Wonderful Tips About Debt Equity Ratio Calculation Formula

A higher d/e ratio means.

Debt equity ratio calculation formula. Debt to equity ratio formula. This means that tesla had $1.01 of debt for every $1.00 of equity. Here’s what the debt to equity ratio formula looks like:

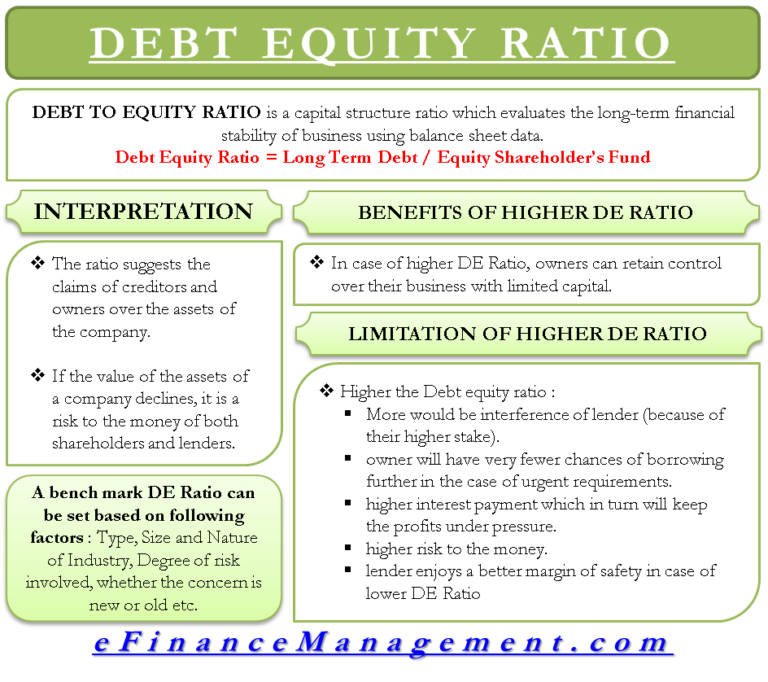

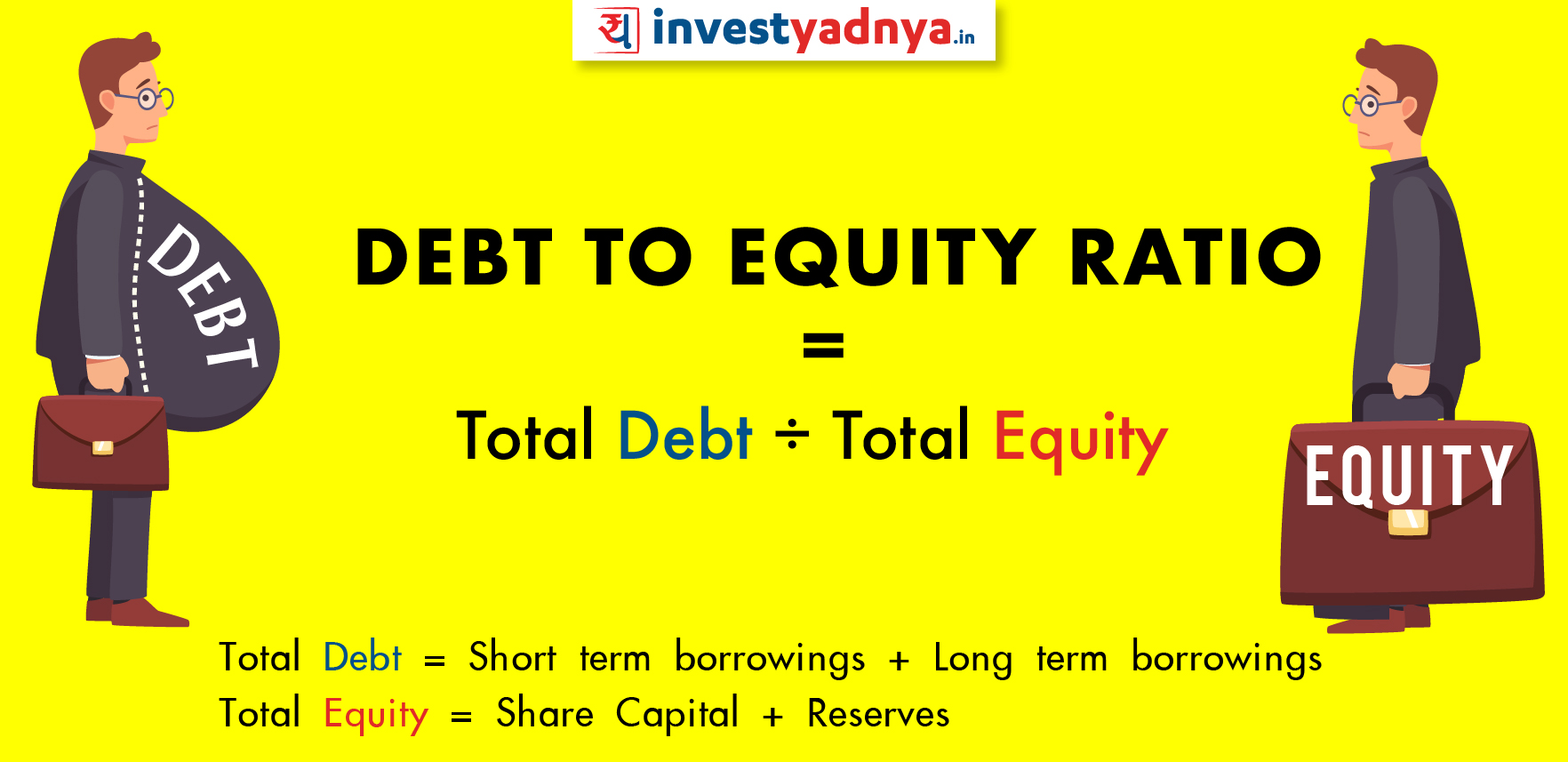

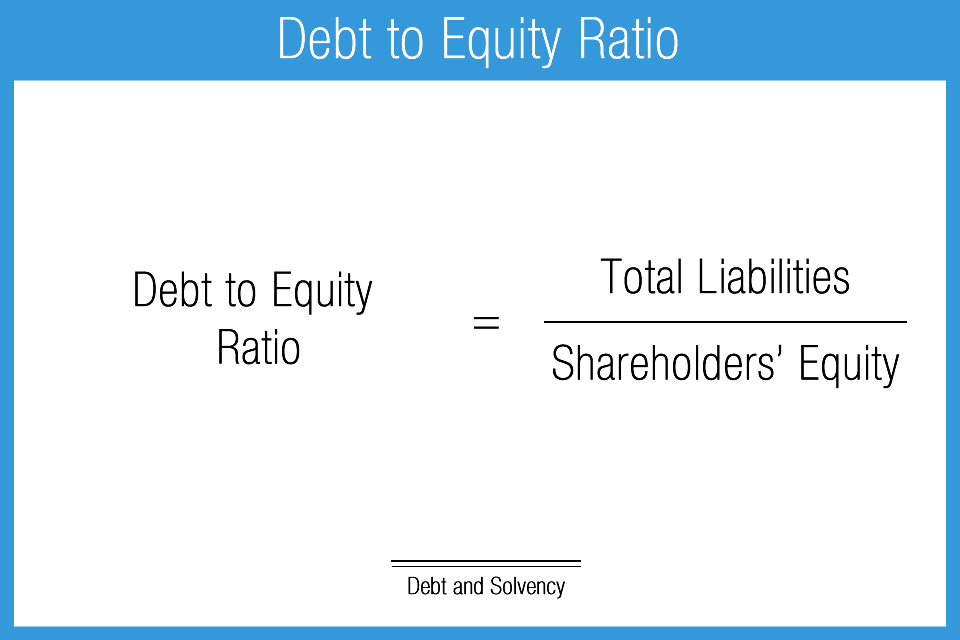

Although it is a simple calculation, this ratio carries substantial weight. Debt to equity ratio formula is calculated by dividing a company’s total liabilities by shareholders’ equity. We can write it in two ways:

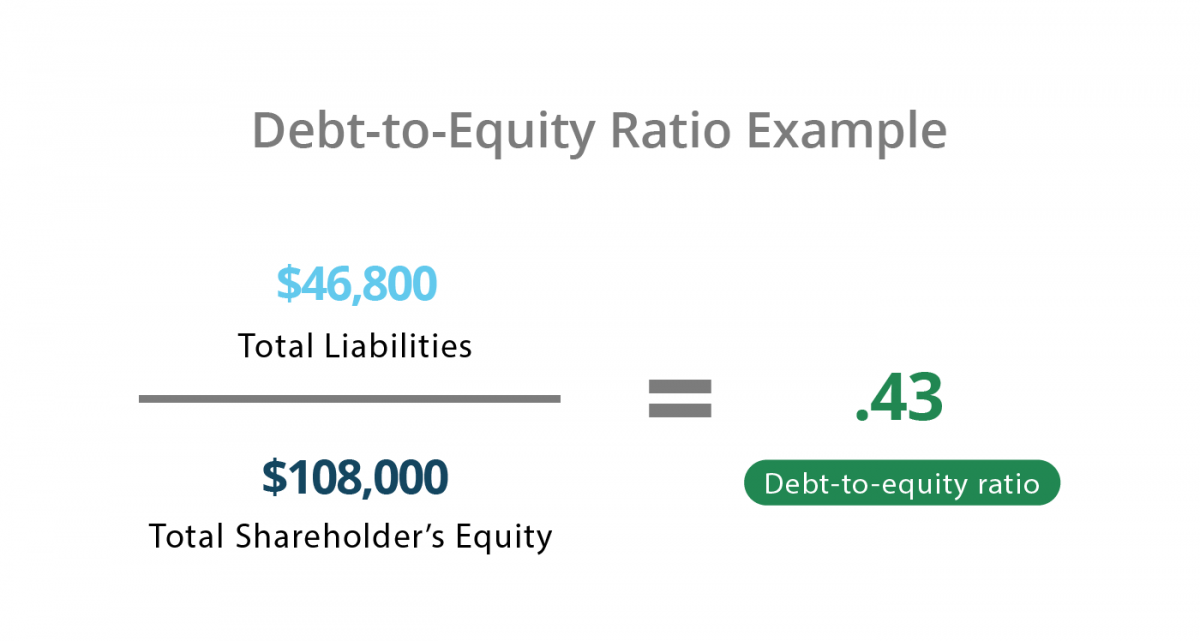

Debt to equity ratio = ₹ (12,00,000+15,00,000) / ₹37,00,000 = 0.729 a d/e ratio equal to 1 indicates that the investors and creditors are on equal footing as far as the company assets are concerned. The d/e ratio is a good way to measure a company's leverage. Debt to equity ratio = total debt / shareholders’ equity.

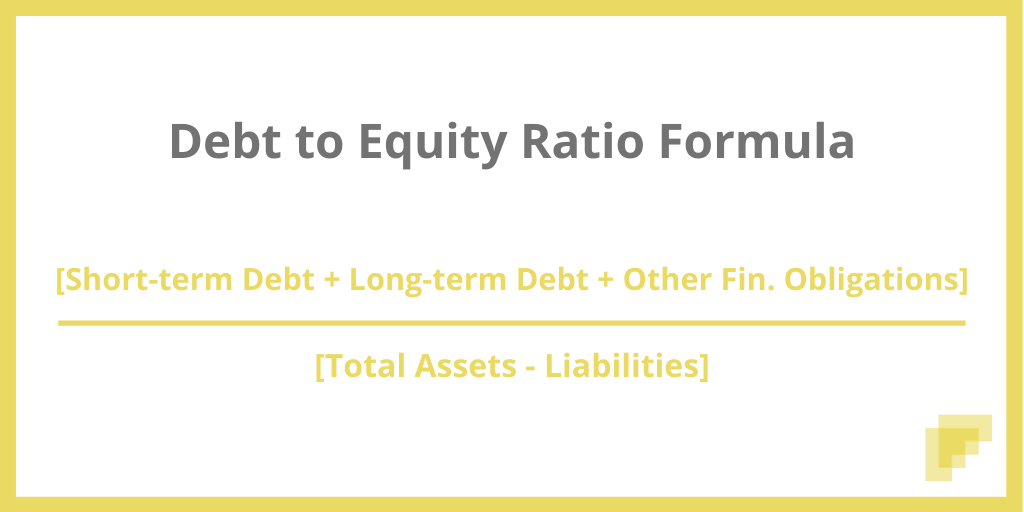

Debt to equity ratio = (short term debt + long term debt + fixed payment obligations) / shareholders’ equity. Here, all the liabilities that a company owes are taken into consideration. And in the denominator, we will consider shareholders’ equity.

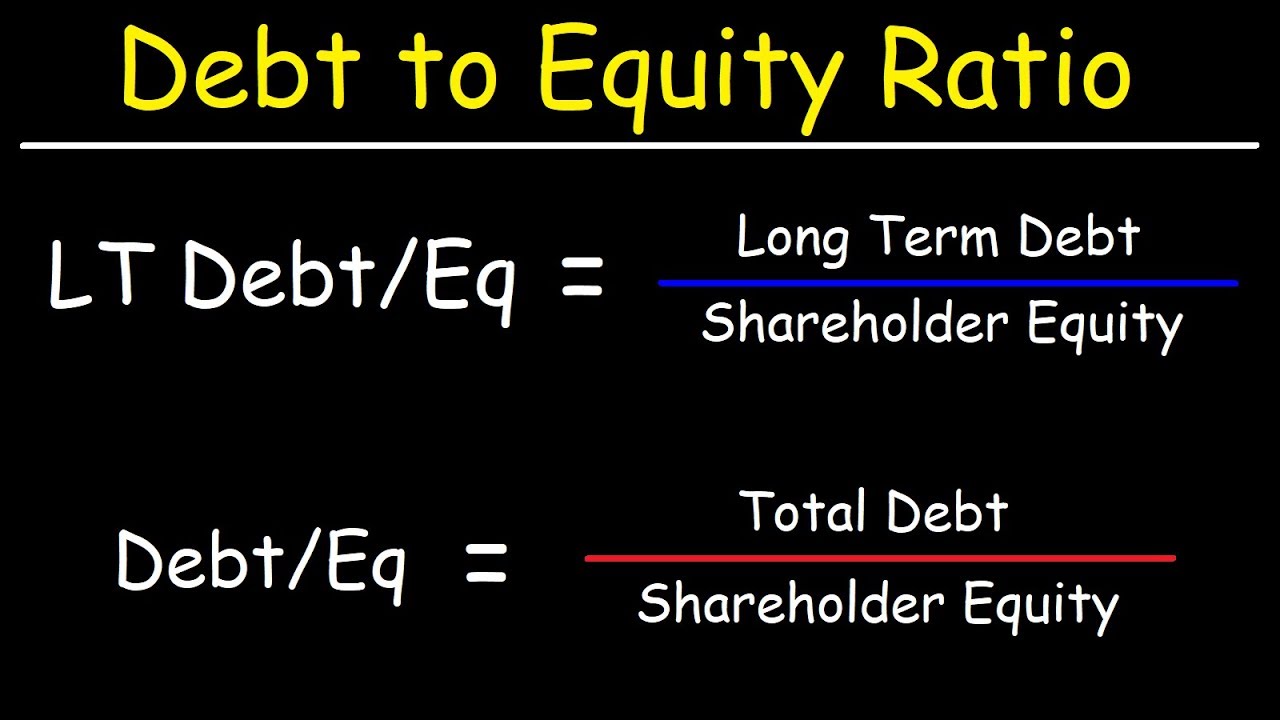

A d/e ratio greater than 1 which is, in this case, indicates a levered firm which is quite preferable. Total liabilities/ equity: Debt to equity ratio = total debt/shareholders' equity.

Using the formula above, the d/e ratio of tesla will be: Debt to equity ratio = total debt / total equity where, total debt: The d/e ratio is calculated by dividing total debt by total shareholder equity.

Debt to equity ratio calculations: Total equity = shareholder’s equity advertisement Considers the total amount of the company's obligations and is the easiest to calculate as the necessary information is available on the company's balance sheet, and no adjustments are necessary.

Debt to equity ratio (d/e) = total debt / total shareholder’s equity what does the value of debt to equity ratio interpret? Has total liabilities of rs 3,000 crore. The debt to equity ratio formula is as follows:

Debt to equity ratio = total liabilities / shareholders' equity. Debt to equity ratio formula (d/e) total debt = $200 million shareholders’ equity = $100 million The formula for the debt to equity ratio is total liabilities divided by total equity.

Both debt and equity will be found on a company's balance sheet. D/e = total liabilities / shareholder equity Shareholder’s equity represents the net assets that a company owns.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)