Best Of The Best Info About Cash Flow Balance

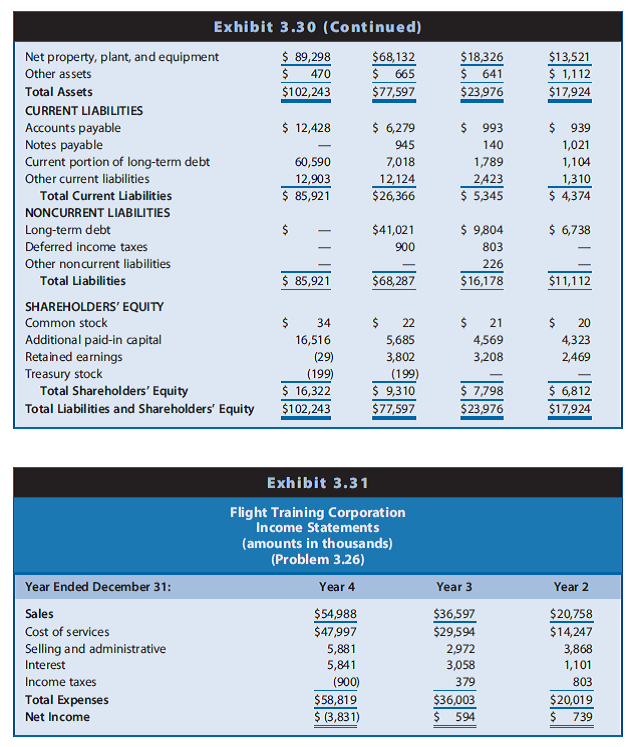

The financial statements are used by investors,.

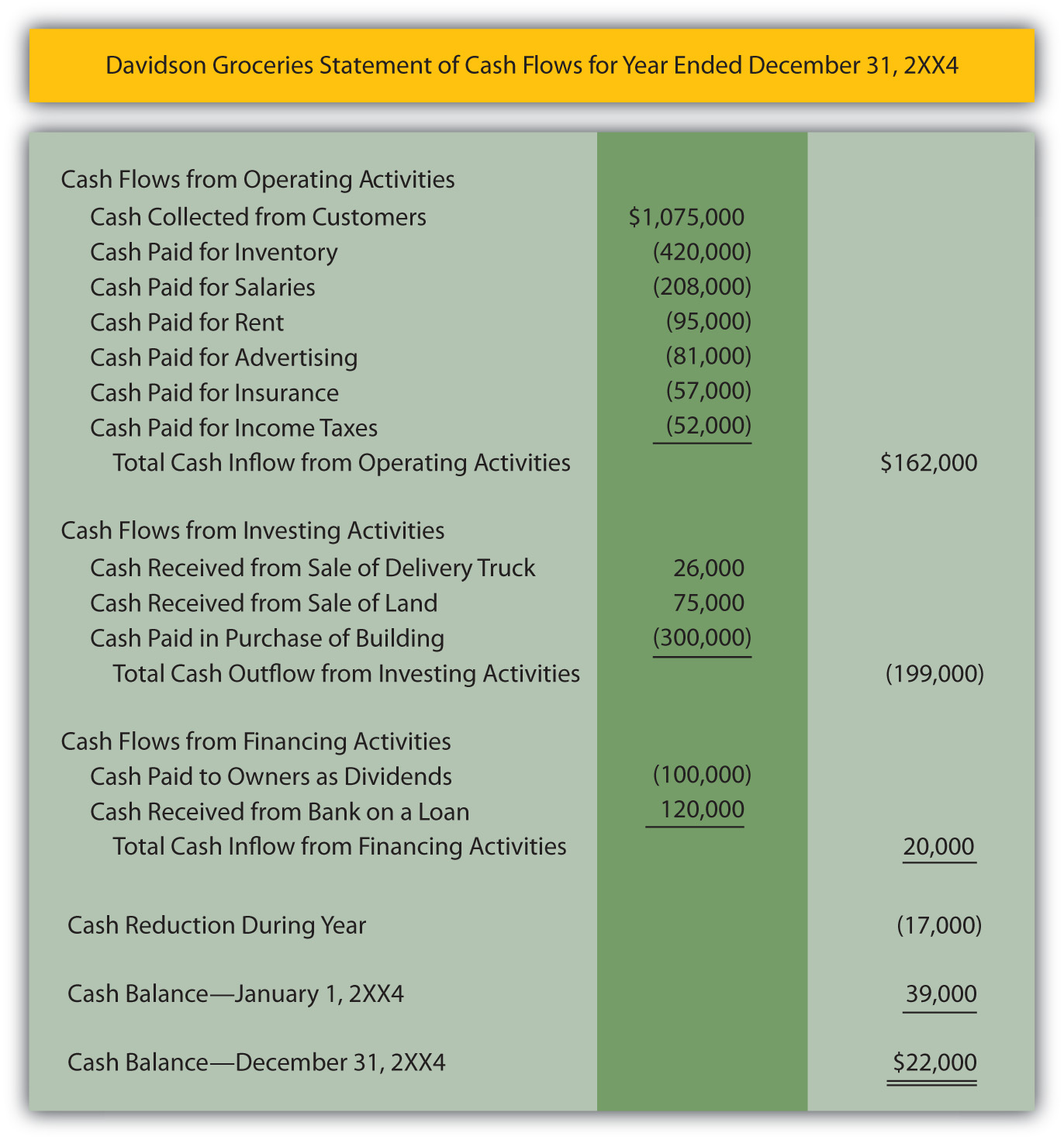

Cash flow balance. You’ll find this on your income statement. Striking a balance between cash flow and growth involves using surplus cash strategically to invest in expansion while maintaining financial stability. The cash flow statement is an important financial statement issued by a company, along with the balance sheet and income statement.

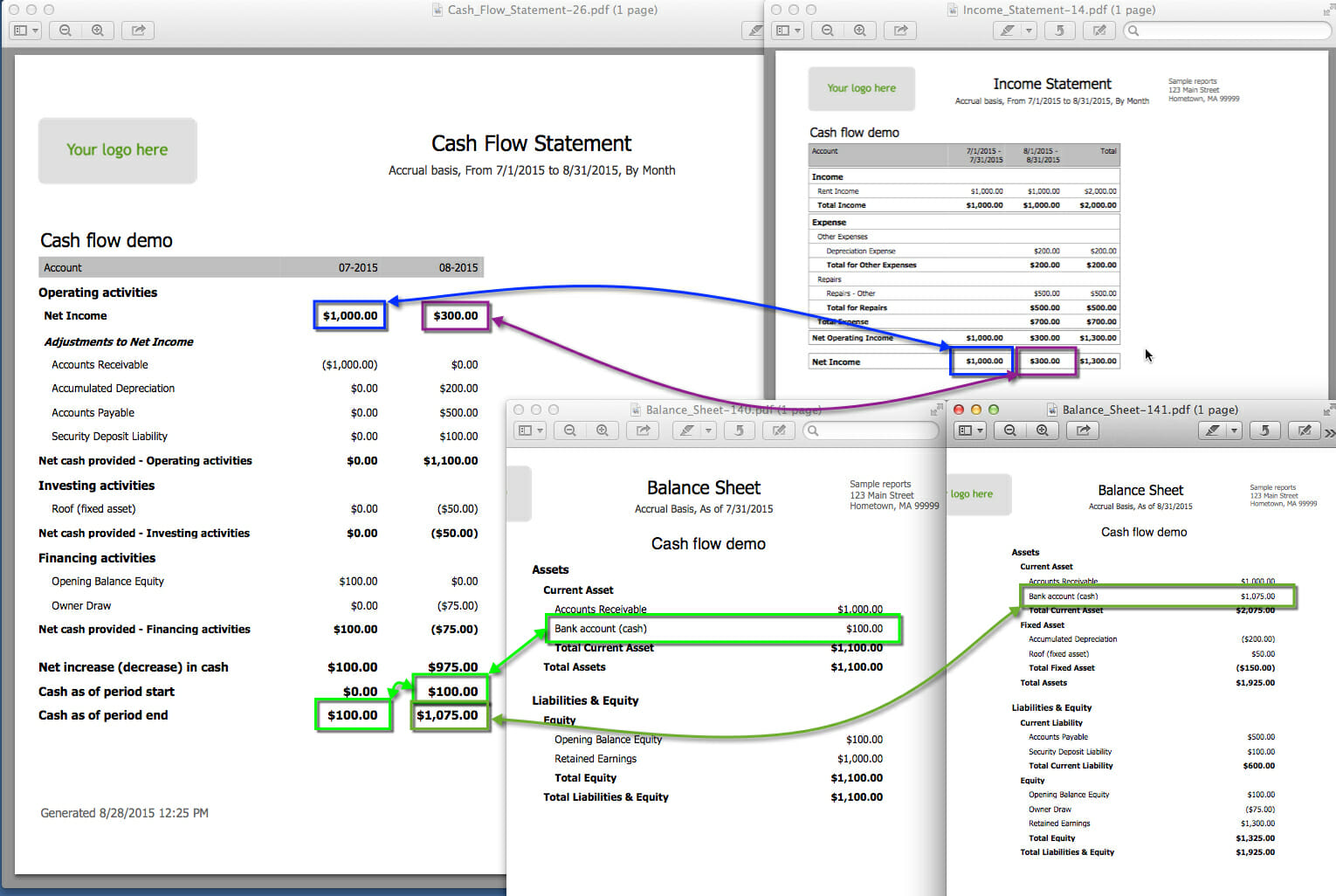

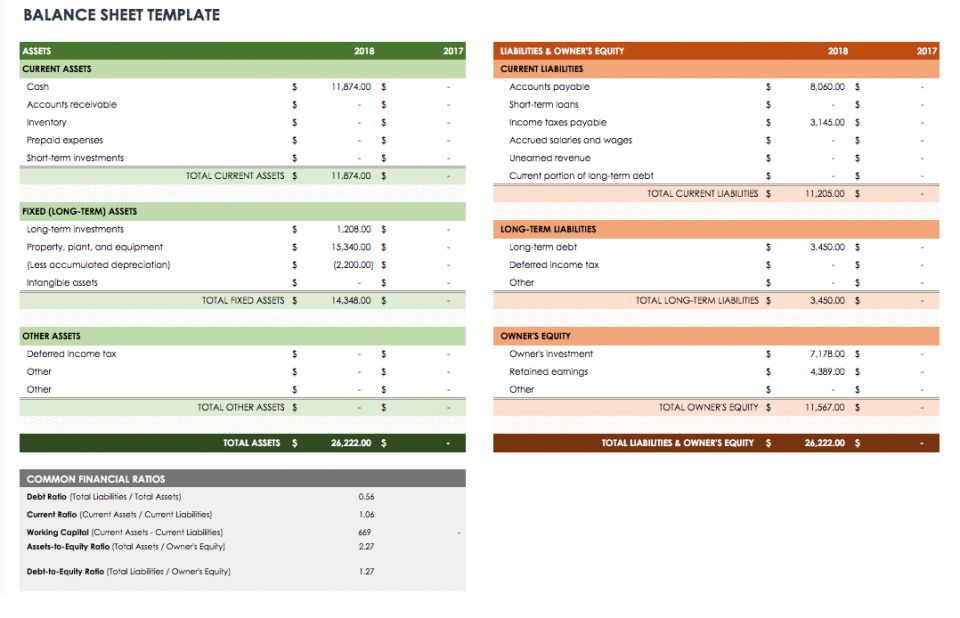

The beginning cash balance is presented from the prior year balance sheet. In our example, it is 92,000 + 101,000 = $193,000. As a reminder, the balance sheet provides a snapshot of the company’s liabilities and assets at a given time.

Updated february 15, 2024 reviewed by natalya yashina fact checked by jared ecker cash flow analysis is an important aspect of a company's financial management because it underscores the cash. It tells you what value your. How do i get my beginning cash balance to be shown in my monthly cash flow report?

Business owners can use it to evaluate performance and communicate with investors. Calculate cash flow from operating activities one you have your starting balance, you need to calculate cash flow. 996 product ideas.

Businesses bring in money through sales, returns on investments, and loans and investments—that’s cash flowing into the business. Cash balance is typically used to pay off debt or is returned to investors as a dividend. On the other hand, the cash flow statement shows the activities that occurred during the period that contributed to any changes in account balances.

The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. Too many people ignore the importance of cash balance or misunderstand how cash flow works. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Present noncash investing and financing transactions. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two.

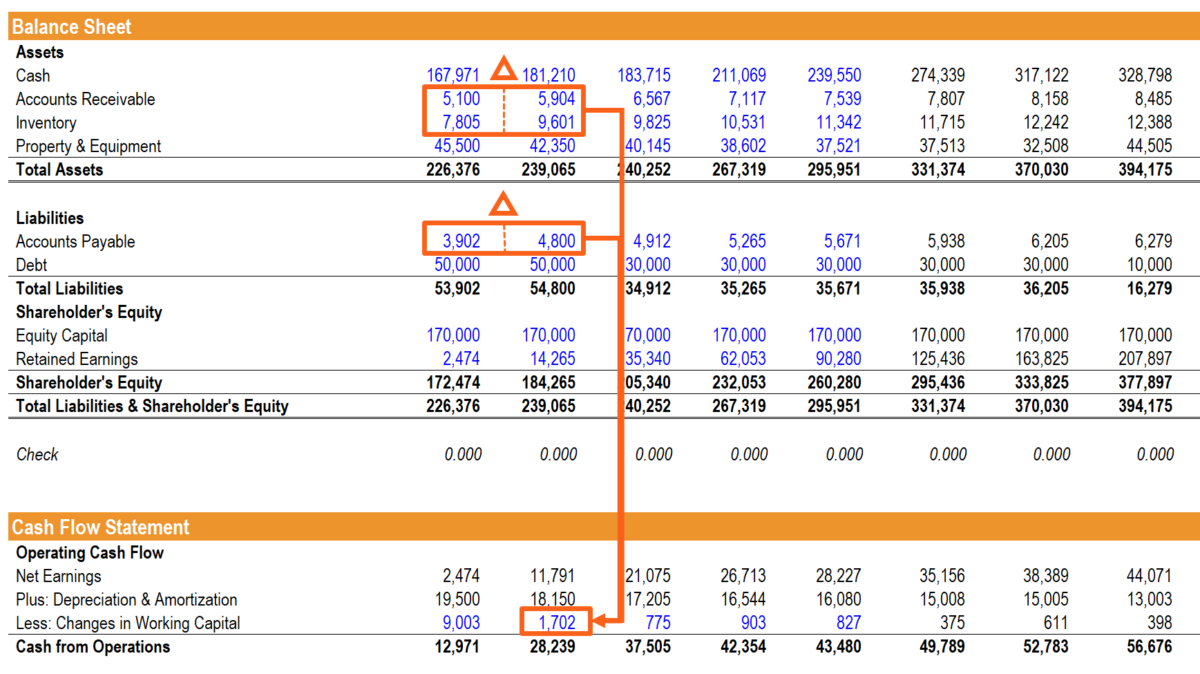

When companies have an excess cash balance, they experience a cash drag and tend to miss out on investment. I will also explain the interconnectivity between the different lines of the cash flow statement and demonstrate why balance sheet accounts and, in particular, net working capital have a central role in making it all work. We can see that the cash movement between the balance sheets is the ending cash balance (75) less the beginning cash balance (30) which, comparing this to the cash flow statement above, is the same as the cash flow (45), so the link.

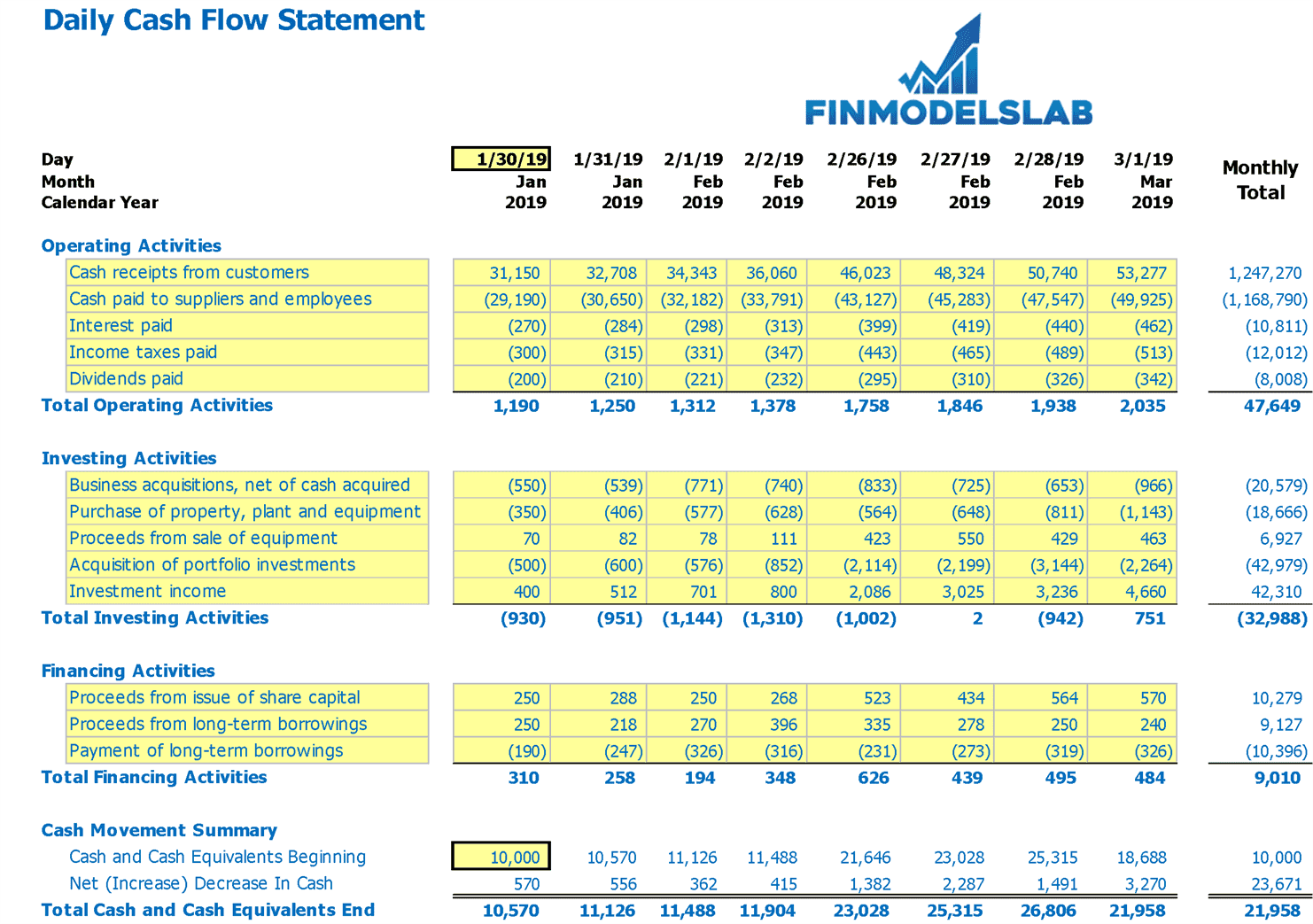

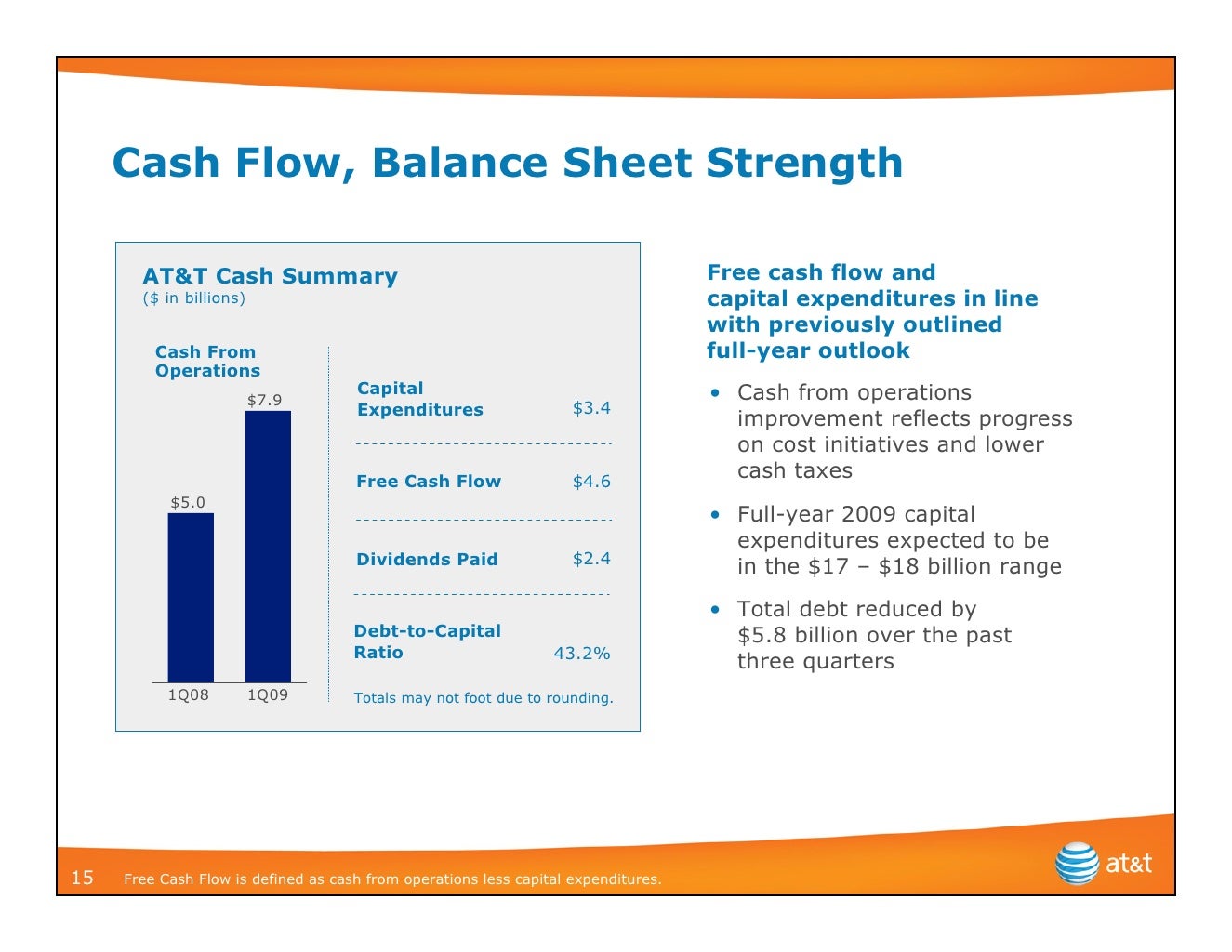

The blue highlighted row shows the beginning and ending cash balances and the cash movement. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements. Free cash flow (fcf) is defined as.

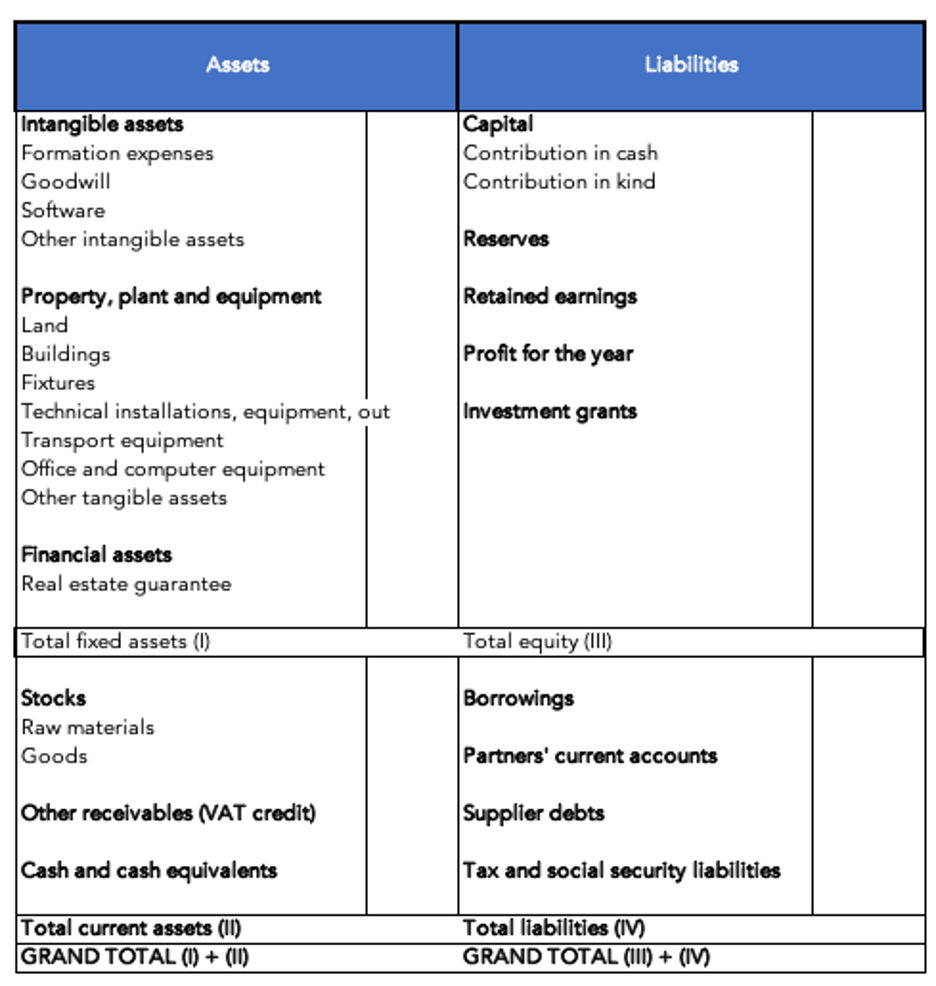

Learn how cash can affect your business processes. The balance sheet on the other hand, is a snapshot showing what the business owns and owes at a single moment in time, i.e. And businesses spend money on supplies and services, utilities, taxes, loan payments, and other bills—that’s.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)