Nice Tips About Free Cash Flow Indirect Method

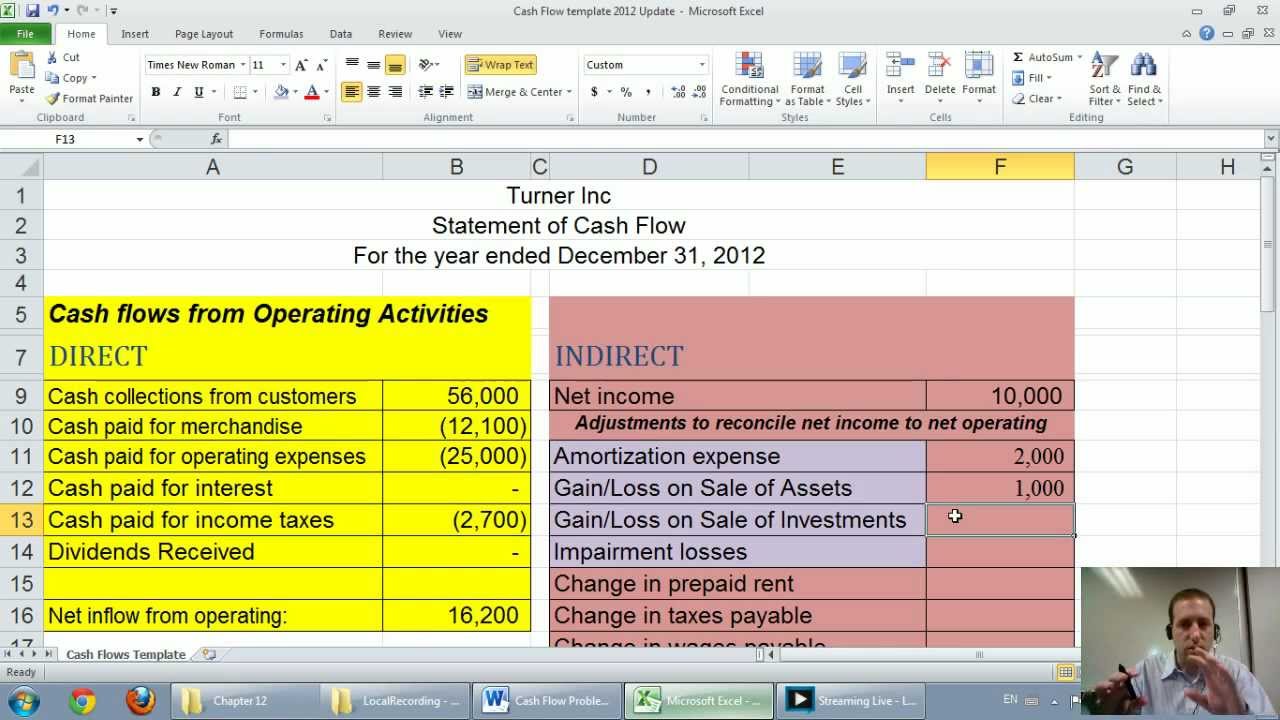

We will use a free excel template so you can interact with the process and apply it to other examples in your work.

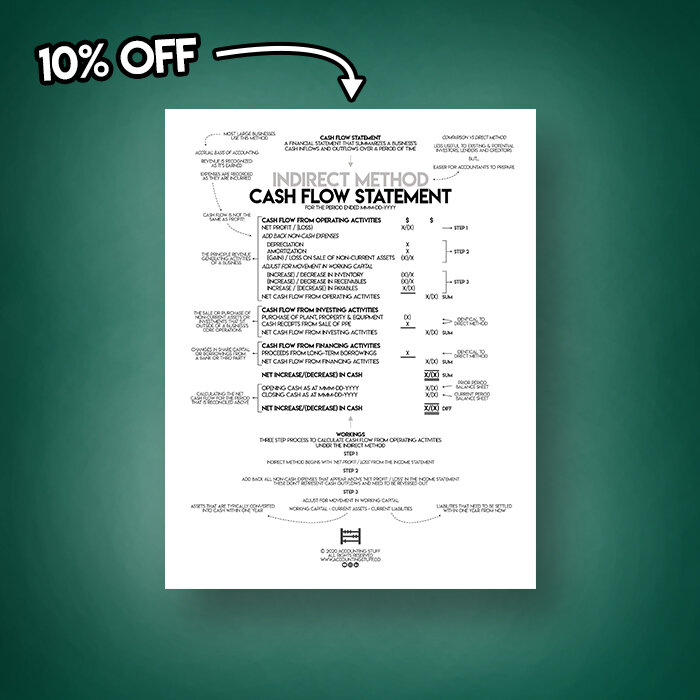

Free cash flow indirect method. Free cash flow can be easily derived from the statement of cash flows by taking operating cash flow and deducting capital expenditures. The indirect method uses increases and decreases in balance sheet line items to modify the. What is the cash flow statement indirect method?

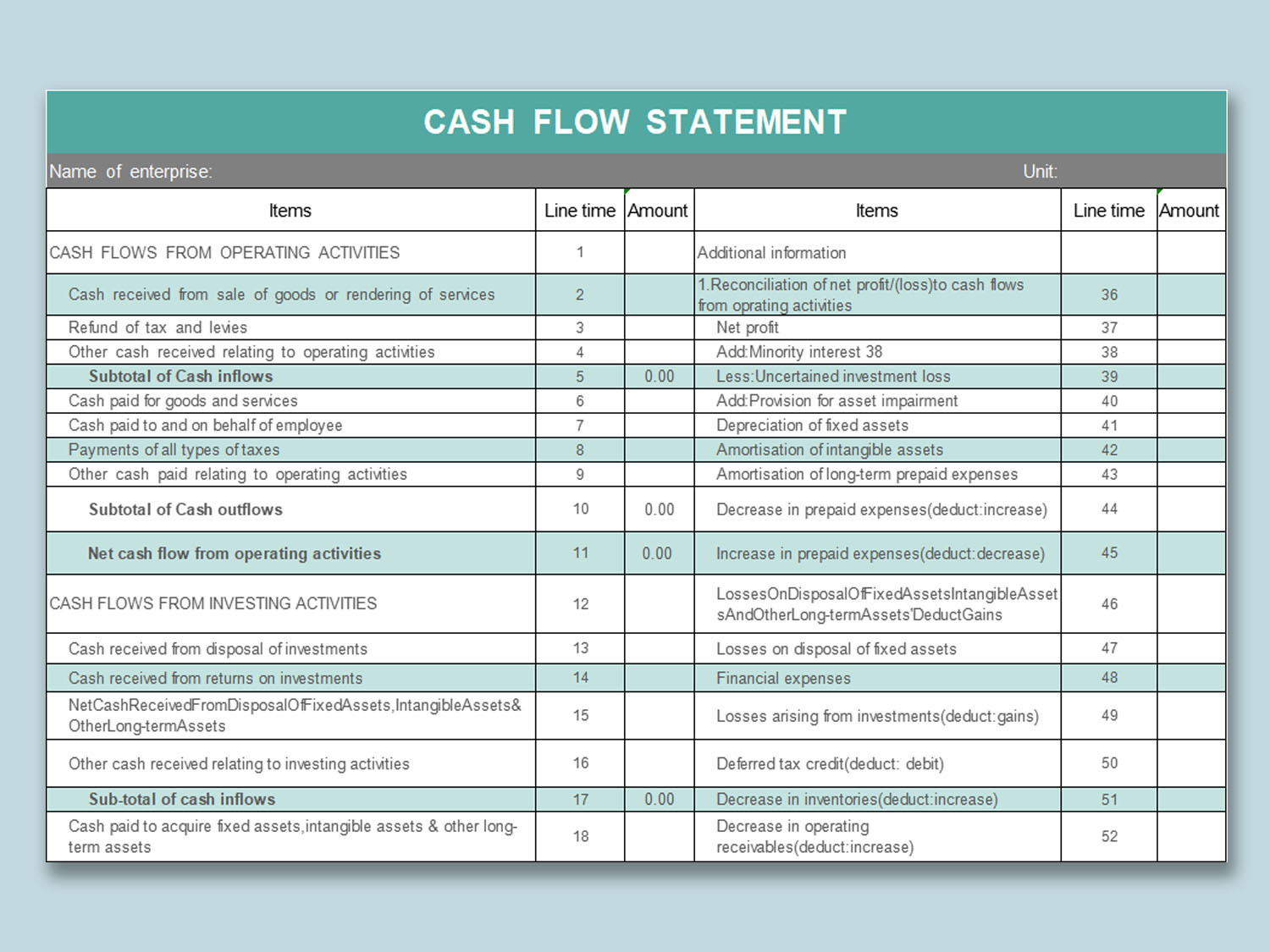

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Additionally, we will explore some basic concepts about. Presented below is the balance sheet and income statement for watson ltd.

Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash flows. It is used both by companies for quick calculations and by investors who want to get an idea of the financial situation of a company. Discover the benefits, key components, and calculation process of the indirect method.

Free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. Begin with net income from the income statement. Management and investors use free cash flow as a measure of a company's.

The indirect method is one of two accounting treatments used to generate a cash flow statement. The indirect method, as the name implies, looks at cash flow indirectly. Prepare the statement of cash flows using the indirect method.

The indirect method reconciles net income to cash flows from operating activities, providing valuable insights into how profit translates into actual cash flow. After that, the three steps demonstrated previously are followed although the mechanical process here is different. Net income | $76,800 adjustments to reconcile net income to net cash provided by operating activities:

(maybe you don’t have to imagine.) Free cash flow for the firm (fcff) is a measure of financial performance that expresses the net amount of cash that is generated for a firm after expenses. Fcf gets its name from the fact that it’s the amount of cash flow “free” (available) for discretionary spending by management/shareholders.

Get your free indirect cash flow statement template. The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions. It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow.

Using the balance sheet changes, the indirect method modifies the operating section of the cash flow statement. What is the statement of cash flows indirect method? The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities.

In this method, you begin with the net income and adjust it to calculate the company’s operating cash flow. The indirect method actually follows the same set of procedures as the direct method except that it begins with net income rather than the business’s entire income statement. The direct method lists all cash receipts and payments to calculate net cash from operating activities.