Breathtaking Info About Best Financial Ratios For Investors

Price to earnings (pe) ratio 2.

Best financial ratios for investors. For added confidence, a combination of ratios and tools can provide a more complete picture of potential investments. 19 most important financial ratios for investors a) valuation ratios 1. This means investor's are paying $29 per $1 of the company's earnings.

The formula for calculating the gross margin ratio is: What are the main uses of financial ratios? Updated jan 27, 2024 frequently asked questions why are financial ratios critical in financial analysis?

In general, investors usually want to know which one is a good company to invest their money in, in accordance with their risk appetites. Shareholders) own free and clear. Profitability, solvency, liquidity, turnover, coverage, and market prospects ratios.

*stock prices used were the afternoon prices. Dividend payout b) profitability ratio 8. Analysis of financial ratios serves two.

Price to sales (p/s) ratio 6. P/b ratio = price per share / book value per share. Earnings per share (eps) 2.

The most important investment ratios 1. This number tells you how much a company earns in profit for each. From stock ratios to investor ratios, our expert guide walks you through 20 of the most important financial ratios to analyze a company.

Return on assets (roa) 9. Return on equity (roe) 11. This ratio can tell you if the company is undervalued or overvalued in the market.

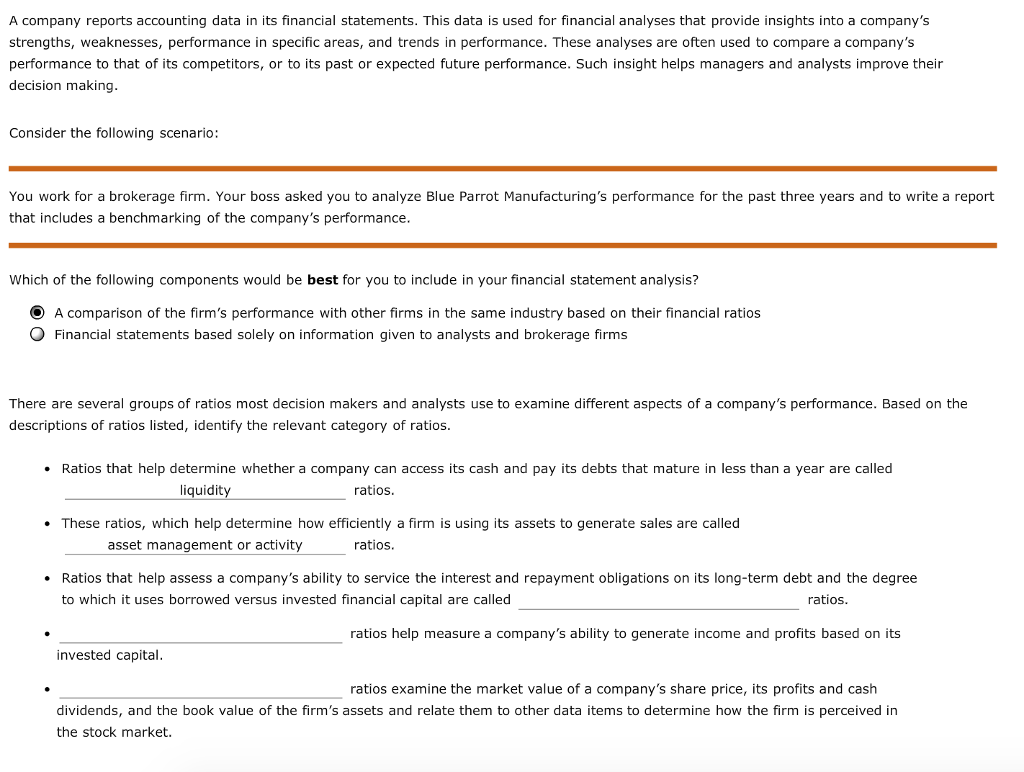

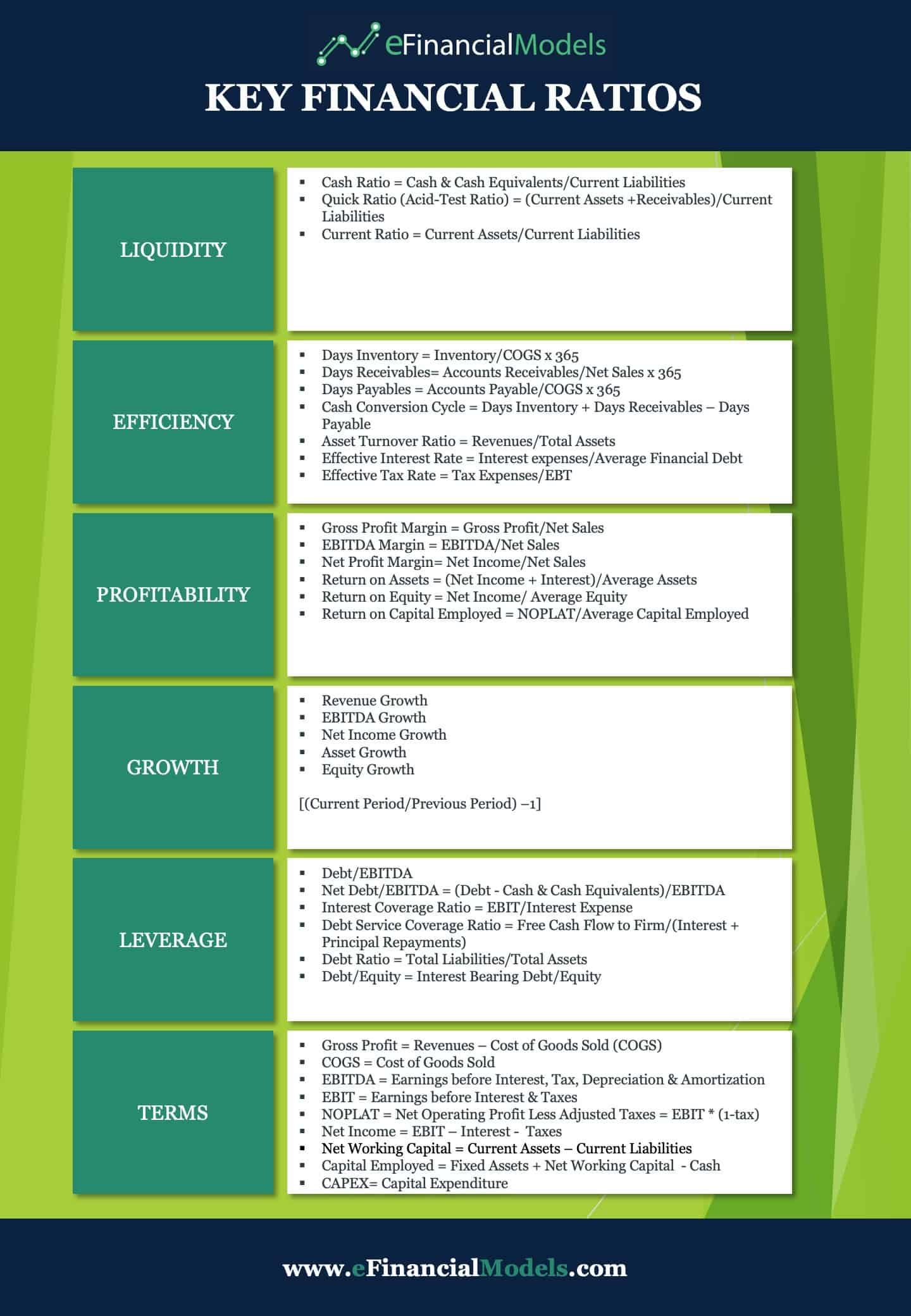

Financial ratio analysis is often broken into six different types: The deal could inject some $300 million into the company. For example, suppose a company has a revenue of $500,000 and a cost of goods sold of $300,000.

Open an account 2 interactive brokers low commission rates start at $0 for u.s. There are six basic ratios that are often used to pick stocks for investment portfolios. Debt to equity (d/e) debt to equity or d/e is a leverage ratio.

Al hill financial ratios overview investors use financial ratios to investigate a stock’s health before investing. Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. Price to book value (p/bv) ratio 3.