Impressive Tips About Is Bad Debt Expense On Income Statement

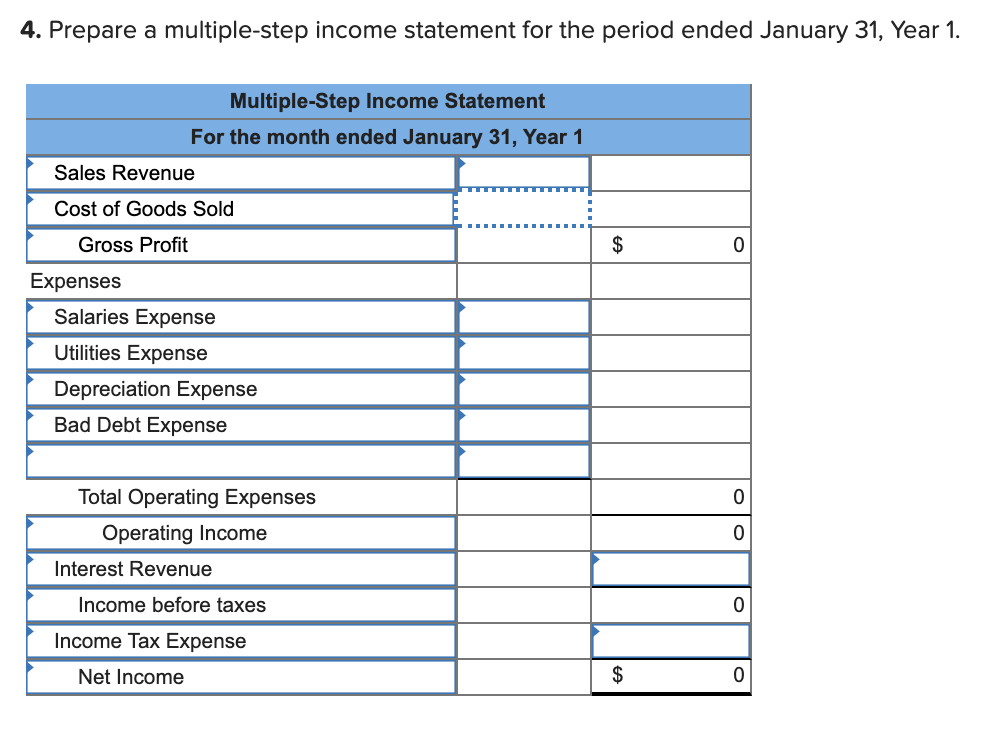

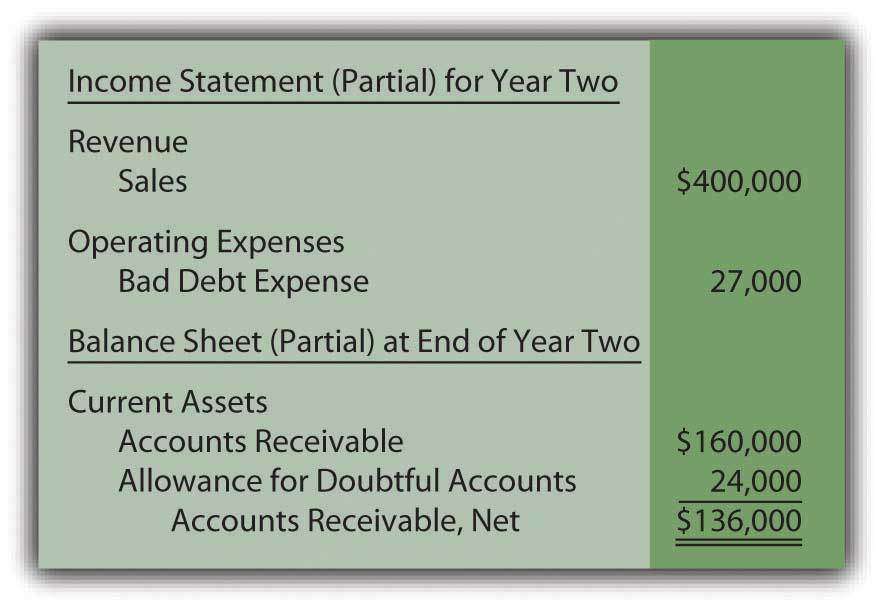

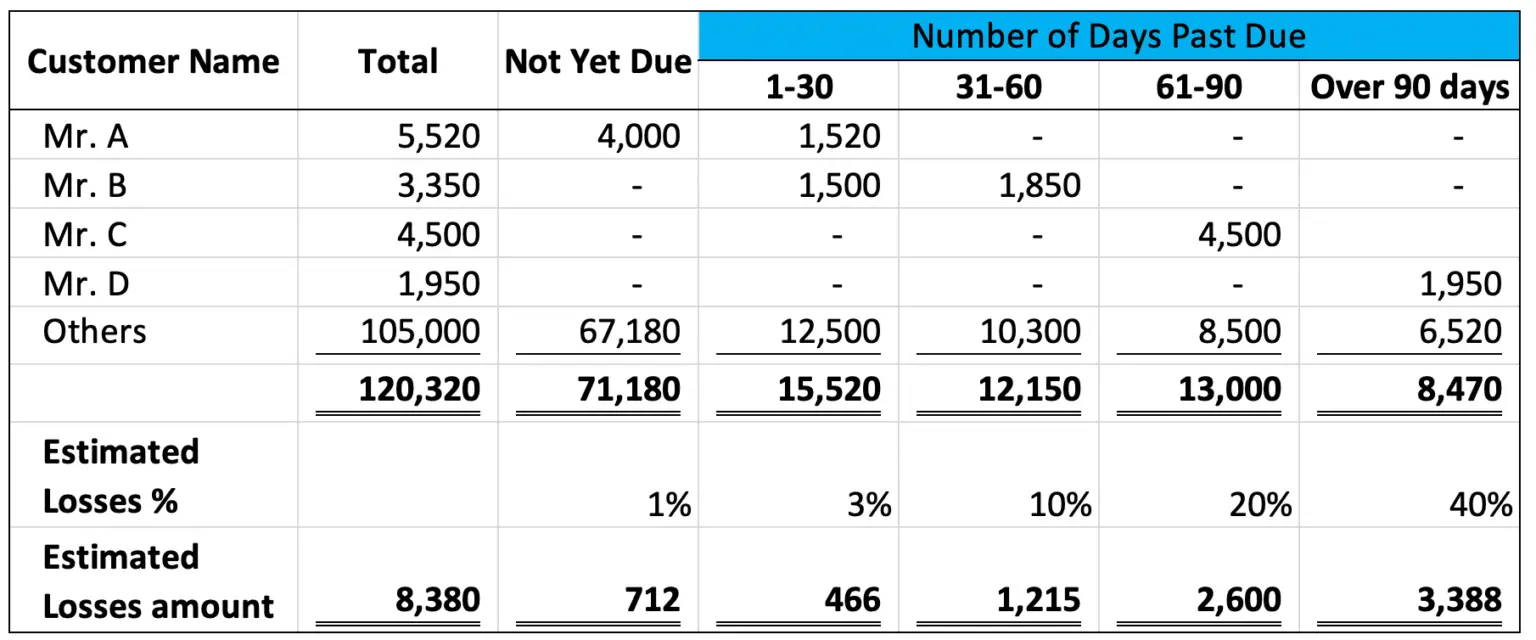

If your company’s bad debt exceeds the original estimate, you’ll be required to list it as a bad debt expense on your income statement.

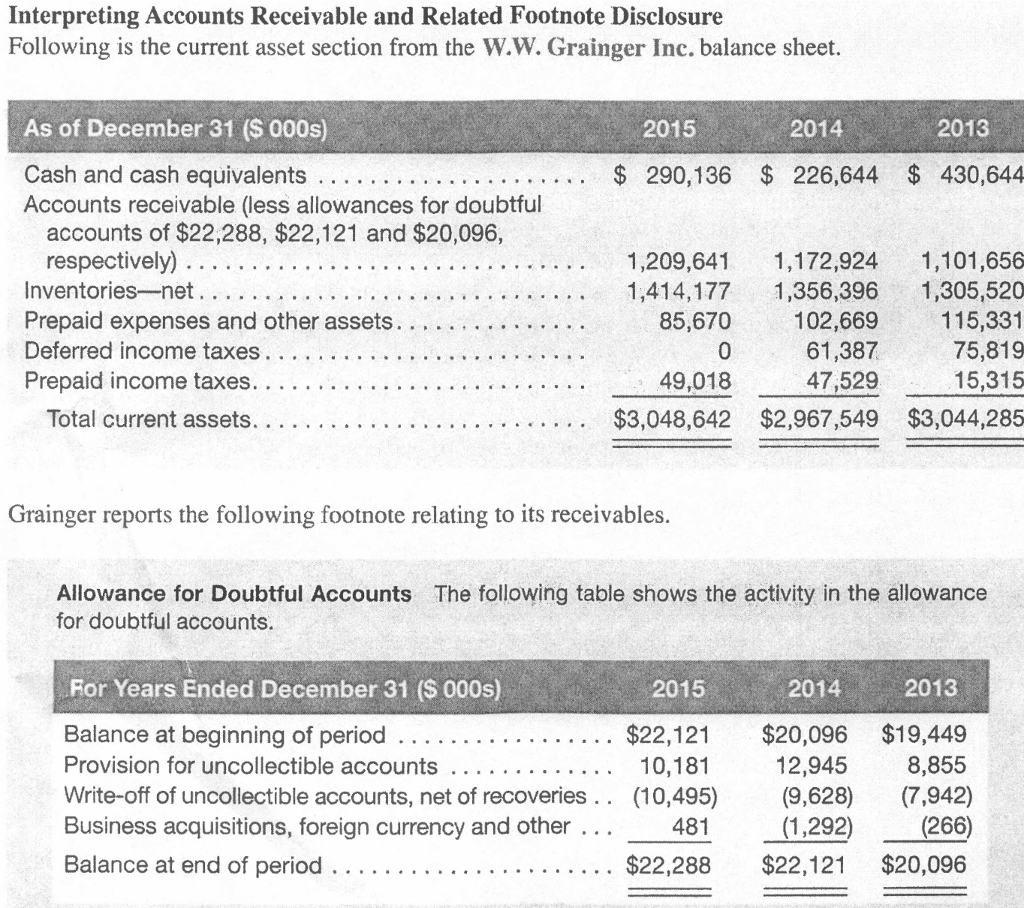

Is bad debt expense on income statement. It is not considered a. The percentage of sales method is an income statement approach, in which bad debt expense shows a direct relationship in percentage to the sales revenue that the. What is bad debts expense?

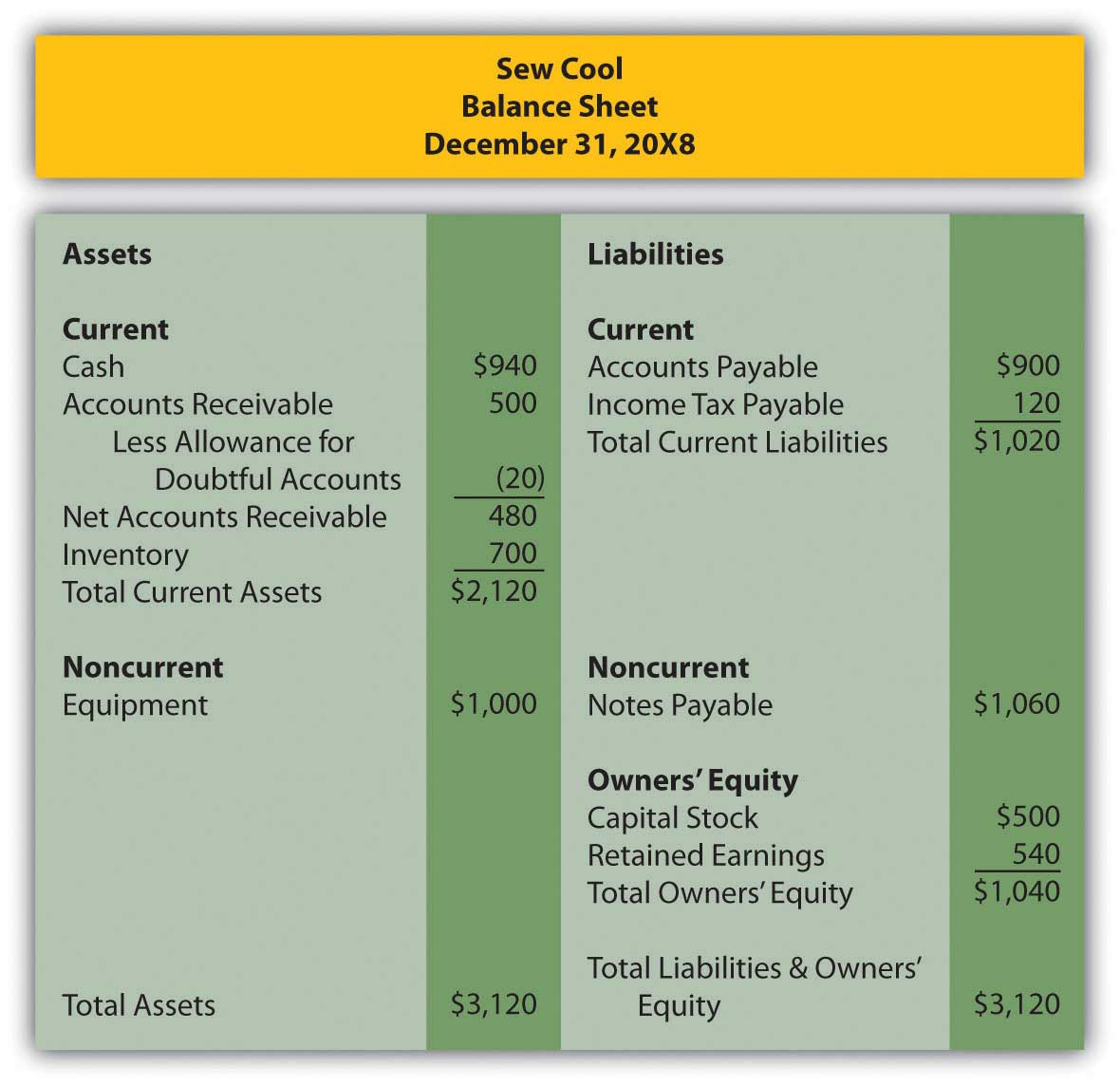

Bad debts expense is related to a company's current asset accounts receivable. The income statement method (also known as the percentage of sales method) estimates bad debt expenses based on the assumption that at the end of the period, a certain. Not that bad debt expense on income statement is not considered a direct cost of sales.

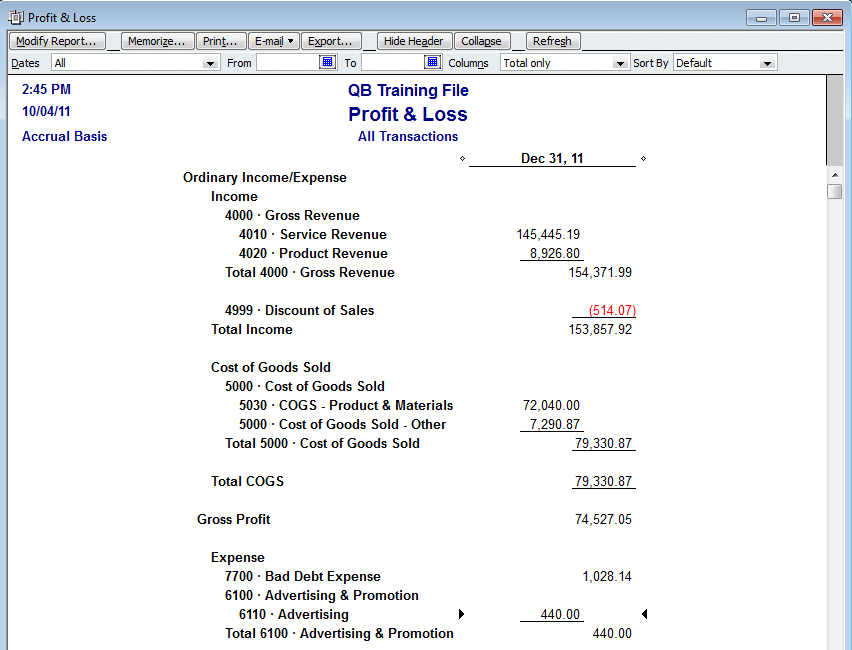

The bad debt expense is recorded in a line item on the income statement within the operating expenses section, which is located on the lower half of the income statement. This article delves into bad debt expense, how. Bad debt expenses are usually categorized as operational costs and are found on a company’s income statement.

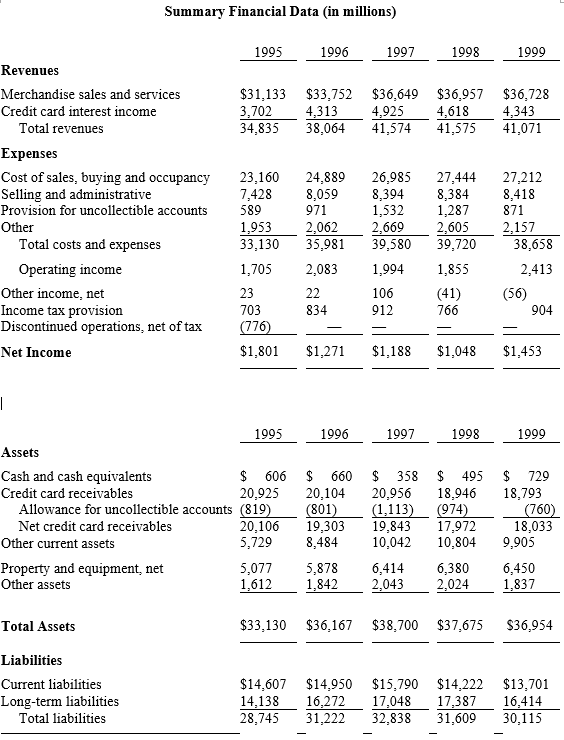

Accountants record bad debt as an expense under sales, general, and administrative expenses (sg&a) on the income statement. The bad debt expense appears in the income. With respect to financial statements, the seller should.

Bad debt expense is something that must be recorded and accounted for every time a company prepares its financial statements. Yes, bad debts are recorded in the income statement. The income statement records bad debt as an expense and reduces the company's net income.

One should also note that the bad debt reserve and. Recording uncollectible debts will help keep. The current period expense pertaining to accounts receivable (and its contra account) is recorded in the account bad debts expense which is reported on the income.

Effect on the income statement. Bad debt expenses are classified as operating costs, and you can usually find them on your business’ income statement under selling, general & administrative costs (sg&a). Bad debts get recorded on a company's income statement.

Bad debt expense is a critical aspect of accounting that affects a business's balance sheet and income statement. Bad debts expense is also. The bad debt expense appears in a line item in the income statement, within the operating expenses section in the lower half of the statement.

Bad debt expense is a key variable on a company’s income statement as it directly influences reported revenue and net. The amount reported in the income statement account bad debts expense pertains to the estimated losses from extending credit during the period shown in the heading of the. Definition of bad debts expense.

This can have a negative impact on the company's profitability and may cause. Because a bad debt expense is comparable to other business expenses, it will be recorded in the general ledger. A credit loss or bad debts expense on its income statement, and a reduction of accounts receivable on its balance sheet.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)