Sensational Tips About Meaning Of Liquidity Position

It has already been stated above that liquidity.

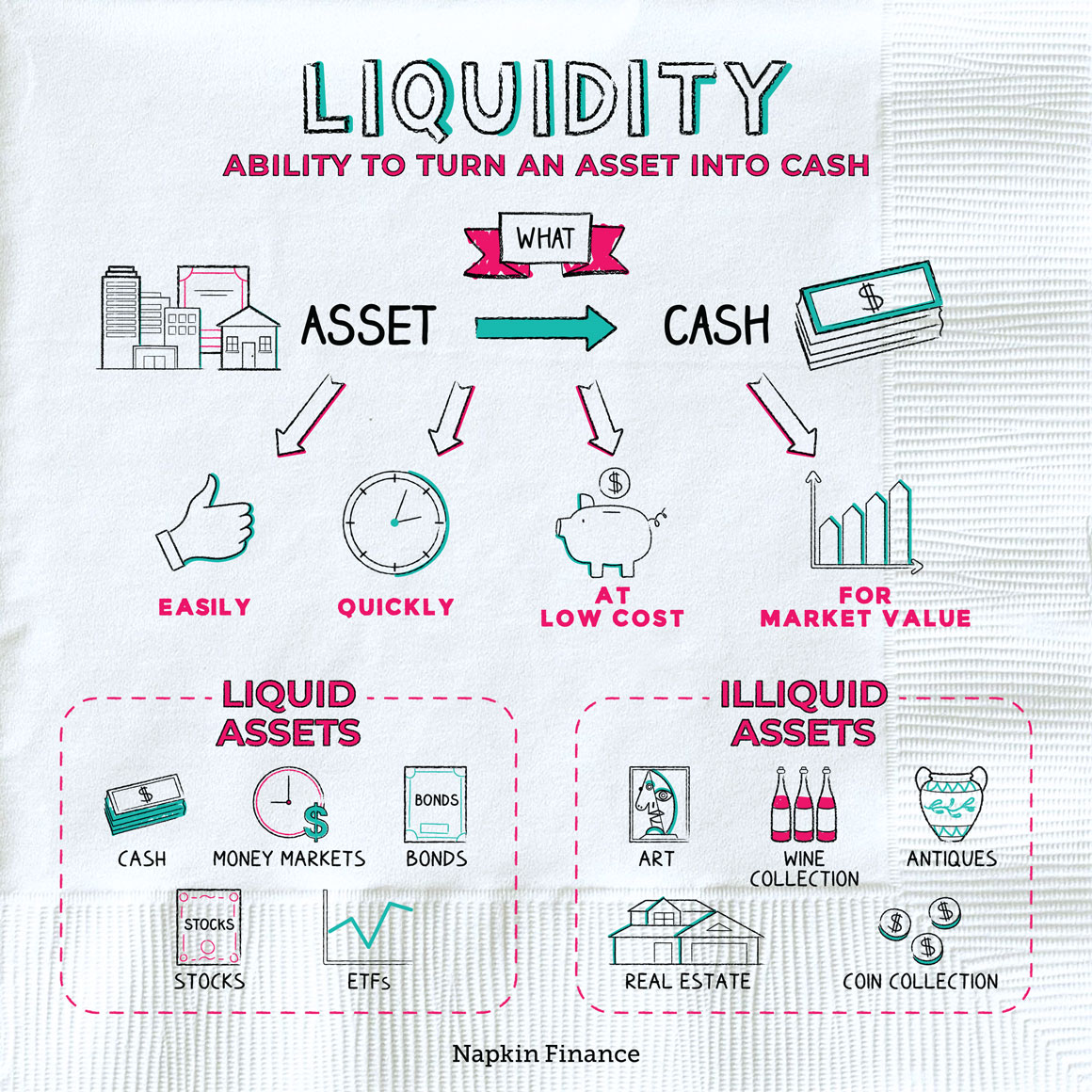

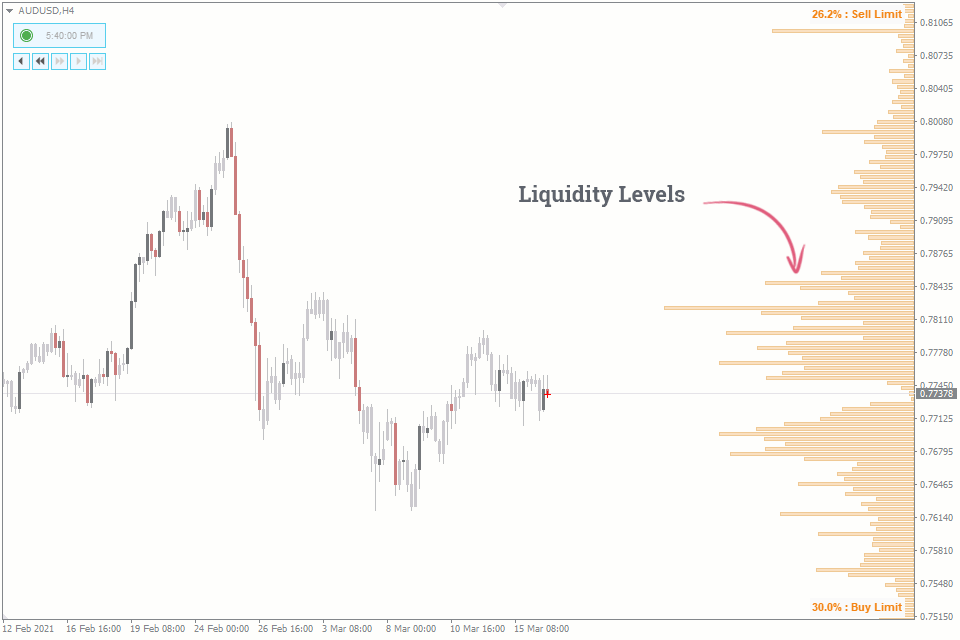

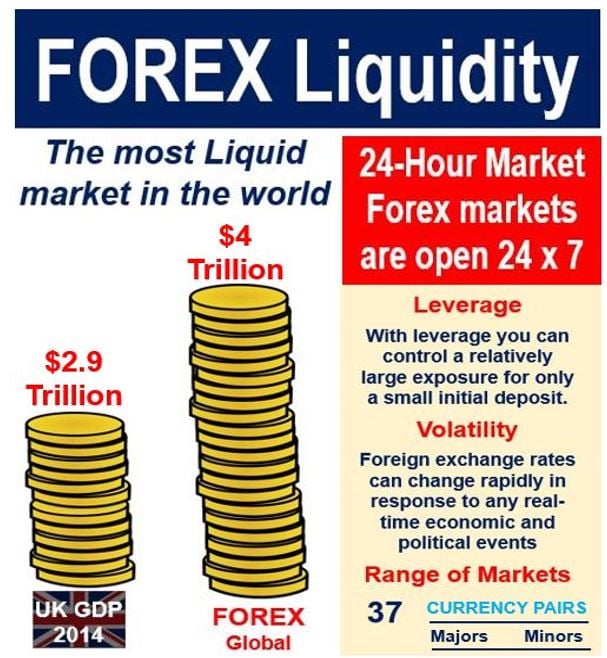

Meaning of liquidity position. The relative ease in which things can be bought or sold is referred to as liquidity. 1) market liquidity and 2) financial liquidity. Liquidity is an estimation of how readily an asset or security can be converted into cash at a price that reflects its intrinsic value.

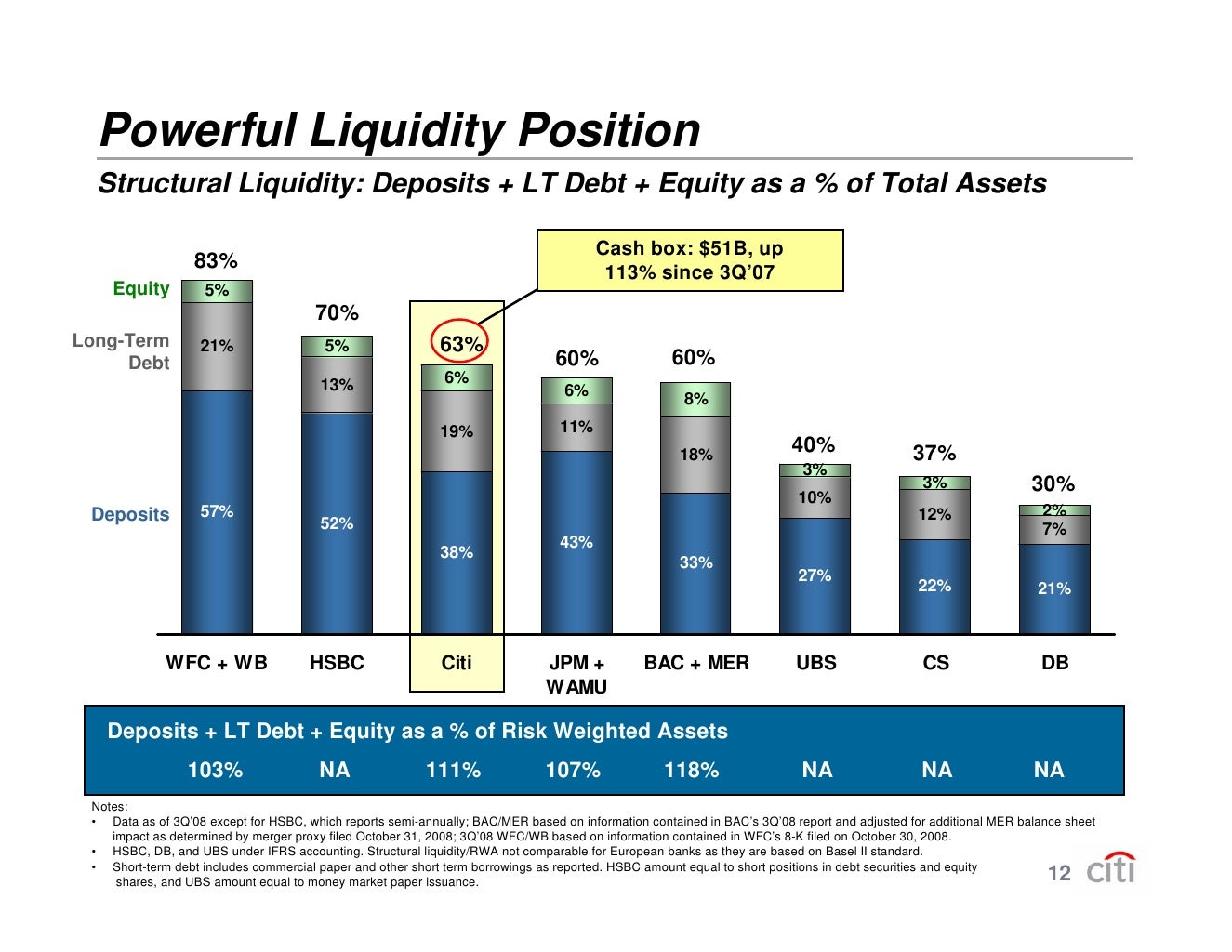

The three main liquidity ratios are the current ratio, quick ratio, and cash. The state of having enough money or assets to pay any money that is owed: Market liquidity describes the time.

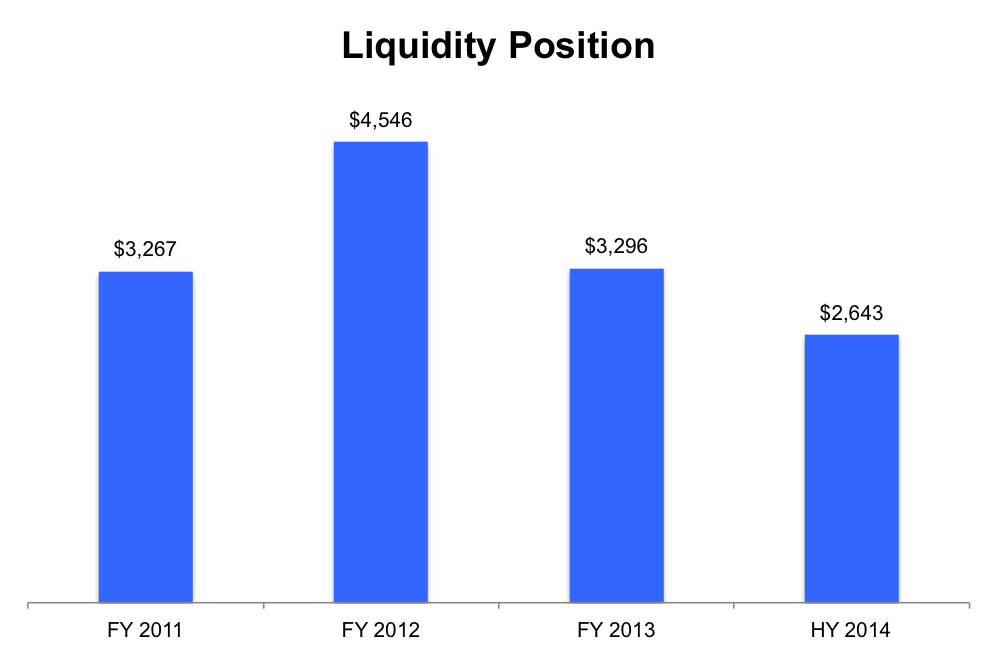

Liquidity ratios measure the liquidity of a company. Liquidity position means the position disclosed in the liquidity report (“liquidity report”) required by the trust deed ( as amended) or disclosed by. The overall liquidity ratio is.

Financial liquidity impacts individuals, companies, and financial markets. They provide insight into the. Ready cash is considered to.

The overall liquidity ratio is the measurement of a company's capacity to pay its outstanding liabilities with its assets on hand. Consequently, the availability of cash to make such conversions is the biggest influence on whether a market can. Based on 2 documents.

The liquidity risk concept can be measured in two forms: They provide insight into a company's ability to repay its debts and other. Liquidity refers to the efficiency or ease with which an asset or securitycan be converted into ready cash without affecting its market price.

Liquidity ratios determine how quickly a company can convert the assets and use them. The most liquid asset of all is cash itself. A company’s level of liquidity depends upon the amount.

Liquidity is a function of current assets and current liabilities and their composition.

/Balance-Sheet-56a0a31d5f9b58eba4b25300.gif)

:max_bytes(150000):strip_icc()/UnderstandingLiquidityRisk32-e6abfec5376d4c85a60e0565eb856d37.png)

:max_bytes(150000):strip_icc()/Term-Definitions_Template_liquidity.asp-c2fedffb30994838ae0ef34e3420ed93.jpg)