Breathtaking Info About Adjusted Trial Balance Closing Entries

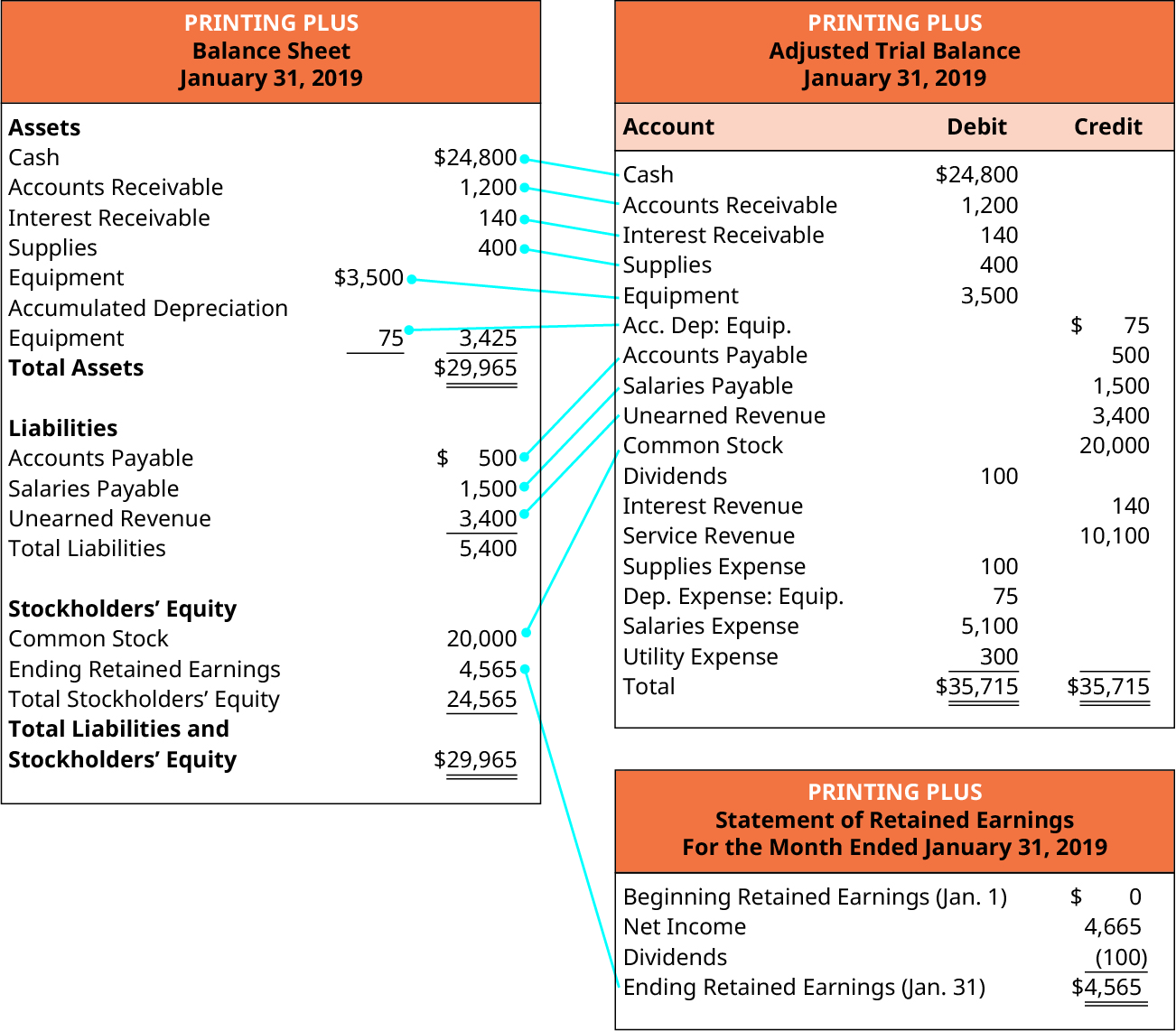

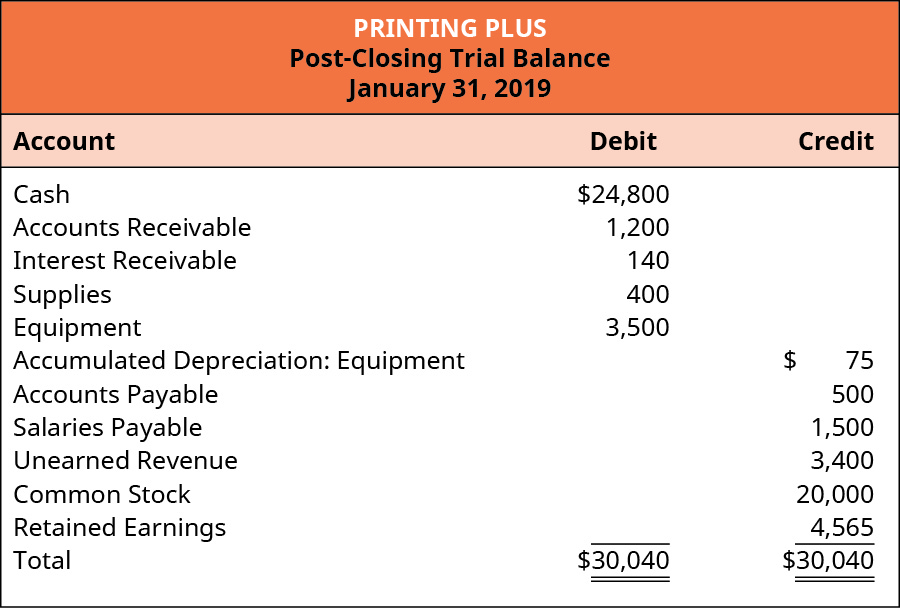

Let’s explore each entry in more detail using printing plus’s information from analyzing and recording transactions and the adjustment process as our example.

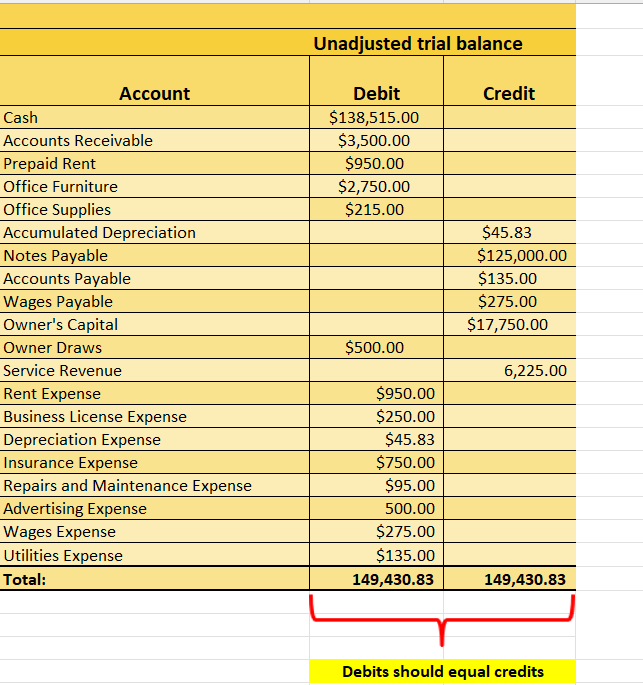

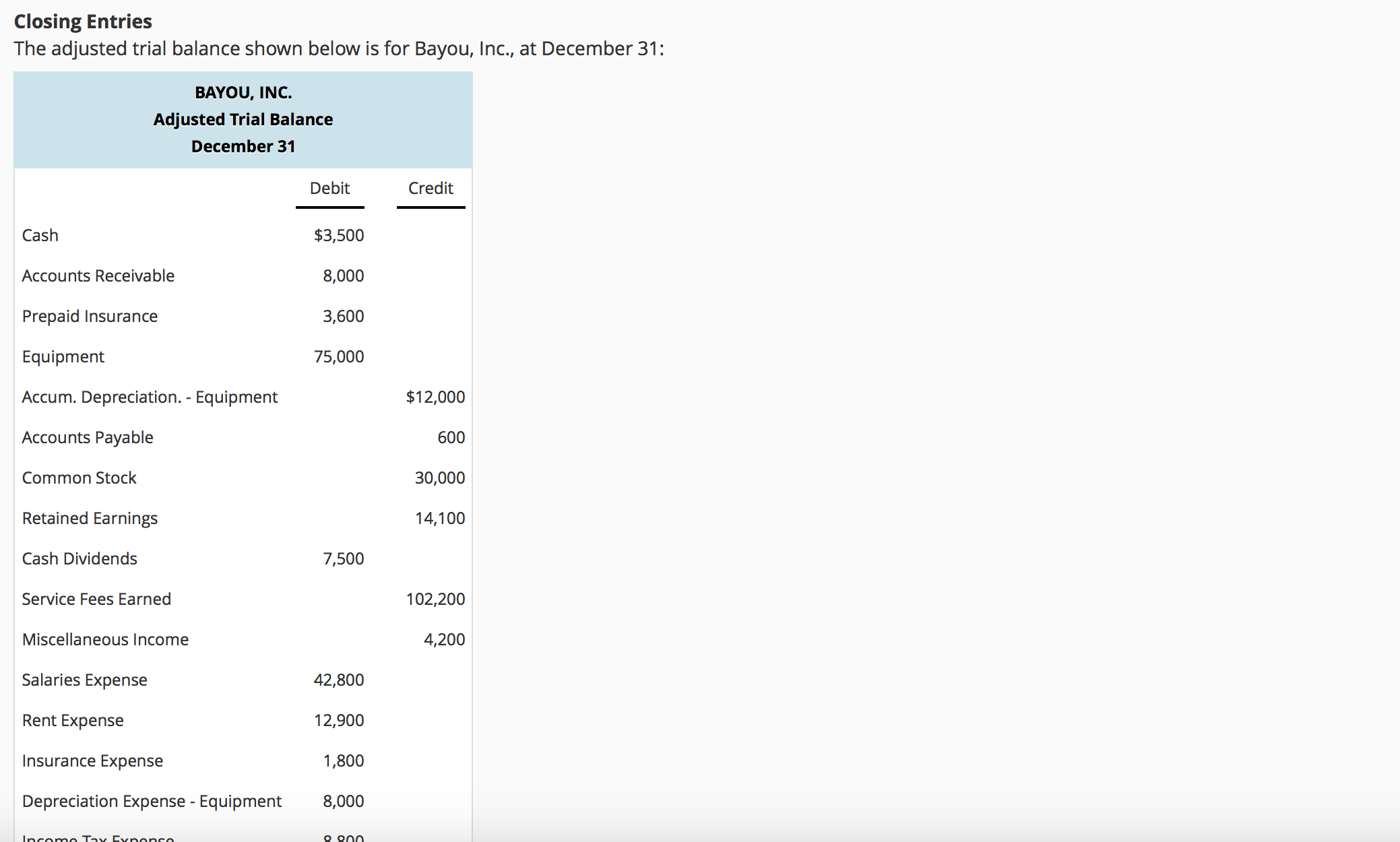

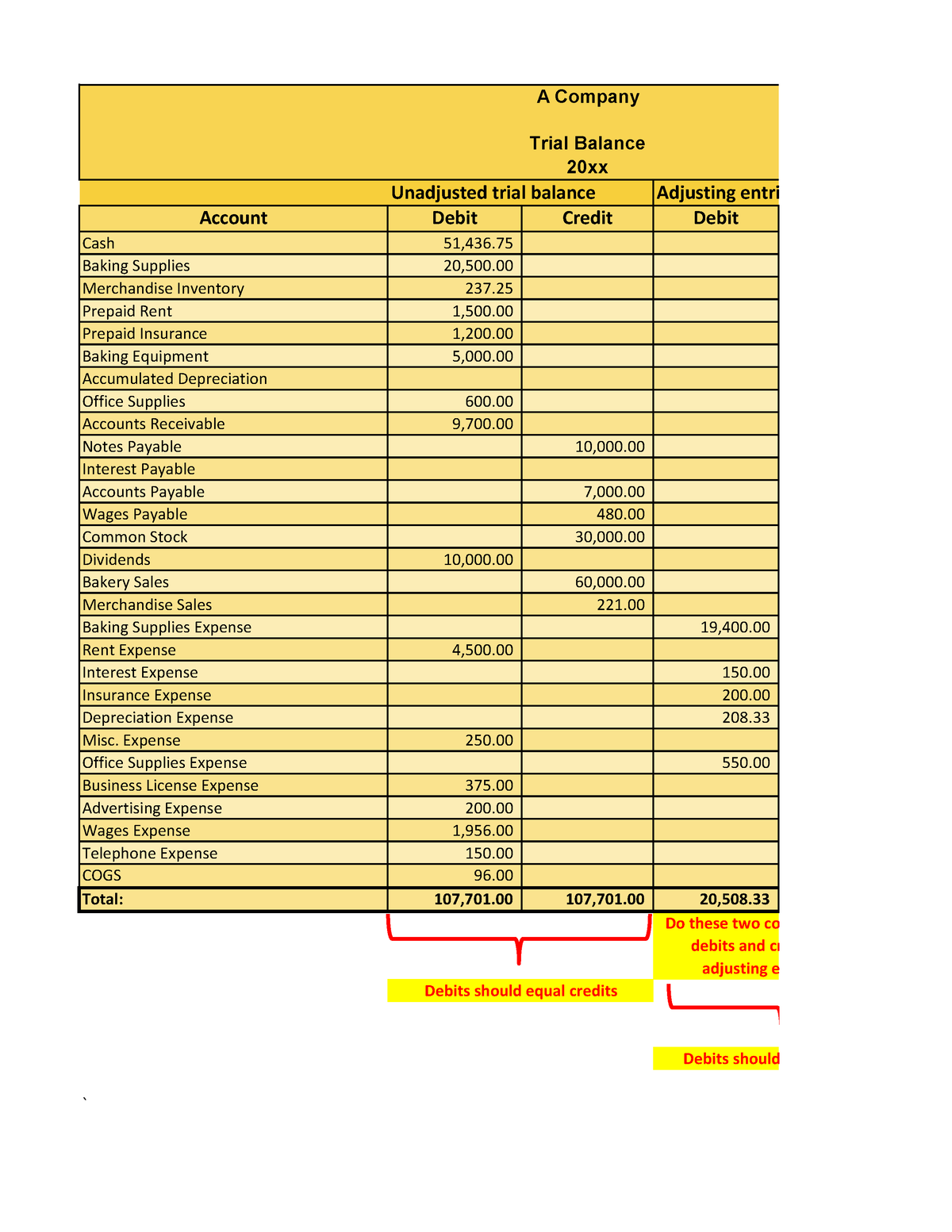

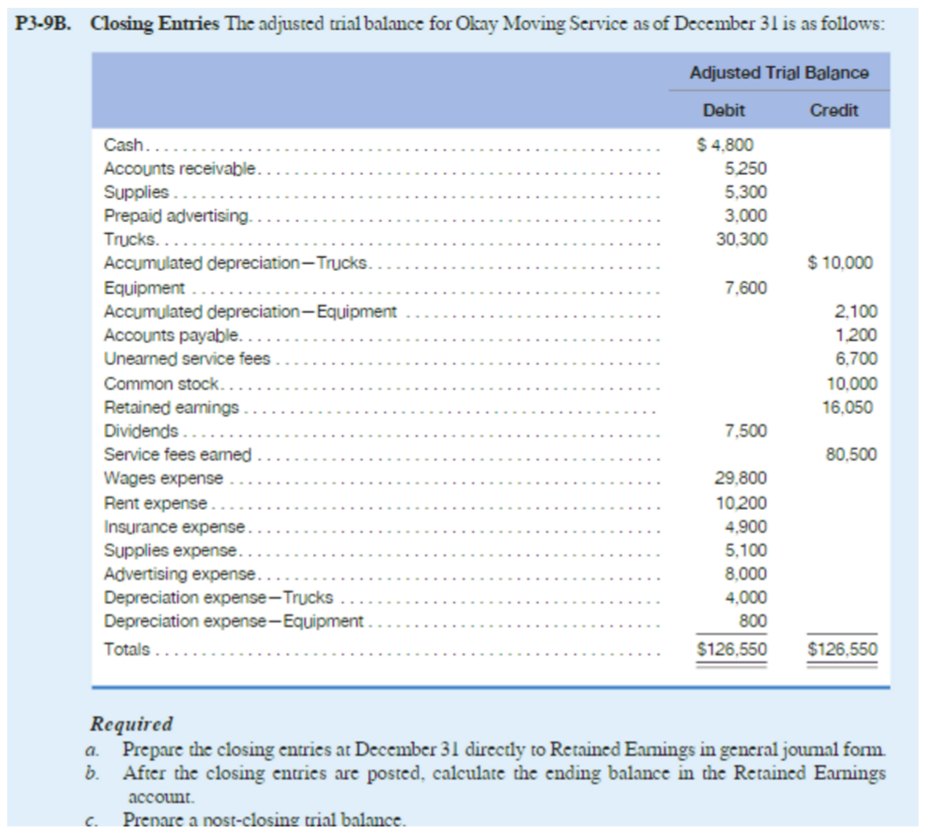

Adjusted trial balance closing entries. Closing entries are journal entries made at the end of an accounting period which transfer the balances of temporary accounts to permanent accounts. Consult your procedure for closing the books, and create adjusting entries based on that procedure. In this section, we are going to revisit neatniks’ october unadjusted trial balance.

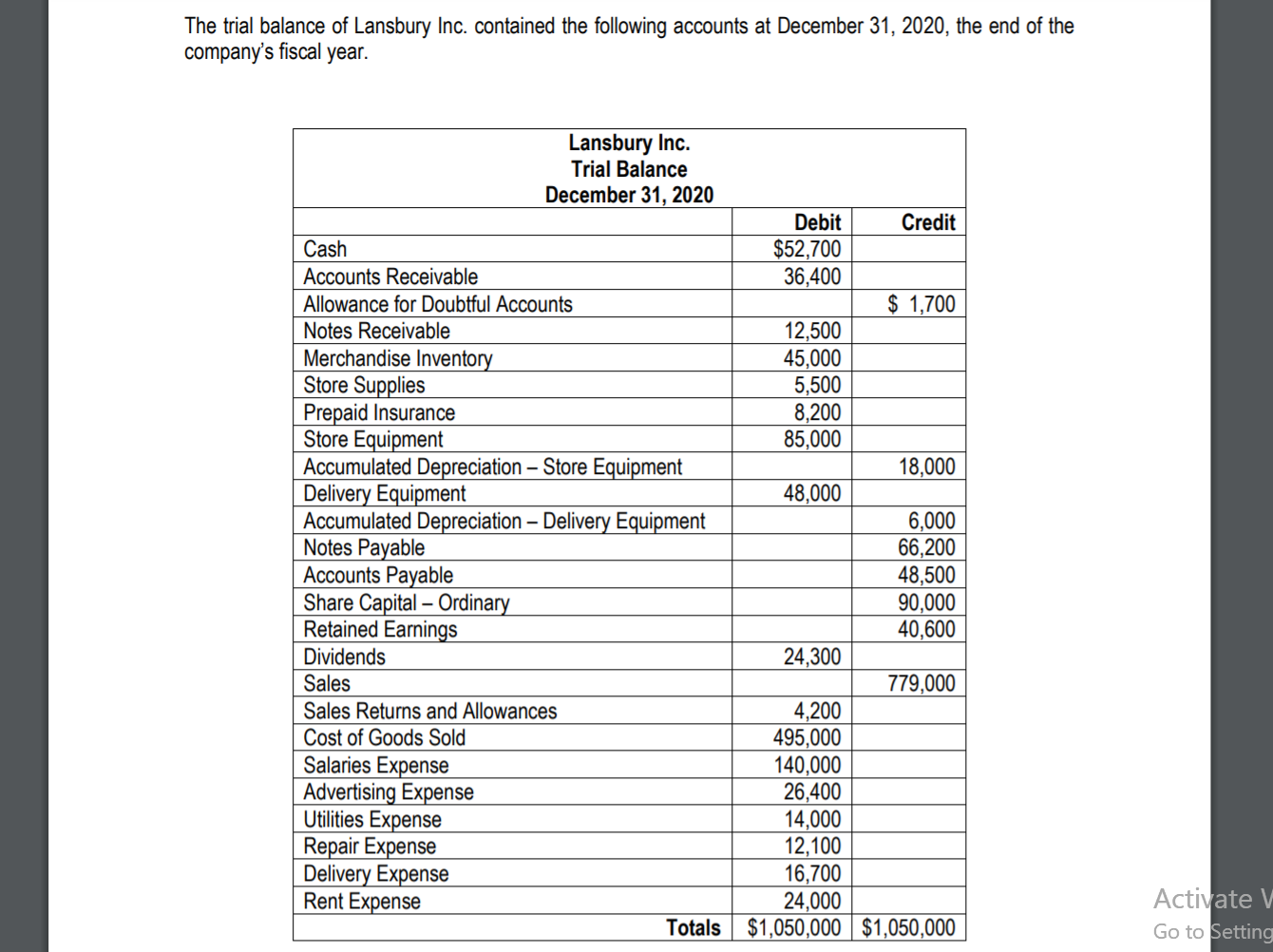

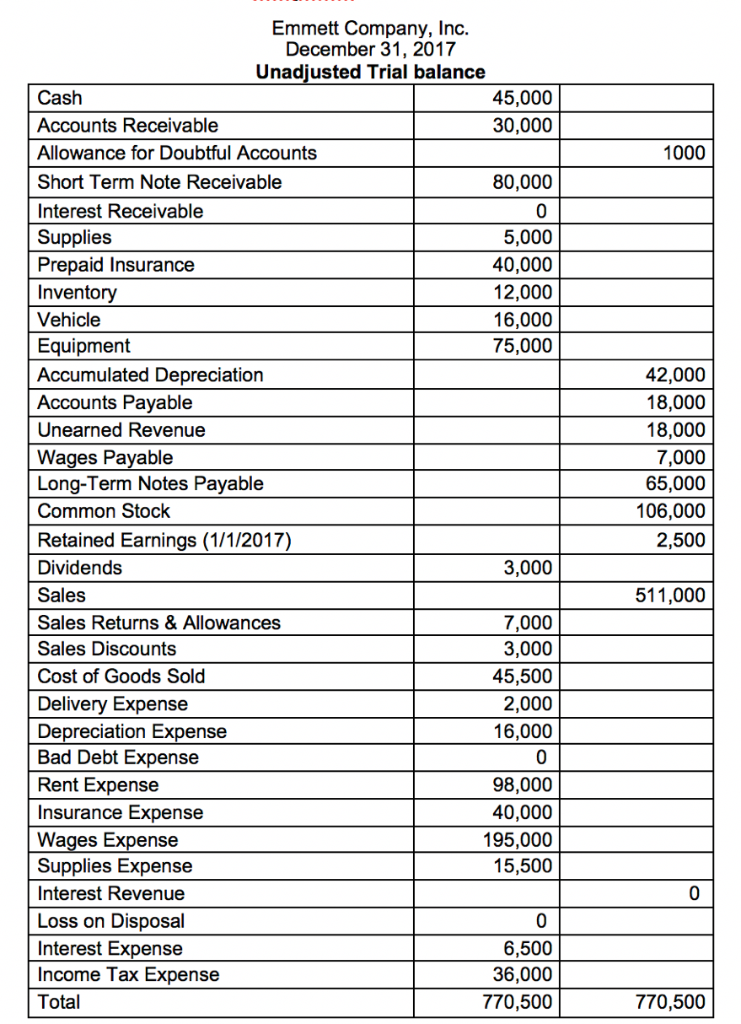

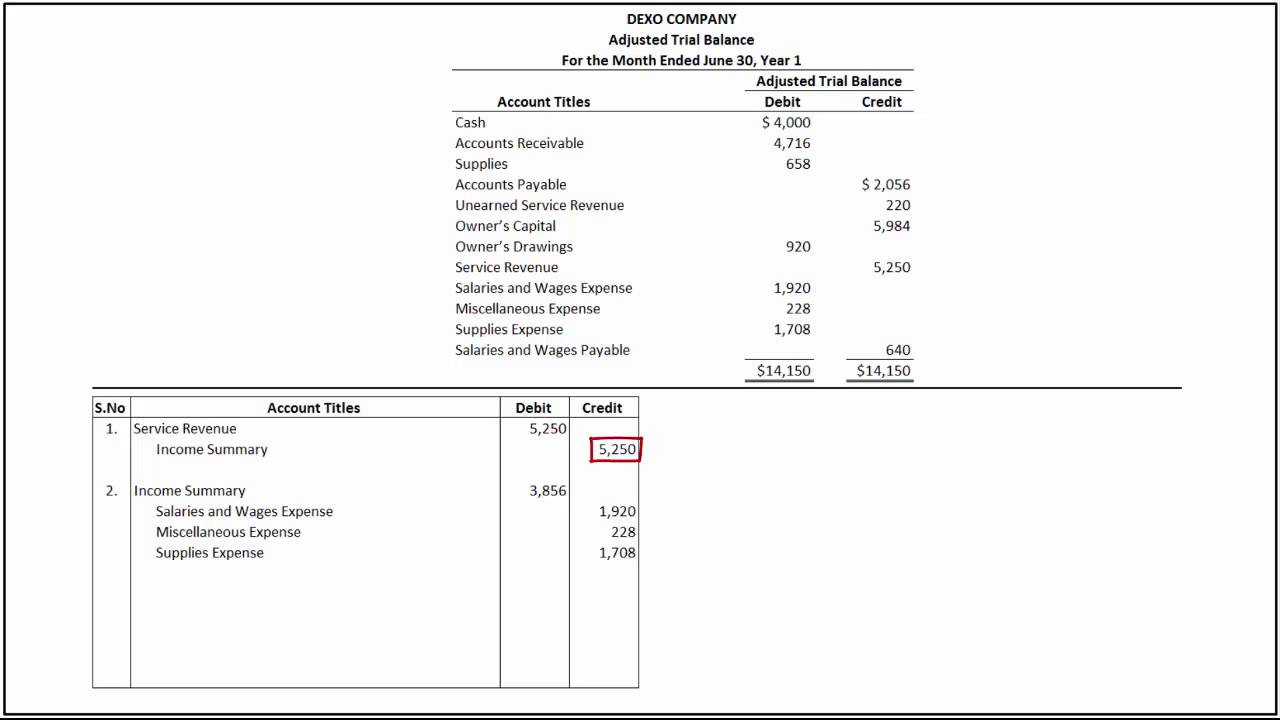

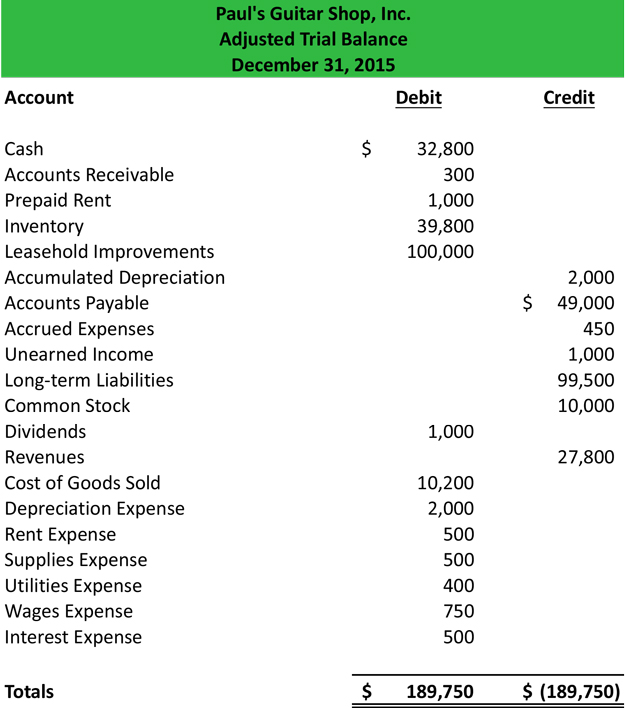

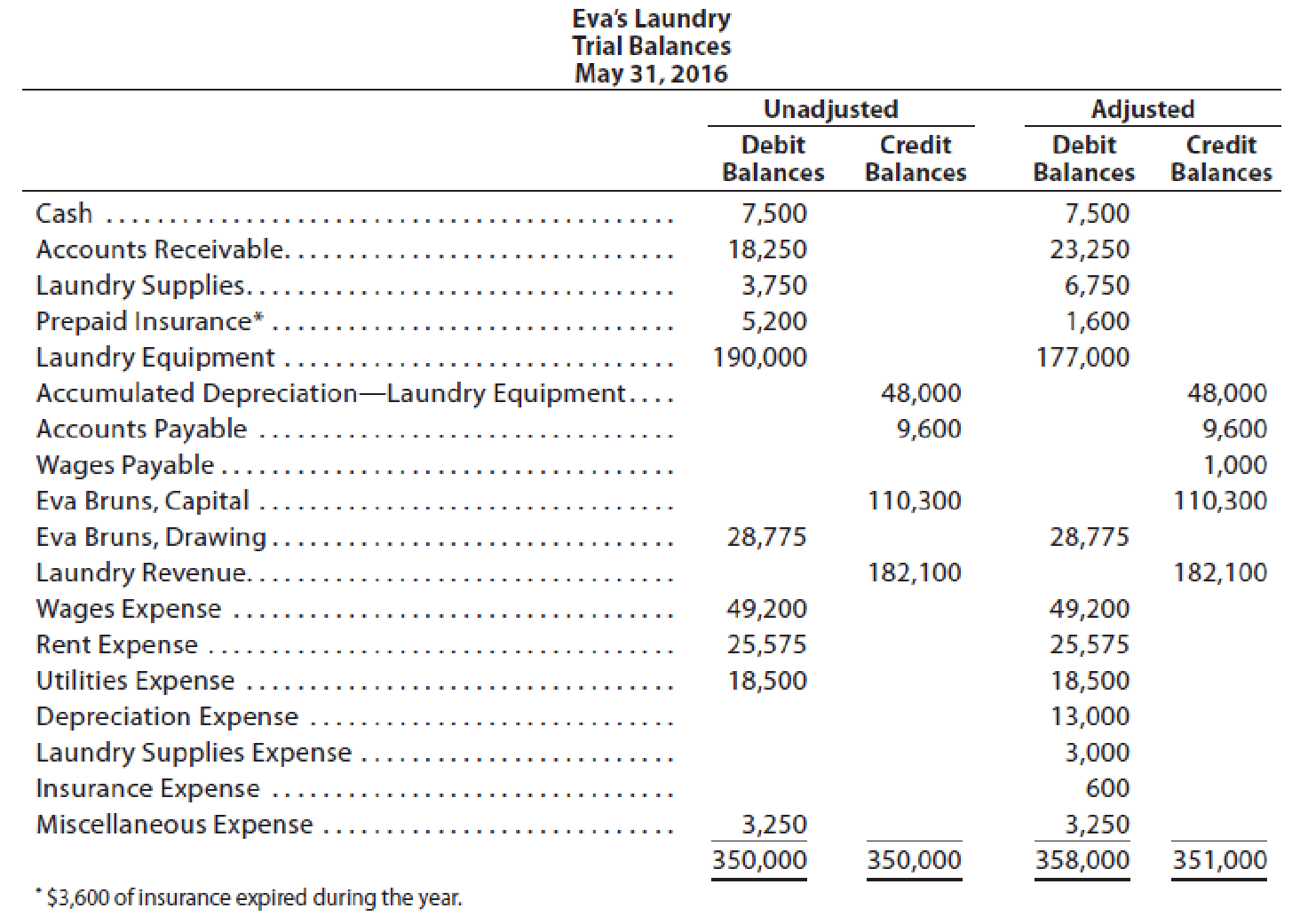

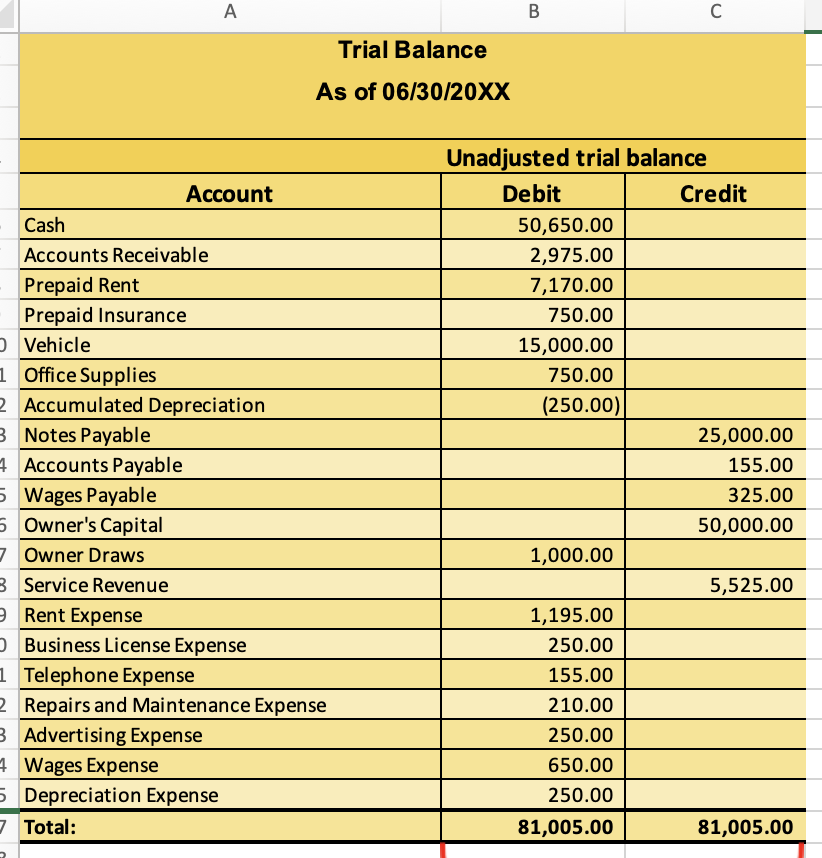

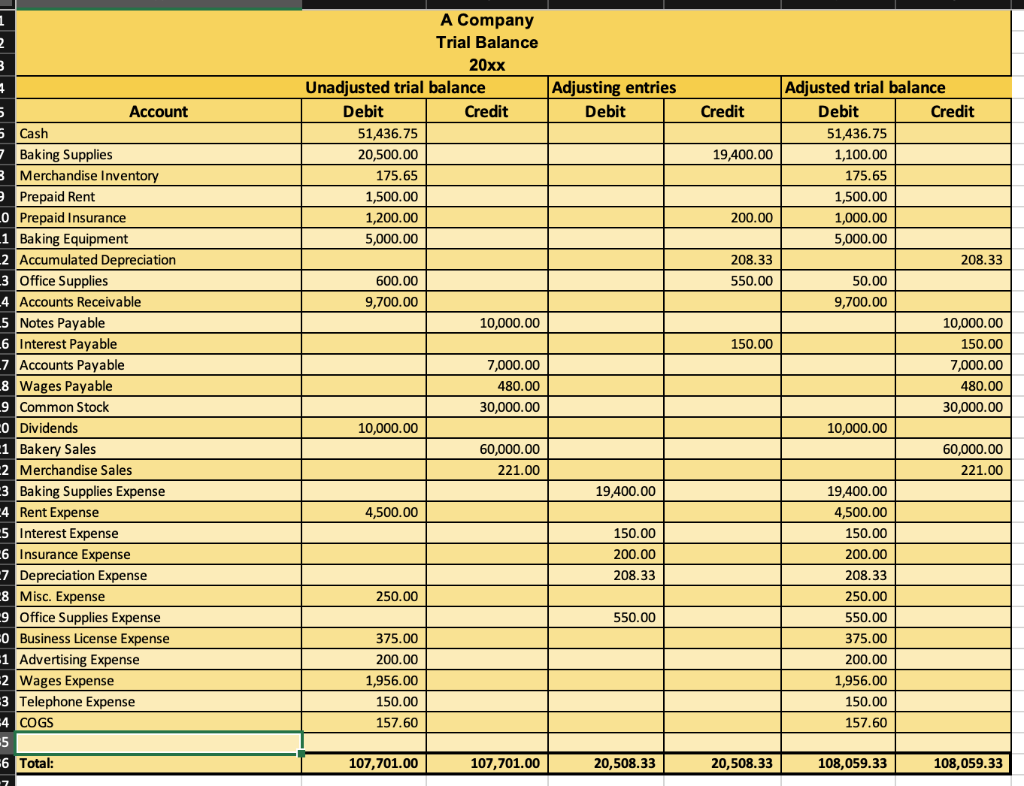

Adjusted trial balance. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances. Closing entries are completed at the end of each accounting period after your adjusted trial balance has been run.

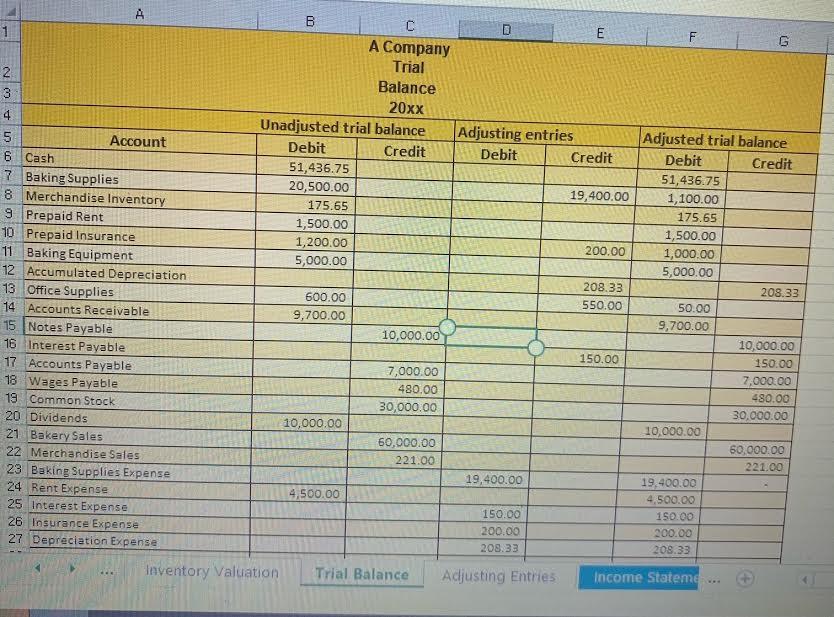

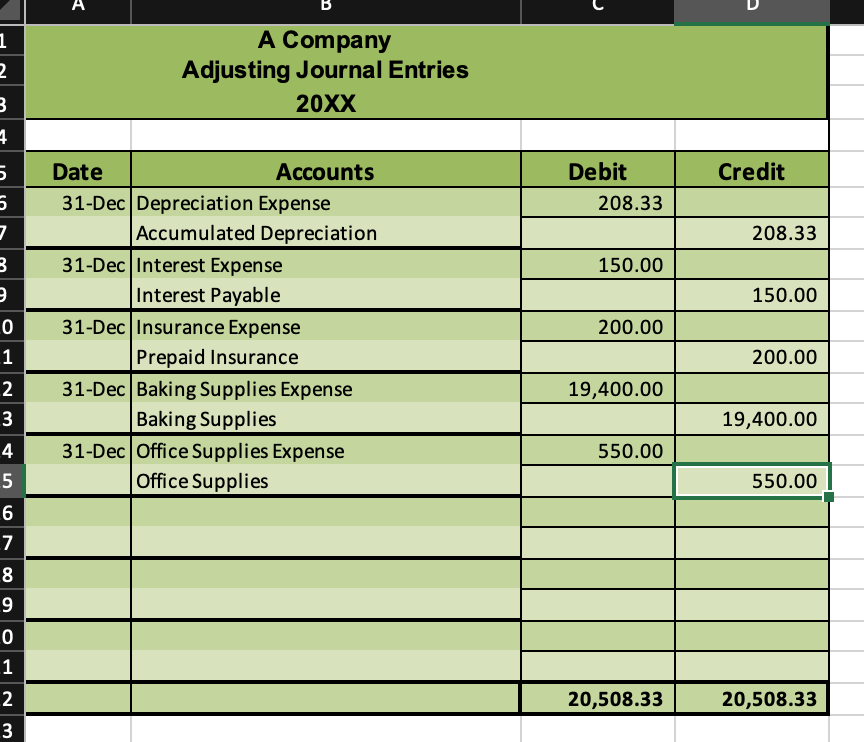

An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger. This trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first five steps in the cycle. The information needed to prepare closing entries comes from the adjusted trial balance.

We will take the following steps: In this lesson, we will discuss what an adjusted trial balance is and illustrate how it works. Jenis berikutnya ada neraca perubahan yang disesuaikan, di mana ini digunakan untuk memberitahu saldo yang dibuat setelah disesuaikan pada setiap akun debit dan akun kredit.

These account balances roll over into the next period. An adjusted trial balance is an internal document that financial professionals use to record each transaction with any possible adjusted entries within general ledger accounts. This, in turn, gives businesses a clear picture of where they stand.

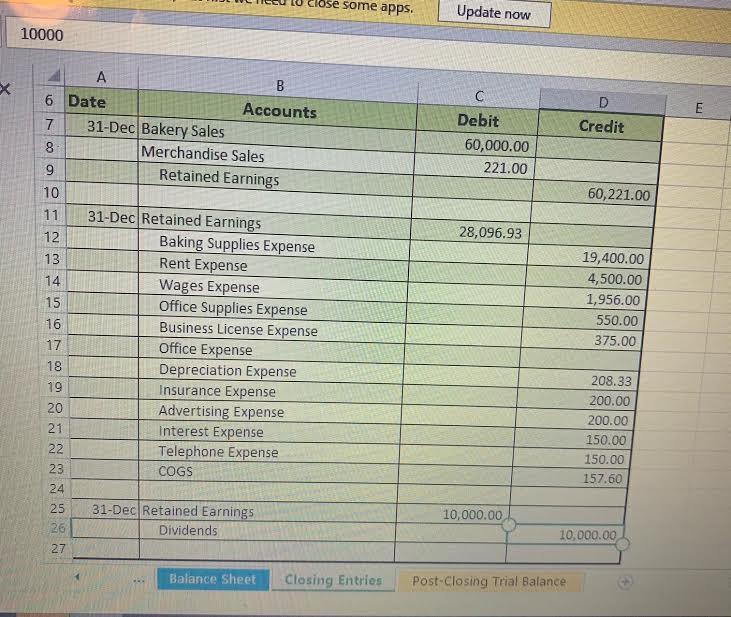

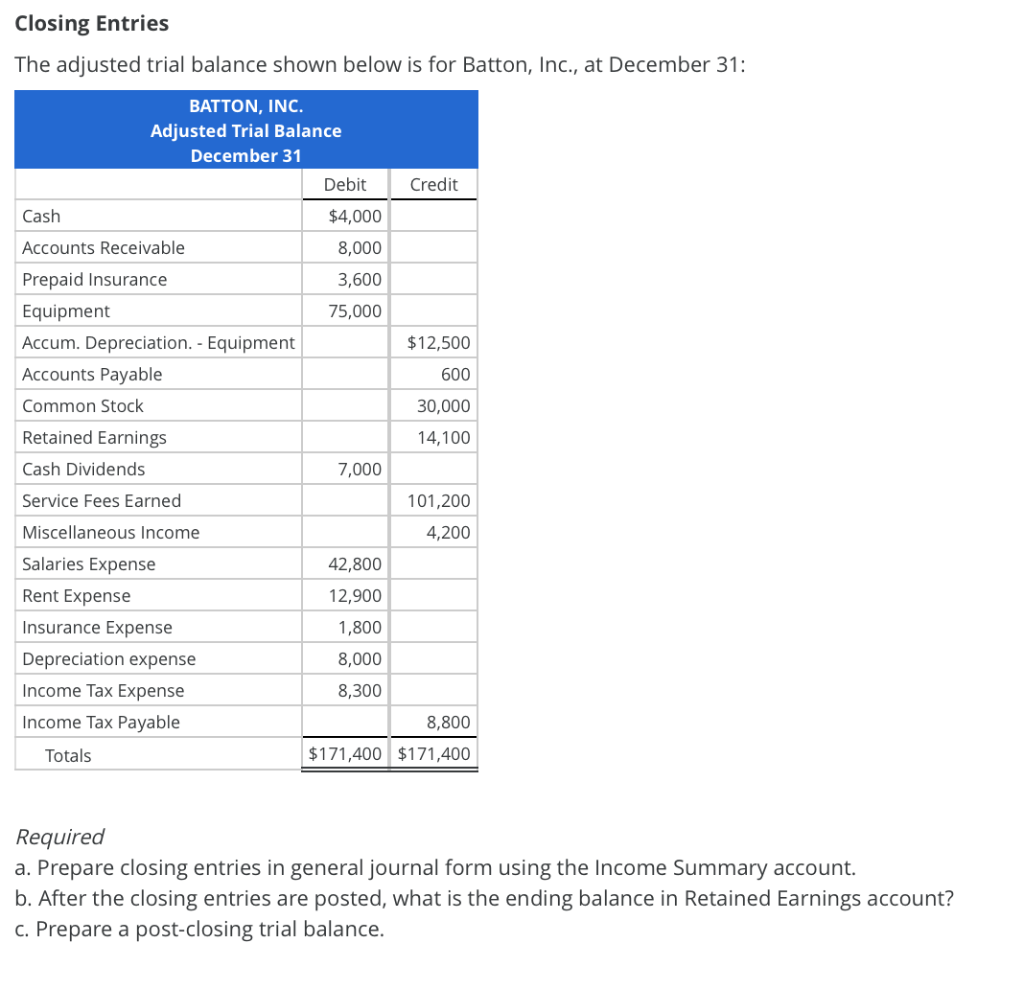

Adjusted trial balance and closing entries professor bossard 1.21k subscribers subscribe save 1.1k views 1 year ago the accounting cycle an adjusted trial balance is a trial. Its purpose is to test the equality between debits and credits after the recording phase. Closing entries are based on the account balances in an adjusted trial balance.

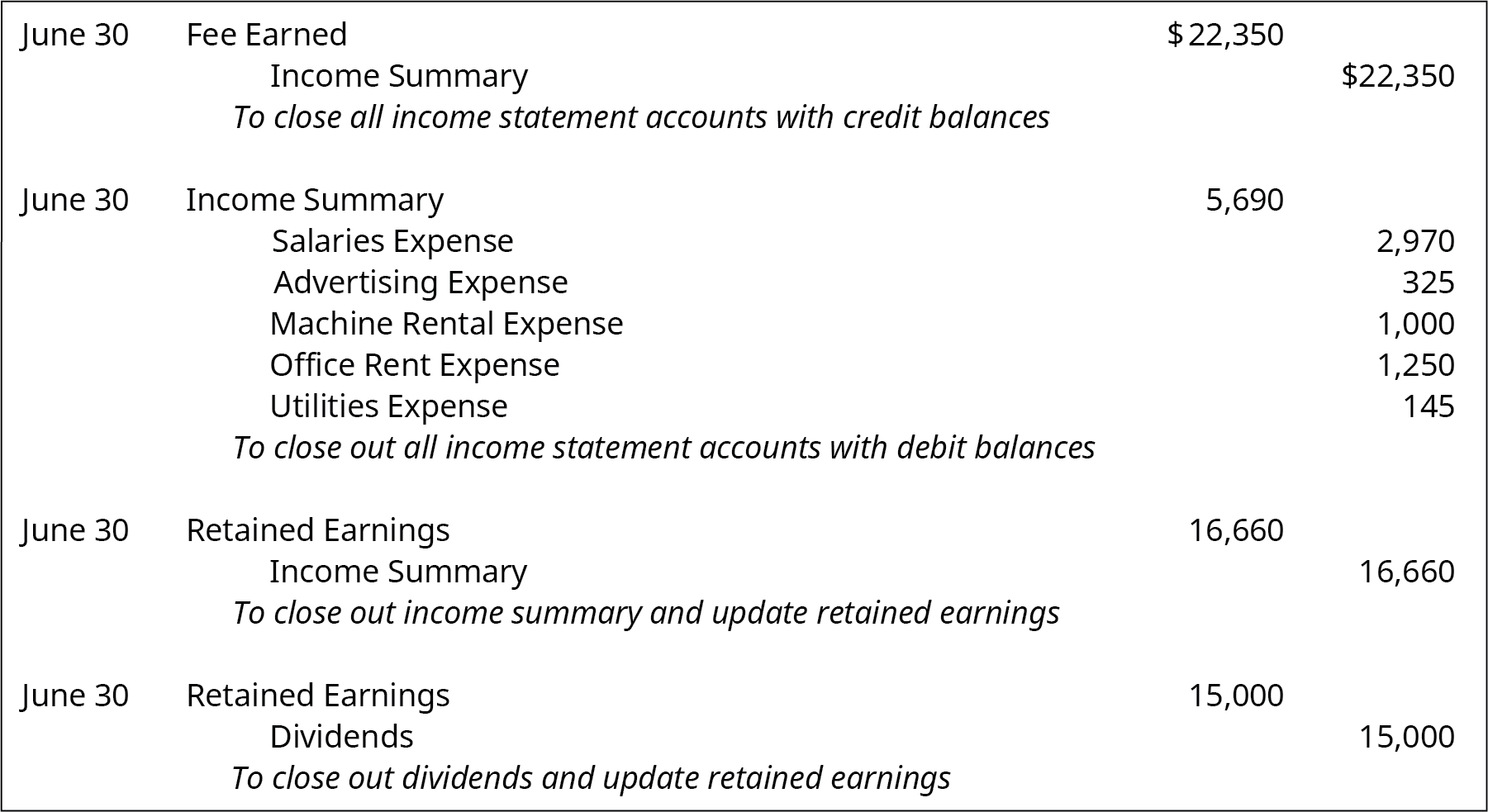

Transferring the credit balances in the revenue accounts to a clearing account called income summary. Accounts are two different groups: Review the schedule of accounts receivable (ar) and payable (ap) in the april reports tab, ensuring totals match the balance for ar and ap in the adjusted trial balance and the balance sheet.

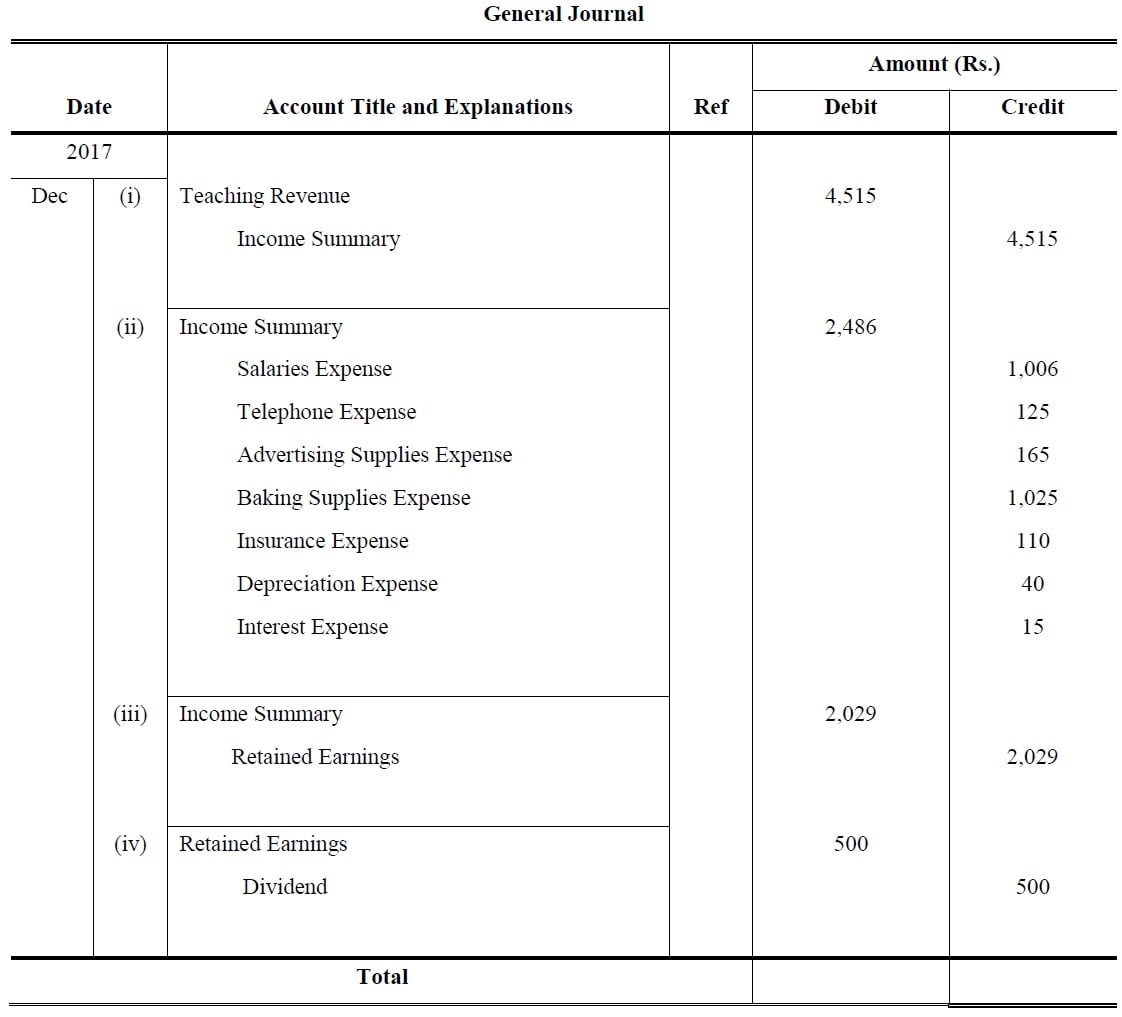

The information needed to prepare closing entries comes from the adjusted trial balance. To make them zero we want to decrease the balance or do the opposite. Analyze, look for any accounts that need to be adjusted in order to bring it into compliance with gaap, create and post adjusting journal entries;

December 31, 2021 account title debit credit: Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc. Adjusted trial balance.

Journalize closing entries (cjes) using information provided for april 30, date these entries as of the last day of the month. Both represent the summaries of ledger accounts of a business. We will debit the revenue accounts and credit the income summary account.