Can’t-Miss Takeaways Of Tips About Insurance Expense Income Statement

This expense is incurred for all insurance contracts, including.

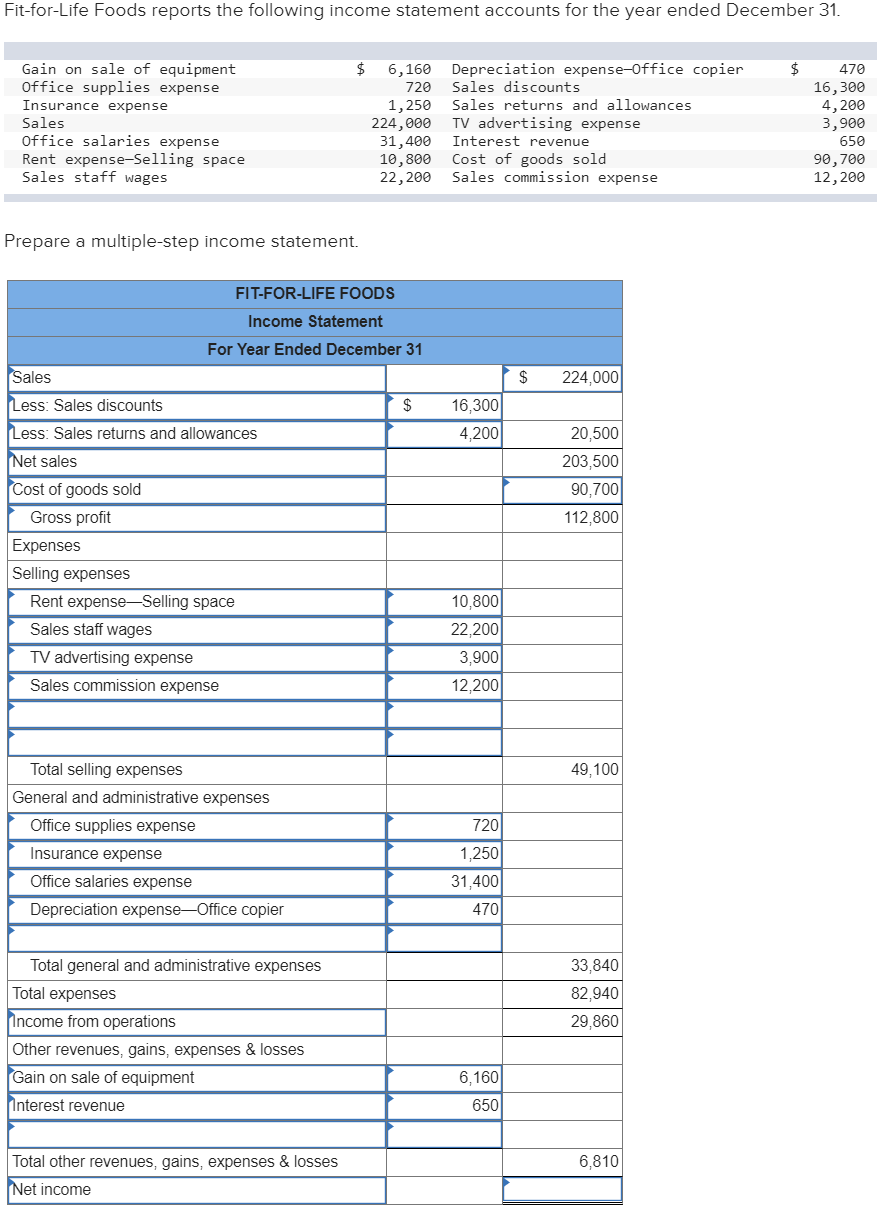

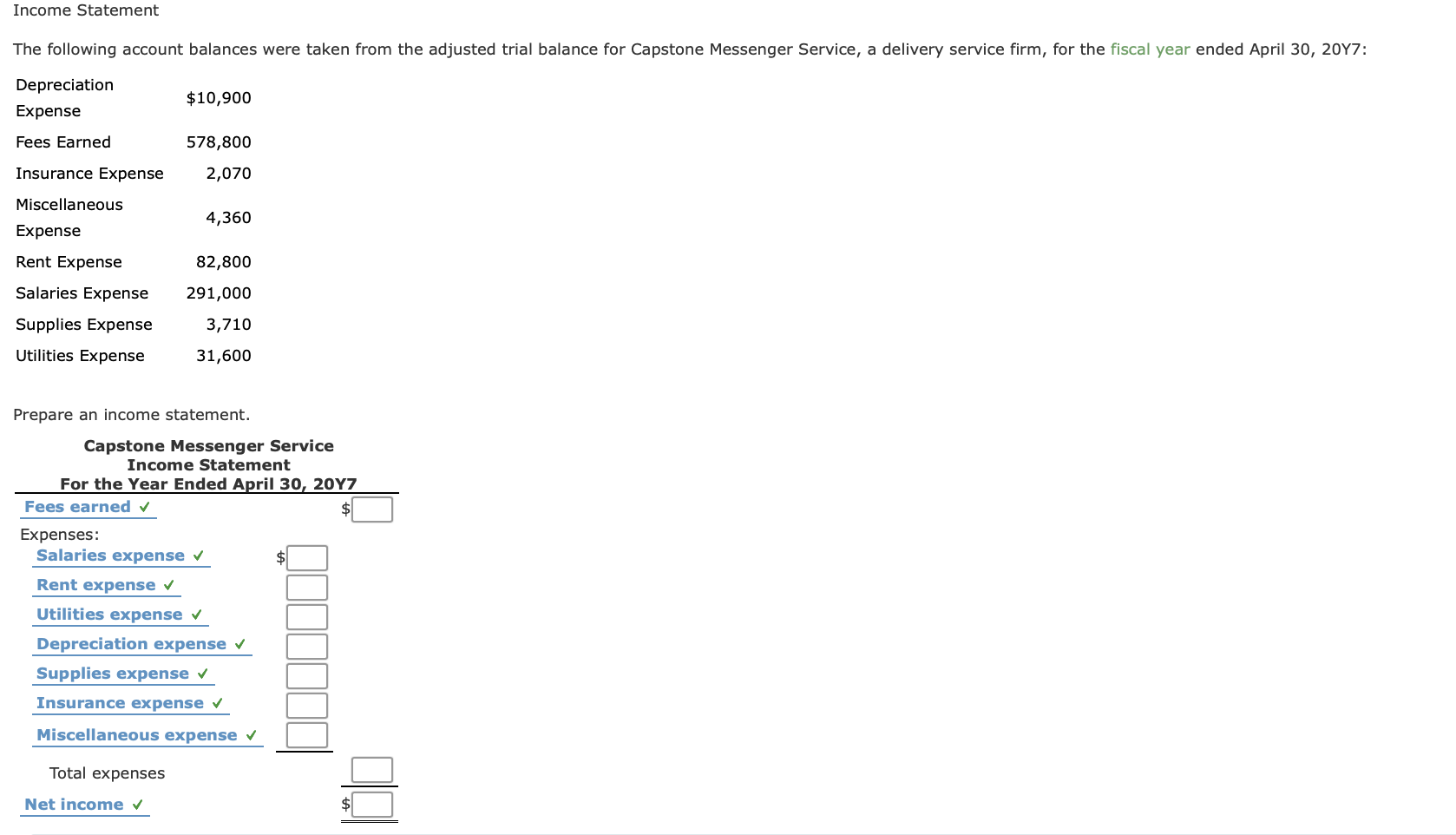

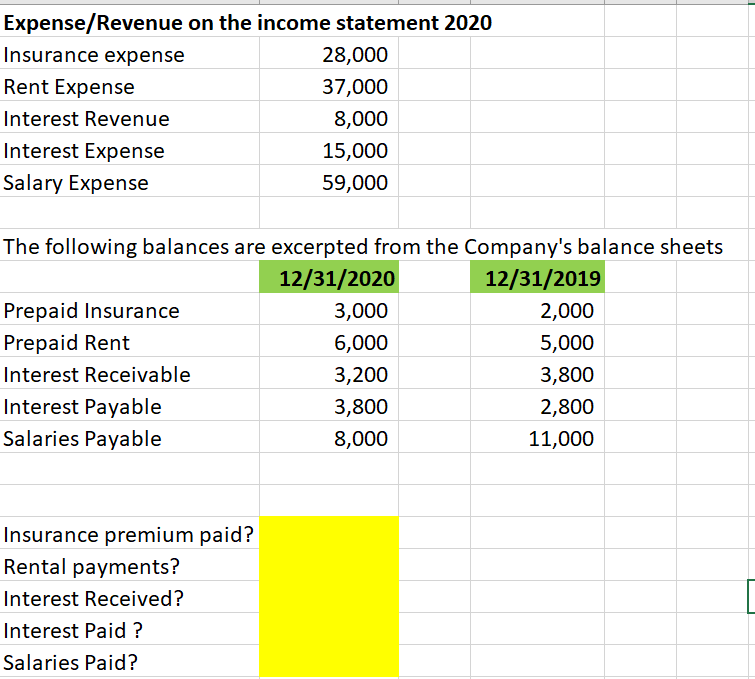

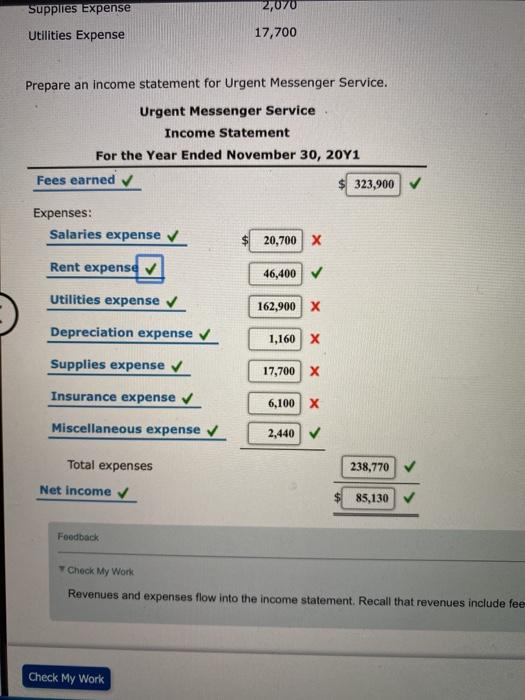

Insurance expense income statement. Insurance revenue and expenses 56 2.4.1. This video explains the income statement method for adjusting entries for prepaid insurance / insurance expense. The costs that have expired should be reported in income statement accounts such as insurance expense, fringe benefits expense, etc.

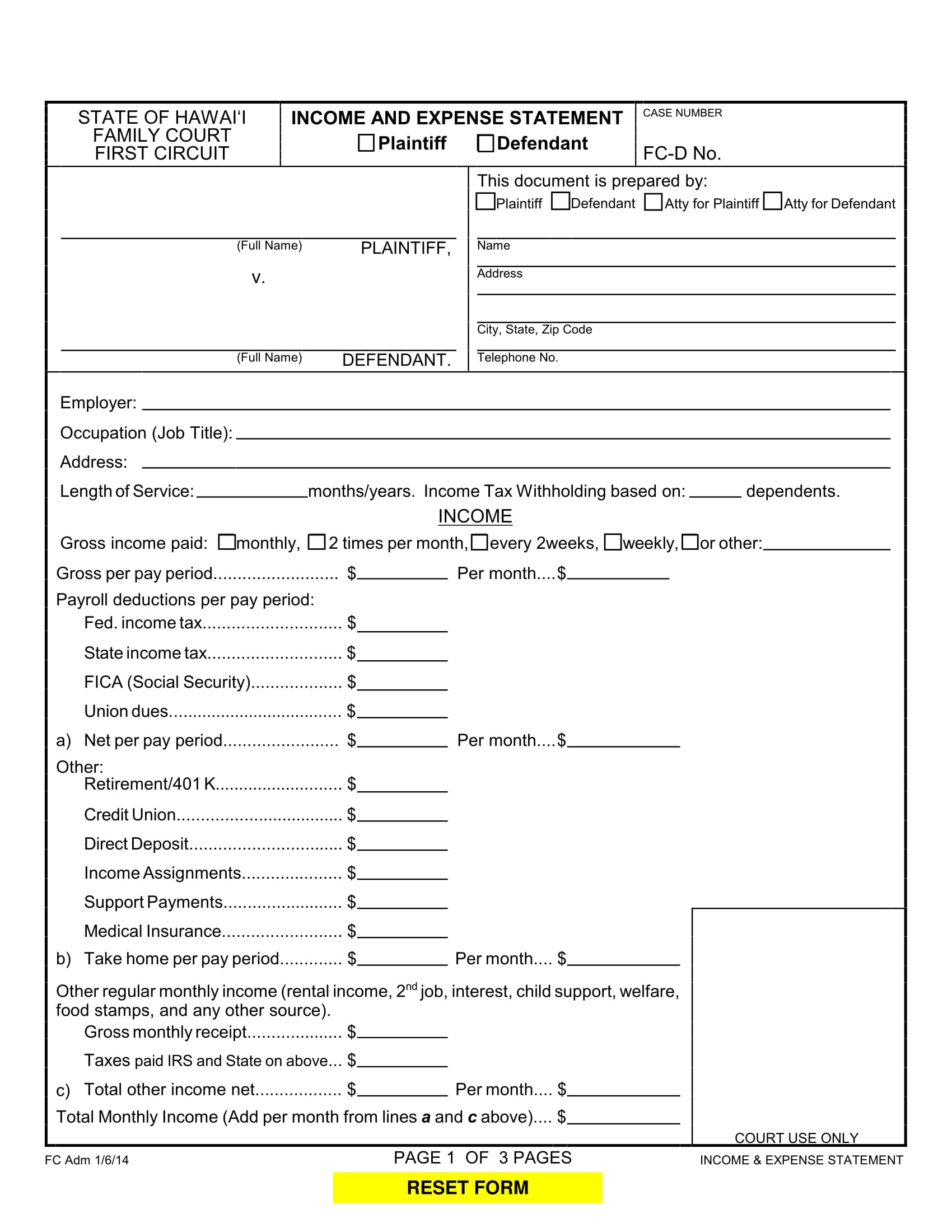

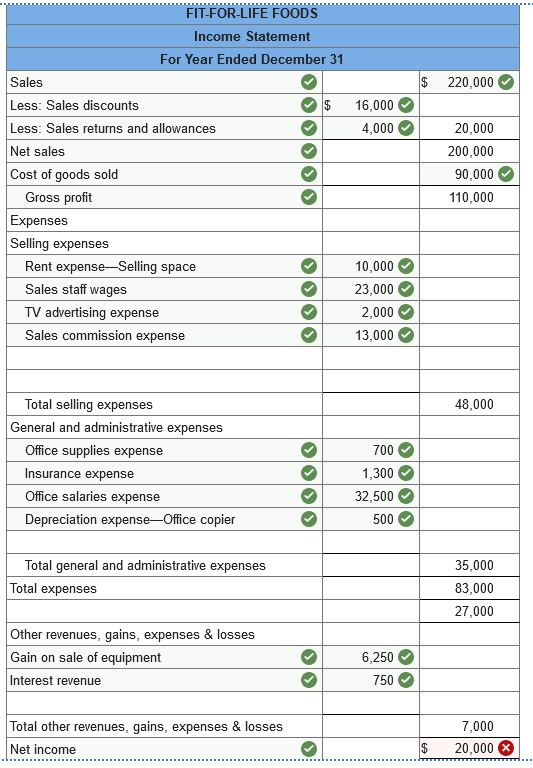

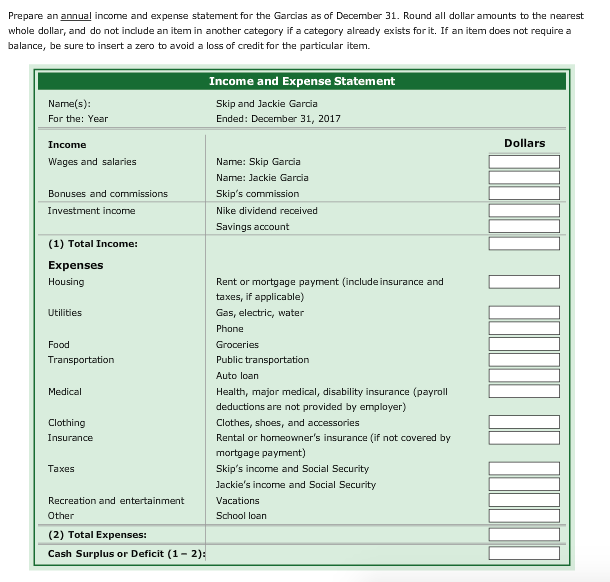

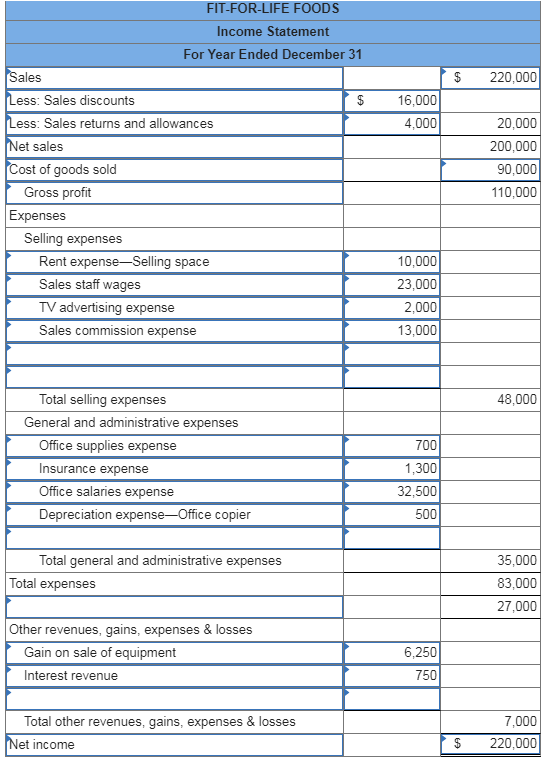

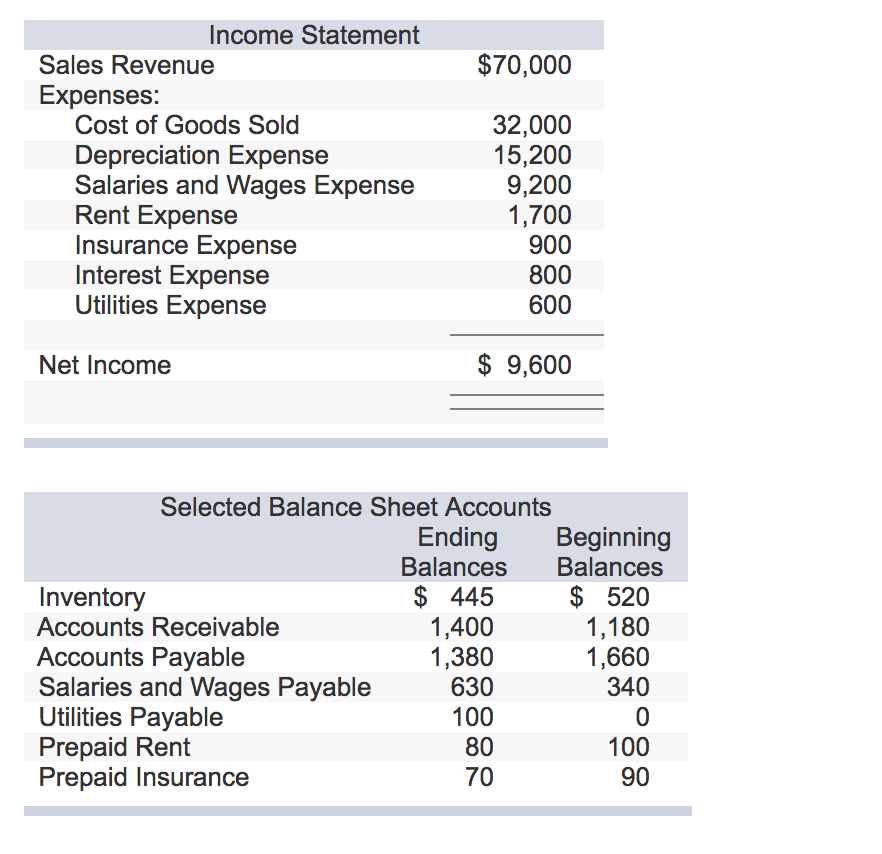

An income statement shows the organization’s financial performance for a given period of time. The insurance premium is an expense, if there is a pay out, that pay out may be considered as income/revenue and you may have to pay tax on the income/revenue. In the united states, all corporate accounting and reporting is governed.

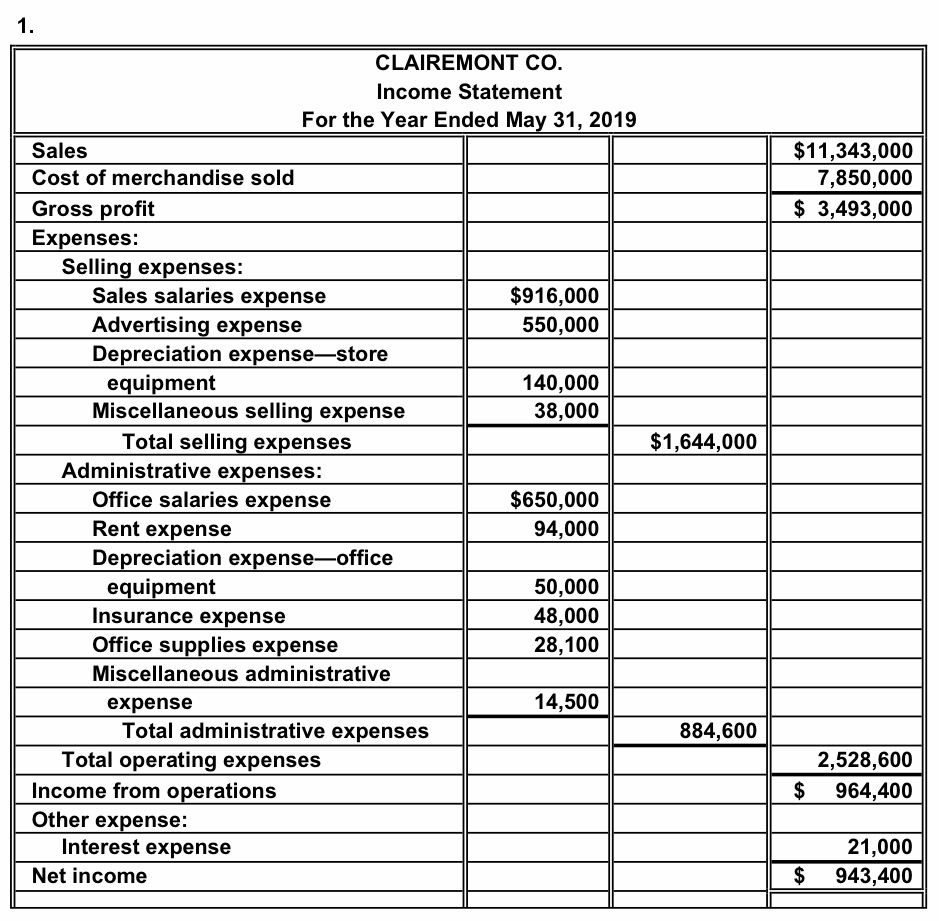

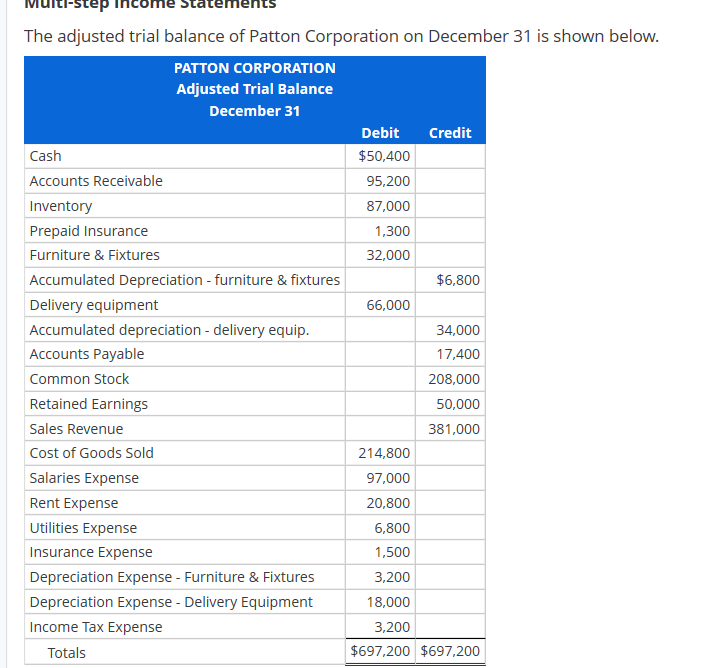

P&l expenses can also be formatted by the nature and the function of the expense. Here's a recap for the cost of. When preparing an income statement, revenues will always come before.

Add up all your gains then deduct your losses. The amount paid to acquire a specific coverage is known as premium. Insurance expense is part of operating expenses in the income statement.

Consolidated statement of comprehensive income 11. Insurance expense is the cost a company pays to get an insurance contract, as well as any unpaid monthly premium costs on the insurance contracts. The ifrs 17 income statement is complicated, so a short explanation is shown below of the new items:

Overview accounting is a system of recording, analyzing and reporting an organization’s financial status. For example, if you itemize, your agi is $100,000. Example of payment for insurance.

The income statement focuses on four key items: The total amount charged to advertising expense for each period an income statement is presented; Insurance expenses are a crucial component of a business’s income statement.

Qbi is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, s corporations, sole. By recording insurance expenses, businesses can track the costs associated with. This information gives a basis for users of financial statements to assess the effect that insurance contracts have on the entity's financial position, financial.

Insurance revenue insurance service expense. Once expenses are incurred, the prepaid asset account is reduced and an entry is made to the expense account on the income statement. Note that the end result, on the financial.

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). Insurance expense, like other business expenditures, belongs on a company's income statement rather than on its balance sheet. Corporate finance financial statements operating expense (opex) definition and examples by will kenton updated august 24, 2023 reviewed by.