Top Notch Tips About Balance Sheet Recs

The answer is with balance sheet reconciliations.

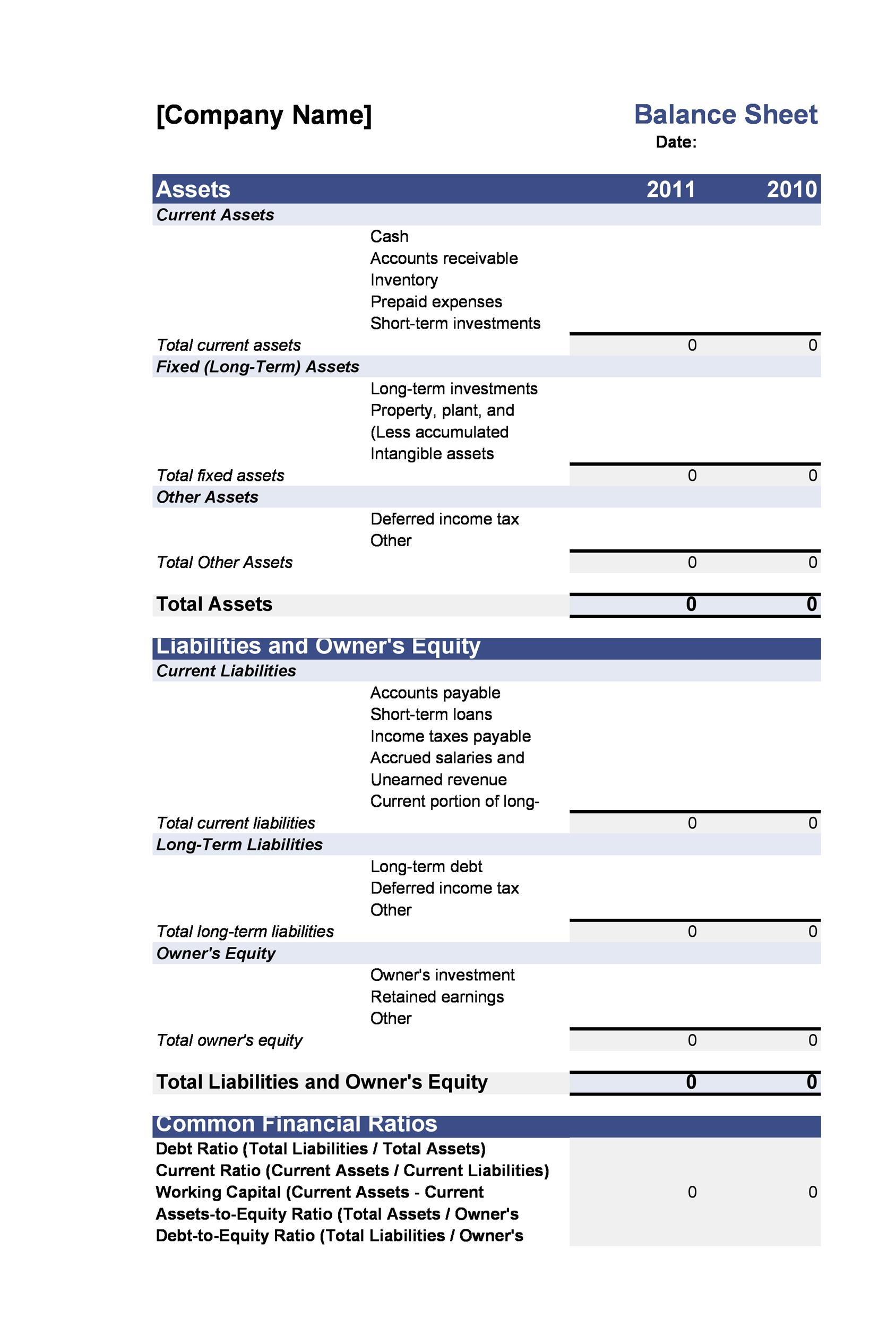

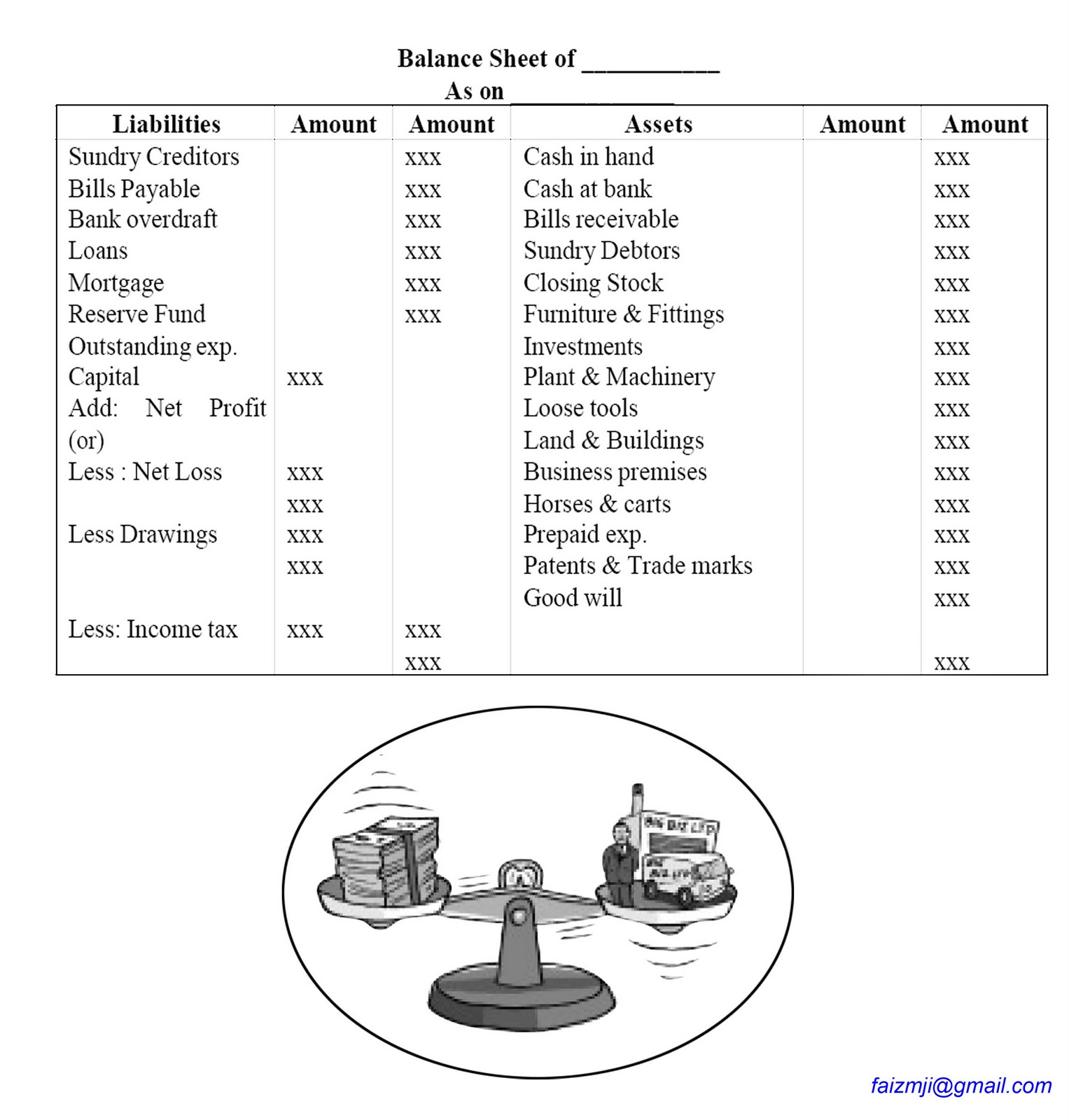

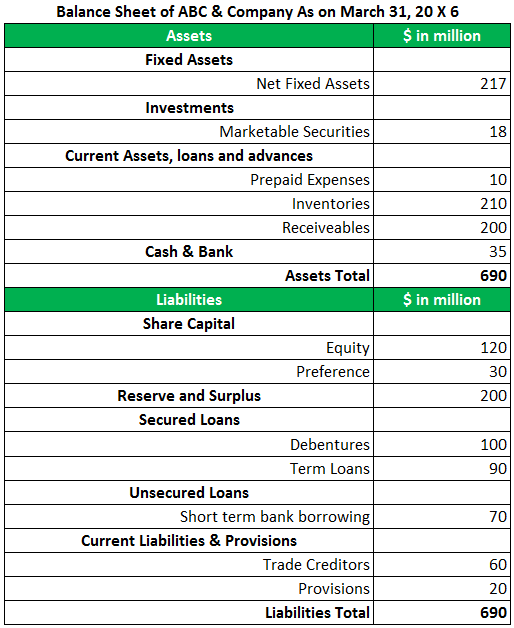

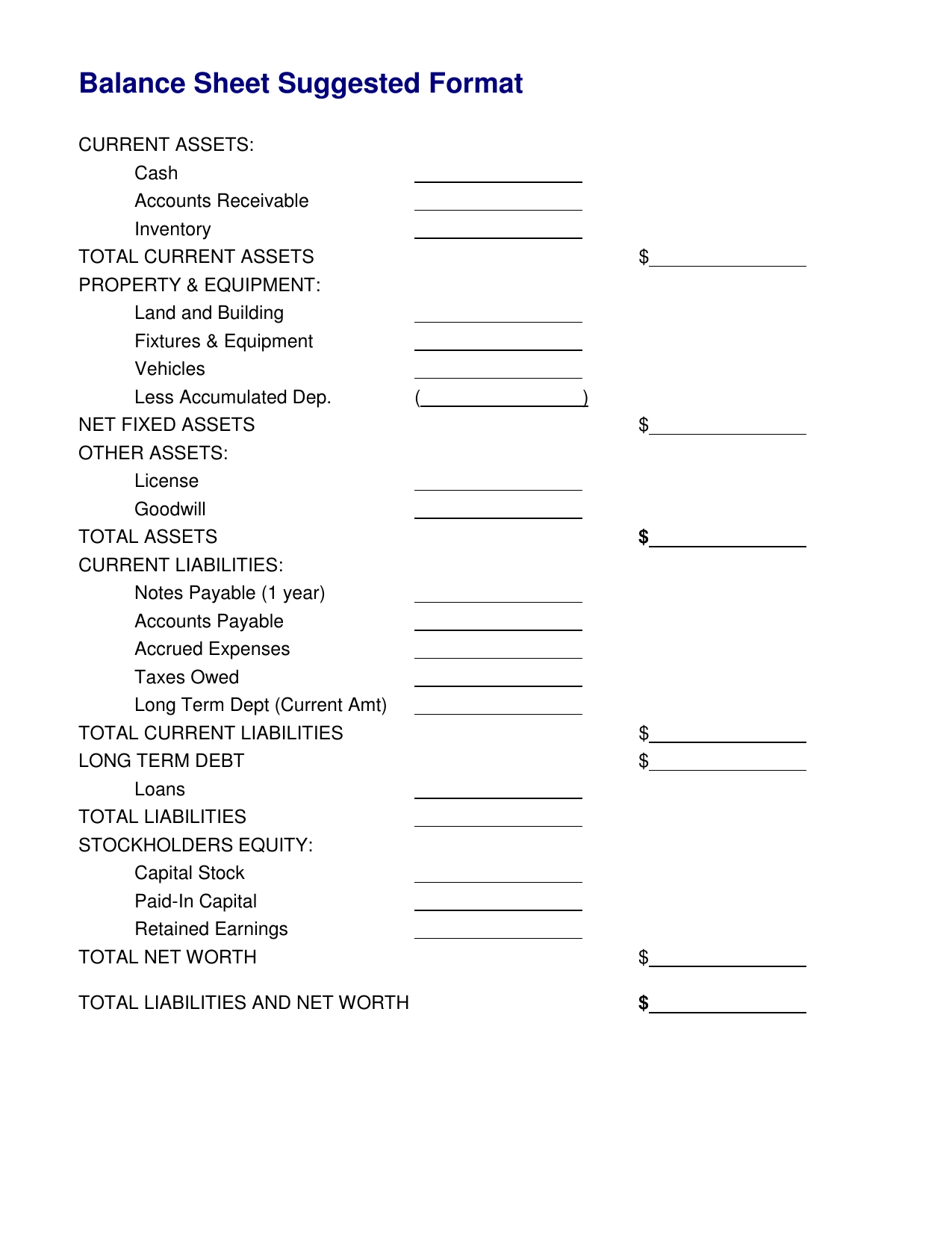

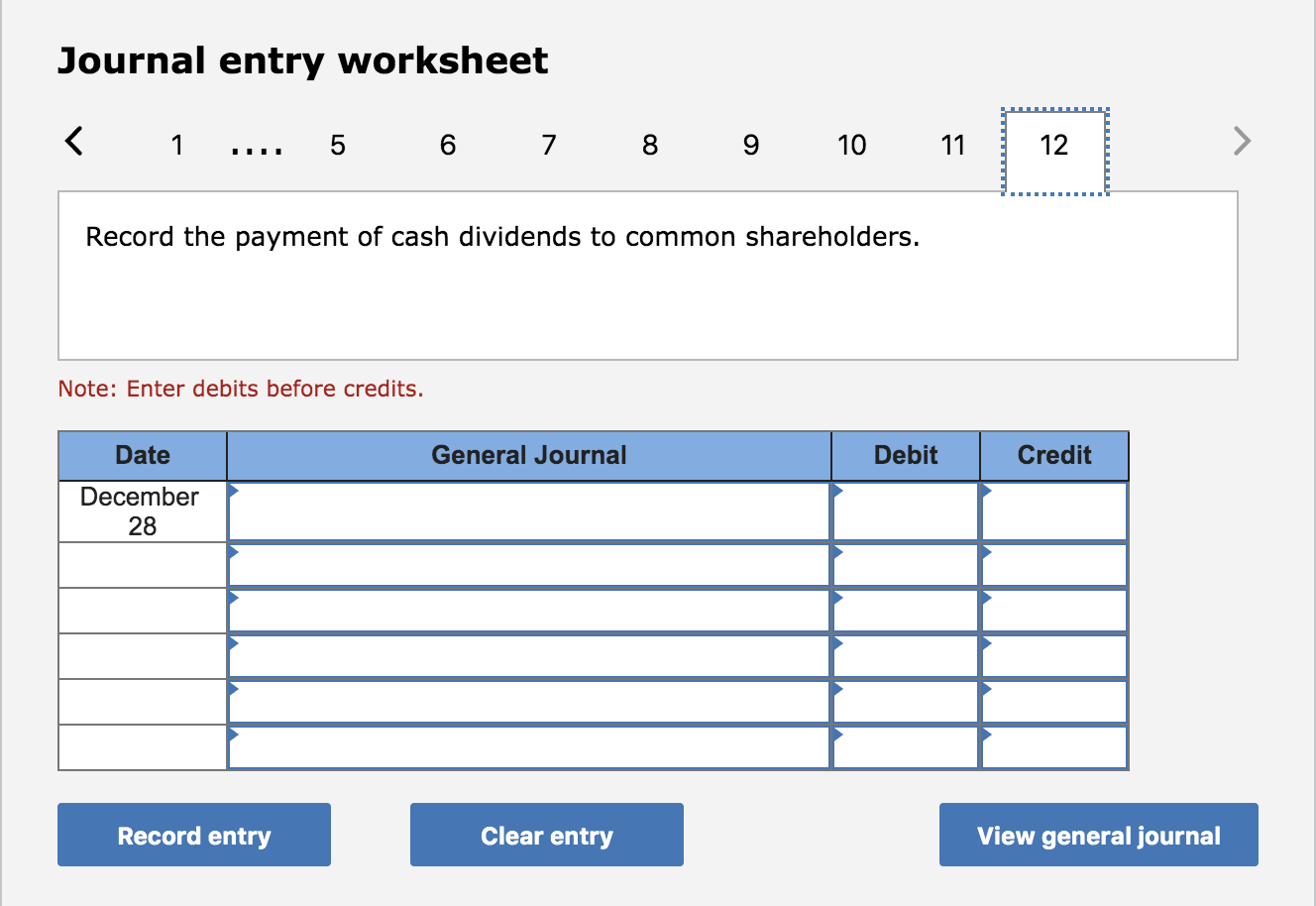

Balance sheet recs. In contrast, the evaluation of whether recs are output is based on a reporting. The financial statement presentation of recs generally follows the nature of the utility’s activities. Balance sheets list assets and liabilities, and every transaction must be categorised as one or the other.

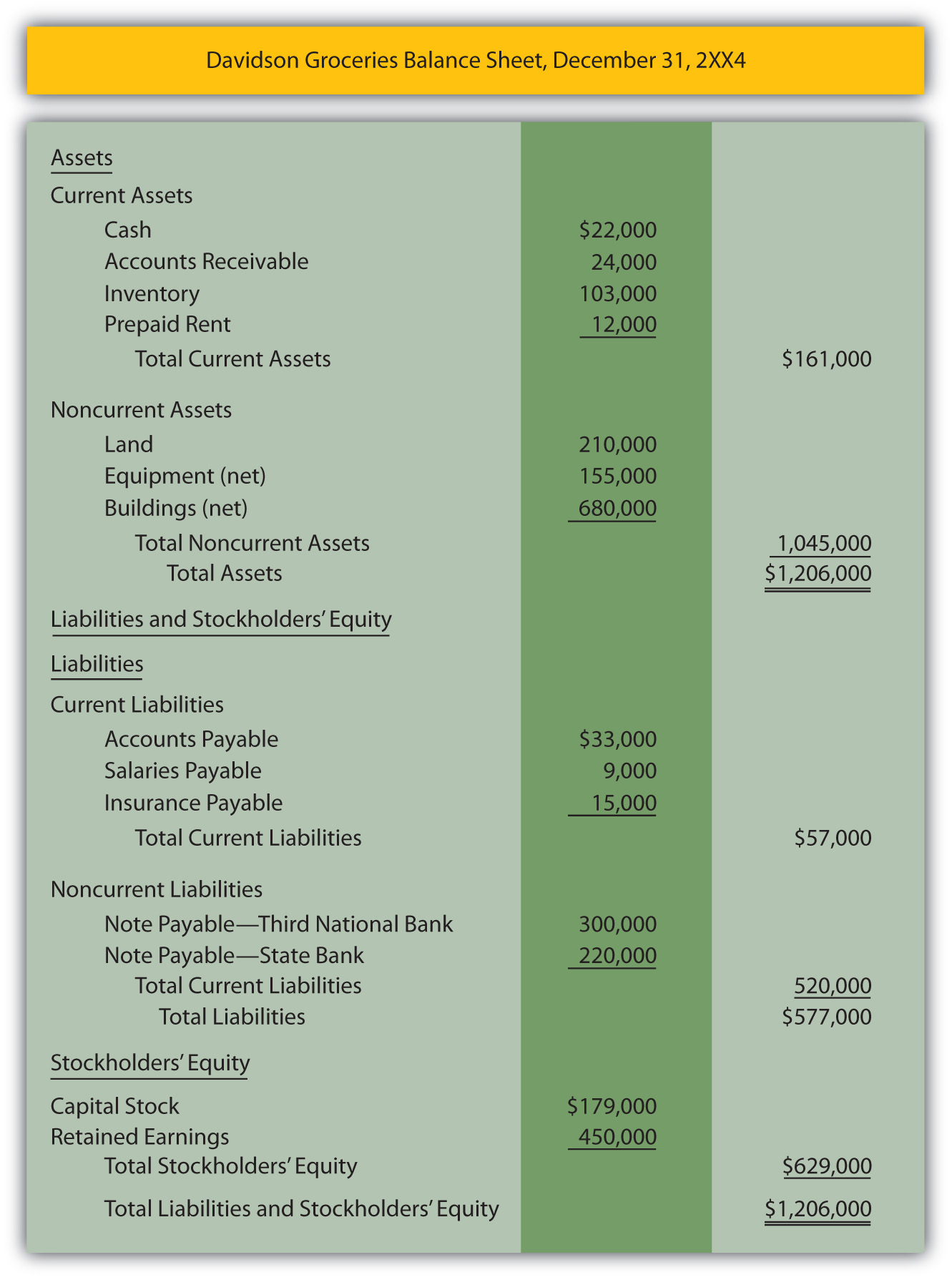

We’re here to explain why reconciling your balance sheet regularly is vital for avoiding costly mistakes. A thorough and balanced analysis of both quantitative and qualitative factors of each individual account is required to place each account into a high, medium, or low risk rating. Your balance sheet gives you a quick view of your business’s assets (what you own) and liabilities (what you owe).

Balance sheet reconciliations are a key component of regular accounting to ensure that your transactions are correct. It also tracks owner and shareholder investments (equity), but that’s less important for most small businesses to keep an extremely close eye on. In short, the balance sheet is a financial statement that provides a.

It’s the fundamental accounting equation. Recs held for sale are generally classified as inventory while recs held for use may be classified as inventory or intangible assets. It summarizes a company’s financial position at a point in time.

Learn how blackline account reconciliations can help your organization. As discussed in up 7.3.1, the balance sheet classification of recs is primarily based on the reporting entity’s intended use: Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure.

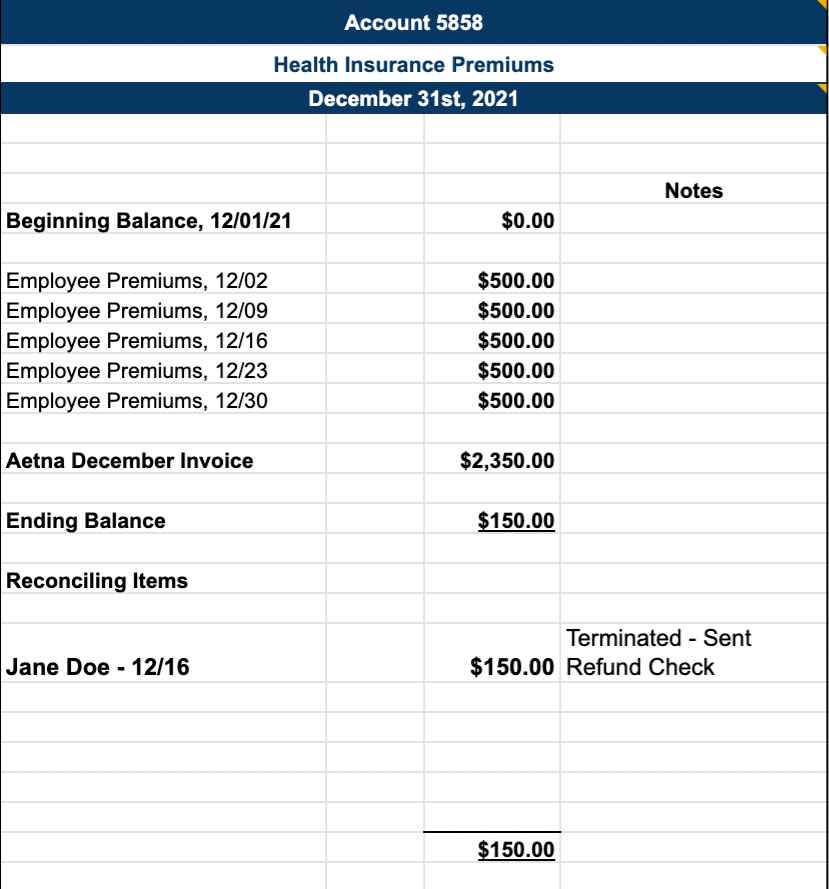

What is a balance sheet reconciliation? Assign specific individuals to specific accounts. But how do you check that your assets, liabilities, and equity are correct?

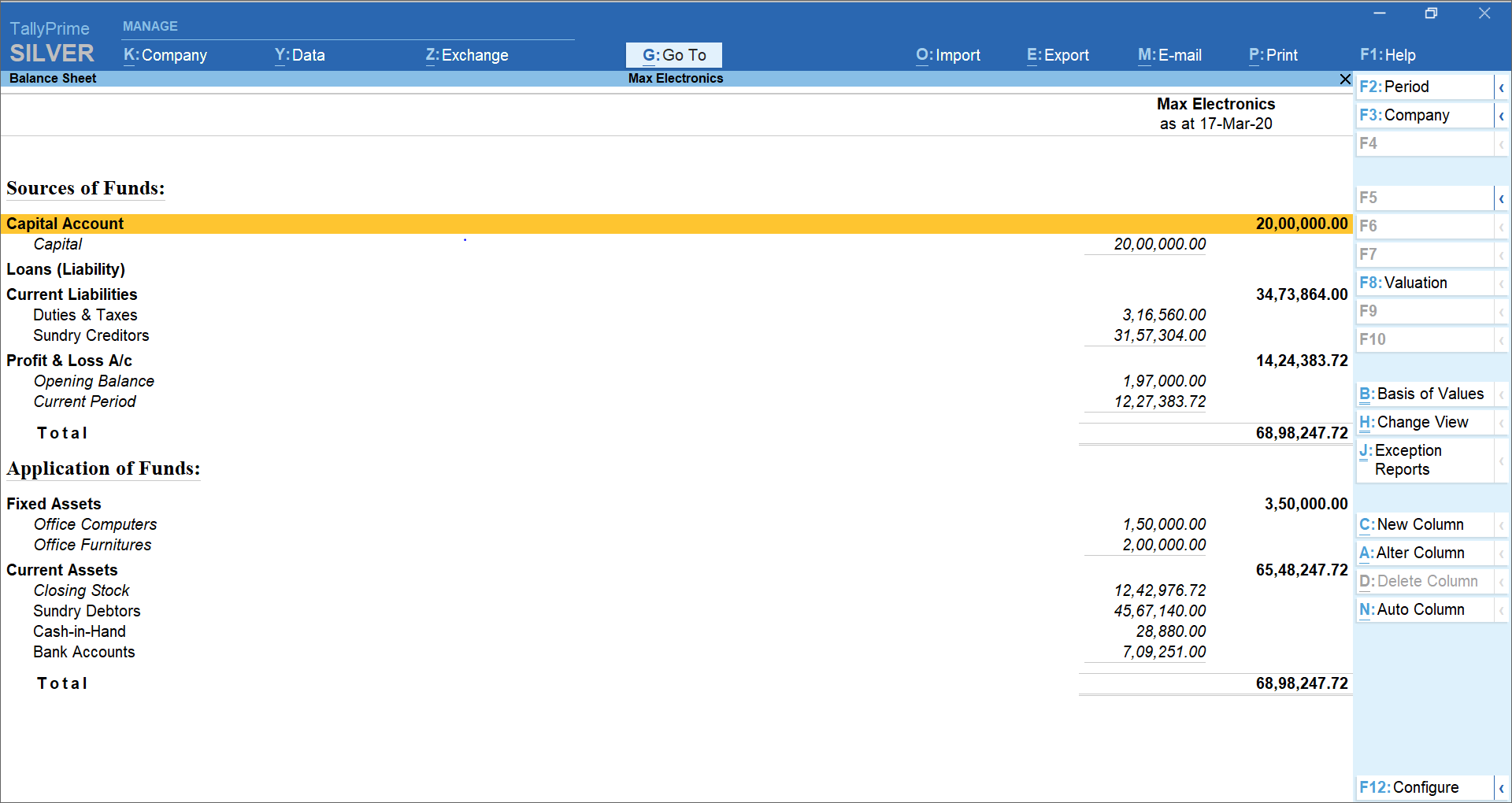

They help you detect issues such as missing transactions or failure of controls or process. Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances, while also ensuring that any differences between the two are adequately and reasonably explained. Ultimately, the risk rating of the account.

Oct 16, 2023 michael whitmire total assets = total liabilities + total equity. 100,000+ accountants and 1,000+ companies perform their balance sheet account reconciliations in blackline. Reconciling your balance sheet lets you verify that all of your entries are recorded and classified correctly.

Before the closing process can typically begin, the information in the general ledger is verified against some type of supporting schedule or document. Balance sheet reconciliation is the process of ensuring your balance sheet information is accurate. It helps identify errors, omissions, and discrepancies in financial records, preventing inaccuracies in.

The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. It is one component of the accounting close cycle. What is a balance sheet reconciliation?