Top Notch Info About Non Cash Items In Flow Statement Examples

Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities.

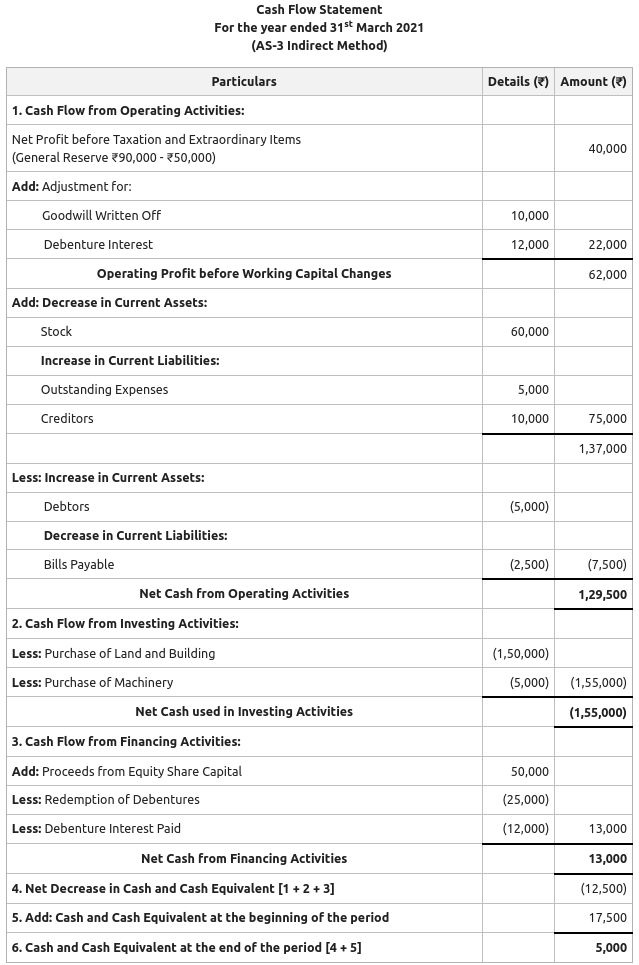

Non cash items in cash flow statement examples. Some of the more important ones include depreciation, bad debts (impairment), and loss on disposal of. When the amount of depreciation is debited in the income statement, the amount of net profit is lowered yet there is no cash flow. Learn how to analyze amazon’s consolidated statement of cash flows in cfi’s amazon advanced financial modeling course.

Cash flow from financing activities this section covers revenue earned or assets spent on financing activities. These items are taken on the income statement in small increments called depreciation or amortization. On july 1, 2017, a company purchases a computer for $2,500 with cash.

Perhaps the best example, and a particularly topical one considering the imminent change to lease accounting due to ifrs 16, is new capitalised. The computer is estimated to have a useful life of five years, so an annual depreciation expense of $500 is created for the next five years. Appreciation in the value of a fixed asset arising out of its revaluation is obviously only a book entry.

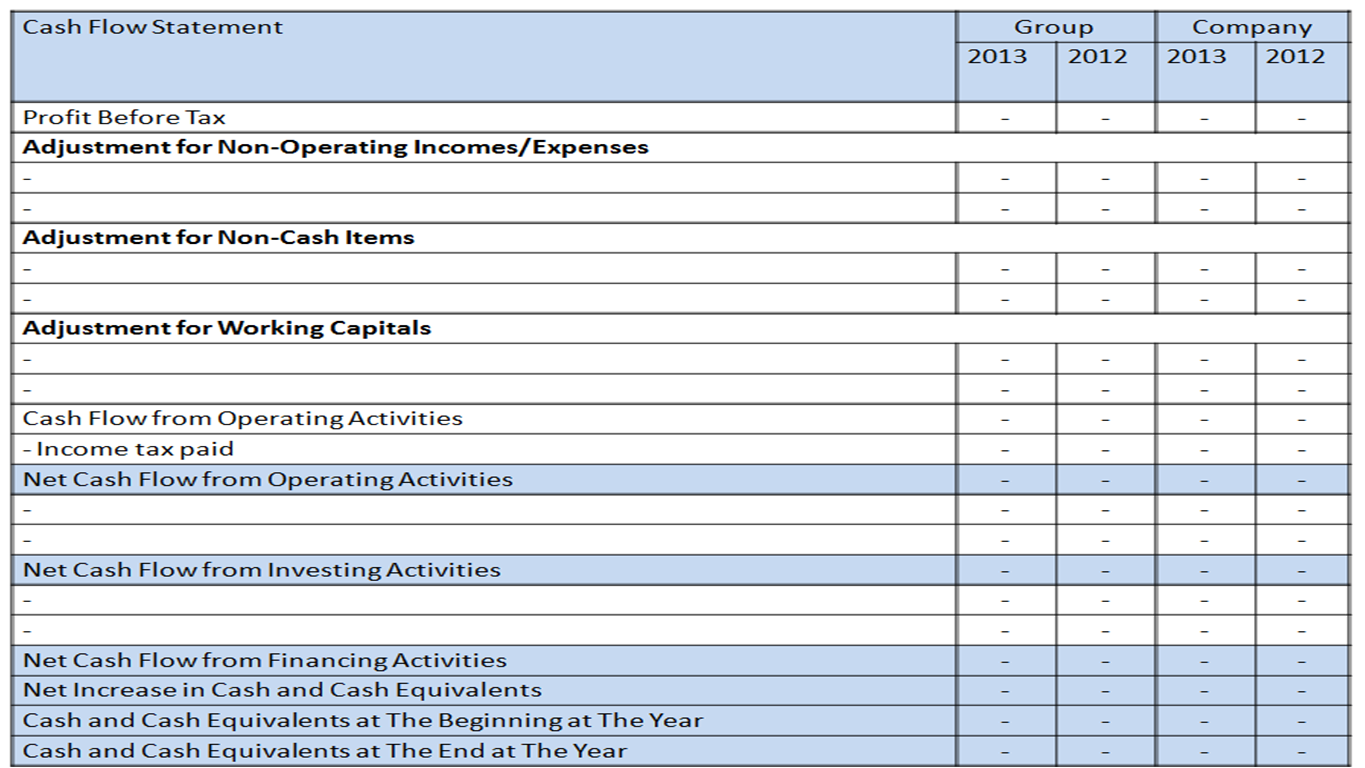

Cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. What are noncash items in income statement? Cash from operating activities the operating activities on.

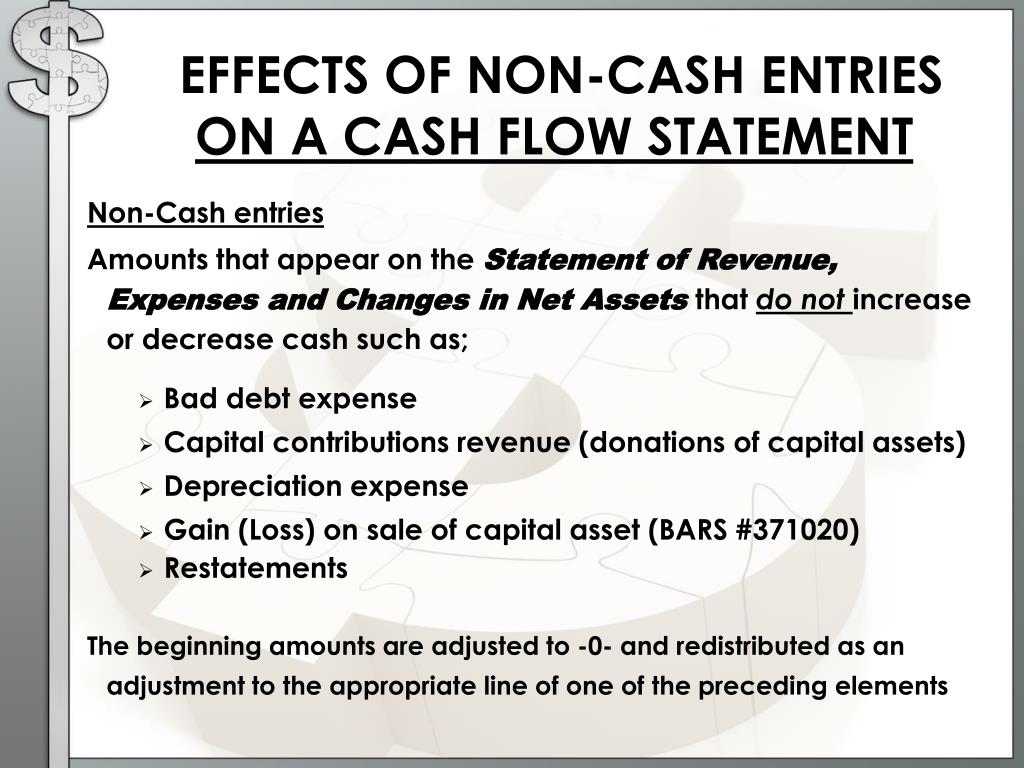

When you debit the depreciation amount in the income statement, it reduces net profit without affecting the cash flow. Adjustments for noncash items in the reconciliation of net income to net cash flows from operating activities may include items such as: In other words, these are expenses that are listed in an income statement that do not involve cash payment.

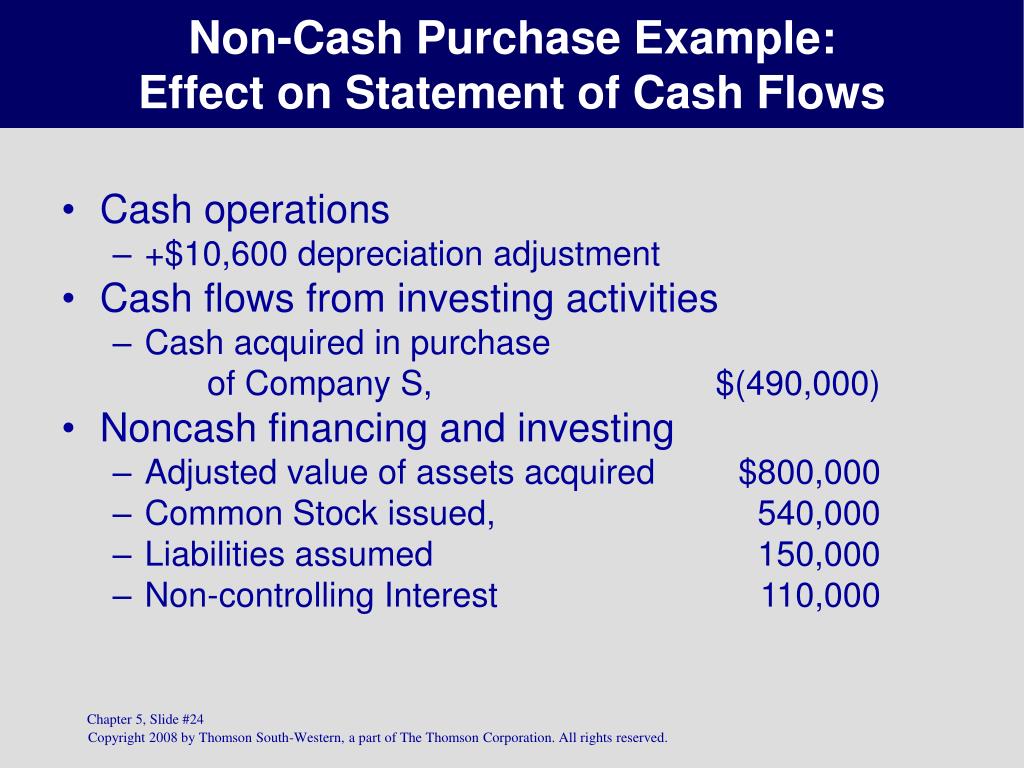

What are the noncash transactions? They are a standard feature of income statements, whose purpose is to account for all of a company's expenses in a given period. (a) the acquisition of assets either by assuming directly related liabilities or by means of a lease;

Statement of cash flows example. The noncash activities may be included on the same page as the statement of cash flows, in a separate footnote, or in other footnotes, as appropriate. Investing and financing activities are also included as sections in the indirect method cash flow statement to reach the ending cash & cash equivalents balance from the balance sheet.

If you are analysing cash flows, a transaction that does not result in an actual cash flow can still matter if your focus is on a cash flow subtotal, such as free cash flow or operating cash flow. Property, plant and equipment resides on the balance sheet. It’s an asset, not cash—so, with ($5,000) on the cash flow statement, we deduct $5,000 from cash on hand.