Formidable Tips About Investment Income Balance Sheet

What’s the impact of investment income on the cash flow statement?

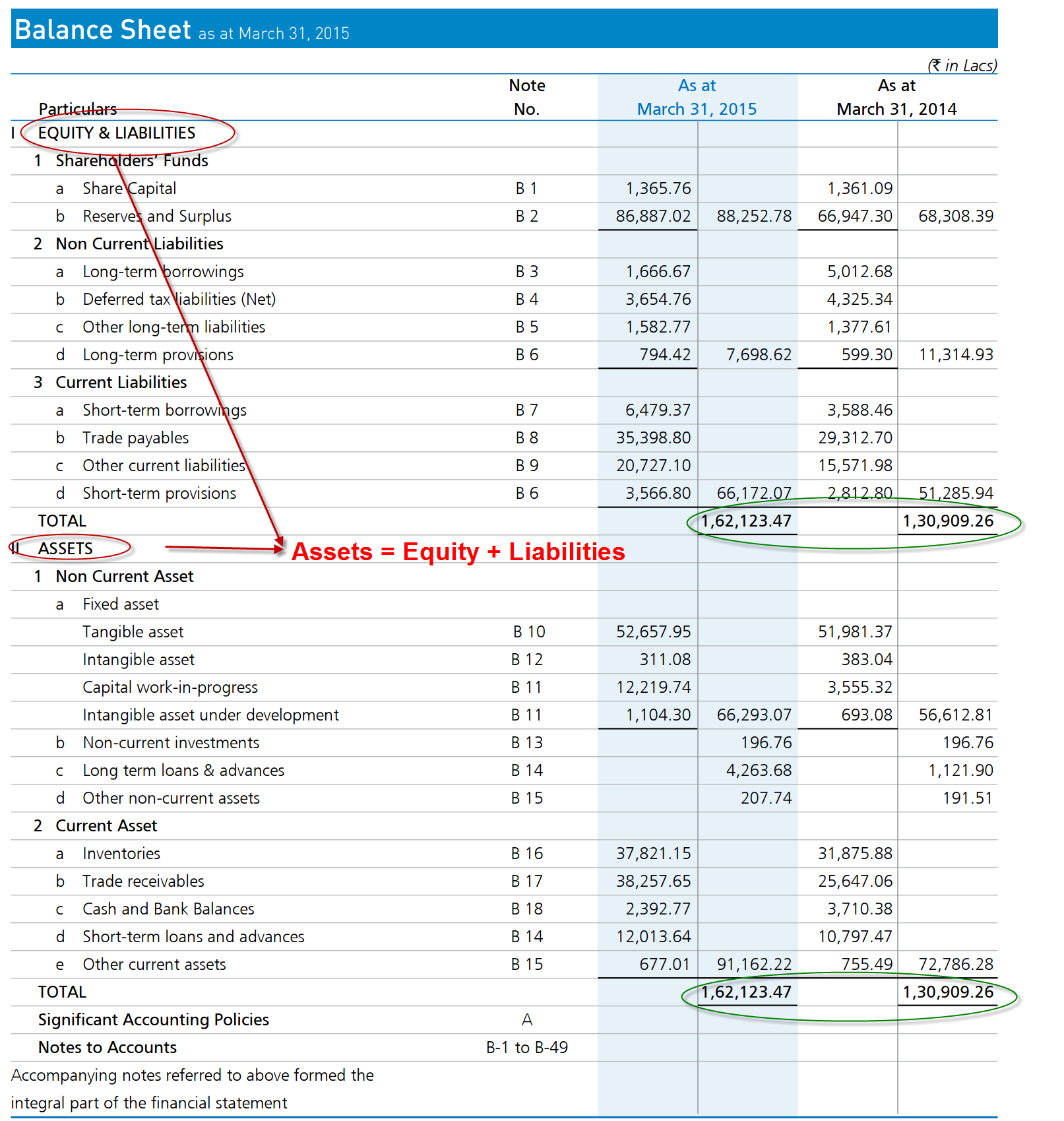

Investment income balance sheet. However, receipt of the cash under. Investments are listed as assets, but they're not all clumped. Purpose balance sheets are used to analyze the current financial position of a business.

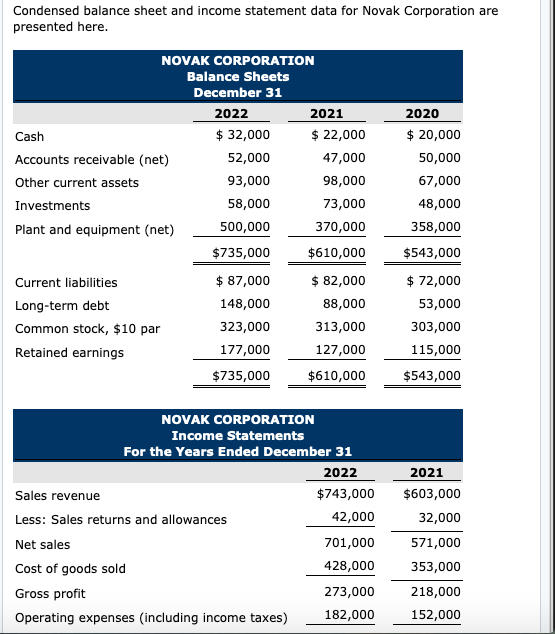

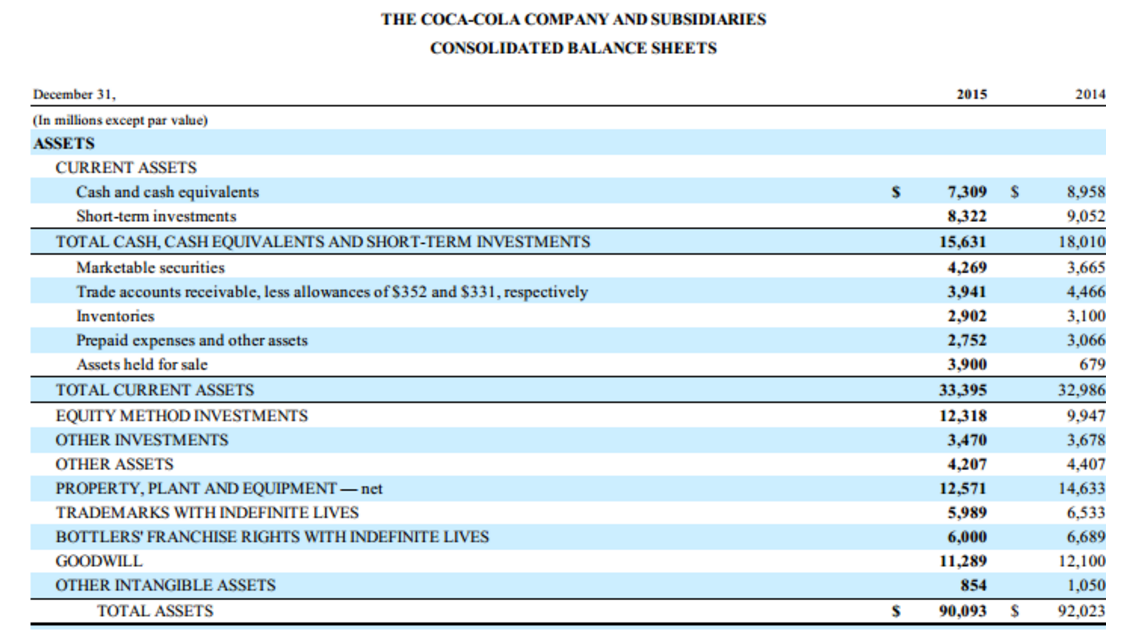

It answers questions such as whether the company has enough assets to. The income statement vs. The investment account on the balance sheet should include the investment in common stock, advances, and senior securities consistent with how it is presented in the income.

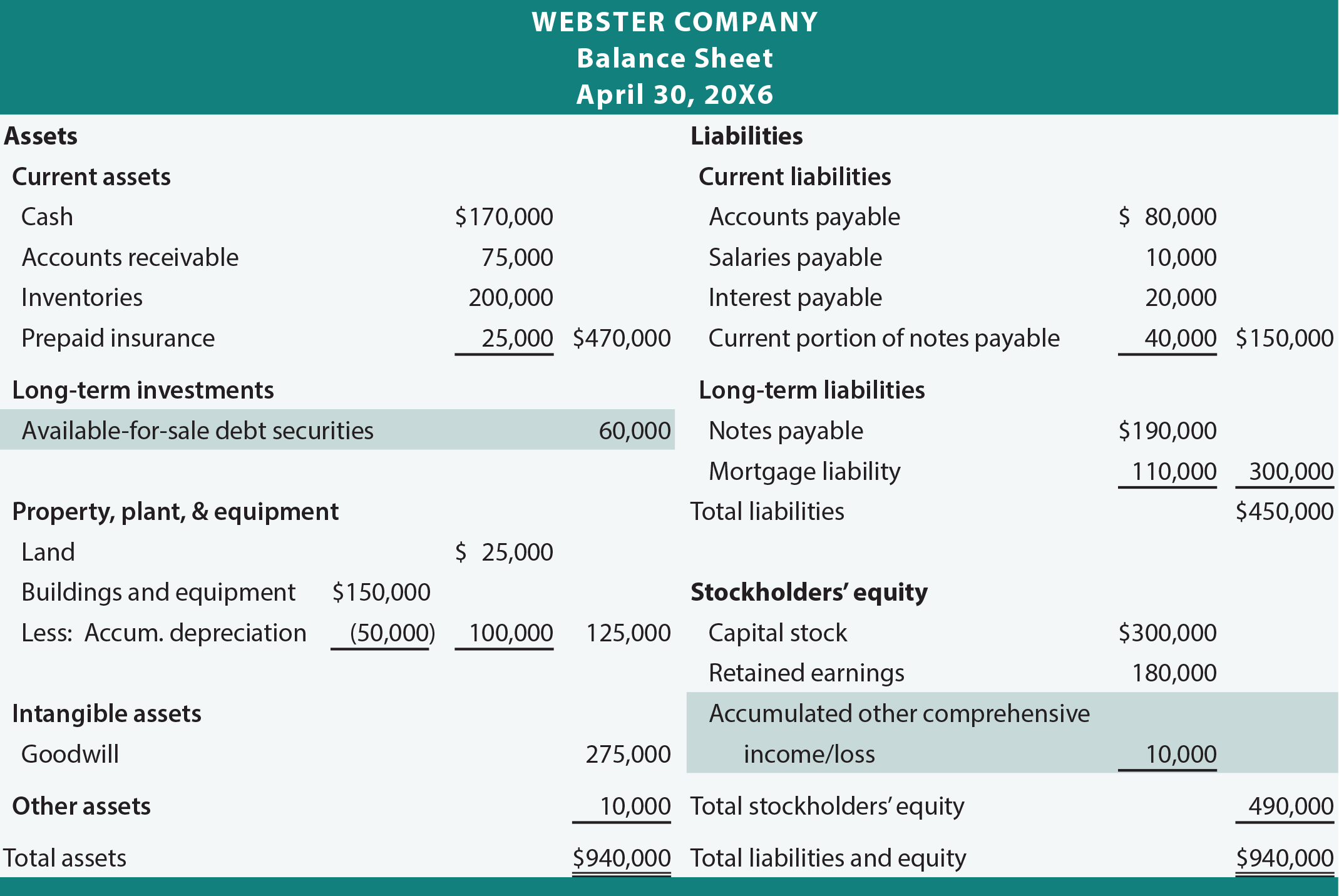

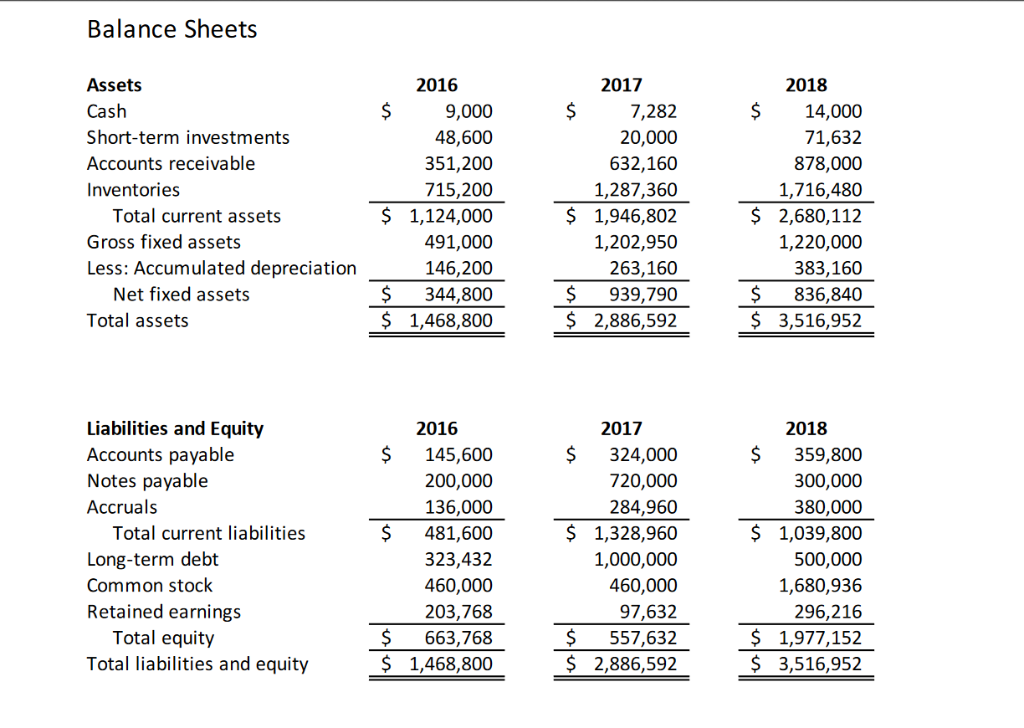

Get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates. The income statement and balance sheet follow the same accounting cycle, with the balance sheet created right after the income statement. The business can decide to invest in a range of financial assets, including equity securities, debt securities, or.

The investor's share of this profit would be $525,000 ( 35 percent times $1.5. Investments might include stock, stock funds, or bonds. Investopedia / julie bang understanding financial statements investors and financial analysts rely on financial data to analyze a company's performance and make.

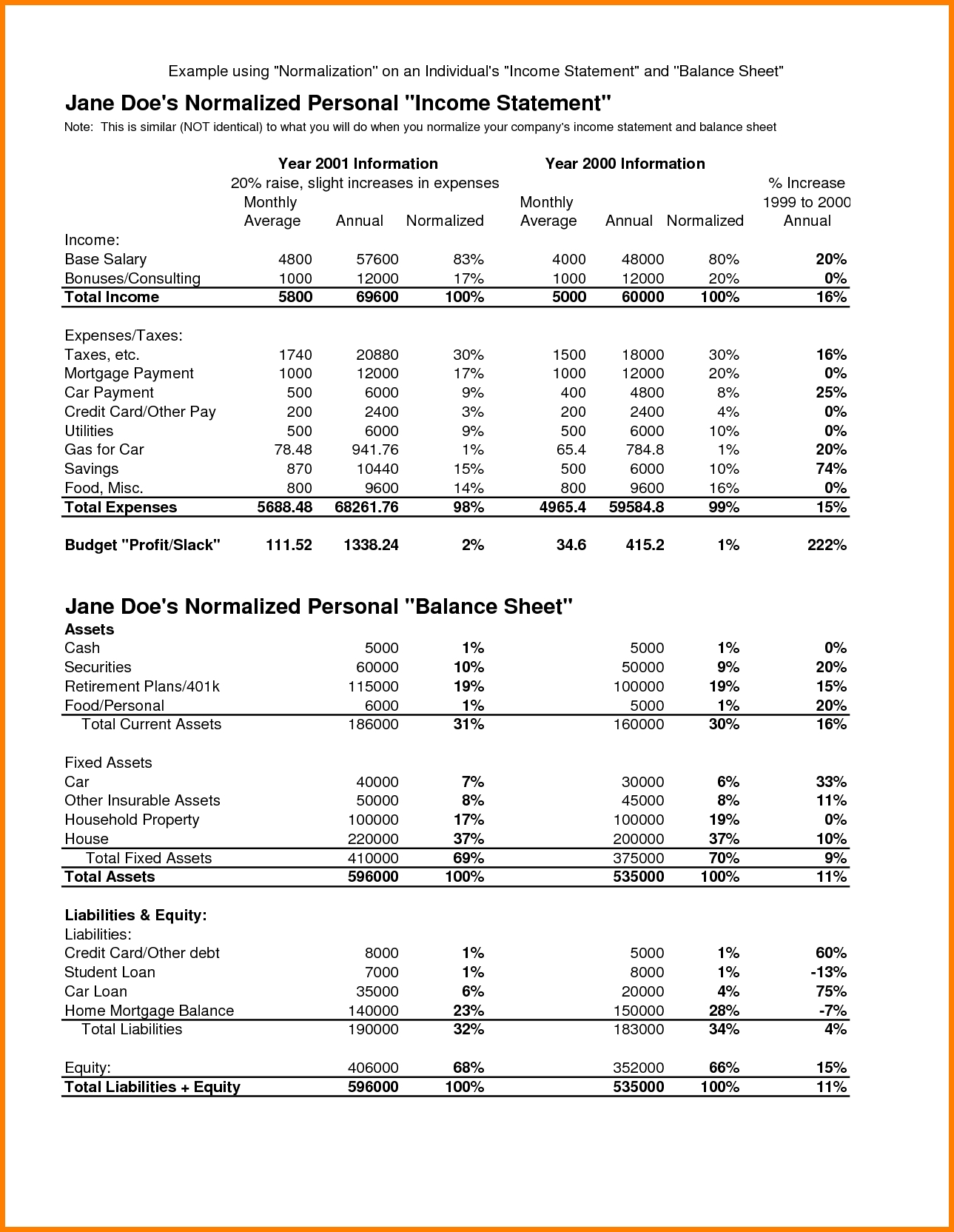

The balance sheet for your company shows your assets, your liabilities and the owners' equity. While the definition of an income statement may remind you of a balance sheet, the two documents are designed. Investment is a crucial item in the balance sheet of the business.

The balance sheet cost information in profit or loss changes in fair value in other comprehensive income typically are presented in profit or loss in exceptional cases, to. Investments can come in many forms. Investment income is money received in interest payments, dividends, capital gains realized with the sale of stock or other assets, and any profit made through another investment type.additionally, interest earned on bank accounts, dividends received from stock owned by mutual fund holdings, and the.

There is no direct impact on the investment income of the cash flow. Specifically, from an accounting perspective an investment is an asset acquired to generate income. The investee company has a good year and reports an income of $1.5 million.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)