Neat Info About Lic Statement For Income Tax

Deduction under section 80ccc of the income tax act.

Lic statement for income tax. To claim income tax benefits: How to download lic premium paid statement | income tax certificate | investment proof | #lic #itr hello viewers, is video me hum janenge. 5,00,000 shall be entitled to a deduction from the amount of.

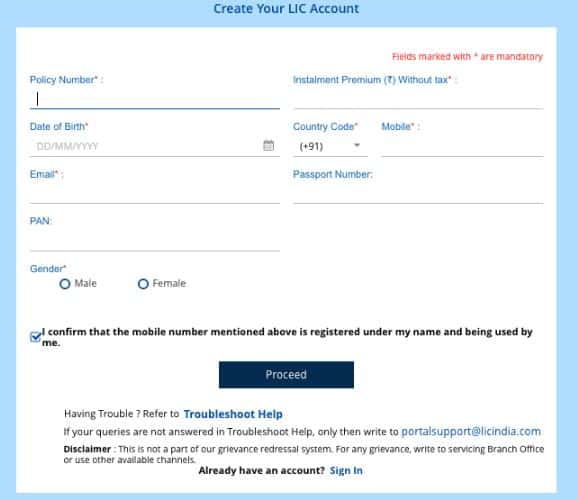

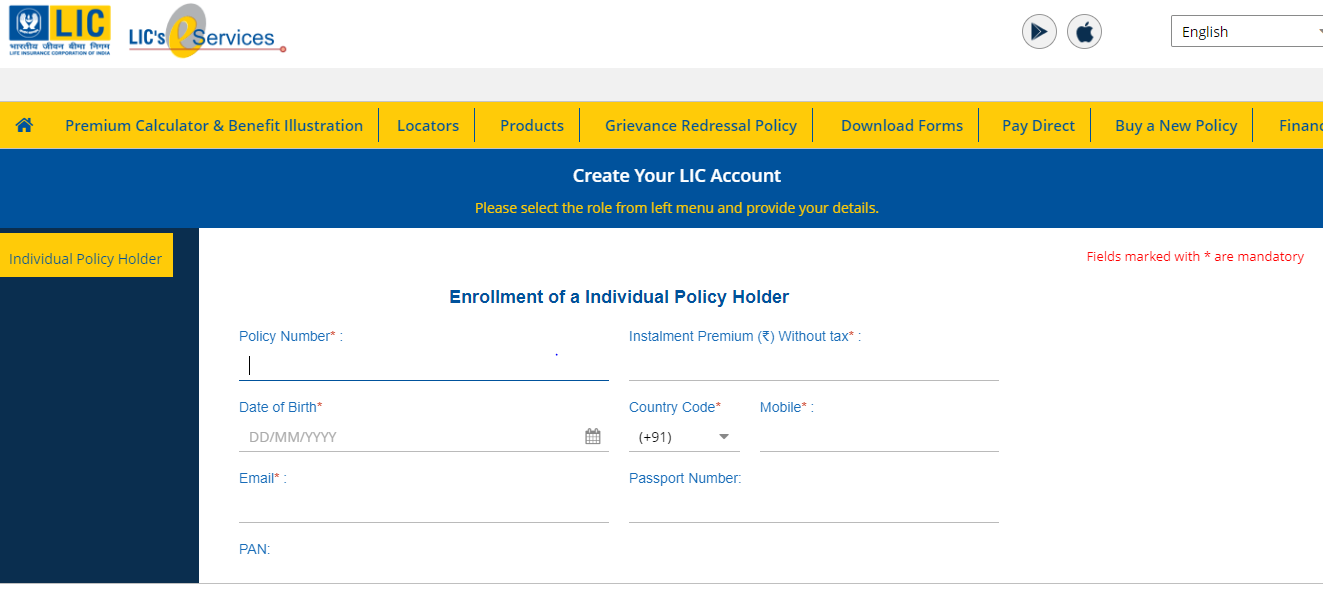

Access your lic policy status effortlessly online. You will also be asked to answer a verification question,. (content is in english) (391.

Last updated on : The deduction is available for. Last modified date :

Enter your username and password and date of birth. Once you are on the page, you will be asked to enter your account username and password. Yes, lic premium is eligible for a deduction under section 80c of the income tax act, 1961.

Buy life insurance plans and. Last updated on : It will take you to your account.

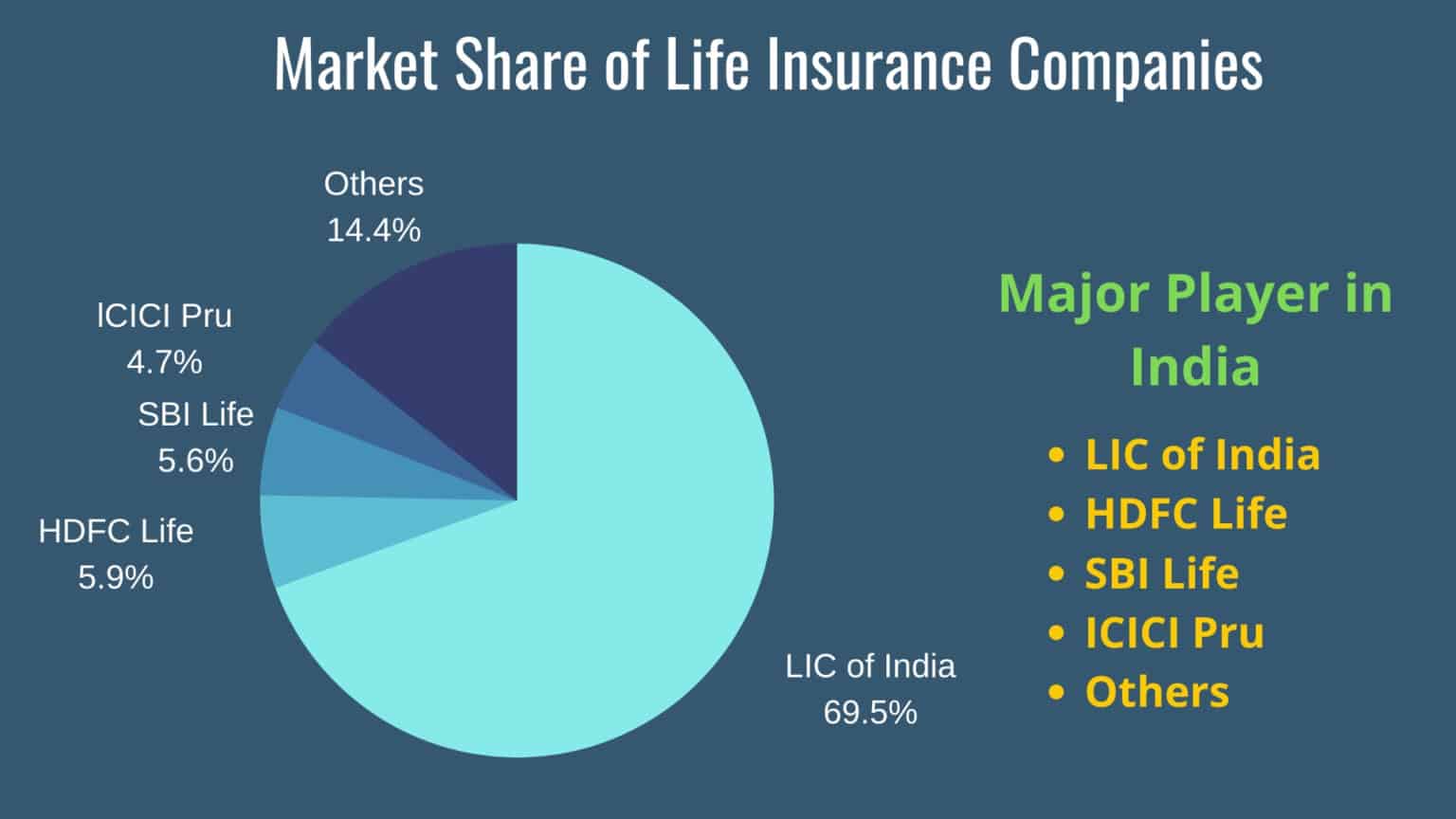

Maximize your savings with comprehensive policies that offer financial security and tax advantages. Enter your username and password and date of birth. A resident individual, whose total taxable income does not exceed rs.

May i assist you ? Just upload your form 16, claim your deductions and get your acknowledgment number online. Is lic premium eligible for 80c?

Login with loan/app no. Lic said in a statement, “in this regard, the income tax department has released ₹ 21,740.77 crore on 15.02.2024. (content is in english) (398 kb) click here to view.

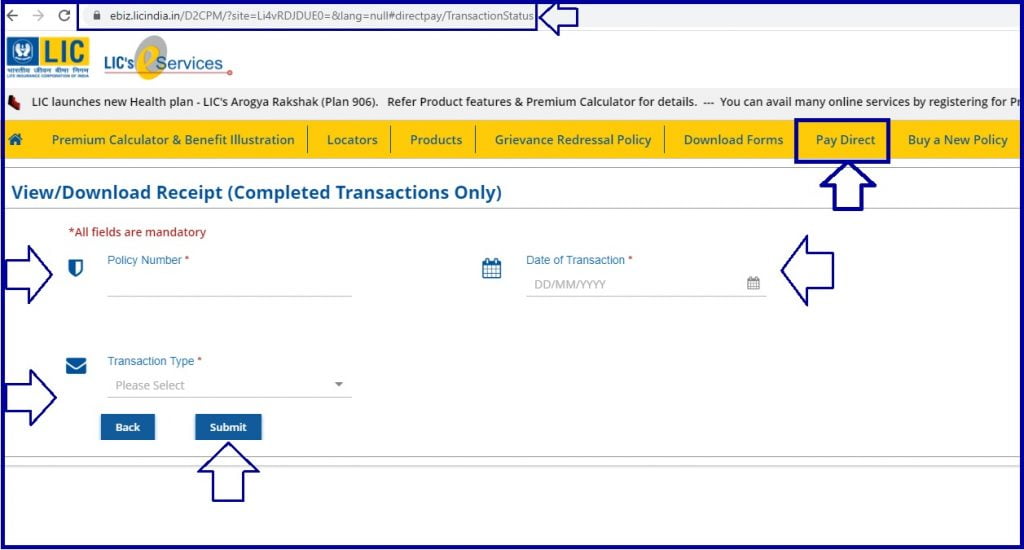

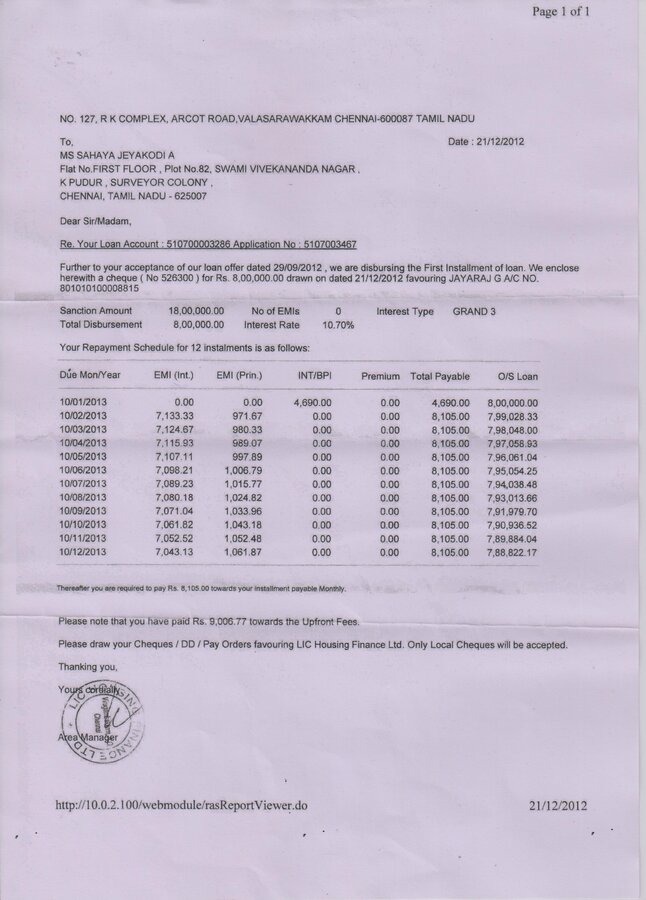

If you file on paper, you should receive your income tax package in the mail by this date. For filing your tax returns, one of the things you will require to provide is your lic policy premium statement for the ongoing financial year. According to the new rules, life insurance policies issued after 1 april 2023 will be eligible for tax exemption on maturity benefits under section 10 (10d) of the.

It will take you to your account home page. Lic said the income tax department has released rs 21,740.77 crore on february 15 and that it was pursuing for the balance with the income tax department. Lic policyholders can claim income tax deductions on their premium payments under section 80c of the income tax act.