Matchless Info About Note Payable Cash Flow Statement

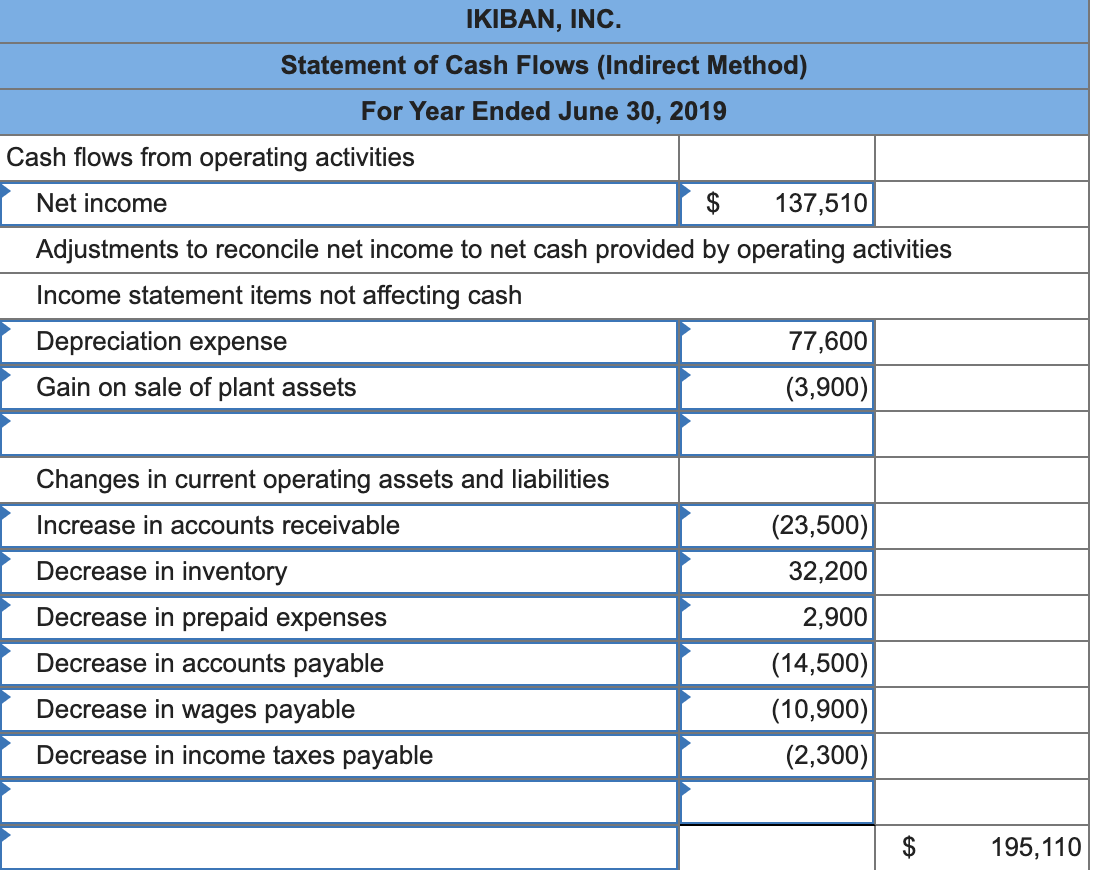

Begin with net income from the income.

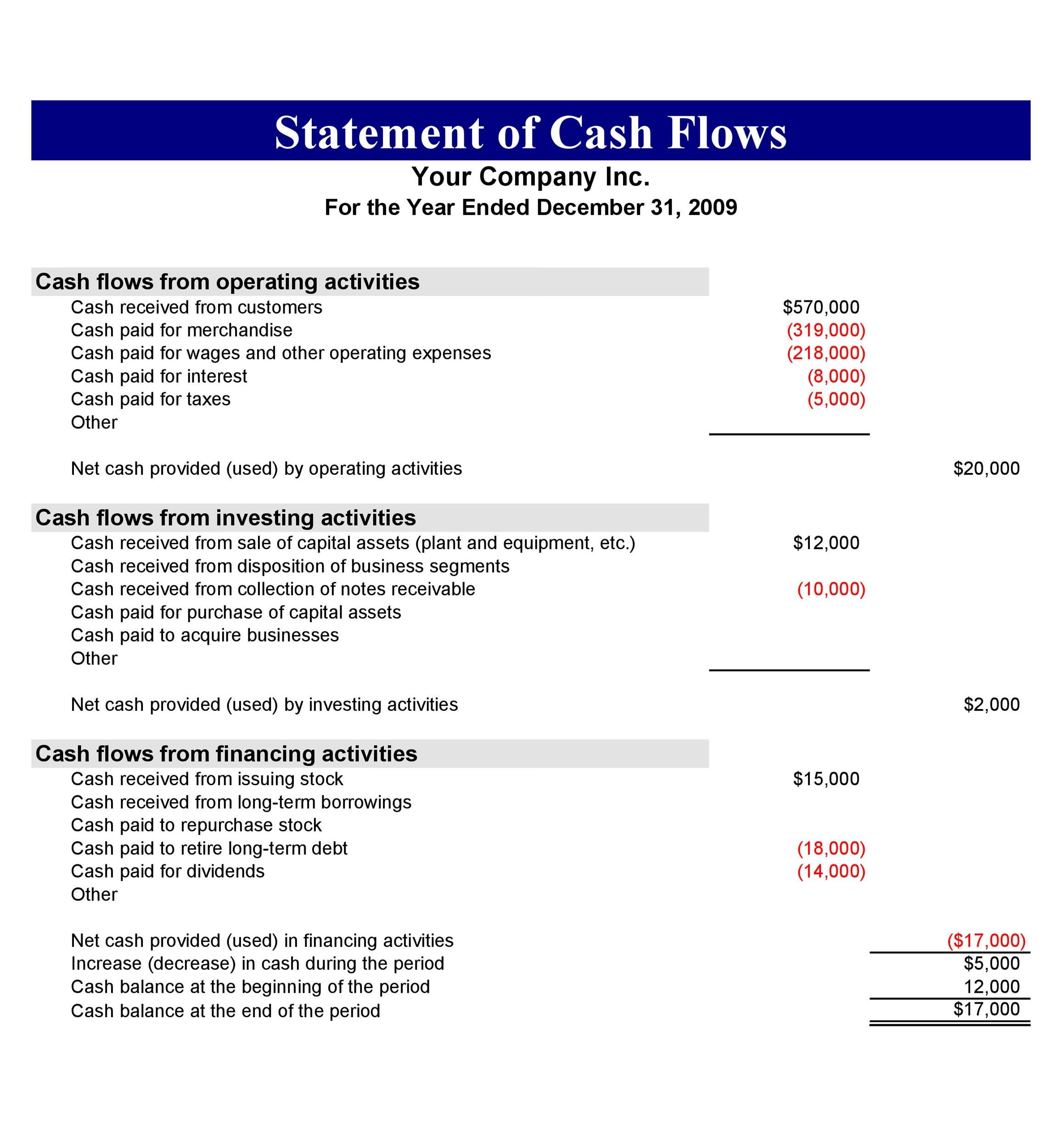

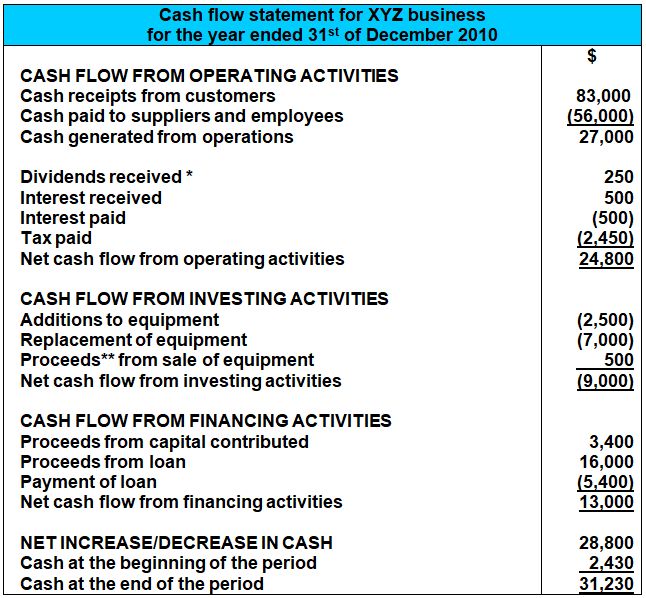

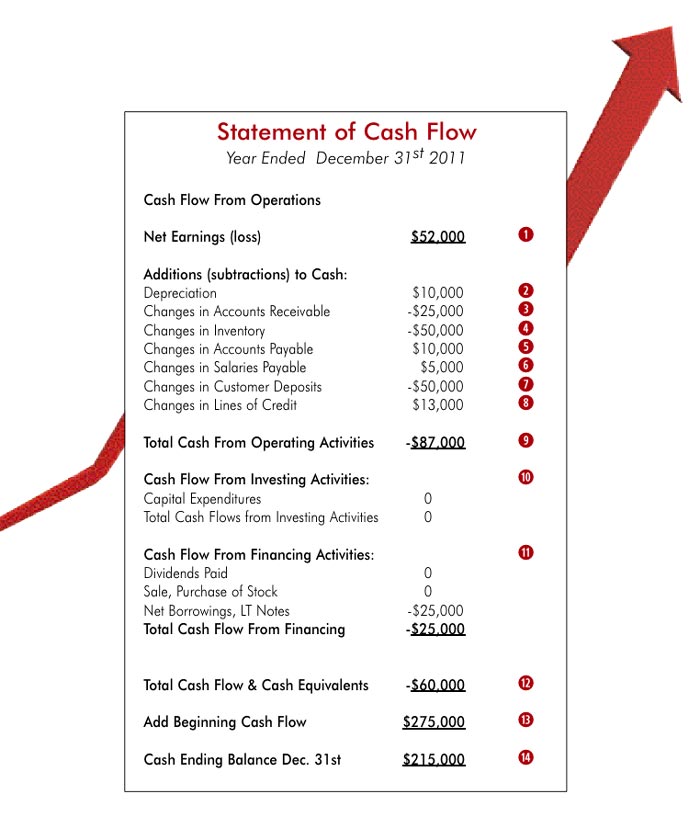

Note payable cash flow statement. A guide to notes payable on cash flow statements types of notes payable there are several types of notes payable, which often vary by amounts,. This article considers the statement of cash flows of which it assumes no prior knowledge. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities. Cash and cash equivalents comprise cash on hand and. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a.

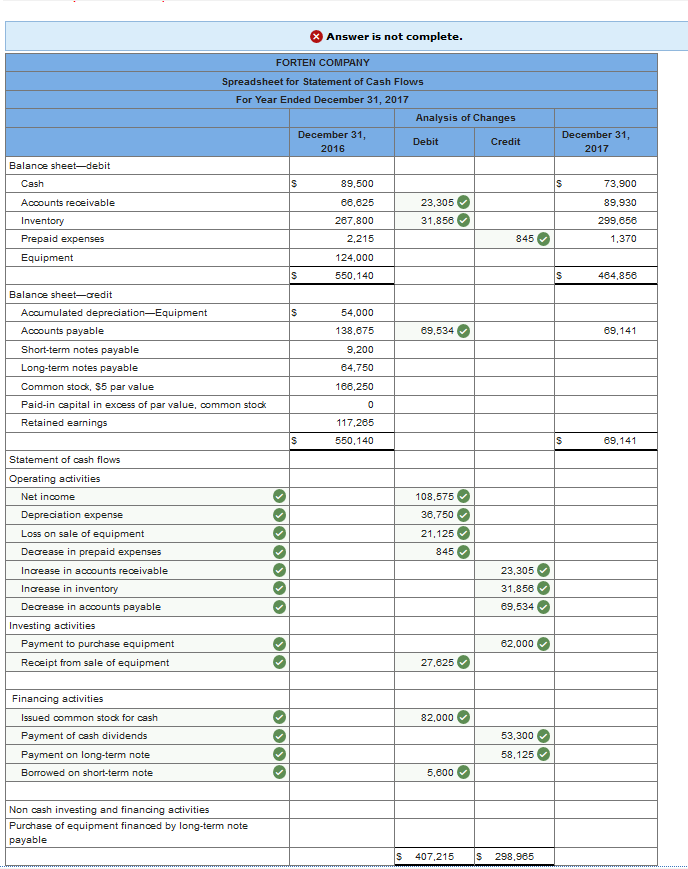

Accountants report distinct elements of notes payable on different portions of a cash flow statement. A notes payable cash flow statement is a financial statement that provides detailed information about the cash flows from a. 7.2.2 cash inflows and outflows.

A common error when preparing the cash flow statement is to present the repayment of €40,000 of the note payable as an outflow of $48,000 (the amount of the debt. It is relevant to the fa (financial. Notes payable are similar to accounts payable and receive similar treatment in the operating section of the cash flow statement.

The scf reports the cash inflows and cash outflows that occurred during the same time interval. Since most corporations report the cash. Notes payable 100,000 accrued expenses and other liabilities 45,000 total liabilities 3,275,000 partners’ capital(2) $ 787,240,000.

The cash flow statement is required for a complete set of financial statements. Notes payable cash flow statement definition. Cash flow statements (cfs) provide a summary of the cash that a company brings in and spends in a given time period, also called cash inflow and cash outflow.

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: A note payable affects the cash flow statement by reducing the amount of cash that a company has available, as payments must be made to repay the loan. Statement of cash flows see.

Most companies are required to produce this. Common items in this section of the statement include the payment of dividends, issuance of. New guidance in september 2022, the fasb issued asu.

See fsp 6.9.11 for discussion of the statement of cash flows classification of supplier finance programs. Operating activities are also referred to as. The first section of the statement of cash flows is described as cash flows from operating activities or shortened to operating activities.

Recall that financing activities are those used to provide funds to run the business. When a company receives the note proceeds, it debits cash and credits notes payable. Presentation of a statement of cash flows.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)