Wonderful Tips About Income Statement Of Manufacturer

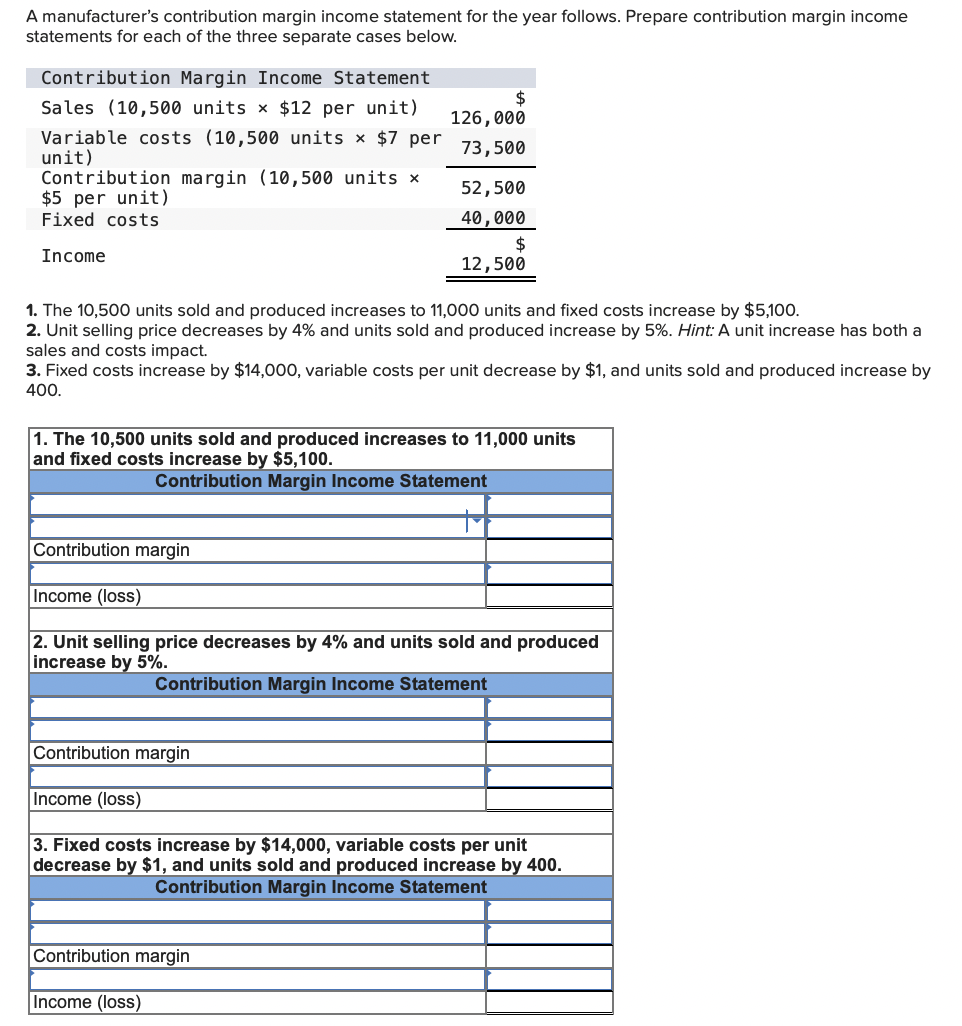

Income statements for each type.

Income statement of manufacturer. Manufacturing financial statements manufacturing companies have several different accounts compared to service and merchandising companies. It is necessary to learn how to prepare income statement for manufacturing business. Net cash € 10.7 billion.

Income statements depict a company’s financial performance over a reporting period. A manufacturing company makes physical products from parts and materials. Understanding income statements in a manufacturing default begins with and inventory daily flow equation.

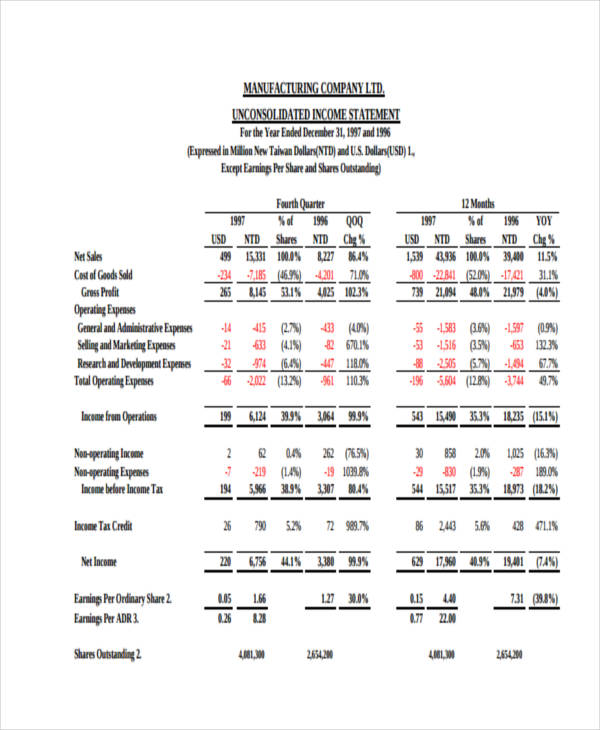

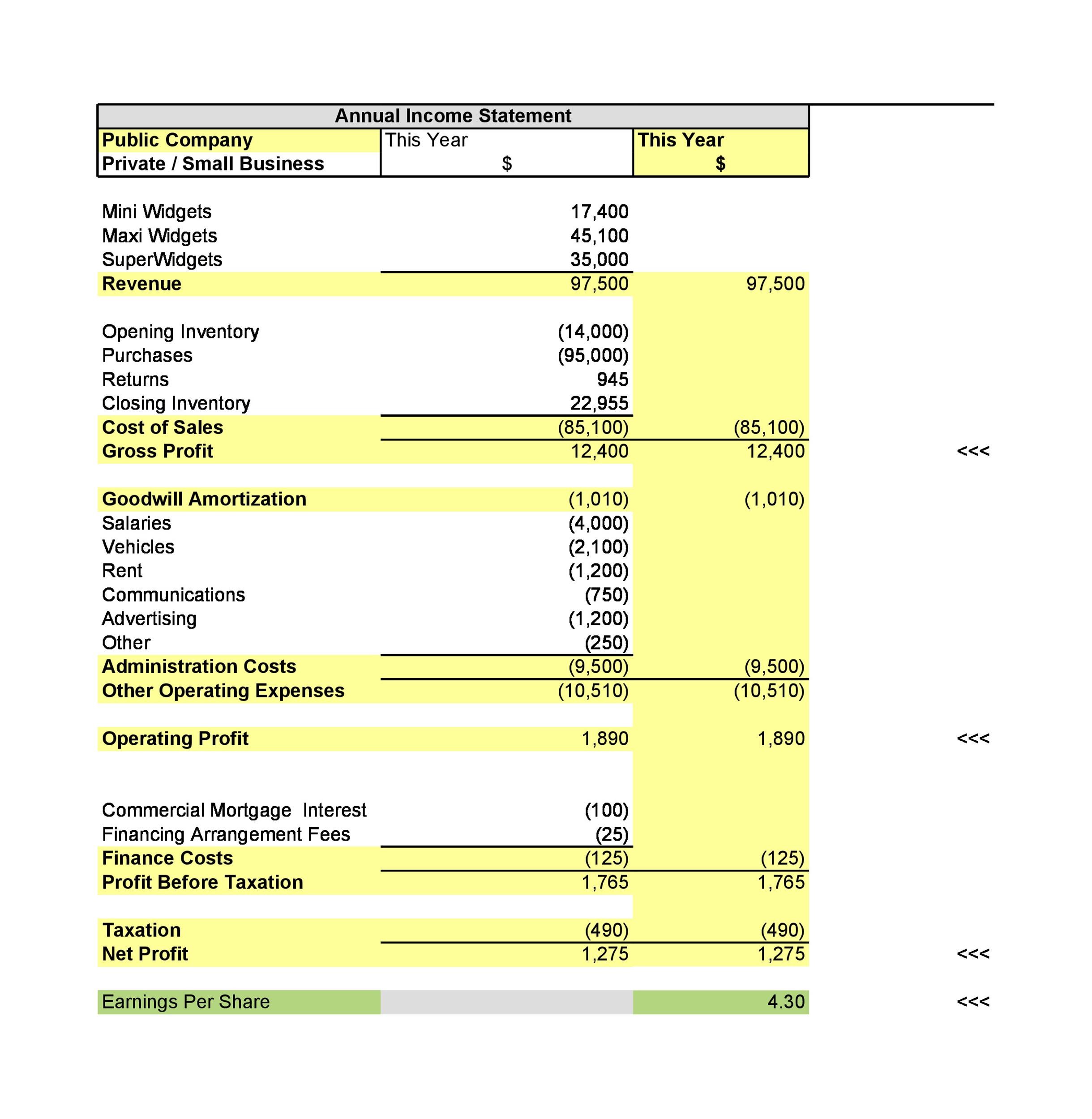

Understanding income statements in a manufacturing setting begins with the inventory cost flow equation. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. It shows how much profit your company has earned over a defined period of time, typically a quarter or a year.

The income statement captures the revenues your company generates and the expenses it incurs. The income statement: Dividend of € 1.80 per share;

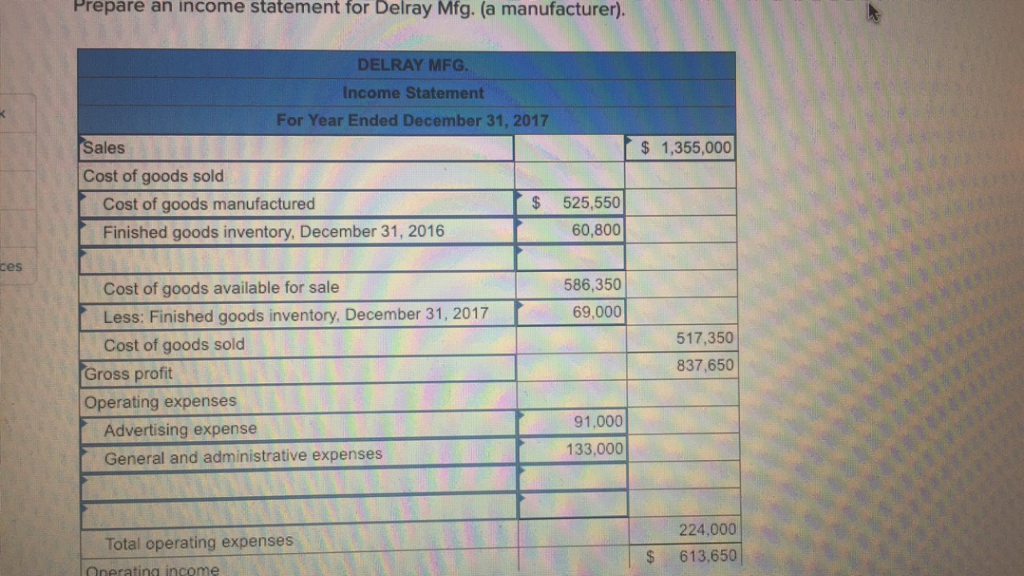

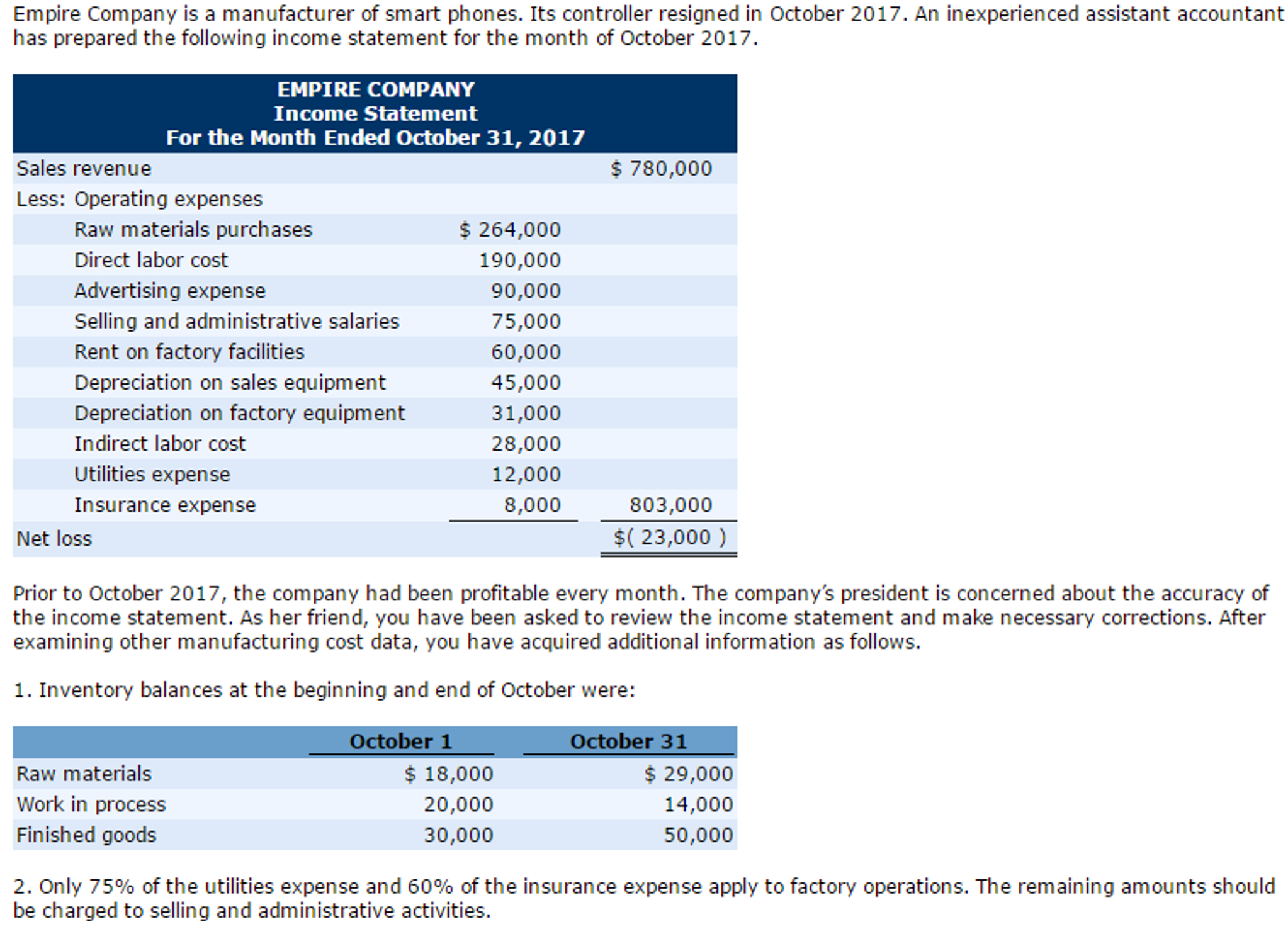

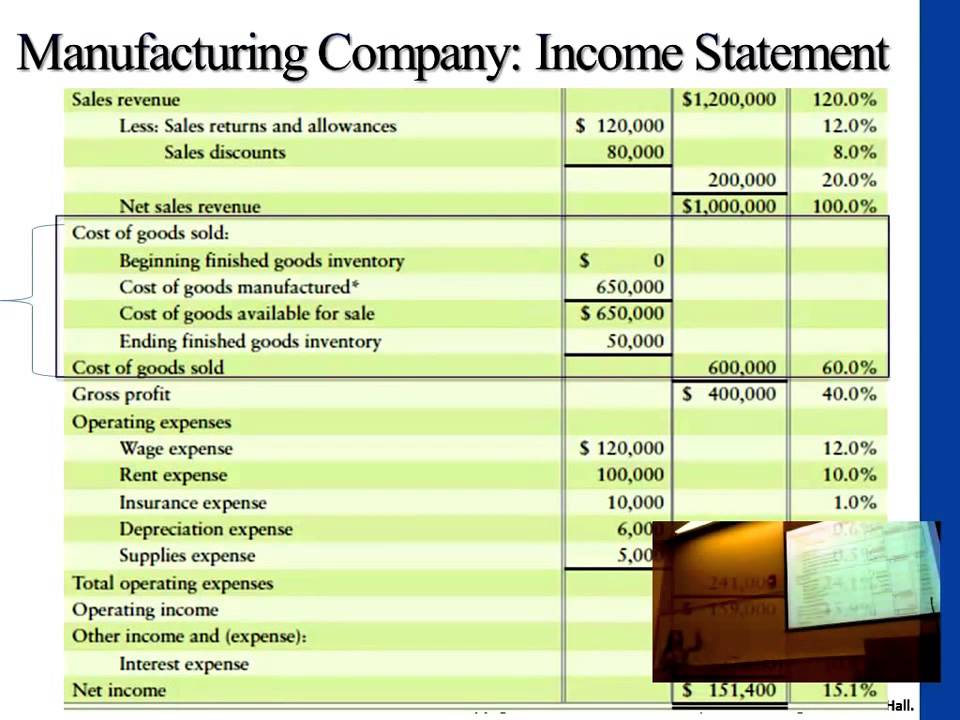

The majority of the income statement remains consistent across business types, with only a few accounts changing and rearranging for manufacturing companies. The income statement is one of the most important financial statements this type of firm prepares. Since income statements for manufacturing companies tend to be more complex than for service or merchandising companies, we devote this section to income statements for manufacturing companies.

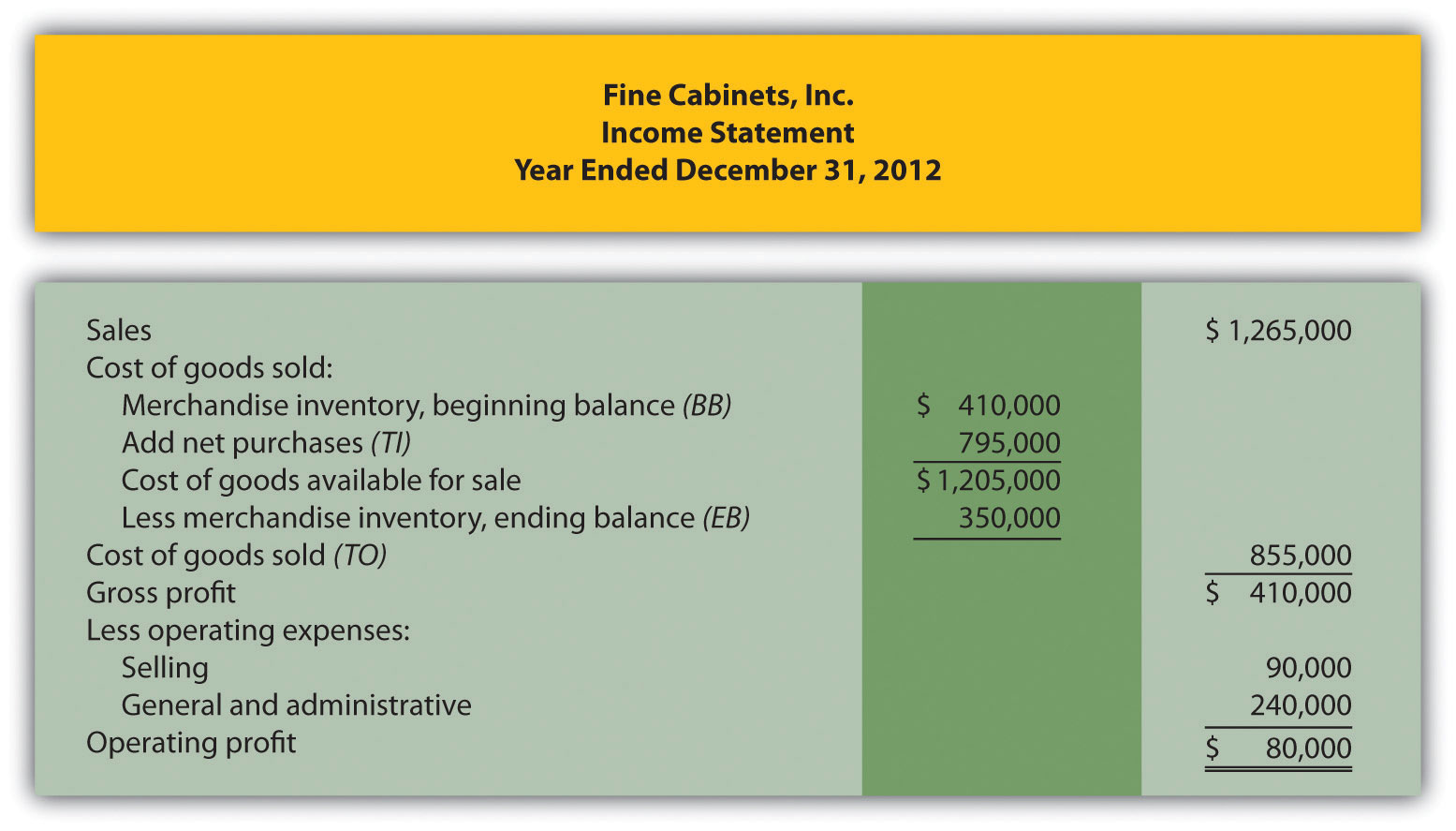

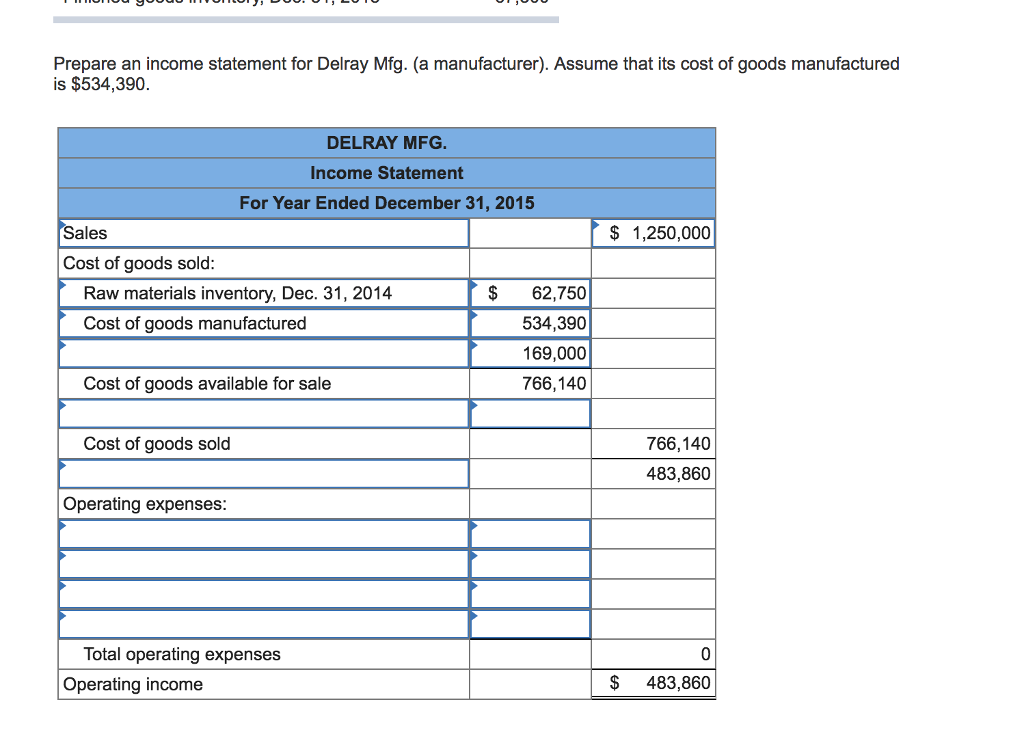

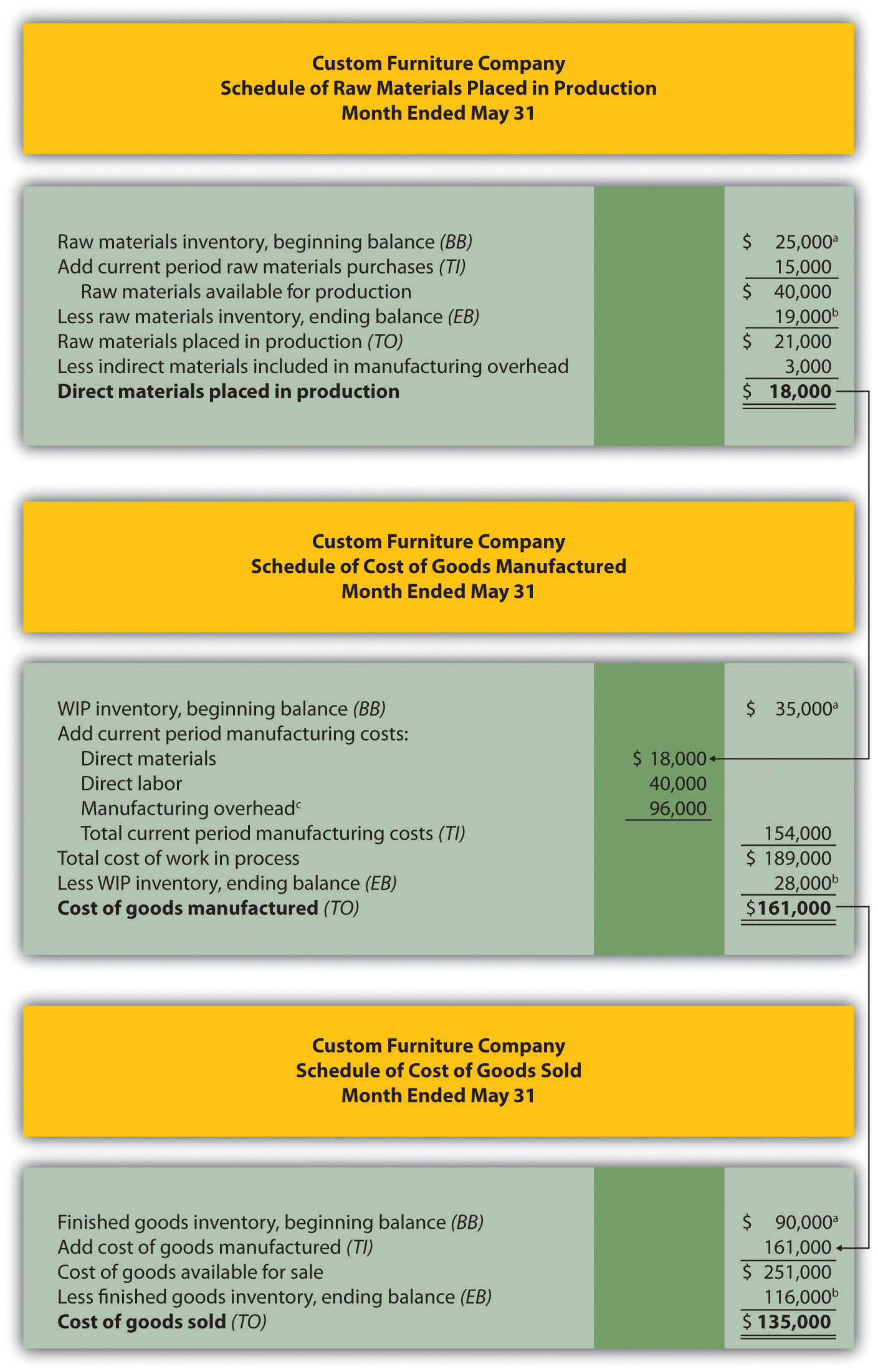

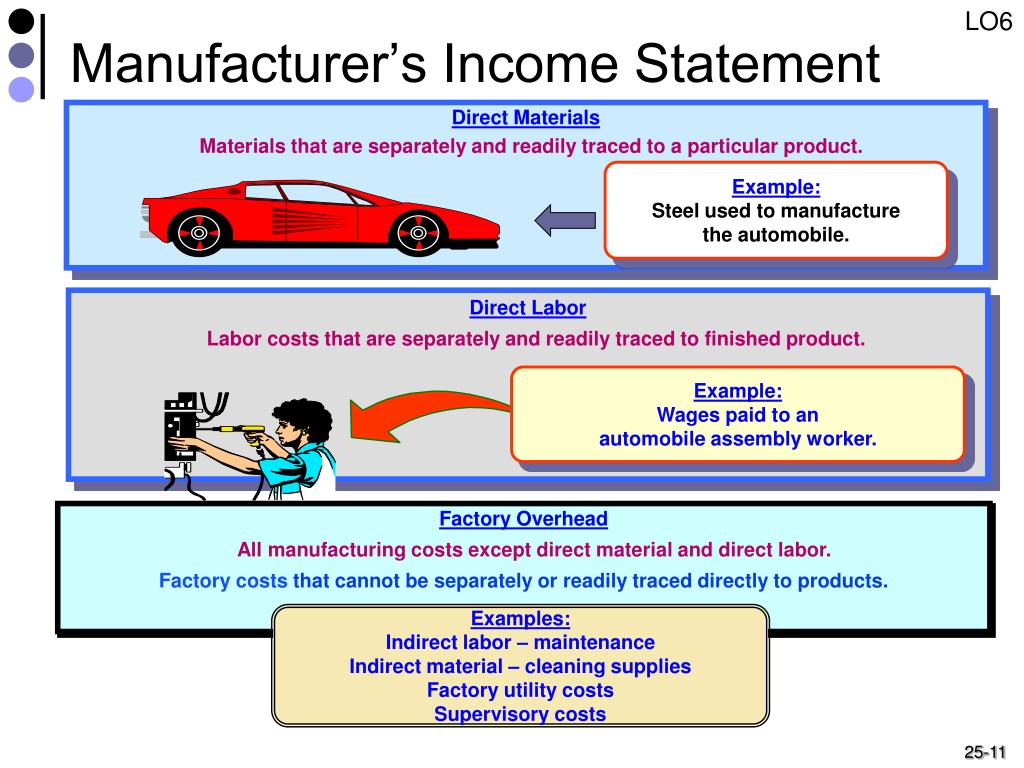

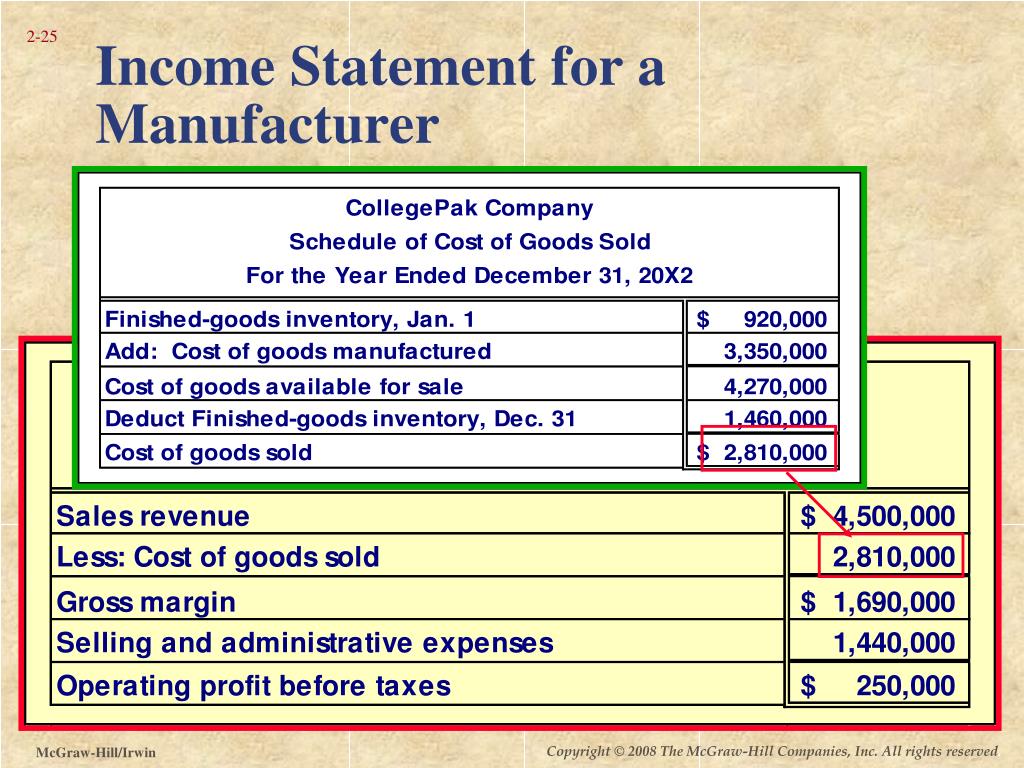

We describe how to calculate these amounts using three formal schedules in the following order: The following terms are used by manufacturing and merchandising companies: Sales, cost of goods available for sale, cost of goods sold, operating expenses, selling, general and administrative, and operating profit.

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. How to prepare a manufacturing income statement. The income statement for merchandising and manufacturing companies differs in the reporting of the cost of the merchandise (goods) available for sale and sold during the period.

Since income reports for manufacturing our tend to be more complex than for service or merchandising company, we devote this section to income statements for manufacturing businesses. What are income statements for manufacturing companies? The statement of cost of goods manufactured supports the cost of goods sold figure on the income statement.

The two most important numbers on this statement are the total manufacturing cost and the cost of goods manufactured. A manufacturing company has no needs to prepare a industrial account, statement of production, or ampere cost sheet, before preparing the income statement. Another crucial component of financial statements is the income statement.

A merchandising company engages in the purchase and resale of tangible goods. The two most important numbers on this statement are the total manufacturing cost and the cost of goods manufactured. It reports the company’s revenues, expenses, and net profit or loss for the accounting period.