Outstanding Tips About As 3 Cash Flow Statement Format

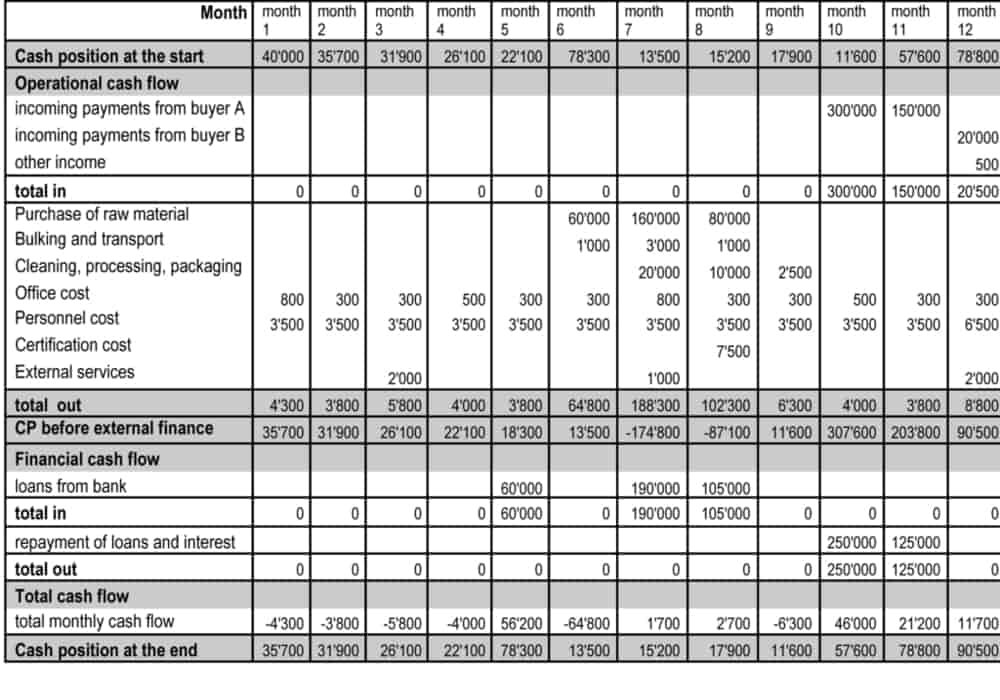

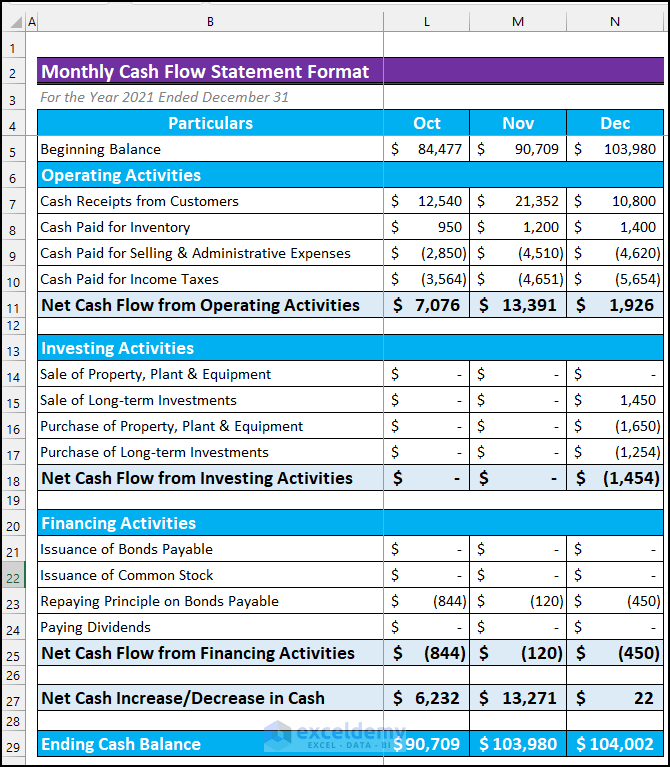

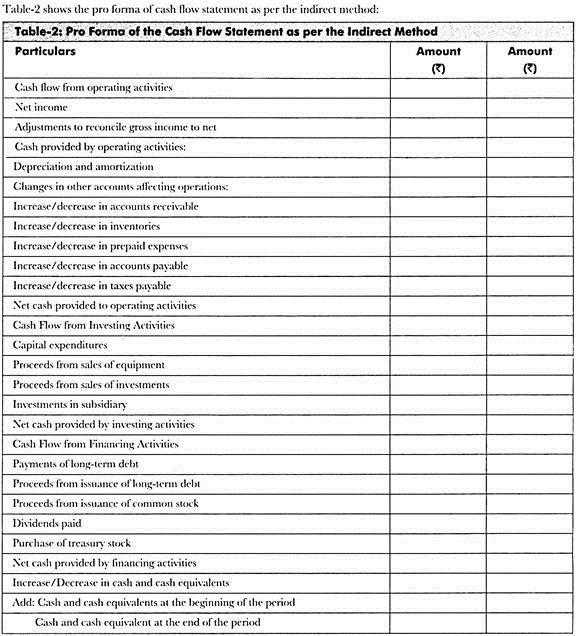

The following are the different formats of the cash flow statement used by small, medium, and large businesses alike.

As 3 cash flow statement format. The standard deals with the provision of information about the historical changes in cash and cash equivalents of an enterprise by means of a cash flow statement which classifies cash flows during the period from operating, investing and financing activities. Accounting standard 3 deals with cash flow statement. How to create a cash flow statement 1.

Ebita margin 15.7%earnings per share before amortisation eur 3.38free cash flow. Add all the annual cash inflow from operating, investing, and financing activities. This accounting standard should b e

The cfs measures how well a. Record adjusted ebitda margin fourth. How to prepare cash flow statement?

An enterprise should prepare a cash flow statement and should present it for each period for which financial statements are presented. The cash flow statements or accounting standard 3 (as 3) provides additional information for the reader. A statement like this evaluates the ability of the company to generate cash and to utilise that cash.

Income from operations of $652 million; In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under. Cash management consists of the investment of excess cash in the cash.

An enterprise should prepare a cash flow statement and should present it for each period for which financial statements are presented. Cash and cash equivalents of an enterprise by means of a cash flow statement which classifies cash flows during the period from operating, investing and financing activities. A cash flow statement, when used in conjunction with the other financial statements, provides information that enables users to evaluate the changes in net assets of an enterprise, its financial structure (including its liquidity and solvency) and its ability to affect the amounts and timing of cash flows in order to adapt to

As 3 cash flow statements states that cash flows should exclude the movements between items which forms part of cash or cash equivalents as these are part of an enterprise’s cash management rather than its operating, financing and investing activities. As 3, accounting standard 3: The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Cash flow statements 53 accounting standard (as) 3 cash flow statements (this accounting standard includes paragraphs set in bold italic type and plain type, which have equal authority. Utrecht, 22 february 2024 highlights revenue eur 3,324 million; Meaning of cash flow statement:

Although the presentation of operating cash flows differs between the two methods,. It is a summary of receipts and payment of cash for a particular period of time. Like all financial statements, the statement of cash flows has a heading that display’s the company name, title of the statement and the time period of the report.

Write the opening balance of cash and bank for the year. Deduct all outbound cash flows via operating, investing, and financing activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)