Marvelous Tips About Other Comprehensive Income Cash Flow Statement

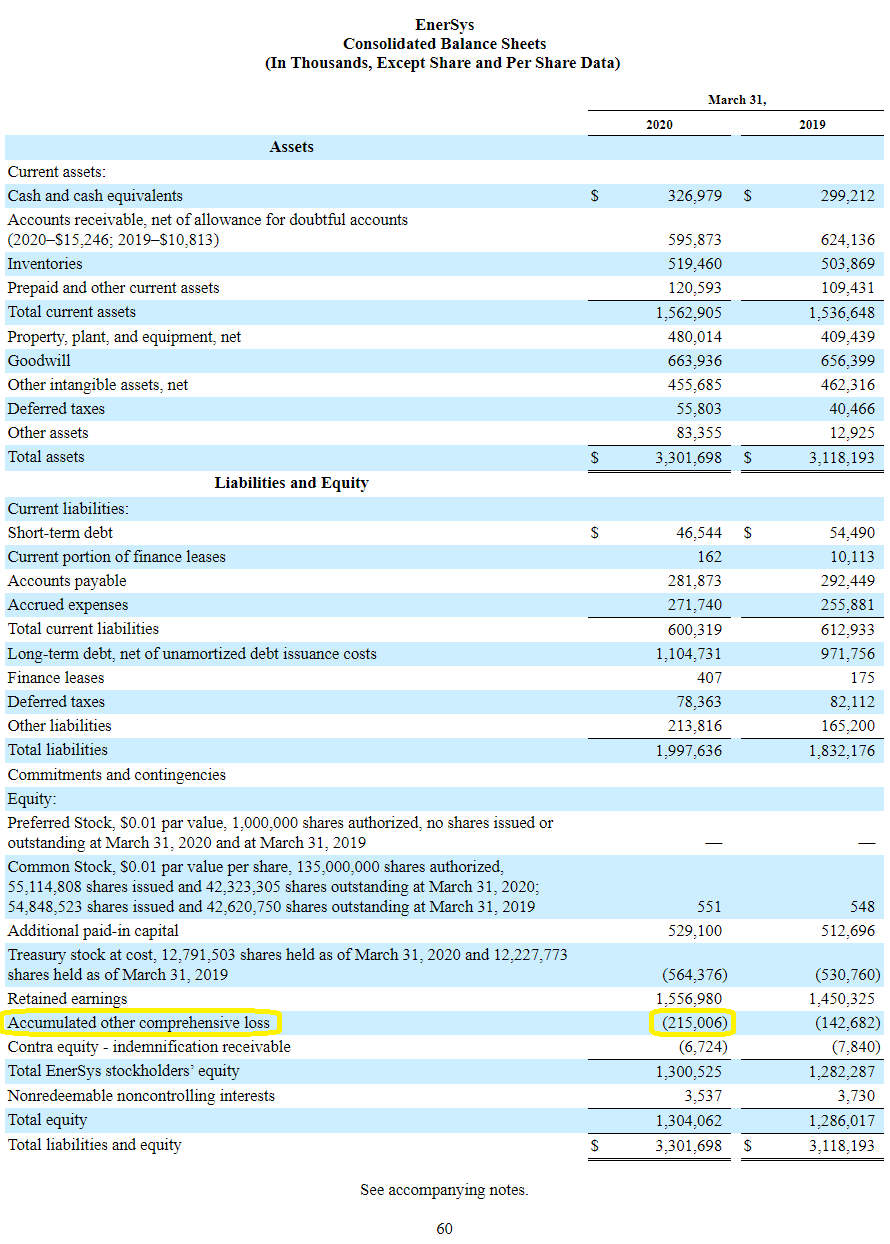

Other comprehensive income is shown on a company’s balance sheet.

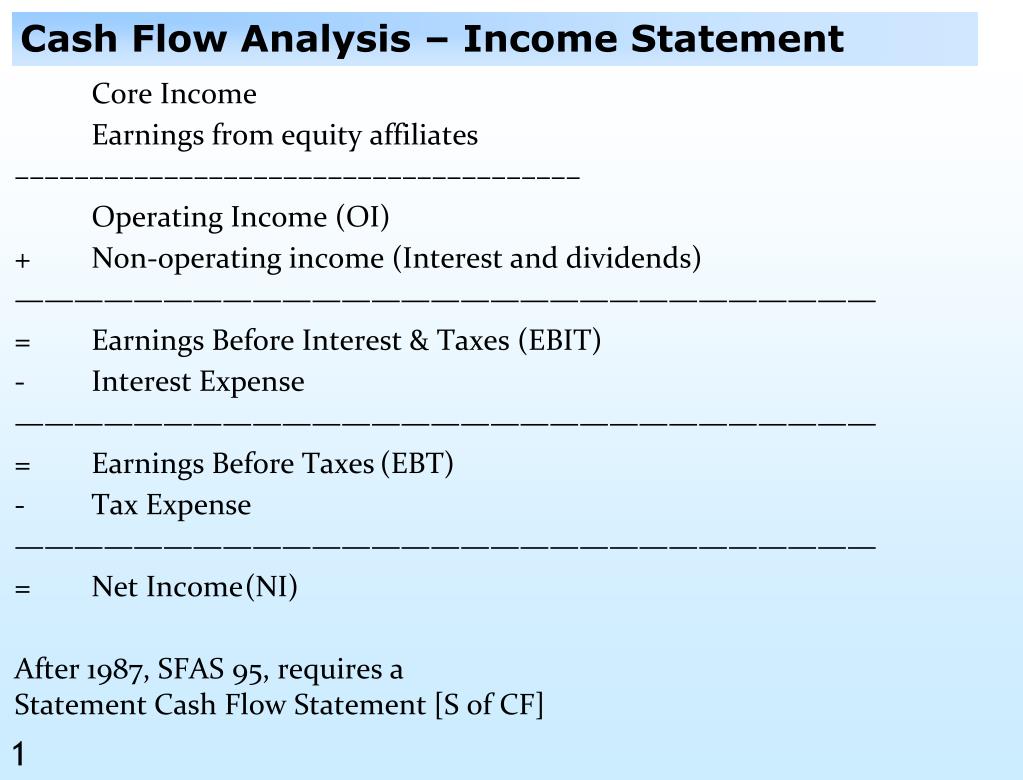

Other comprehensive income cash flow statement. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. Statement of cash flows. Transactions that could lead to aoci can go into the cf statement, such as the purchase of marketable.

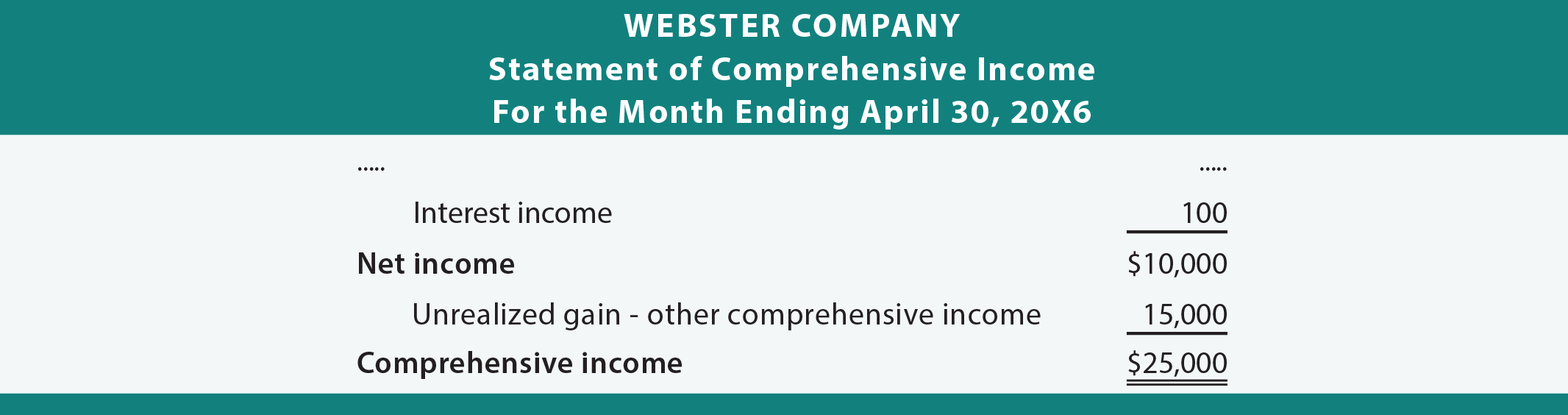

A comprehensive income statement, also known as the statement of comprehensive income (sci), offers a broader view of the company’s income. The entity did not recognise any components of other comprehensive income in the period ended 20x2. A single statement of comprehensive income;

A reporting entity should disclose the income tax effect of each component of oci, including reclassification adjustments, either on the face of the statement in which those. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. 4.5 accumulated other comprehensive income and reclassification adjustments publication date:

A cash flow statement is generally divided into three main parts: Other comprehensive income is not listed with net income, instead, it appears listed in its own section, separate from the regular income statement and often. The statement of retained earnings includes two key.

Transactions related to changes in accumulated other comprehensive income (aoci), including reclassifications out of accumulated other comprehensive income. These items, such as a company’s. What is the statement of cash flows?

Other comprehensive income (oci) = certain gains or losses not already included in net income, net of tax, with tax amount disclosed total comprehensive income = net. A statement displaying components of profit or loss (an income statement), and a second. Comprehensive income = net income + other comprehensive income (oci) a reminder (from above) that depending on the financial statement, oci could.

The statement of comprehensive income reports the change in net equity of a business enterprise over a given period. Other comprehensive income (oci) is an accounting item for firms that includes revenues, expenses, gains, and losses that have yet to be realized. 12 nov 2019 us financial statement presentation guide 4.5 as.

This helps reduce the volatility of net income as the value of unrealized gains/losses moves up and down. No aoci does not go to the cash flow statement. It is similar to retained earnings, which is impacted by net income, except it includes those items that are excludedfrom net income.

Operating activities analyze a company’s cash flow from net income or losses by reconciling the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)

:max_bytes(150000):strip_icc()/comprehensiveincome_final-2ff1de7967204cd2a69a4ab5b8778fff.png)