Brilliant Info About Tds View 26as

What is form 26as ?

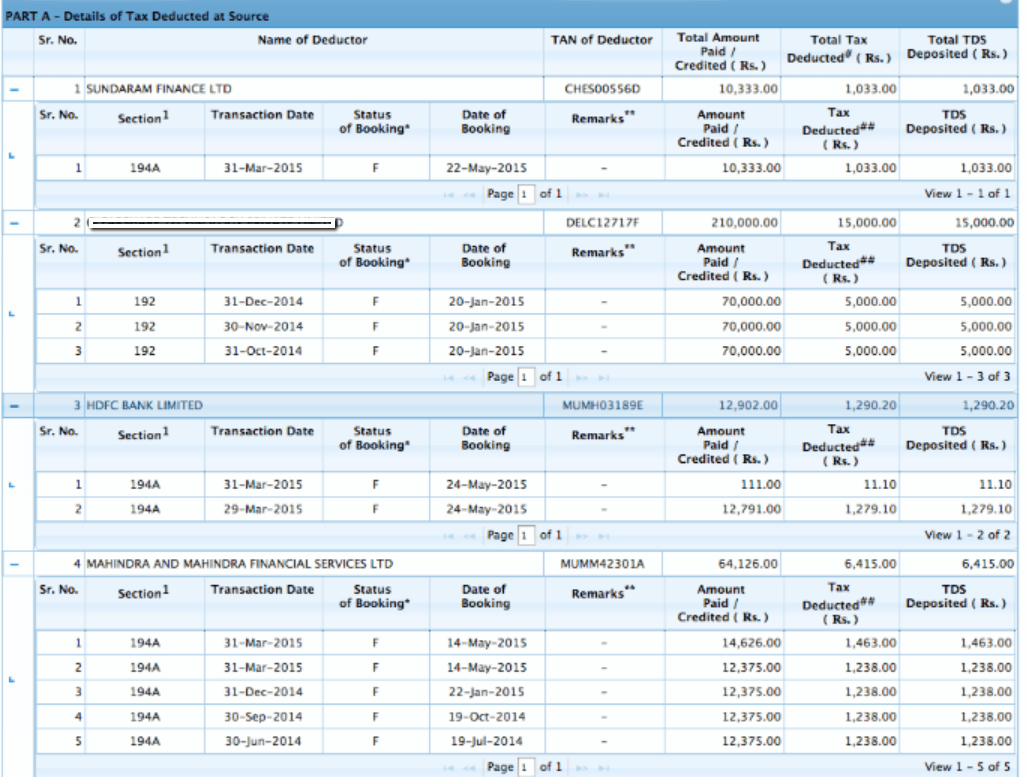

Tds view 26as. It is an important document needed at the time of filing itr,. Select the box on the screen and click on 'proceed'. The website provides access to the pan holders to view the details of tax credits in form 26as.

Users having pan number registered with their home branch can avail the facility of. To view form 26as or. What information available in form 26as?

How to download form 26as? The tds reconciliation analysis and correction enabling system (traces) is an online service. Form 26as is a tax credit statement that provides the complete record of the taxes paid by a taxpayer.

The significance of form 26as lies in its ability to provide transparency in financial dealings. Introduction form 26as is a consolidated tax statement issued to the pan holders. It is also known as tax credit statement or annual tax statement.

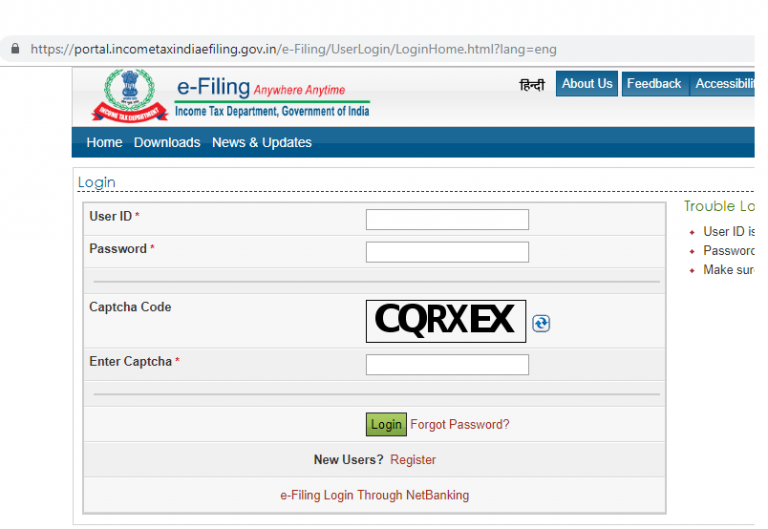

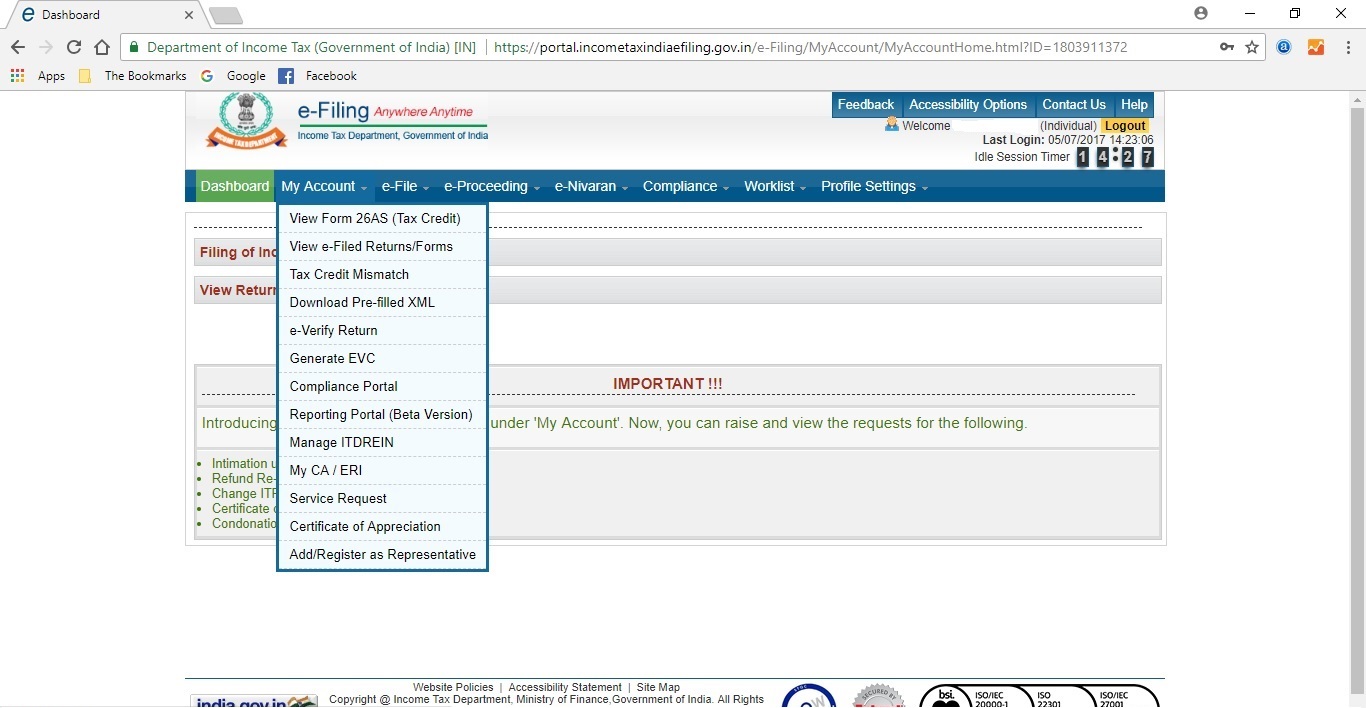

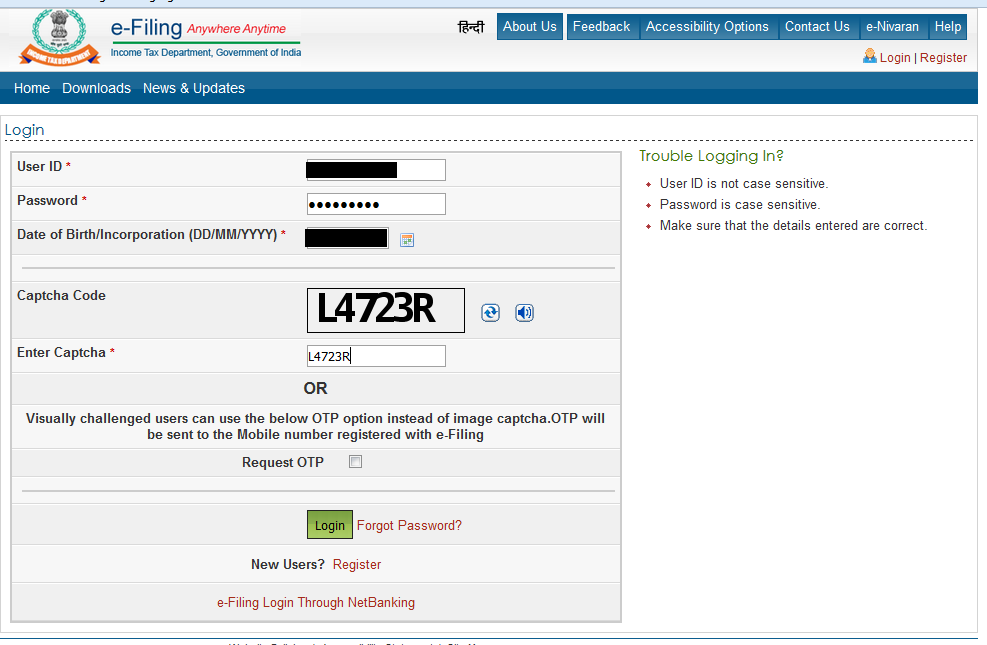

To make sure that the tds withheld from your income is actually deposited with the income tax department, it is helpful to check the information on the tds certificate. How to view form 26as? How to view your tds through form 26as?

Form 26as is, in essence, an acknowledgement of sorts when it comes to tax deducted at source (tds). If you are not registered with traces, please refer to our e. How to view form 26as?

How to view form 26as through a net banking facility? Individuals have the option to view form 26as from the traces portal and can also download it as shown in the previous section. How to view form 26as?

Which is to say that form 26as shows the amount of. You may view form 26as by pan no. What is in the new form 26as?

Click on the link at. Users of retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login : As a taxpayer you can view form 26as in two modes: