Smart Info About Significant Accounting Policies And Notes To Accounts

And a statement of financial position as at the beginning of the preceding.

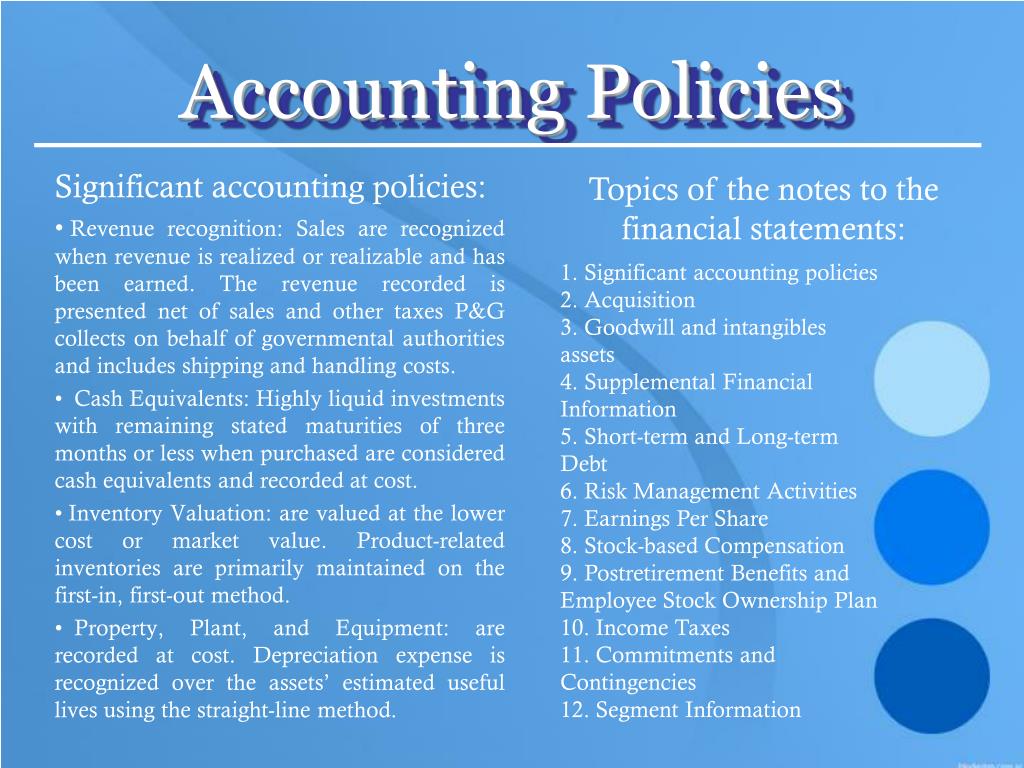

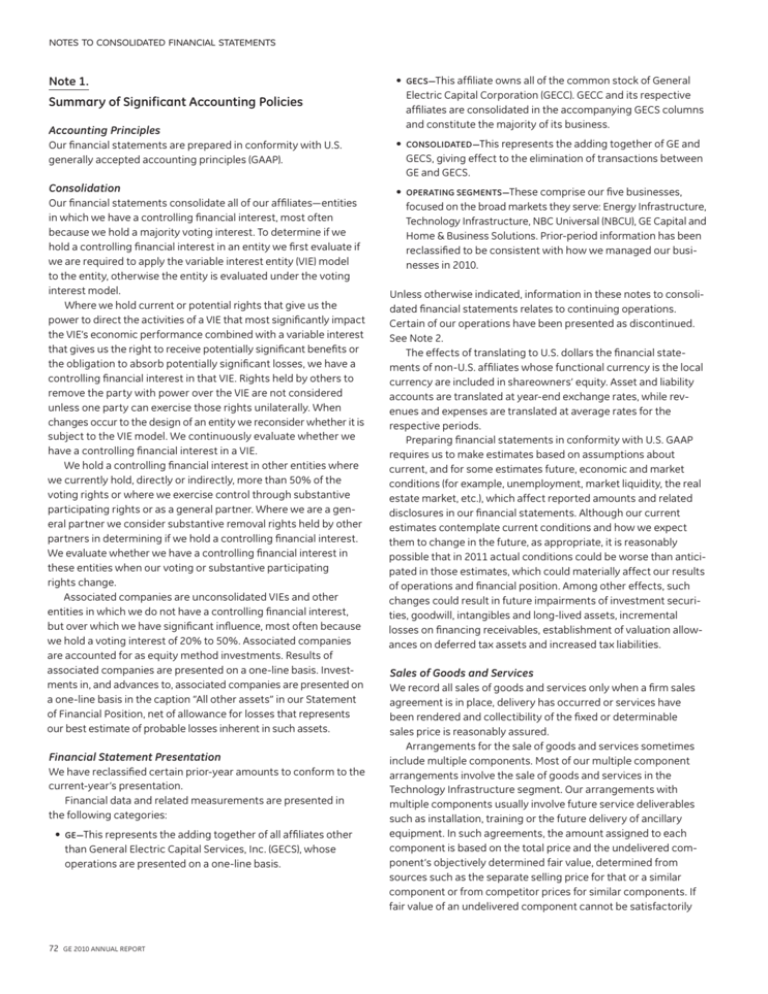

Significant accounting policies and notes to accounts. 2.3 summary of significant accounting policies banks should disclose the accounting policies regarding key areas of operations at one place (under schedule 17) along with. This note describes shell’s significant accounting policies, which are those relevant to an understanding of the consolidated financial statements.

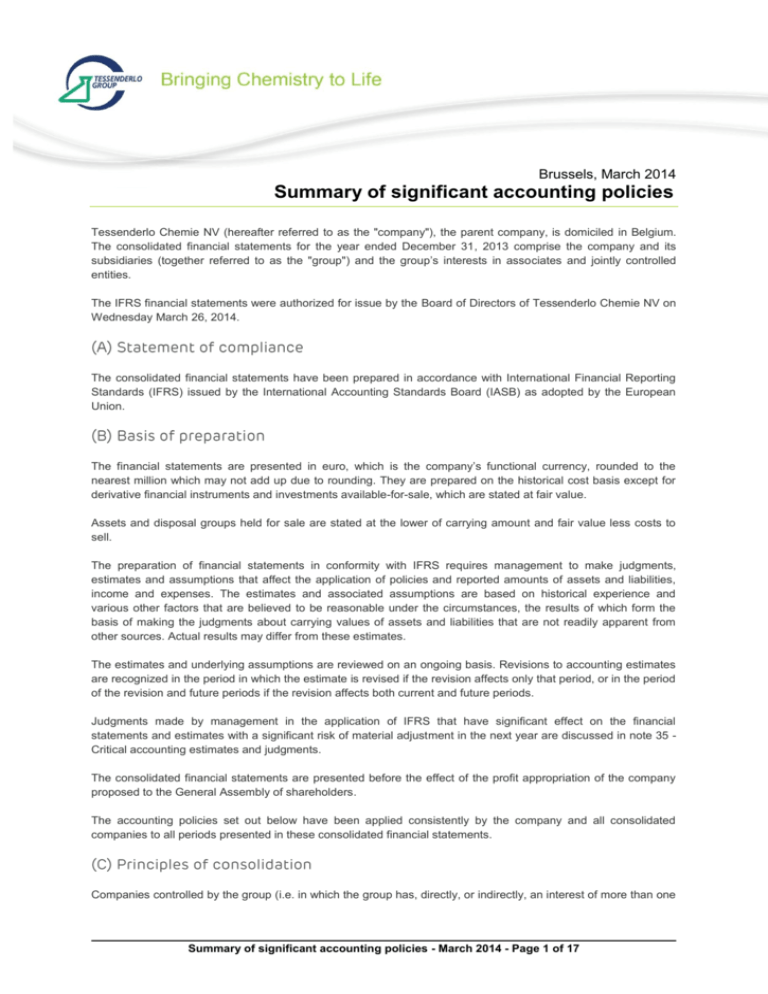

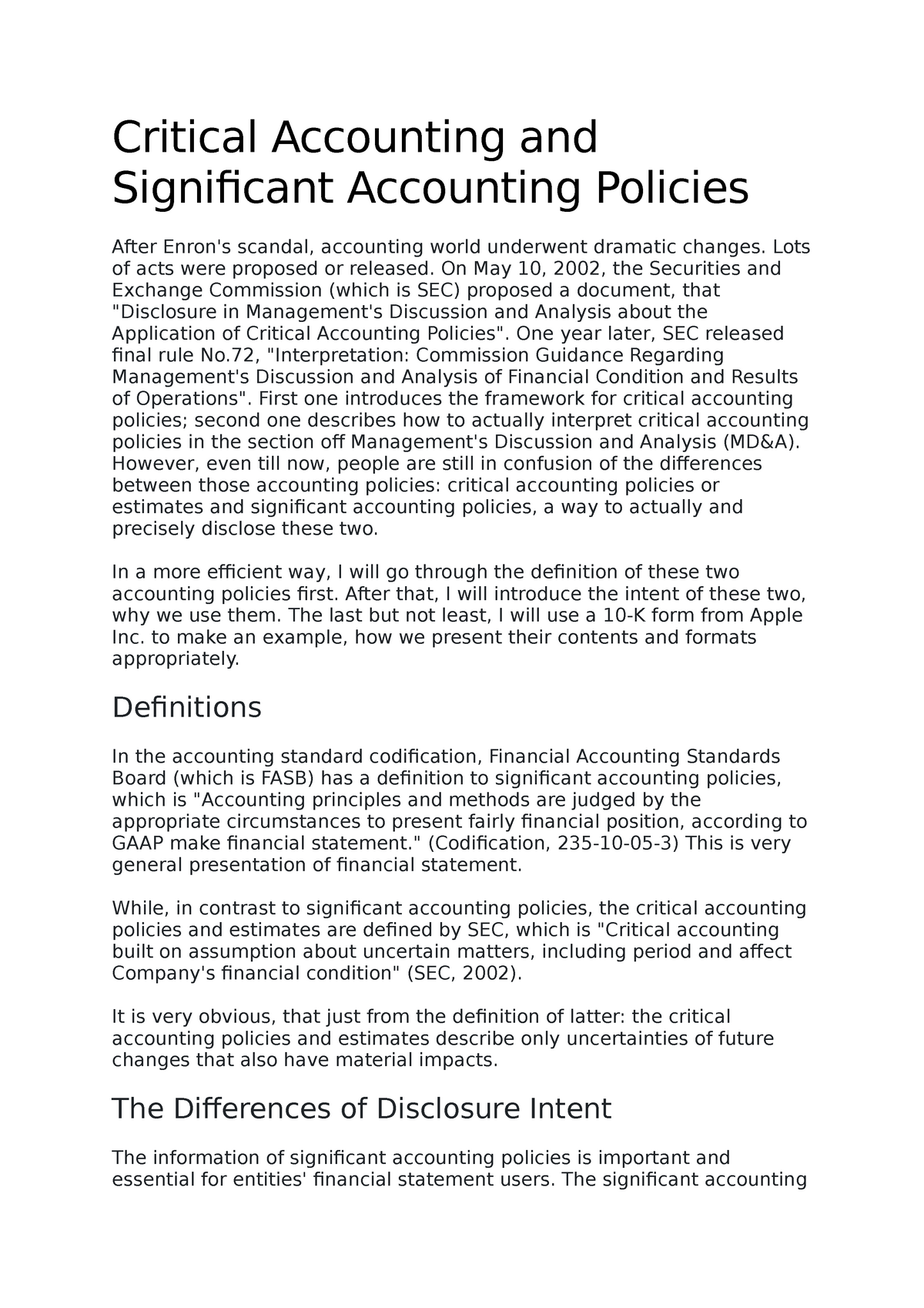

For sec registrants, disclosure of the application of critical accounting policies and significant estimates is normally made in the management’s discussion and analysis. Notes to the accounts 1. Ifrs practice statement 2) for the first time in 2023.

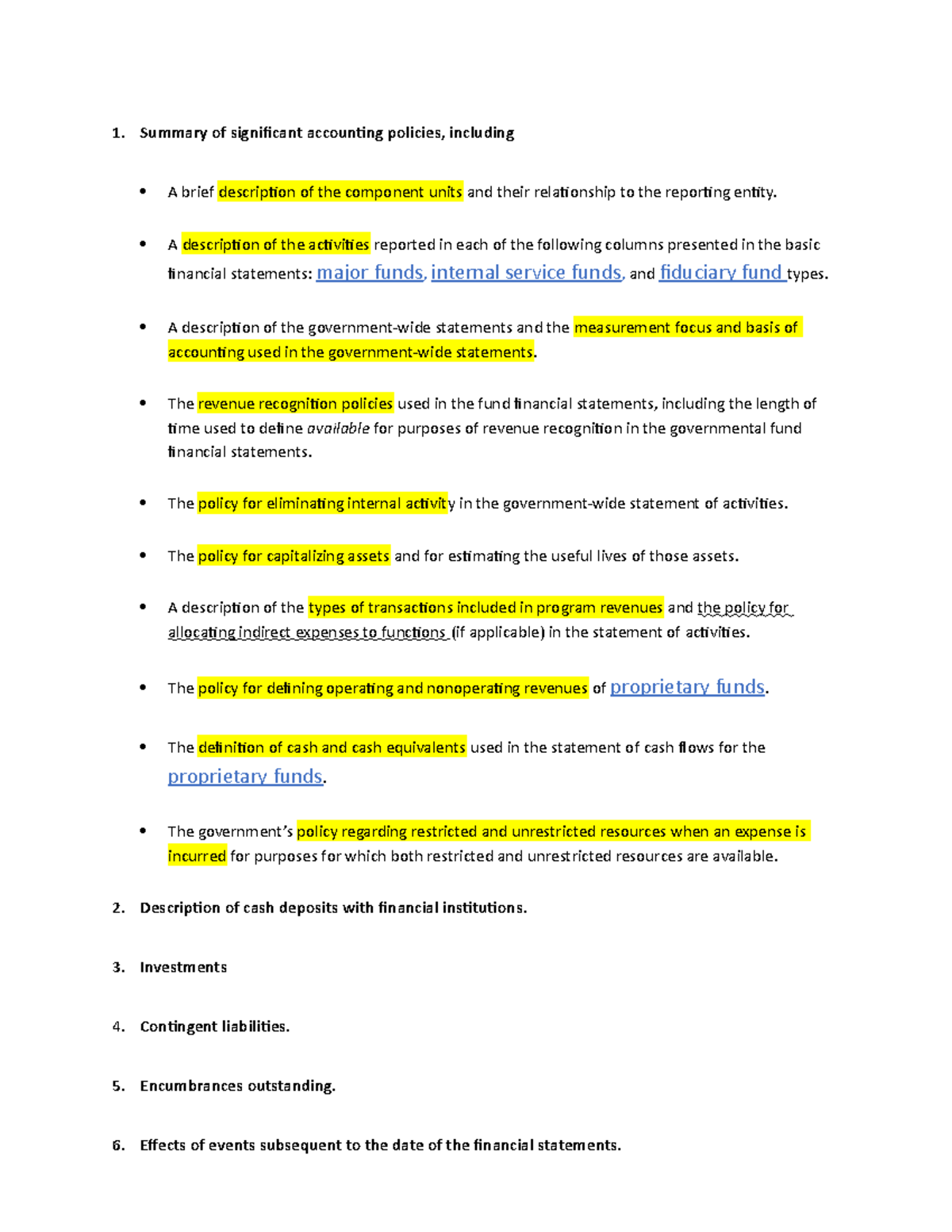

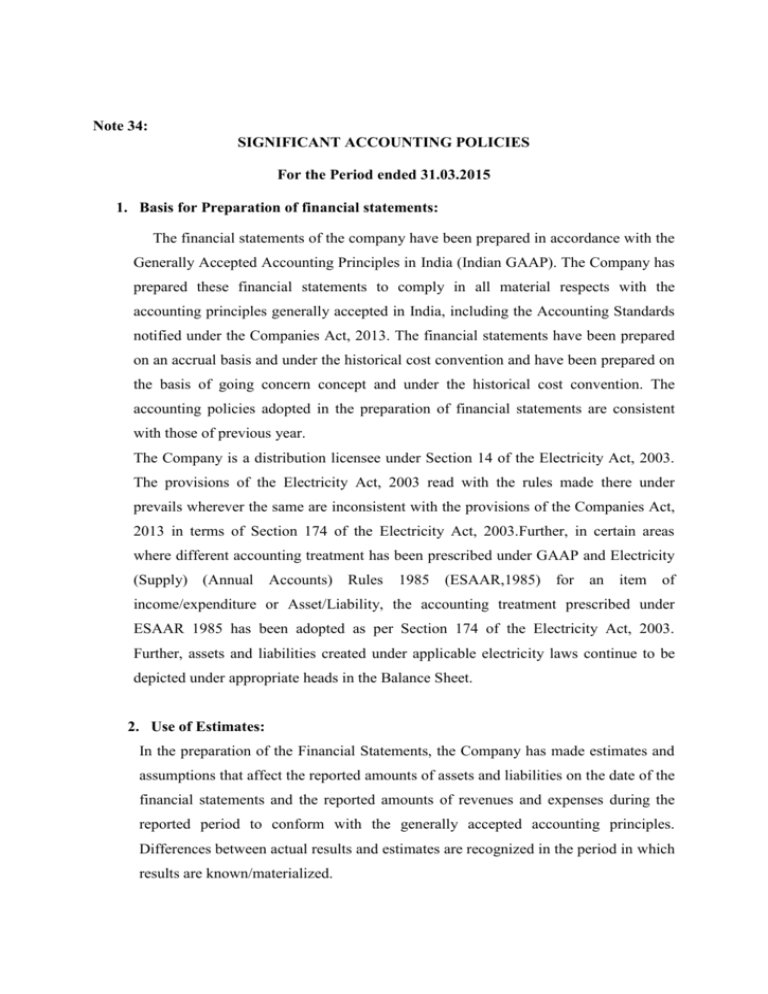

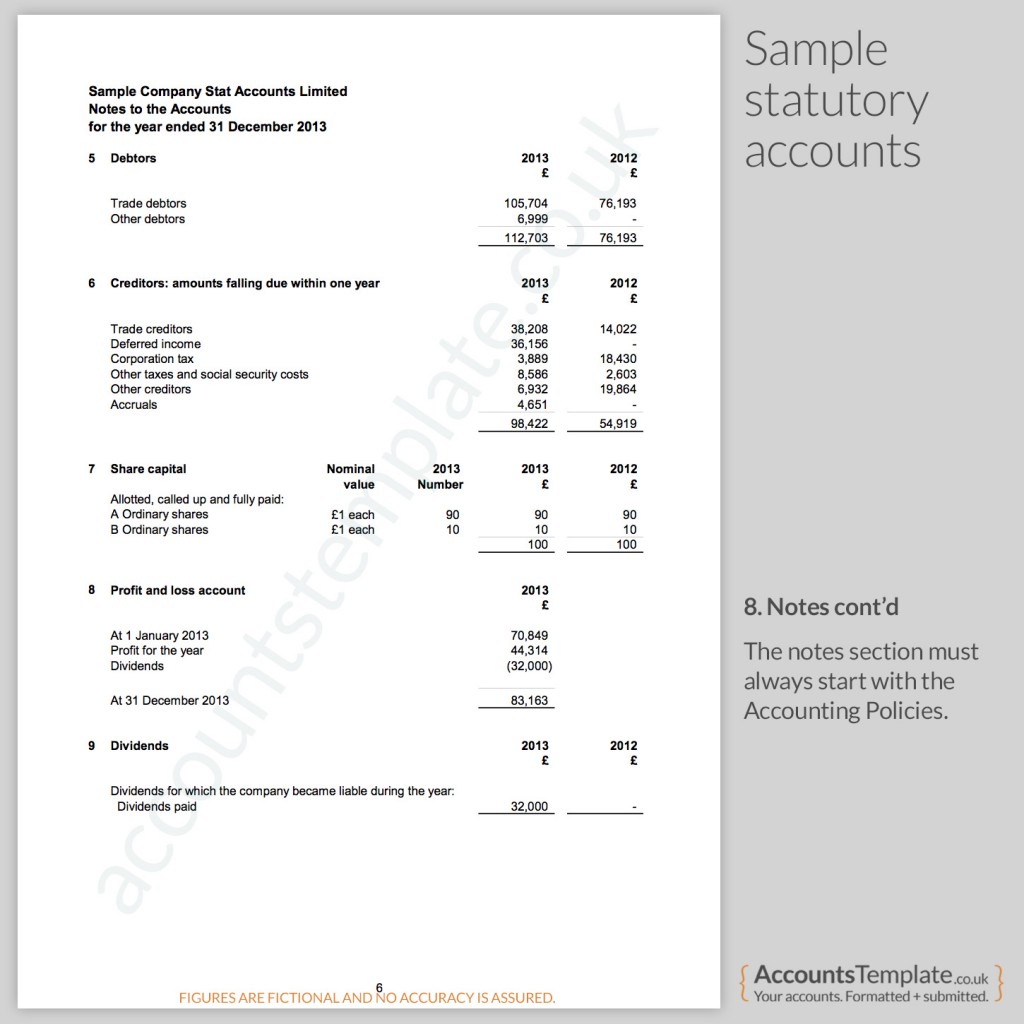

Determining which accounting policies are considered “significant” is a matter of management judgment. Management might consider materiality of the related account,. Notes, comprising a summary of significant accounting policies and other explanatory notes;

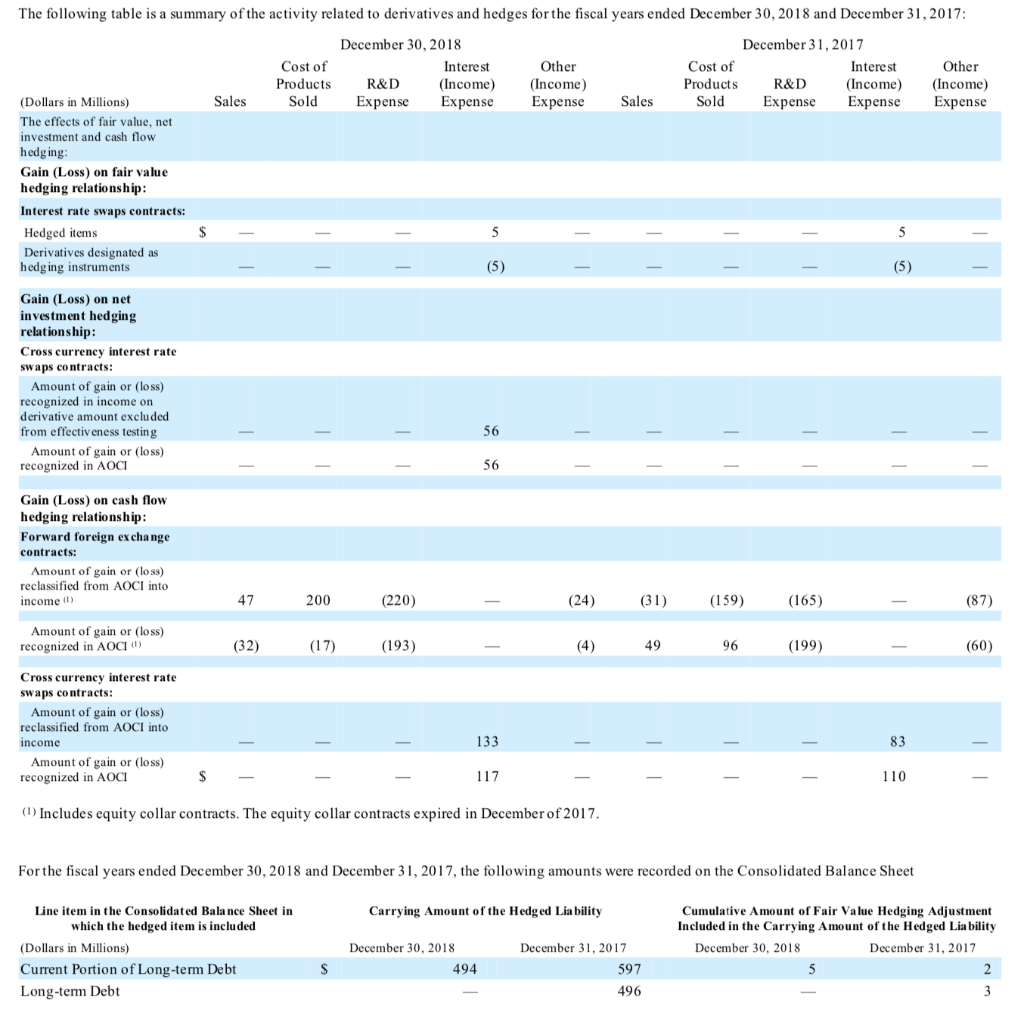

The most critical accounting policies involving a higher degree of judgment and complexity in applying principles of valuation are described below. Disclosure of accounting policies (amendments to ias 1 and. This note describes the accounting policies, significant estimates and accounting judgements that are relevant to the financial statements as a whole.

Ipsas 1 specifies minimum disclosure requirements for the notes. Accounting policies are rules and guidelines that are selected by a company for use in preparing and presenting its financial statements. Notes, comprising a summary of significant accounting policies and other explanatory information;

What are accounting policies? These shall include information about: Comparative information prescribed by the standard.

The accounts are prepared under the historical cost convention unless. The disclosure of the significant accounting. The judgements that management has.

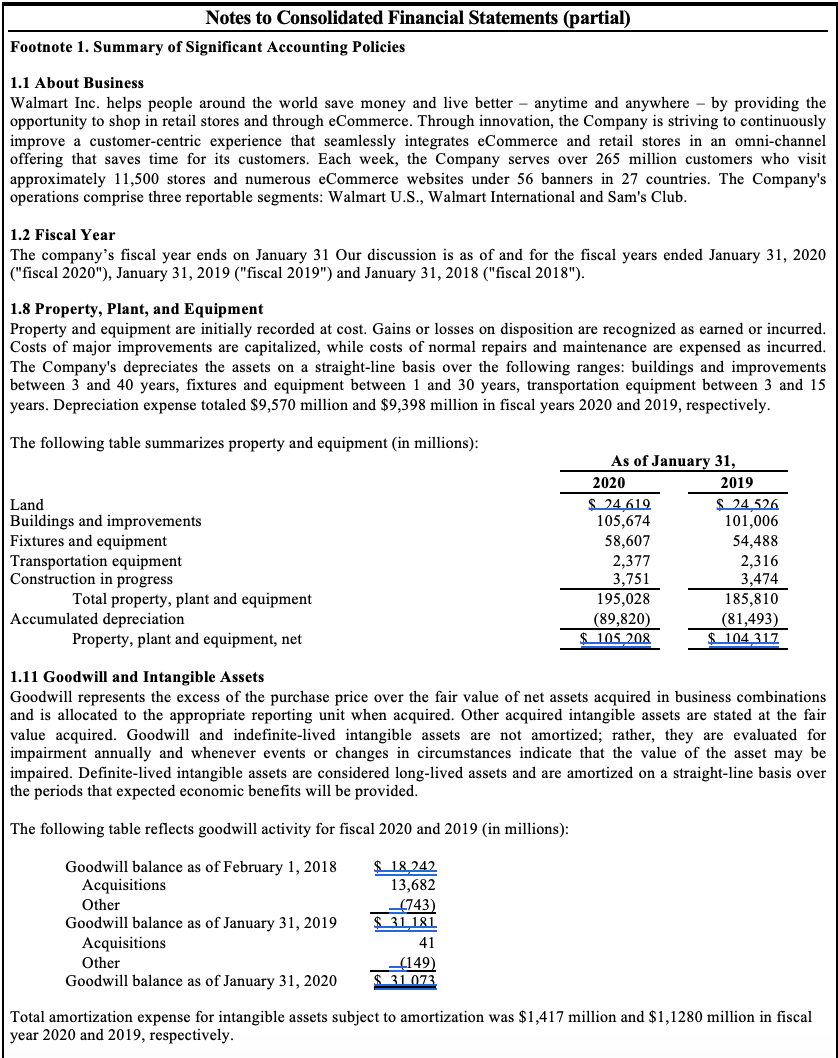

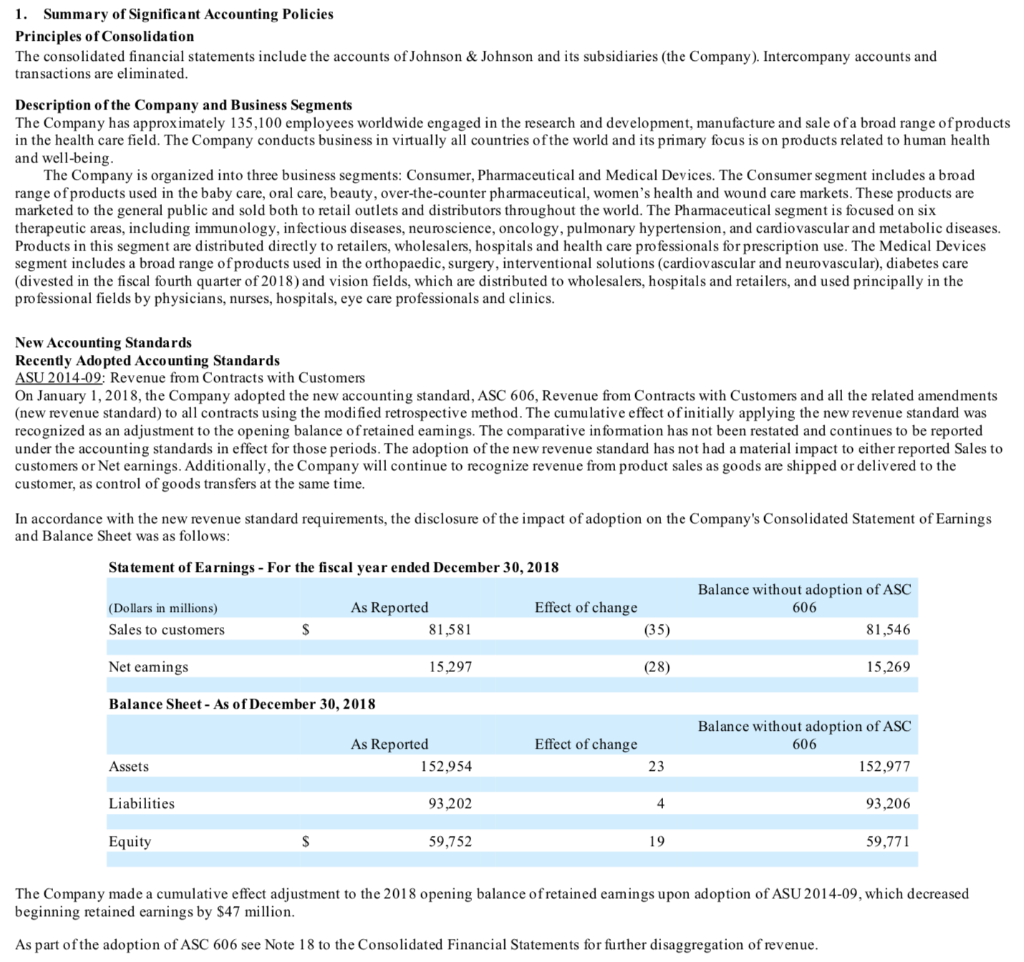

The summary of significant accounting policies is a section of the footnotes that accompany an entity's financial statements, describing the key policies. I) in accordance with the notification issued by the ministry of corporate affairs, the company is required to prepare its financial statements as per the indian accounting. Summary of significant accounting policies;

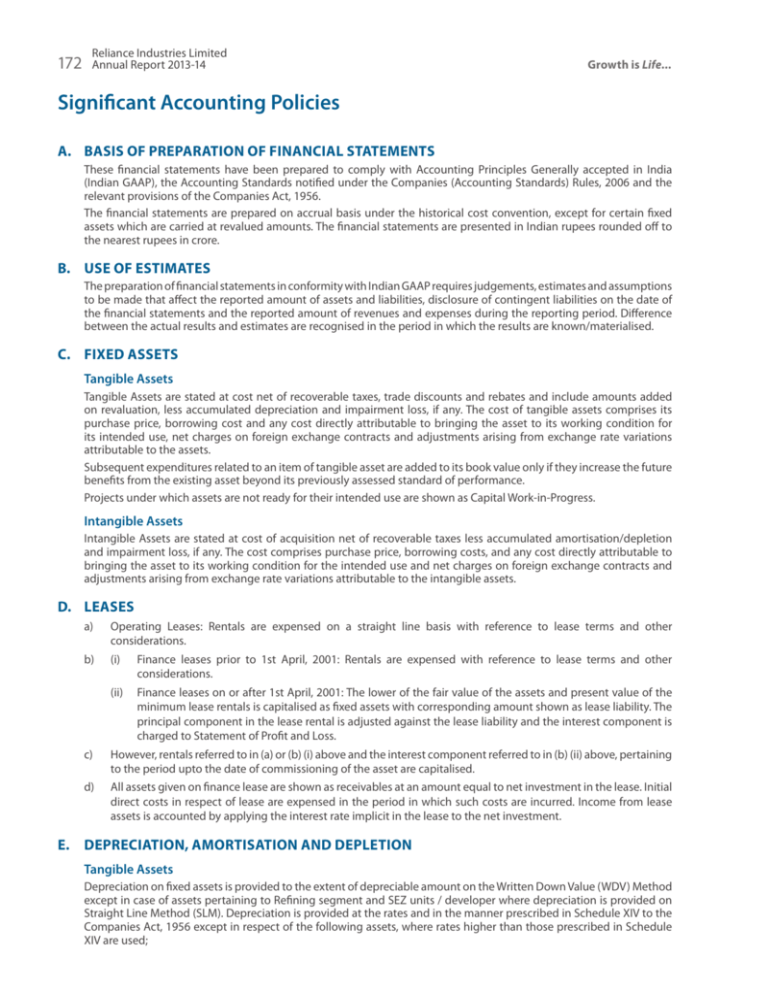

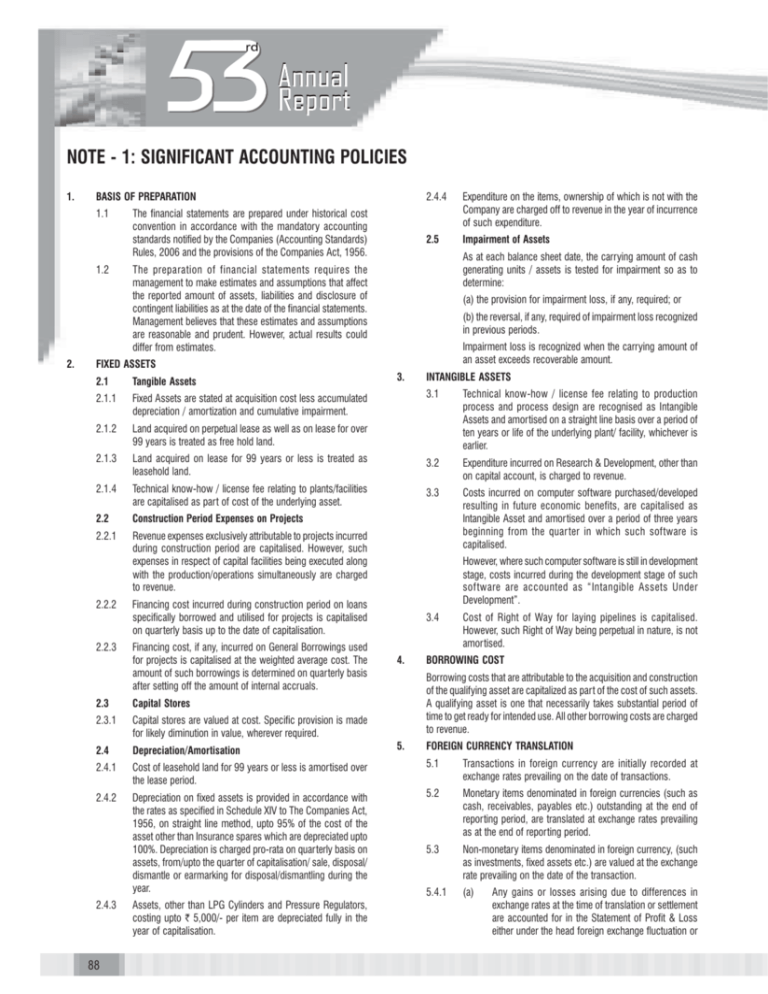

Basis of preparation of financial statements the accompanying financial statements are prepared in accordance with indian. The amendments require entities to disclose their ‘material’. Basis for preparation of accounts:

Basis for preparation of accounts: 16.1 significant accounting policies 16.1.1 basis of preparation of financial statements the financial statements are prepared under the historical cost convention, in. 1 significant accounting policies 22.1.1.

:max_bytes(150000):strip_icc()/Accountingpolicies_color-6c5485e2b09541c697abd98d3094534c.png)