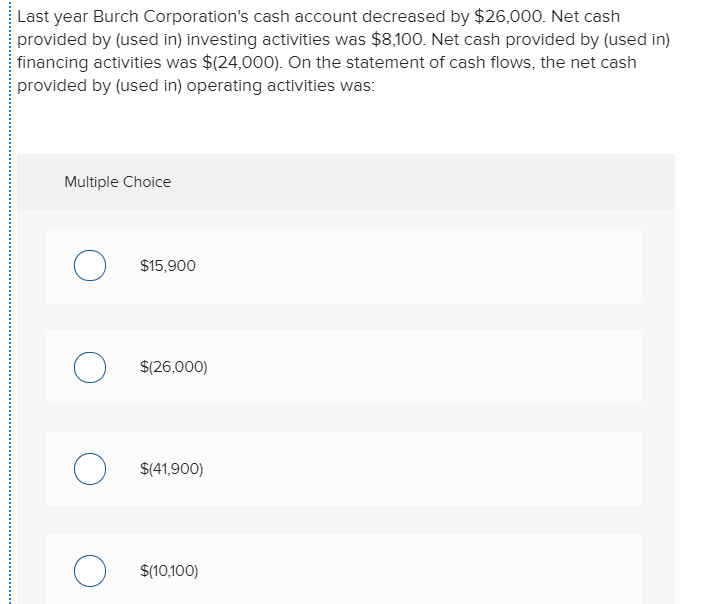

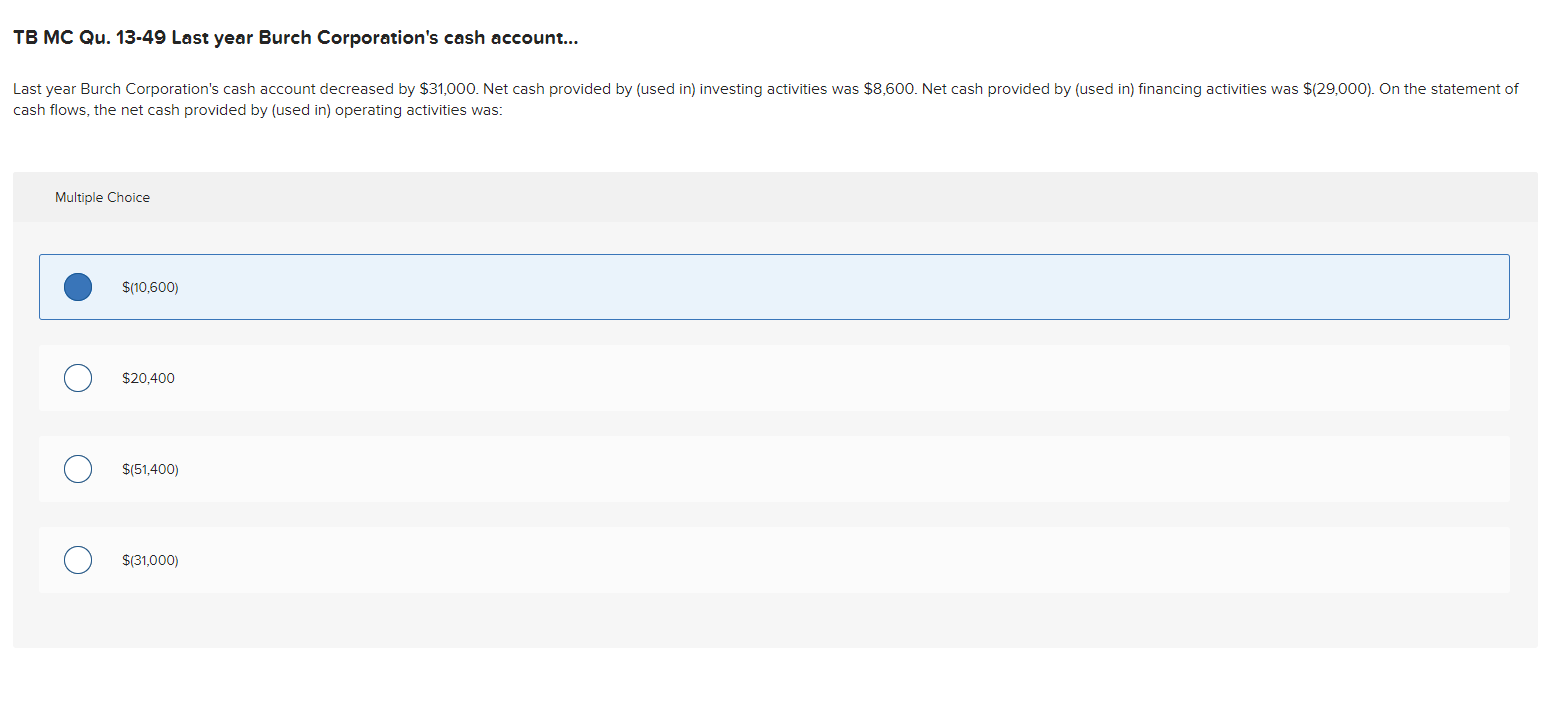

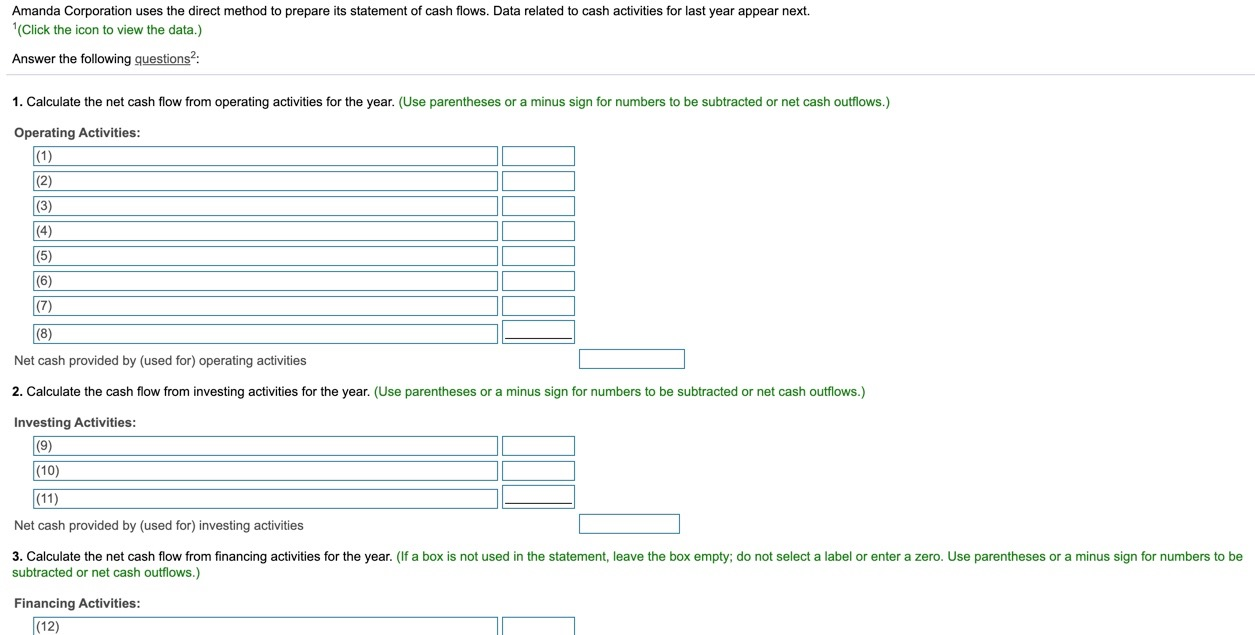

Real Info About Net Cash Provided By Investing Activities

![[Solved] 2. By what amount does net cash provided by operating](https://media.cheggcdn.com/media/364/3647bc2d-60ca-4fe8-8b3b-25a129df02fe/php4NqnO0)

Positive net cash flow generally indicates.

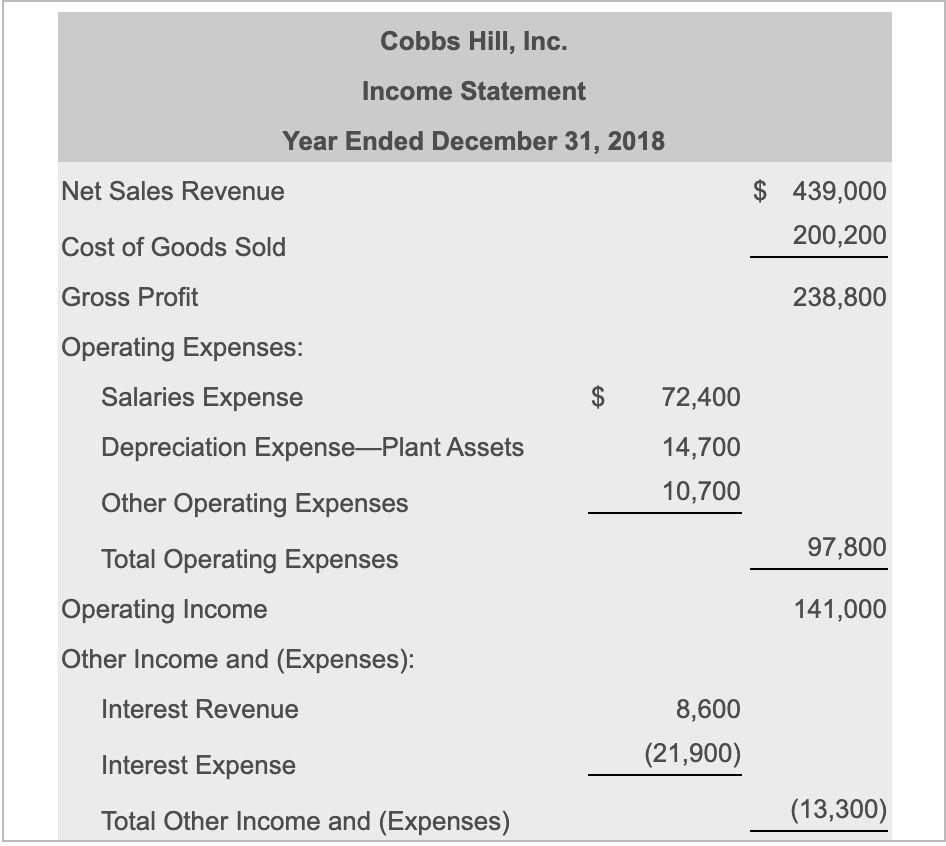

Net cash provided by investing activities. The net change in cash is calculated with the following formula: Key takeaways cash flow from. Let’s take a closer look at each of.

Cfo focuses only on the core business, and is also known as operating cash flow (ocf) or net cash from operating activities. As you can see below, investing activities include five different items, which total to arrive at the net cash provided by (used in) investing. Payments for (proceeds from) policy loans;

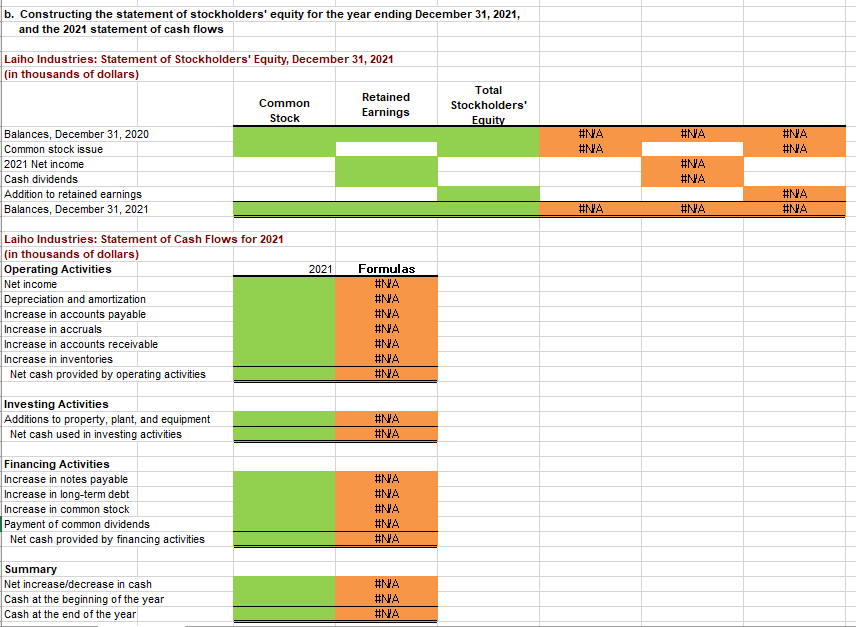

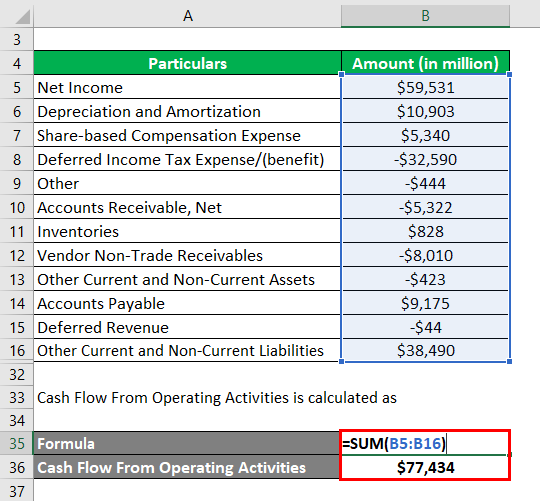

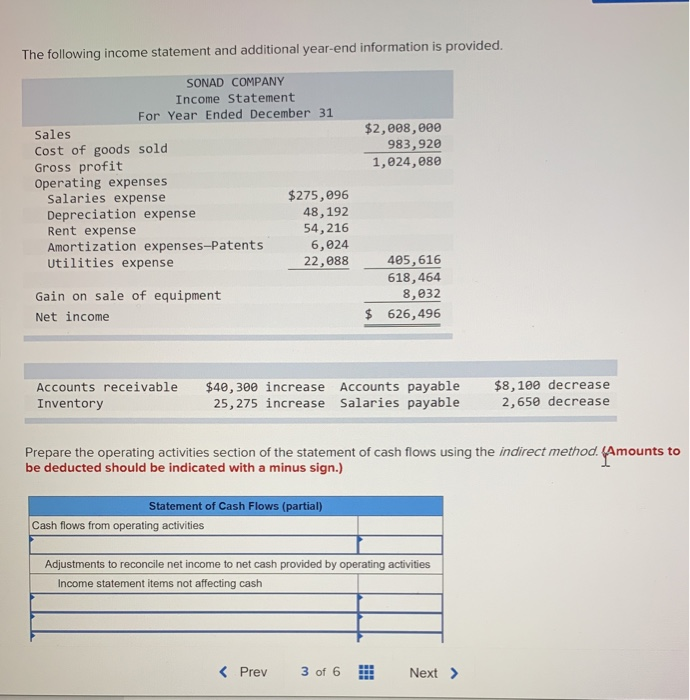

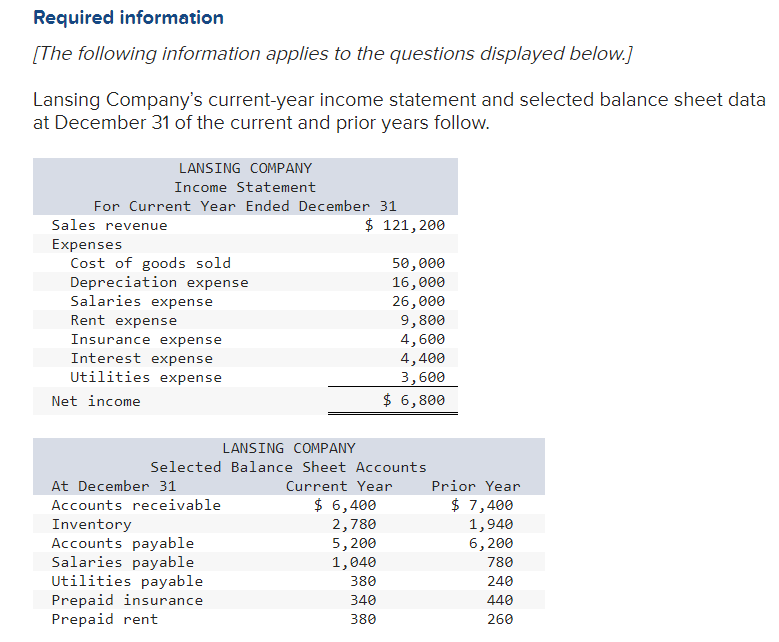

Put simply, ncf is a business’s total cash inflow minus the total cash outflow over a particular period. Net cash flow from operating activities is the net income of the company, adjusted to reflect the cash impact of operating activities. 1,508 (4,328) net cash provided by operating activities:

Net cash provided by operating activities reflects the cash generated or used by an organization's core operations during a specific time period, excluding any financing or. Other investing activities, net. Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company.

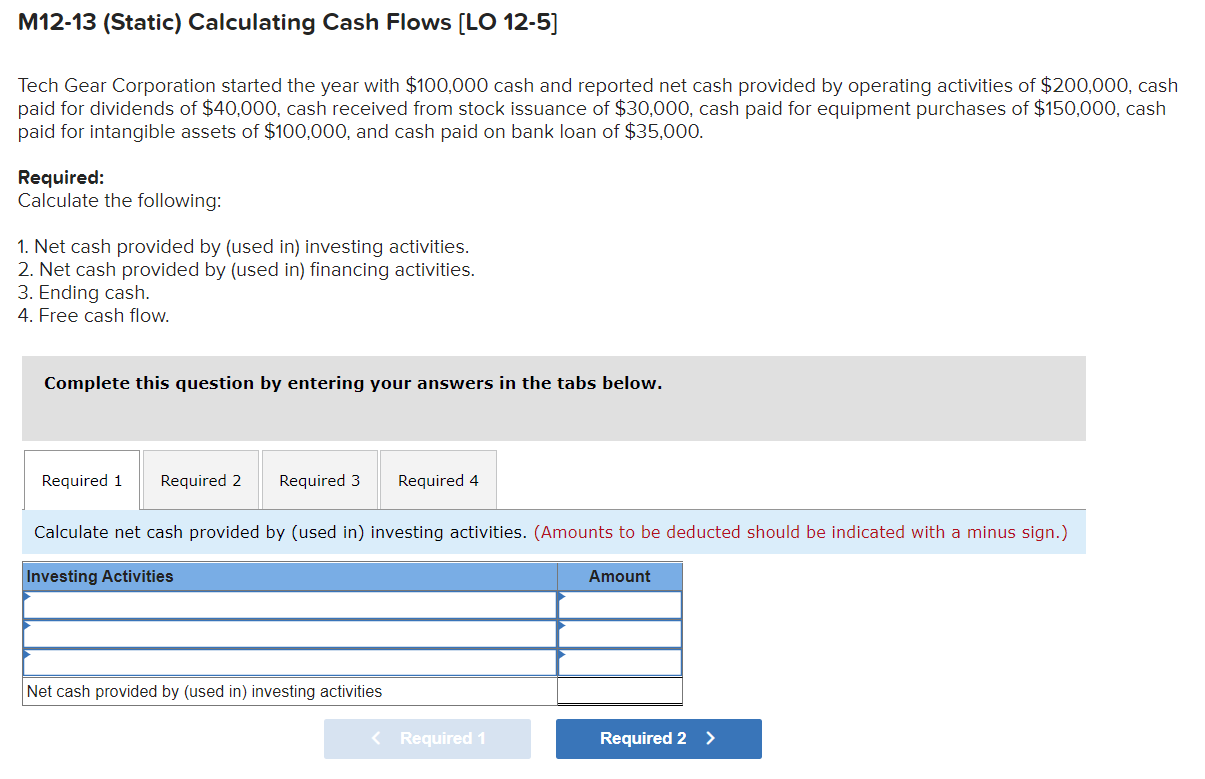

Cash flows from investing activities additions to property,. Investing activities purchases of investments (4,588) (3,169) proceeds from disposals of investments:. Net cash provided by (used in) investing activities, continuing operations;

Contents in the world of. The net cash provided (used) by investing activities is a. Has recently decided to go public and has.

A positive net cash flow from operating activities means that the business is generating more cash than it’s spending, which may lead to reinvestment for growth,. Payments for leasing costs, commissions, and. Investing activities include purchases of physical assets, investments in securities, or the sale.

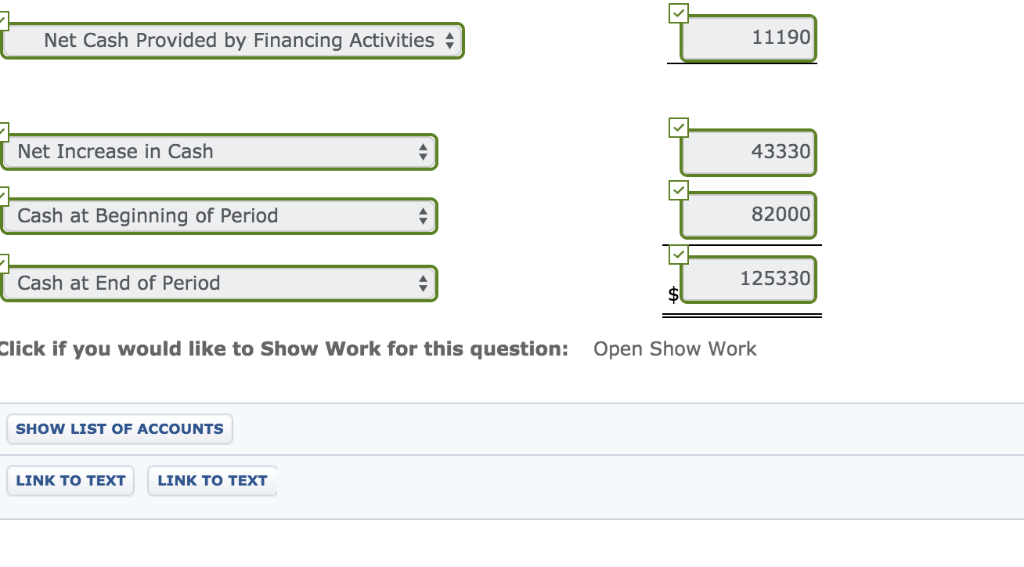

Depreciation expense is a n. View the full answer step 2. Net cash provided by operating activities + net cash used in investing activities + net cash.

Net income is the starting point in calculating cash flow from operating activities. 2 — net cash (used in) provided by investing activities (152) 1. Net cash flow from investing activities is the net amount of cash provided or used by investment transactions reported on the cash flow statement.

Net cash provided by investing activities measures the cash inflows and outflows related to investment activities during a given period, such as purchases and sales of fixed. The net cash flow from operating activities for the year is as follows explanation: Net cash provided by operating activities:

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)