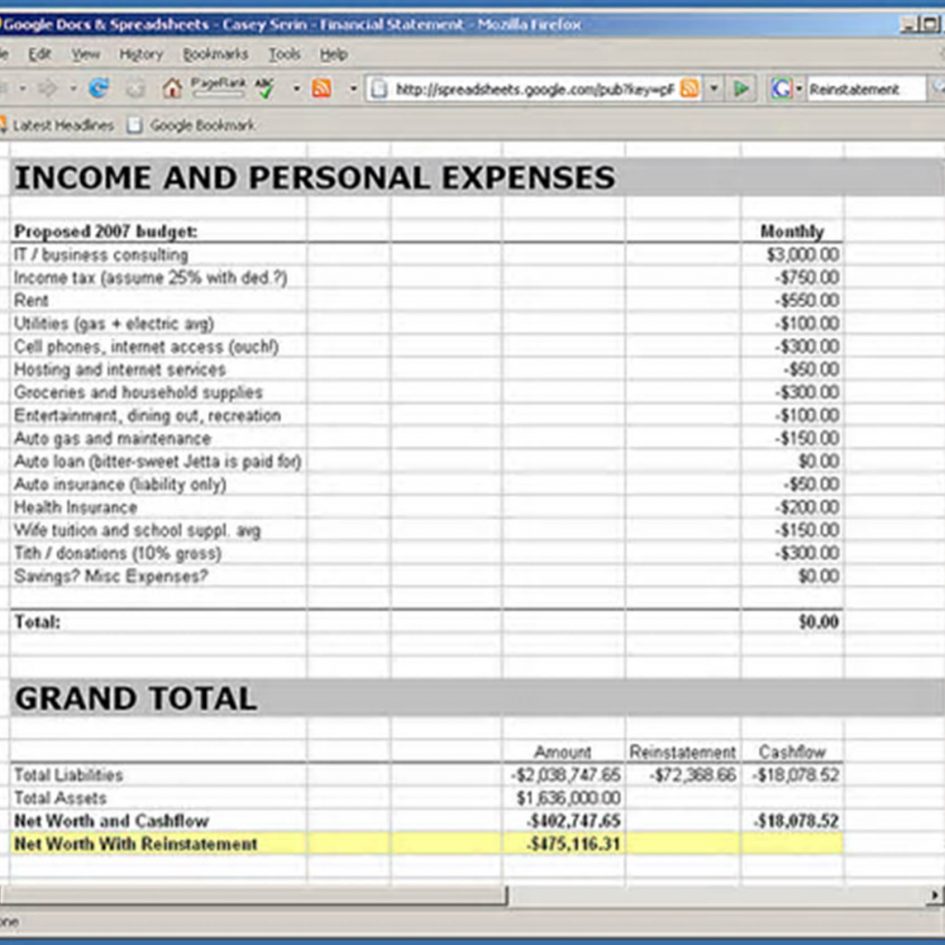

Total expenses are subtracted from total revenues to get a net income of $4,665. Revenue and expense information is taken from the adjusted trial balance as follows: How an expense affects the.

The balance sheet is divided into three main sections: On the balance sheet, these revenues are typically reflected in the retained earnings. Revenue and expenses on a balance sheet although there is no line on your balance sheet that directly summarizes the revenue and expense lines on your income statement, these two financial statements are deeply connected.

Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for each. While a balance sheet provides the snapshot of a company’s financials as of a particular date, the income statement reports income through a specific period, usually a quarter or a year, and. Remember that the retained earnings account reflects all income the firm has earned since its inception less any dividends paid out to shareholders.

This equation ensures that the balance sheet remains in balance, as the total value of a company’s assets is equal to the sum of its liabilities and equity. If total expenses were more than total revenues, printing plus would have a net loss rather than a net income. The top line of the income statement is typically reserved for reporting sales revenue.

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)