Have A Tips About Accounts Payable Entry In Balance Sheet

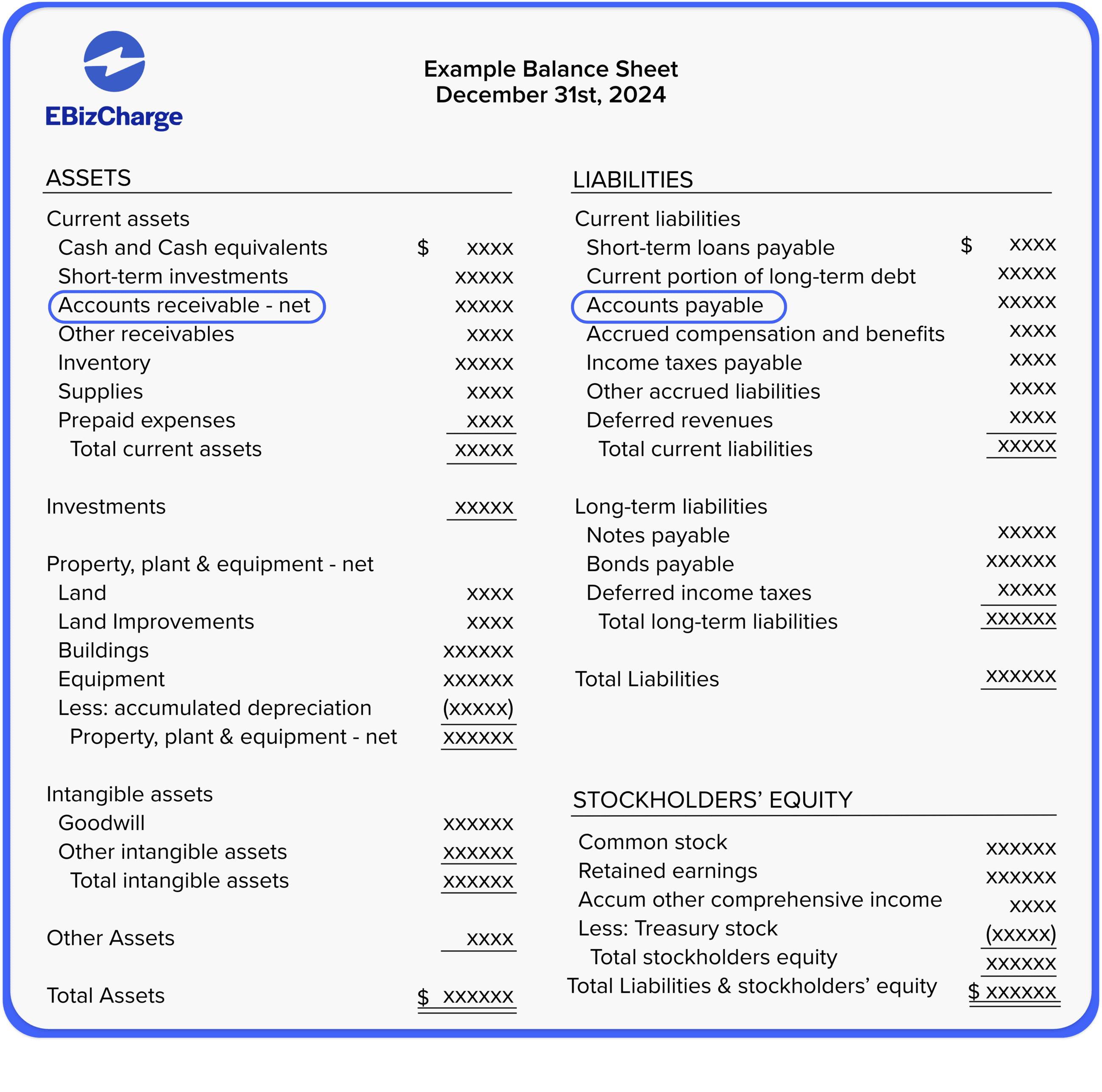

Under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers.

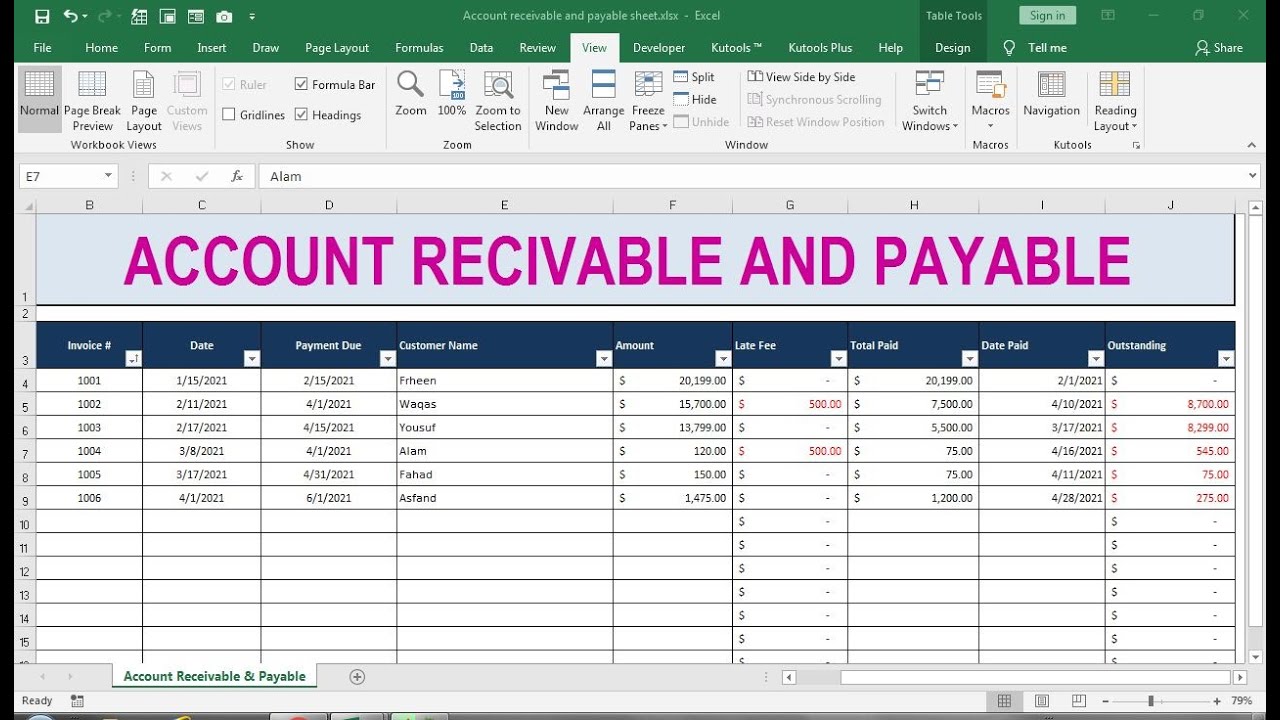

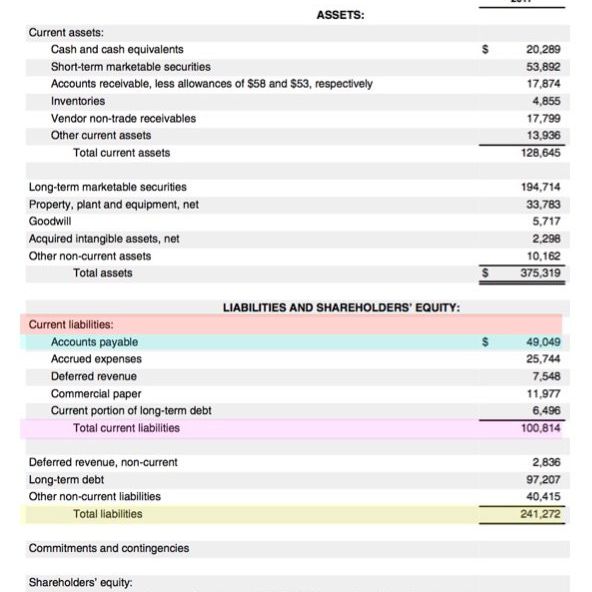

Accounts payable entry in balance sheet. Short term bills payable are due within one year from the balance sheet date and classified under current liabilities in the. Accounts payable for apple was approximately $49 billion (highlighted in. Accounts payable turnover accounts payables turnover is a key metric used.

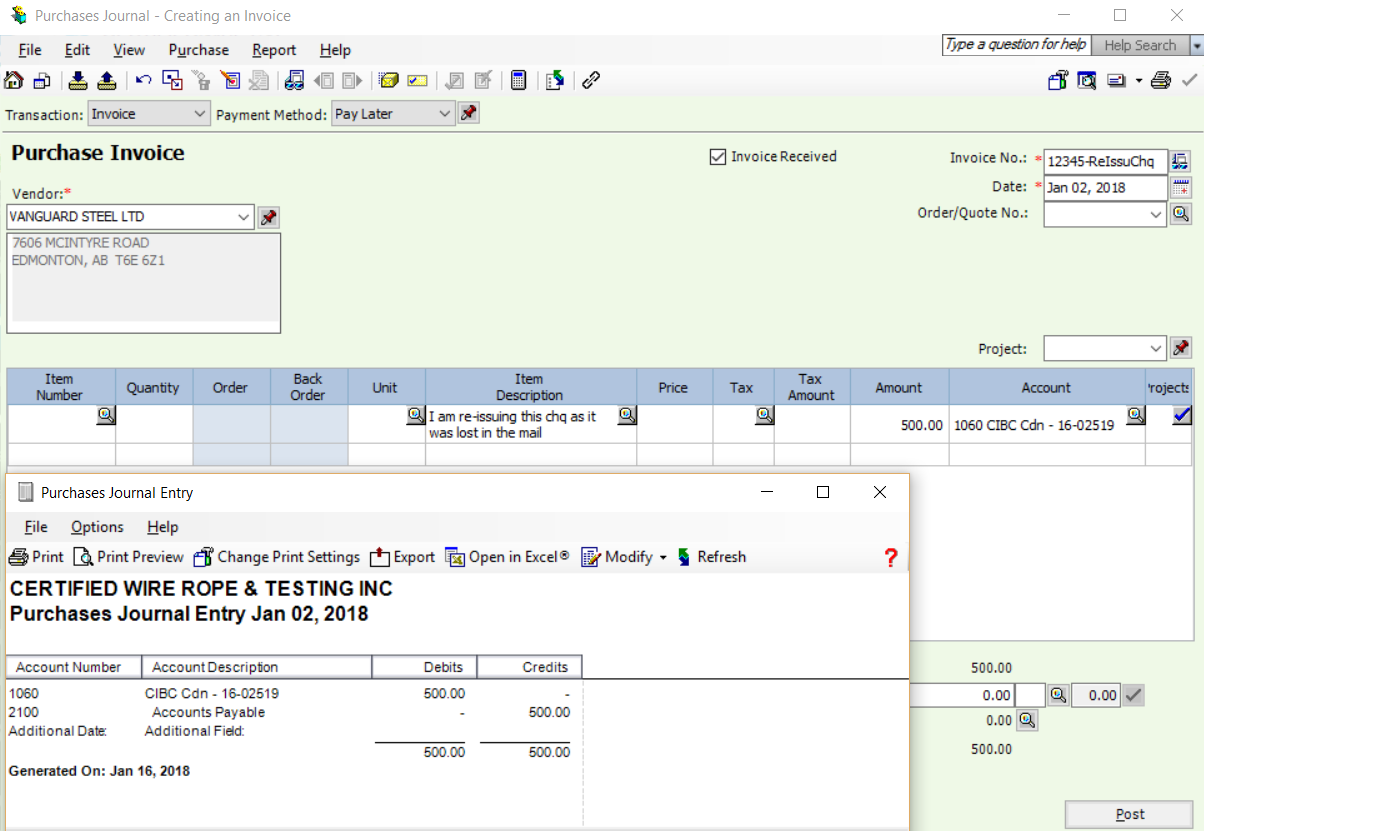

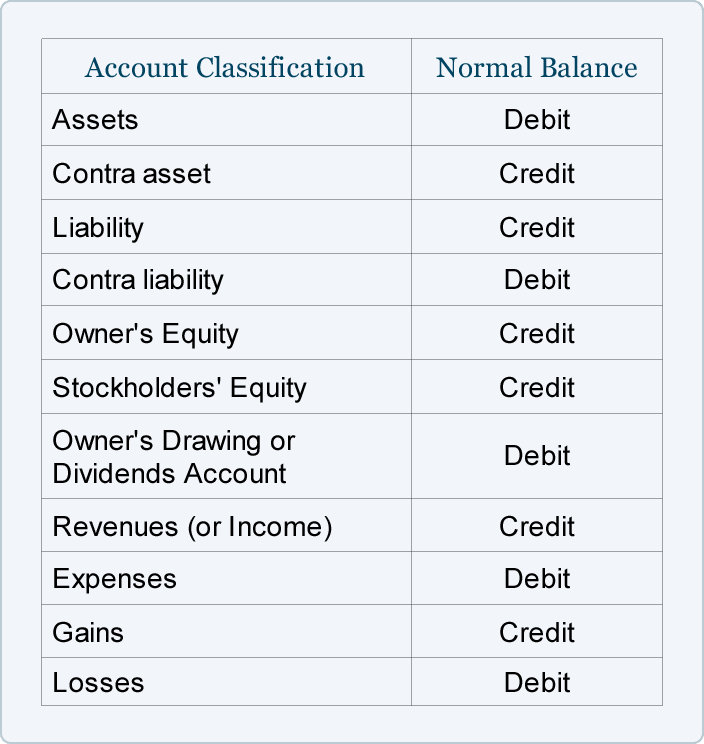

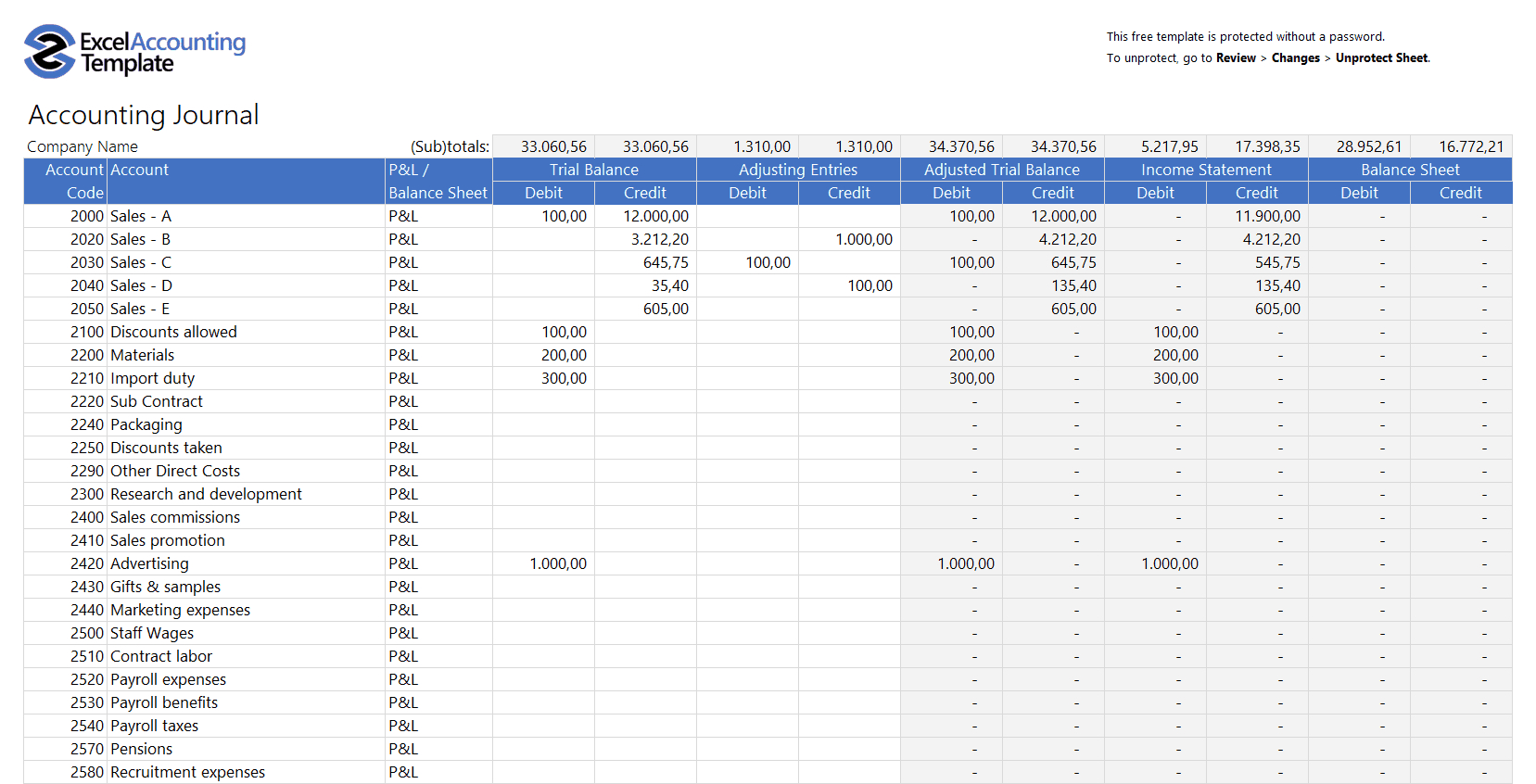

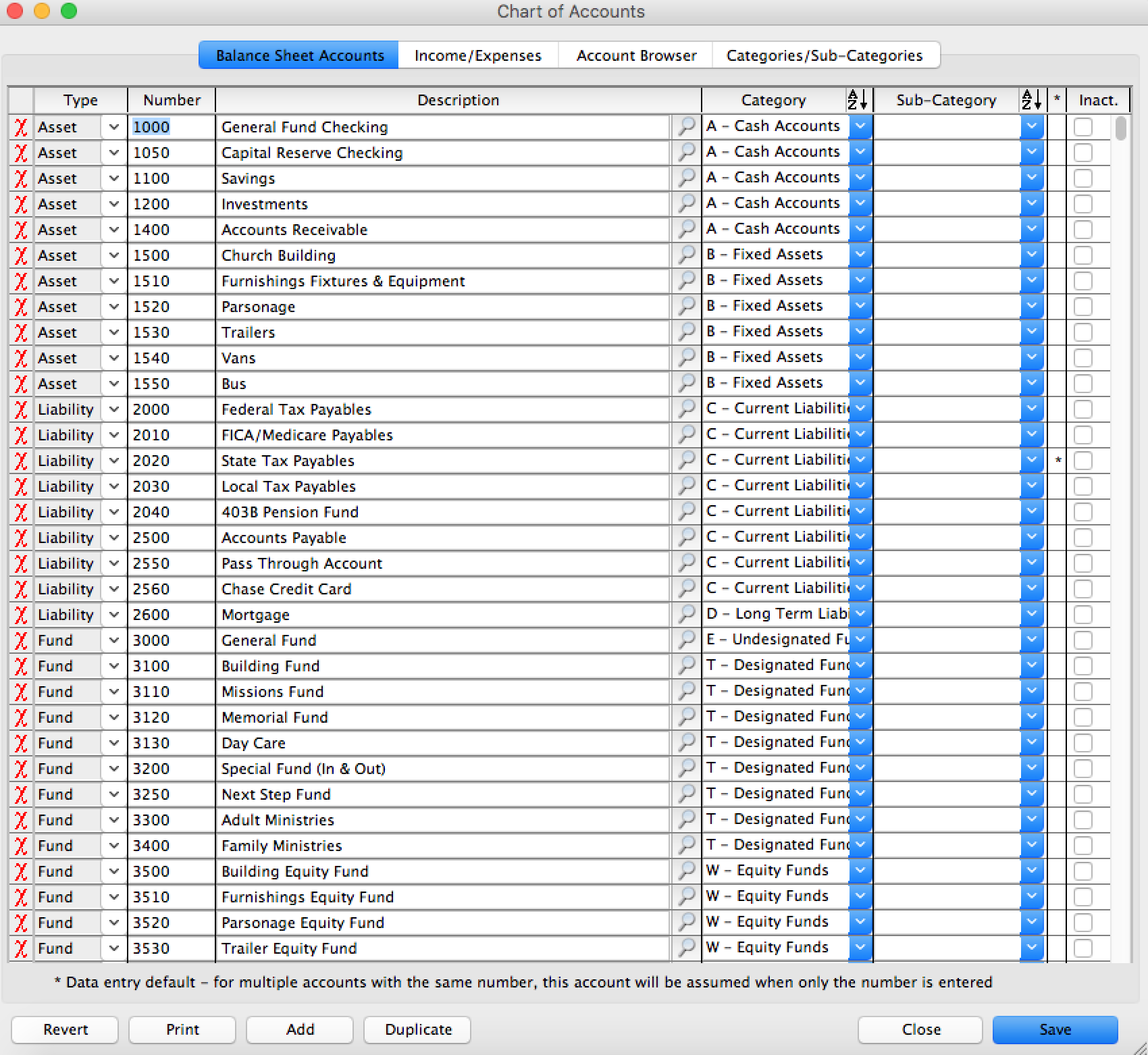

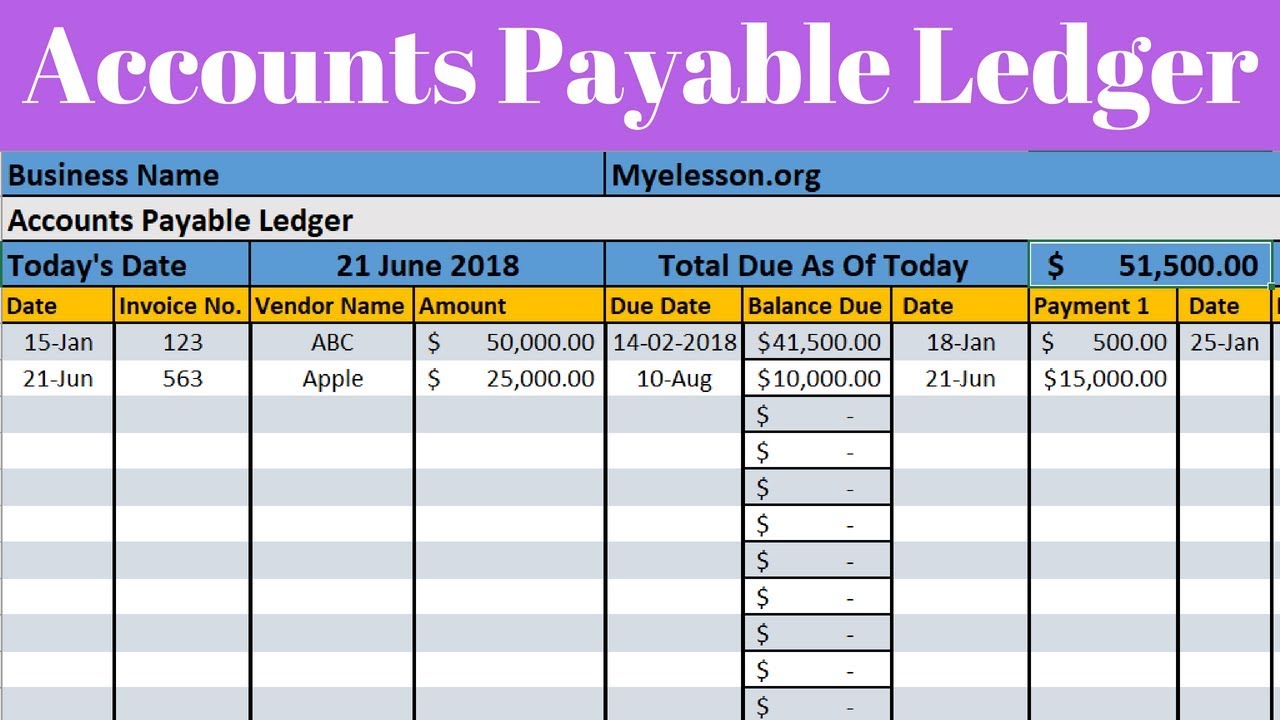

Accounts payable journal entry is the method of recording payables data in the general ledger. If a business has accounts payable (a/p), they have received goods or services from other companies that they need to pay off in the near. Current liabilities are highlighted in red.

Cfi’s financial analysis course as such, the balance sheet is divided into two. Bills payable on the balance sheet. Accounts payable (also known as creditors) are balances of money owed to other individuals, firms or companies.

2 rows tracking and paying your liabilities is an important part of keeping your business running at peak. What is accounts payable on a balance sheet? The balance sheet is based on the fundamental equation:

The five main types of journal entries made on accounts payable are when a product is purchased on accounts when inventory is damaged and returned to the supplier when a. It is represented as the amount of outstanding balances that have to be paid to the suppliers. Ap is considered one of the most current forms of the current liabilities on the balance sheet.

Understanding the accounts payable balance sheet is crucial for maintaining a company's financial health. Notes payable is a liability account that reports the amount of principal owed as of the balance sheet date. It's a snapshot of what a company owes and.

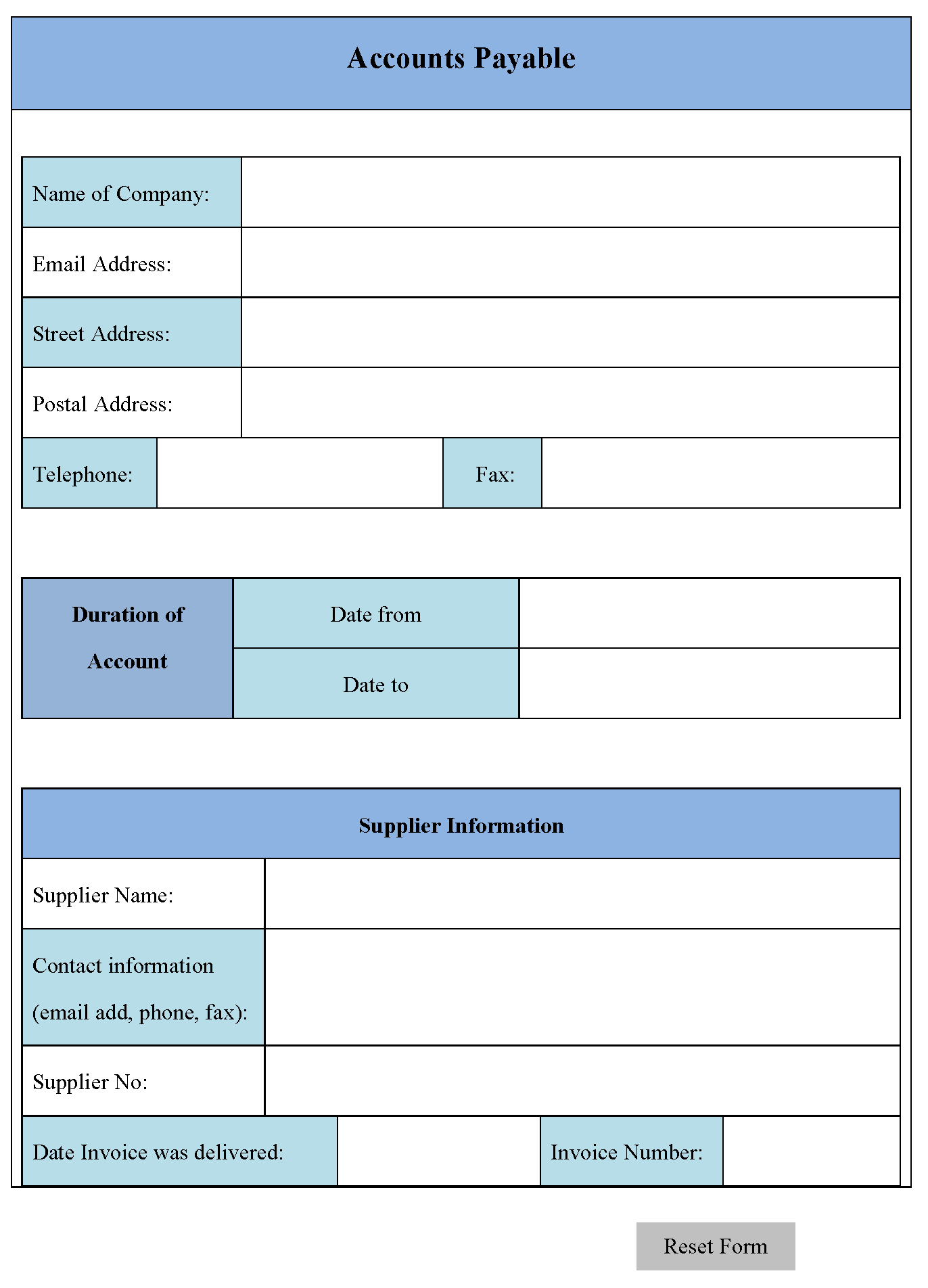

Accounts payable (ap) is a liability that appears on a company’s balance sheet. The first step is the receipt of the invoice, which can be done through various channels such as email, fax, or courier. The accounts payable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry.

Accounts payable forms a part of the current liabilities in your company’s balance sheet. Accounts payable are recorded in the balance sheet under. Accounts payable is sum of money owed by a business to its suppliers shown as a liability on a company's balance sheet.

Assets = liabilities + equity. The accounts payable are the current liabilities that are shown on the balance sheet for which the balances are due within one year. Understanding accounts payable on a balance sheet.

An accounts payable journal entry impacts the financial statements as follows: Accounts payable journal entries refer to the accounting entries related to amount payable in the company’s books of creditors for the purchase of goods or services. In this case, the company has an obligation.