Perfect Tips About T2125 Business Income

T2125 statement of business or professional activities.

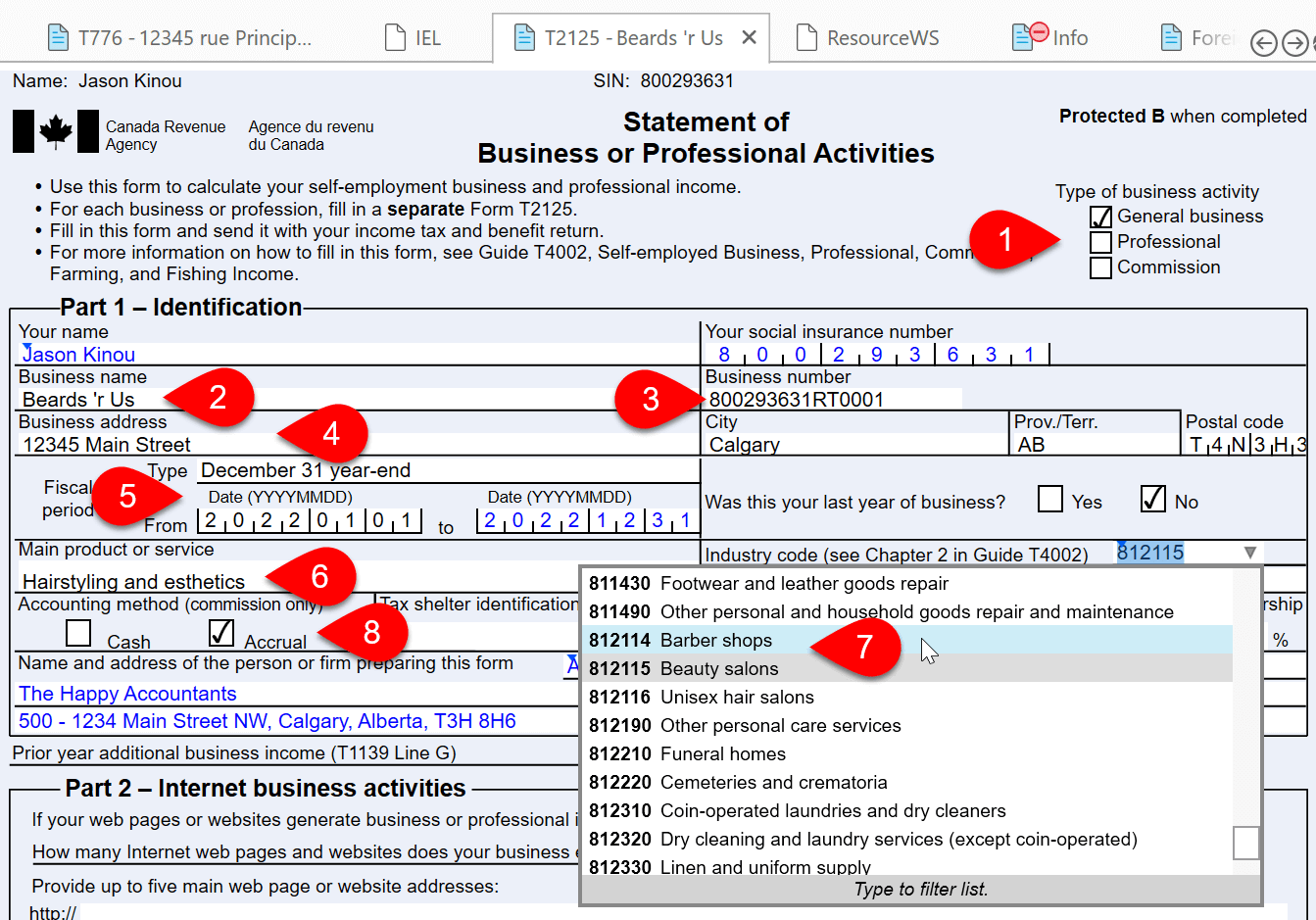

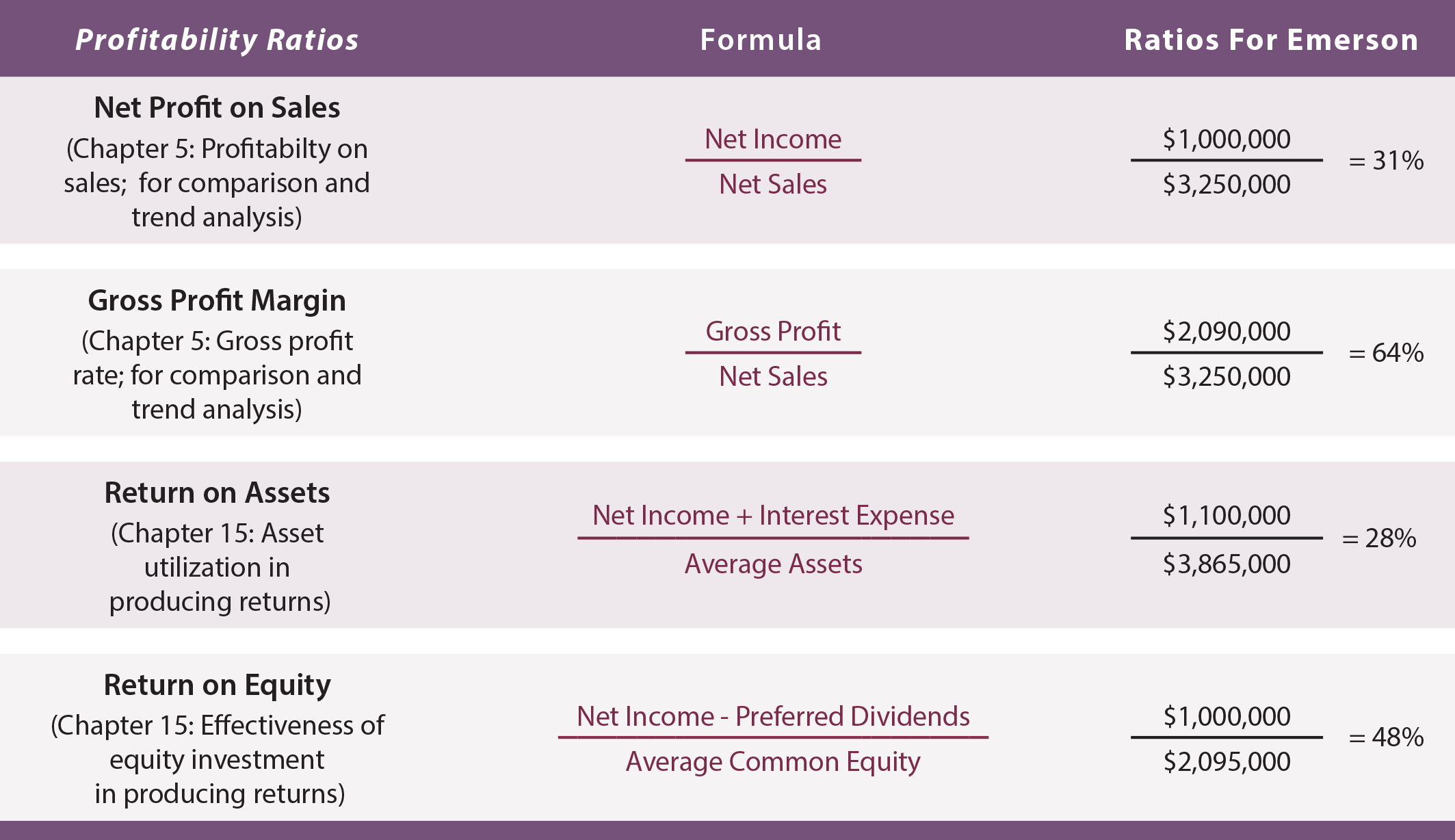

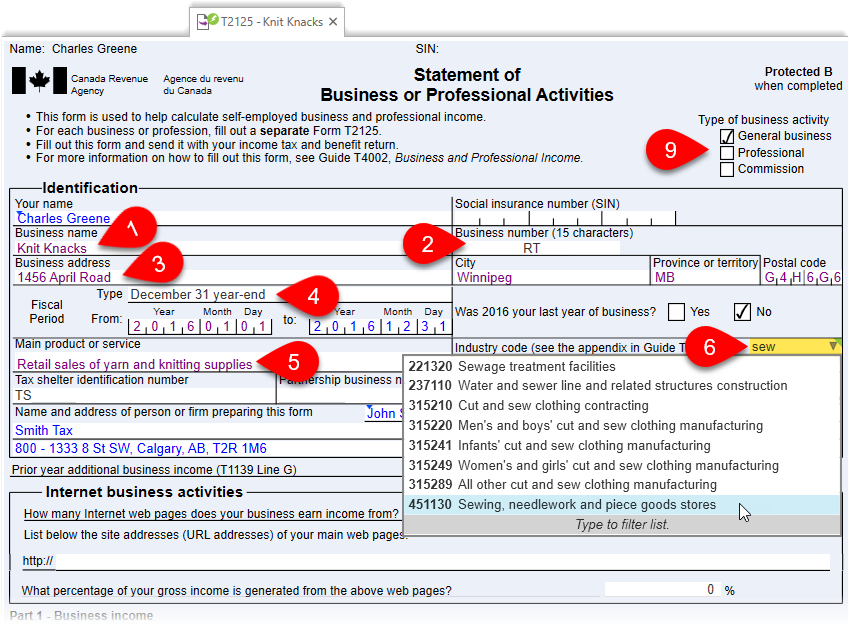

T2125 business income. For each location, the expenses limit. Get started with the basics of preparing a t2125 business statement in taxcycle t1. The basic idea of the t2125 is to input all the business and professional income you earn, and subtract any relevant expense to come up with your net business.

The identification section of form t2125 holds the basic info about your business including your name, the name, and address of the business (if your. For a professional activity, enter your adjusted. The t2125 form is part of the canadian government’s t1 income tax package.

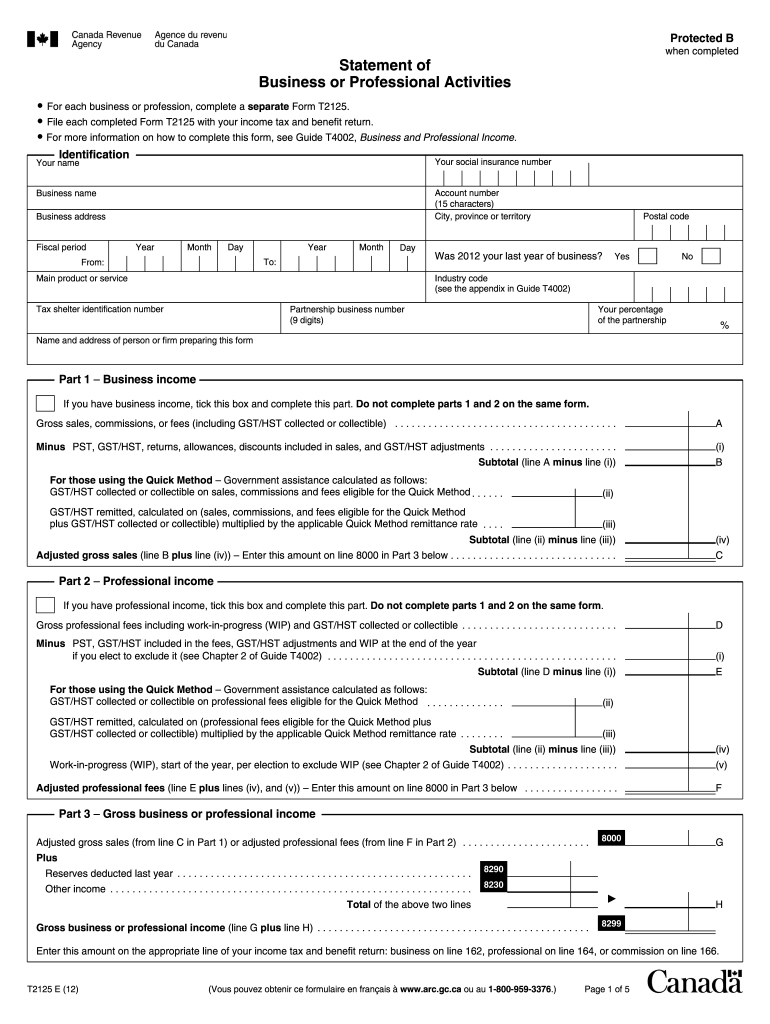

It should be filed with form t1 for. If you are completing form t2125 for a business activity, enter at line 8000 your adjusted gross sales from amount 3g in part 3a. Anyone who has business income of any kind is required to fill out a t2125.

This form combines the two previous forms, t2124, statement of business activities, and t2032, statement of professional. To report business or professional income and expenses, we encourage you to use form t2125. This includes sole proprietors, members of a partnership, and even unincorporated.

We also accept this information on other types of financial statements. Business or professional income overview, business or. If you have both business.

It enables the canada revenue agency (cra) to accurately evaluate how much money you made. The expenses you can deduct include any gst/hst you incur on these. This form can help you calculate your.

This refundable tax credit is 25% of eligible expenses on the improvement of air quality or ventilation at your place of business. T2125 business statements. Generally, you can deduct any reasonable current expense you incur to earn business income.

Form t2125 is a form you need to fill out if you need to report professional or business income and expenses. Fill in this part only if you have business income. Statement of business or professional activities form to report your income and expenses for the year.

If you have professional income, leave this part blank and fill in part 3b.

:max_bytes(150000):strip_icc()/CRAFormT2125-a3f2076202c546f1b72af673d094e89b.png)