Brilliant Info About Balance Sheet Of A Small Company

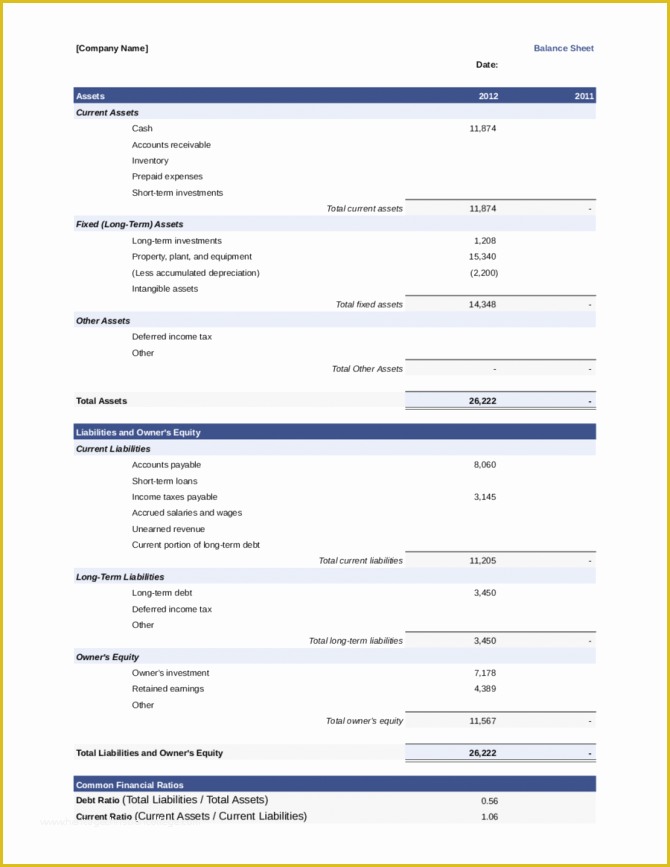

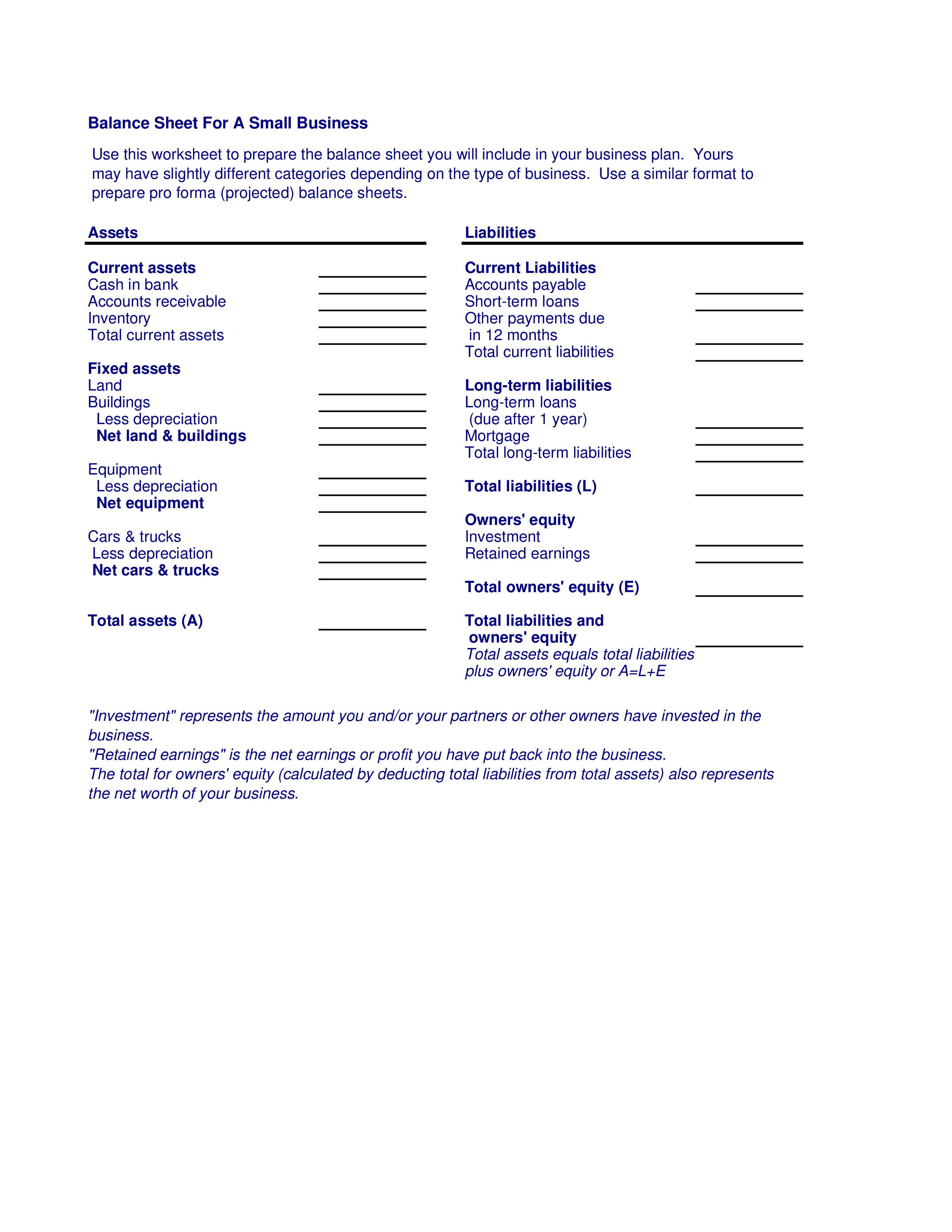

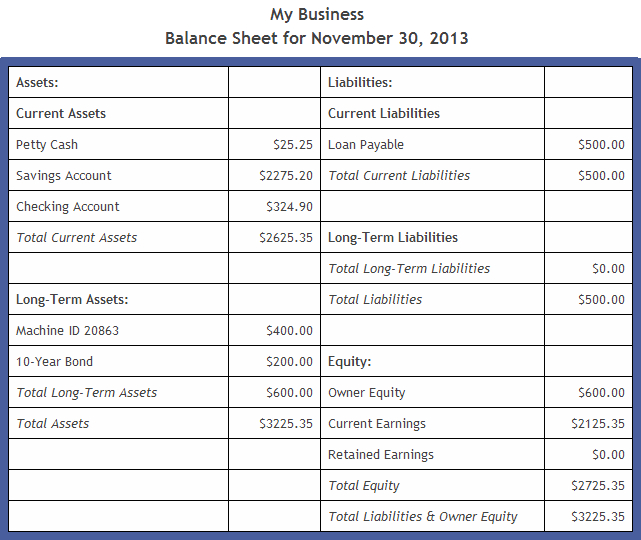

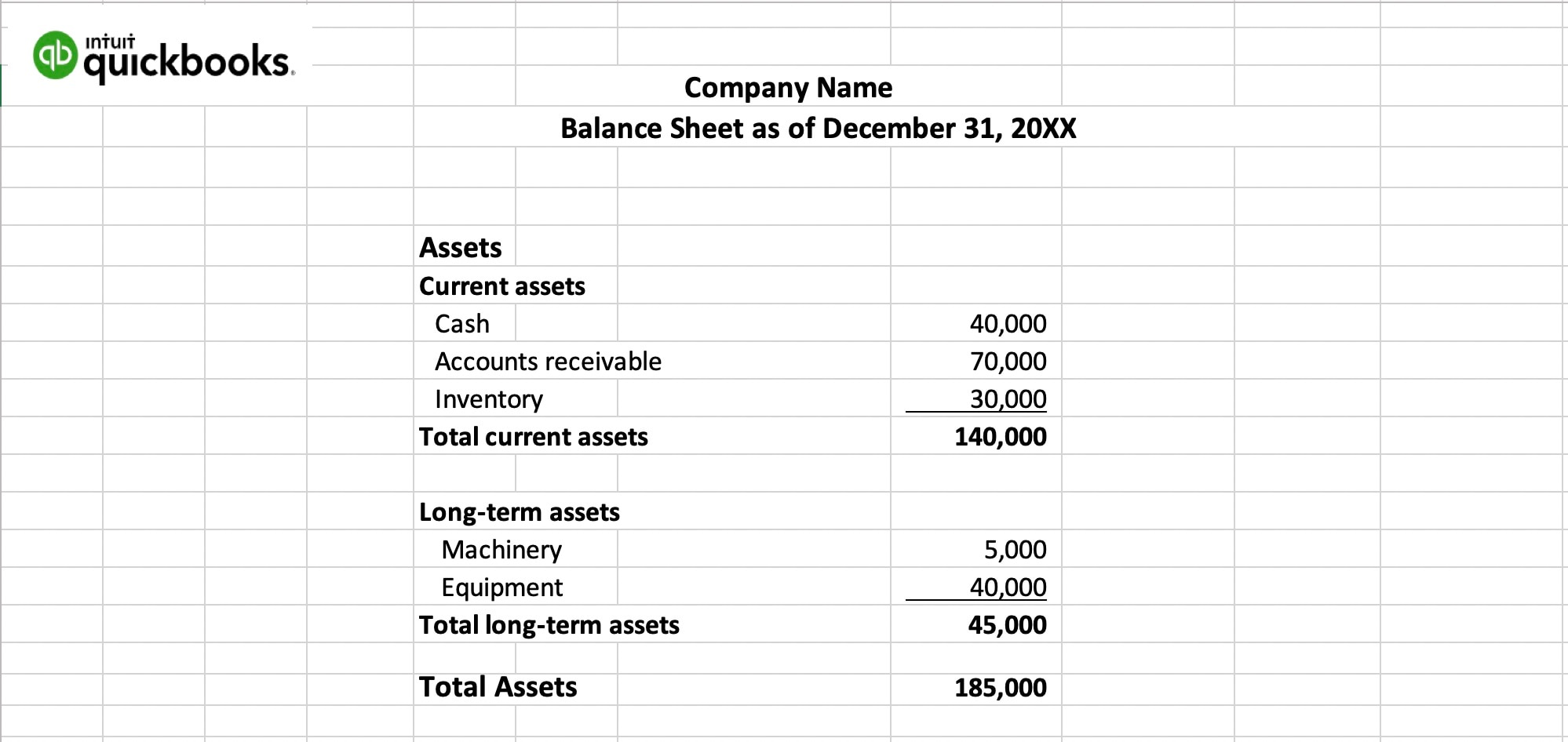

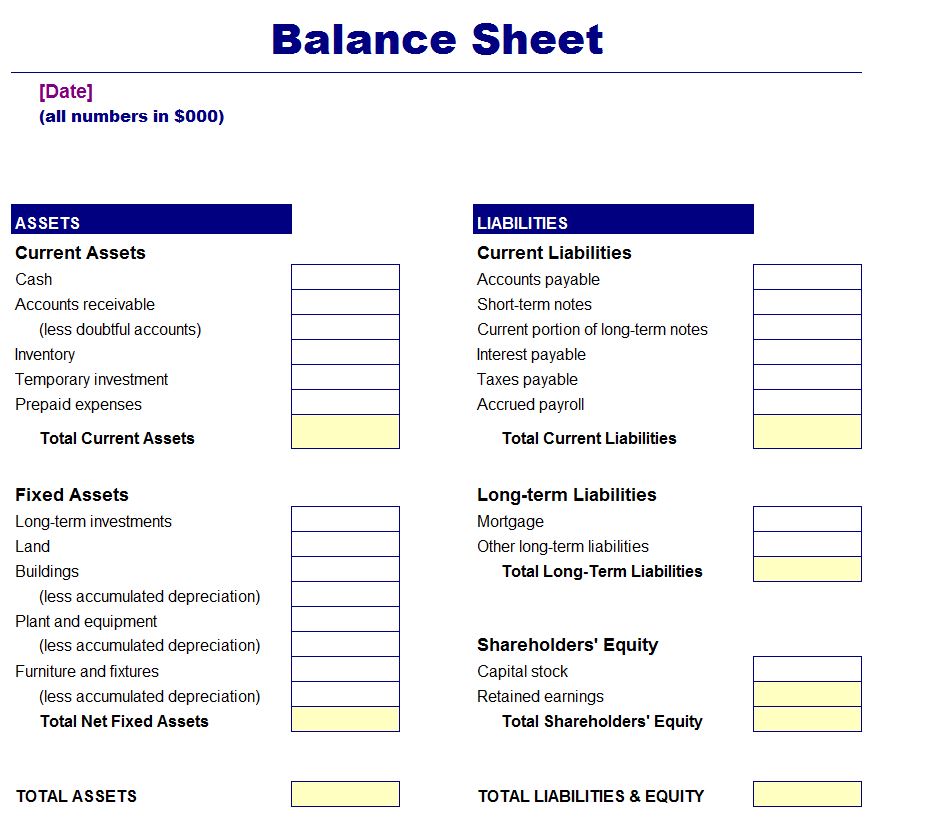

A small business balance sheet consists of two vertical columns or horizontal sections.

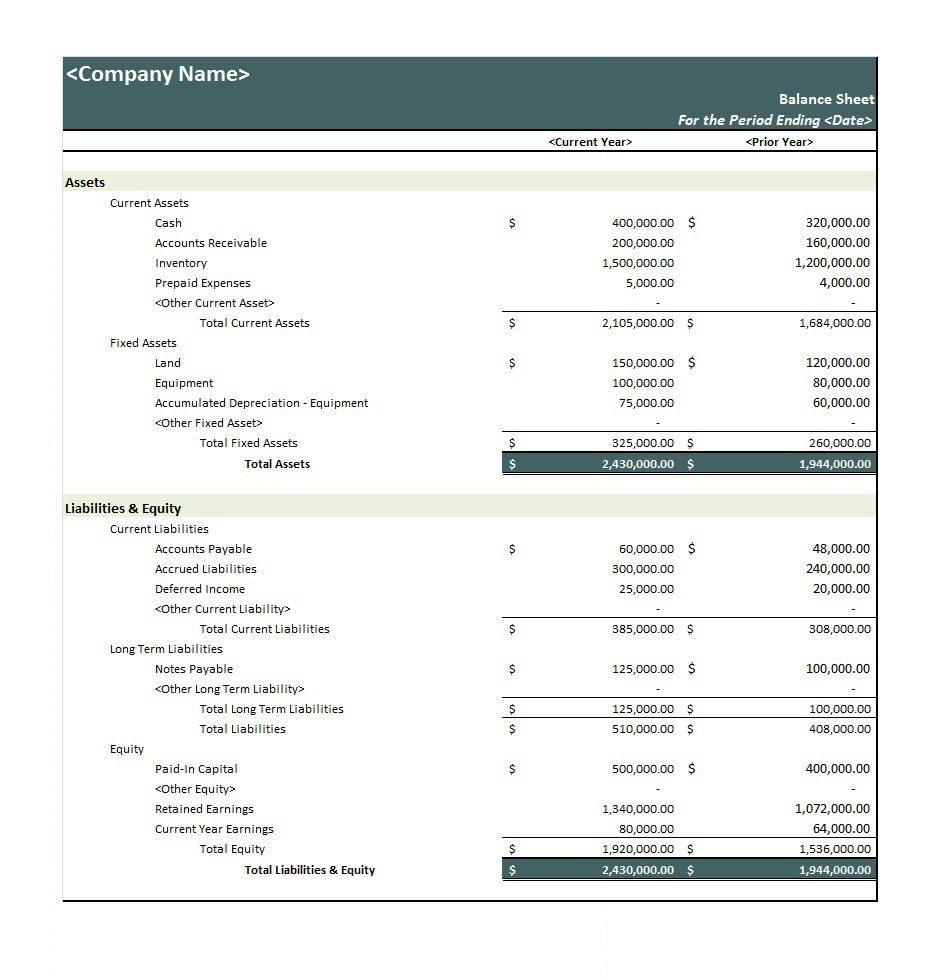

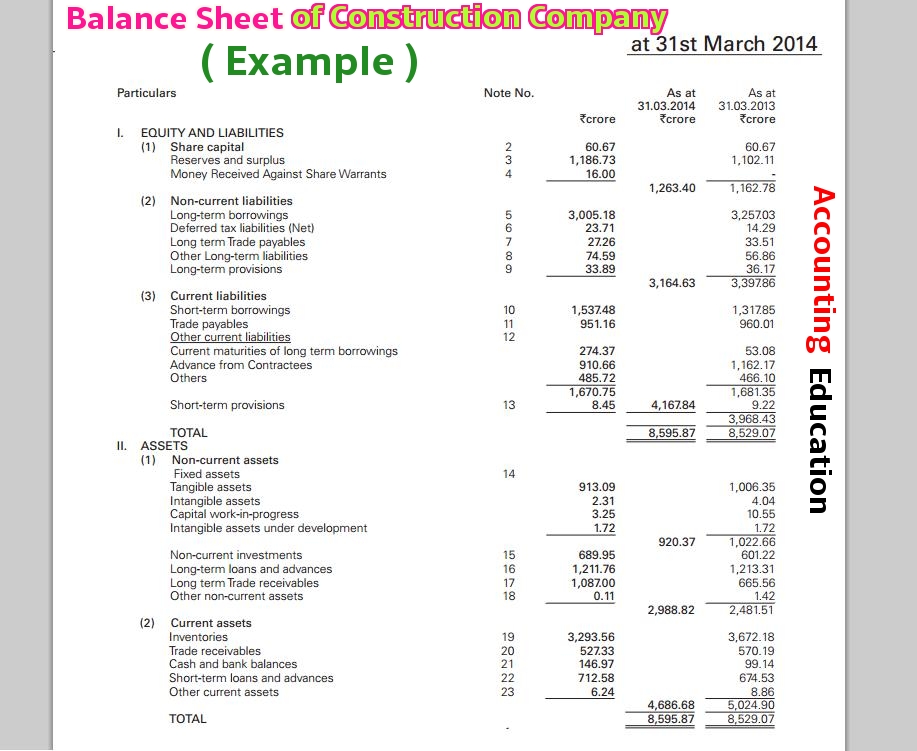

Balance sheet of a small company. It presents a company’s financial position at a specific point in time, showcasing its assets, liabilities, and equity. At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations or derailing its broader. What is a balance sheet?

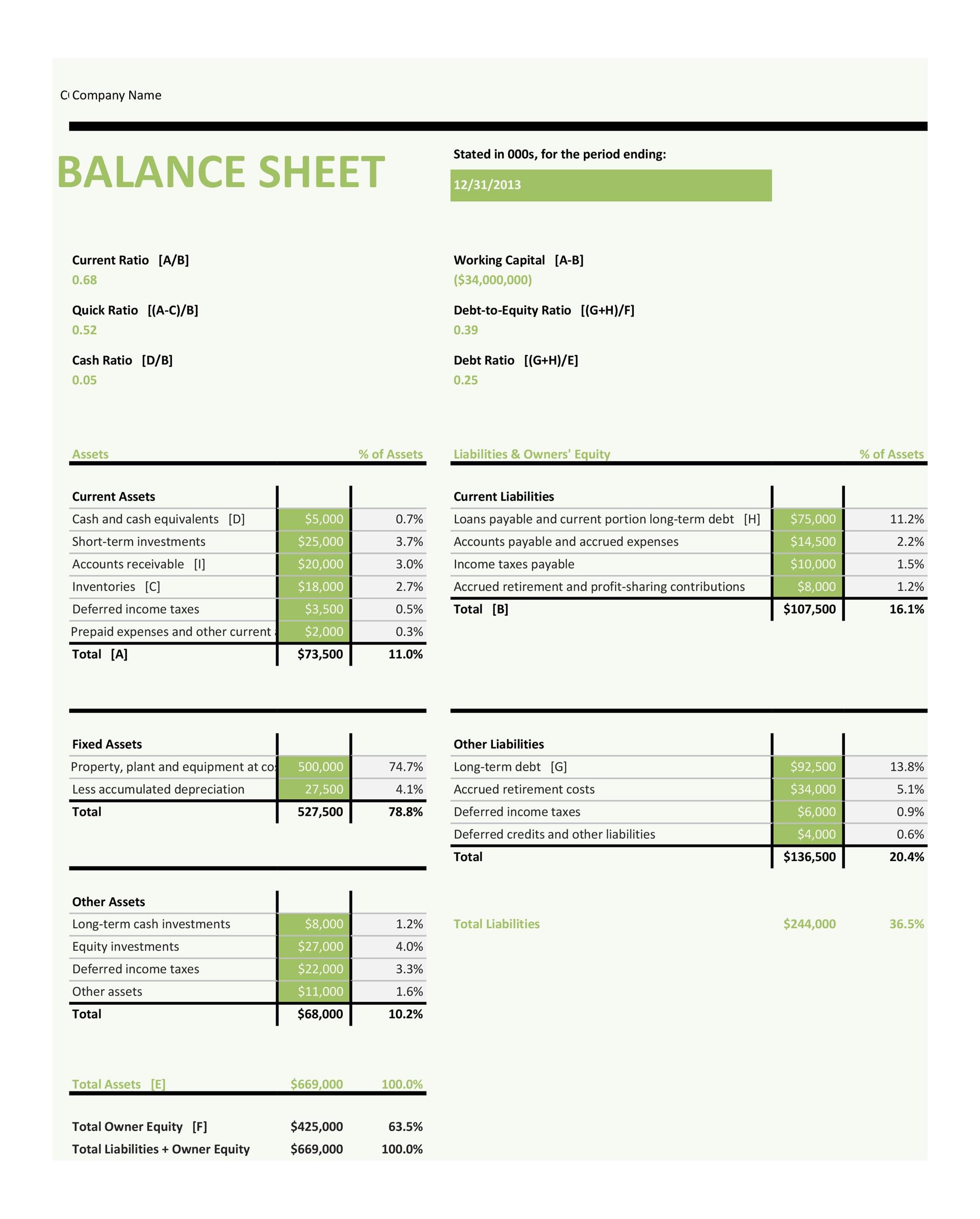

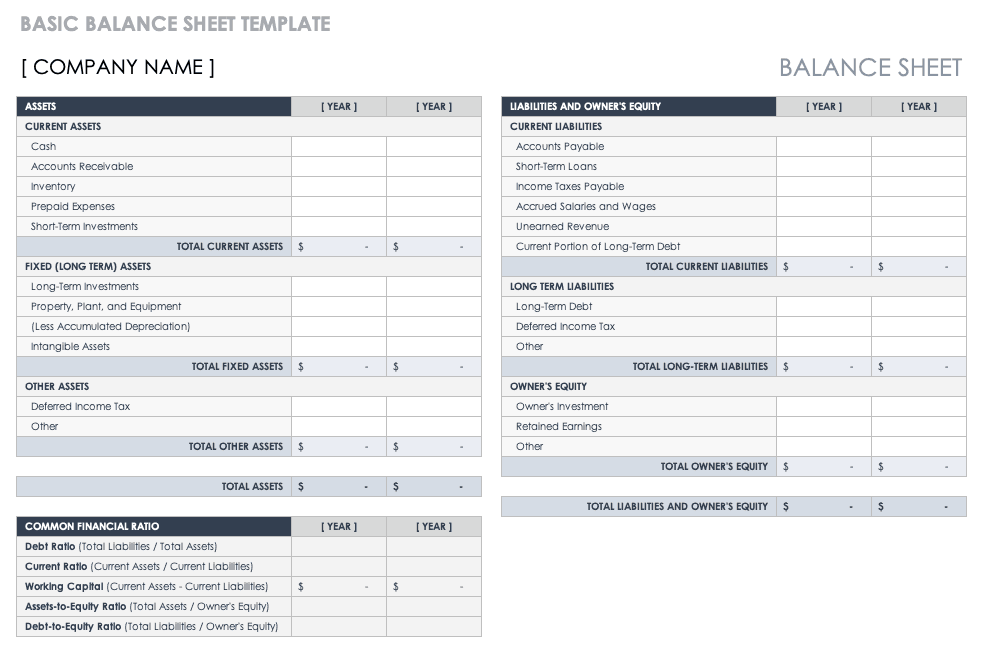

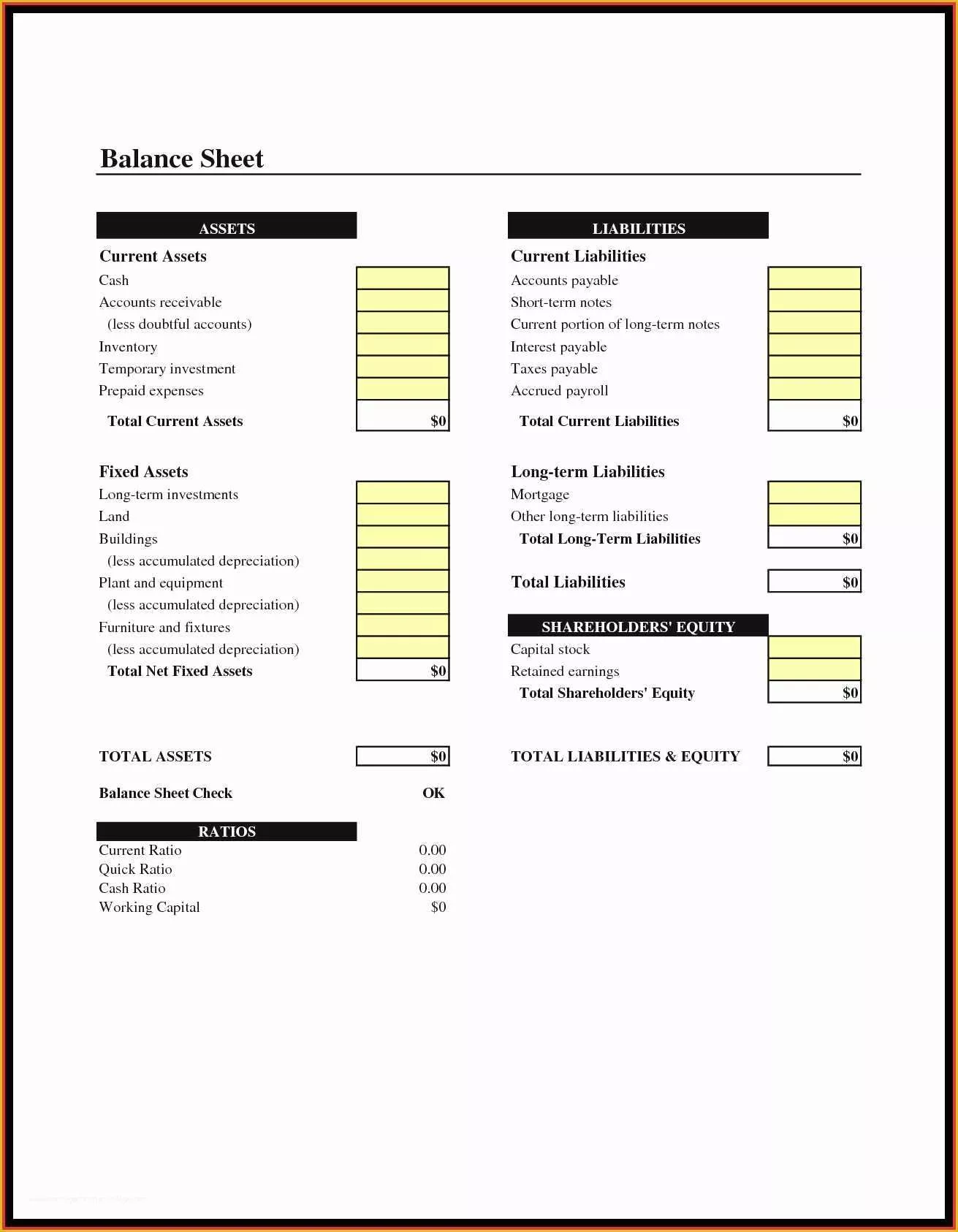

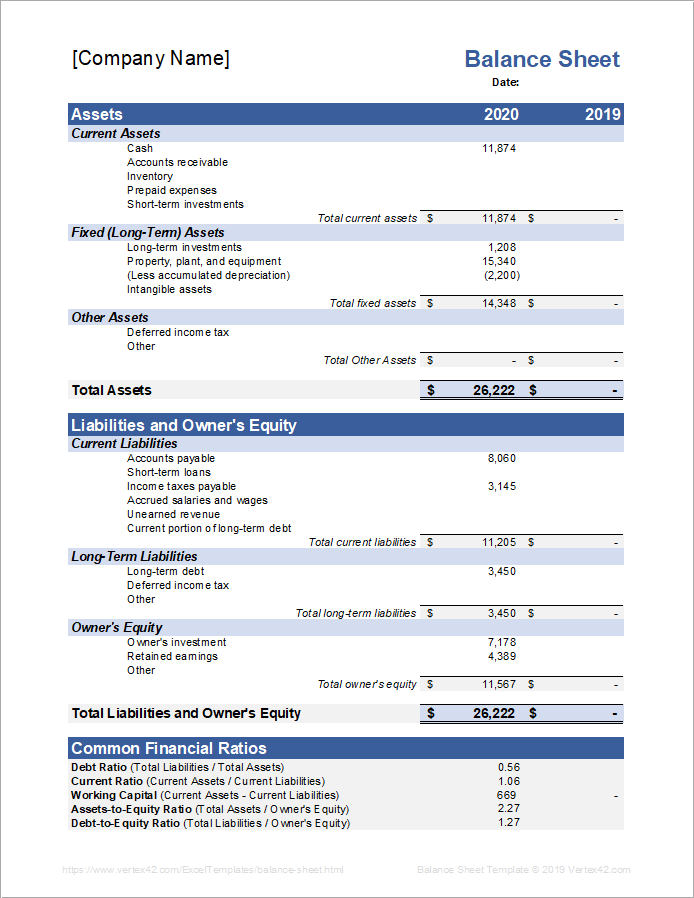

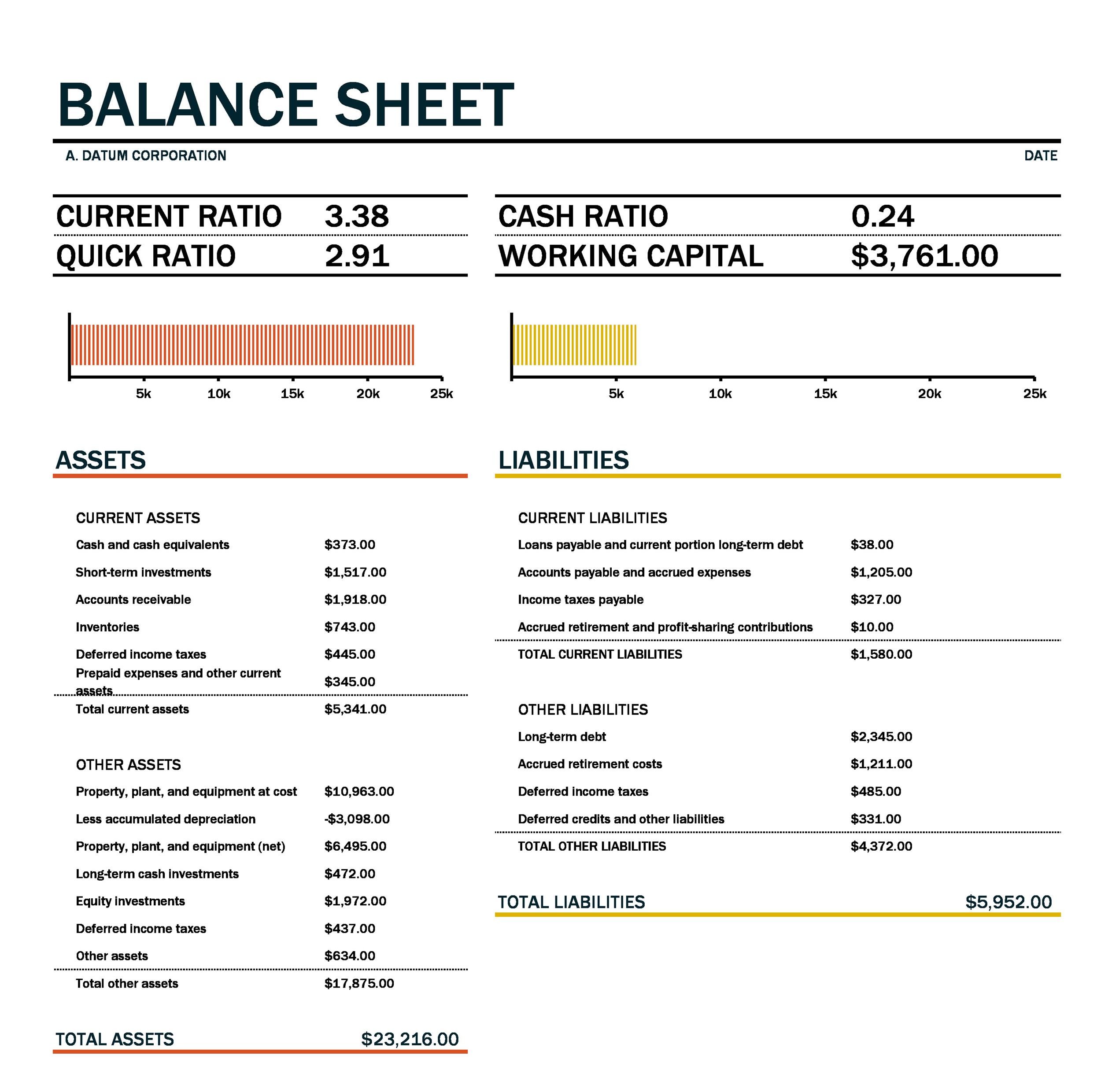

Moreover, you can pair a balance sheet with other financial statements to calculate financial ratios and conduct. The balance sheet is based on the fundamental equation: The balance sheet shows a company’s assets, liabilities, and shareholders’ equity.

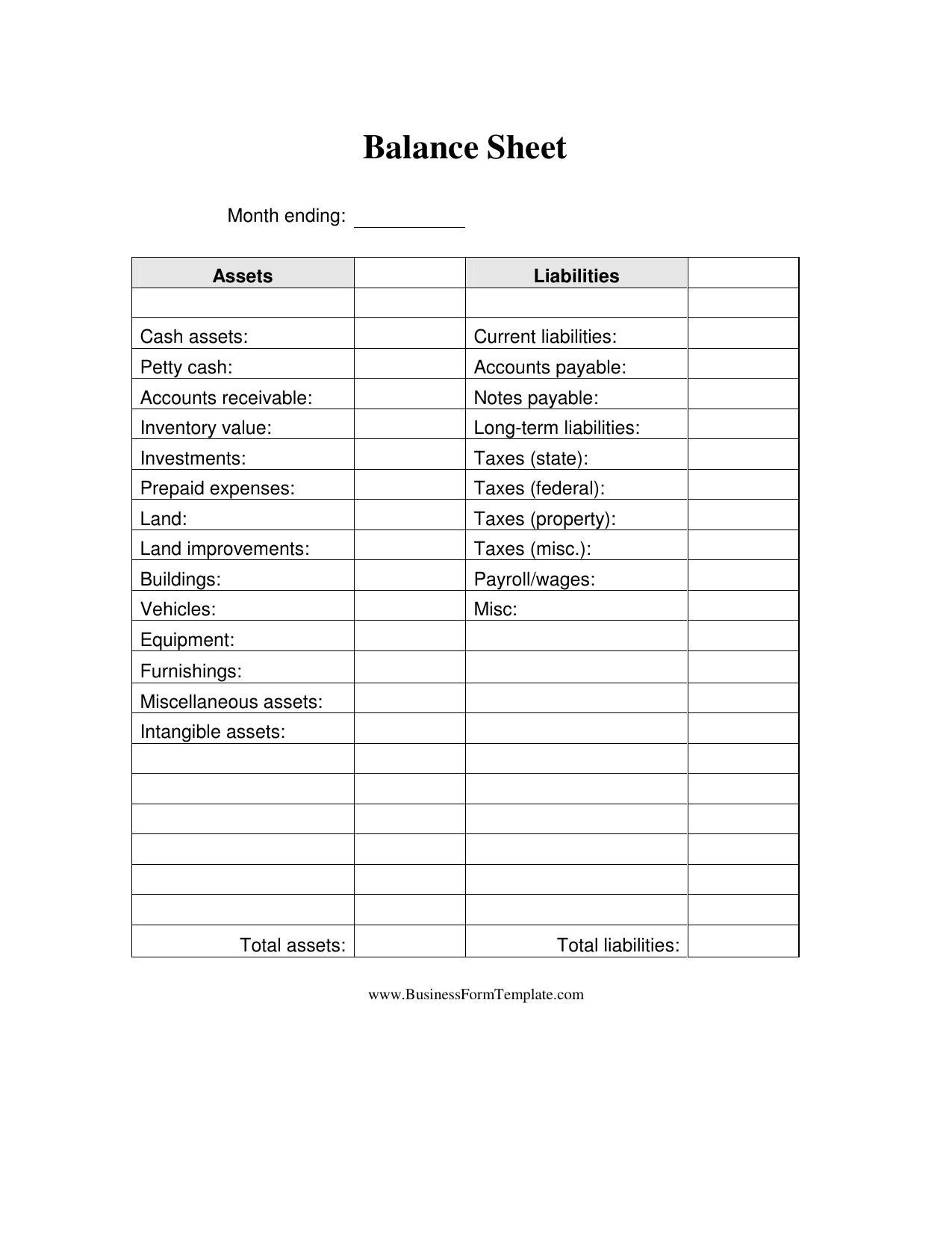

It can also be referred to as a statement of net worth or a statement of financial position. Liabilities are your business’ debts, including accounts payable, mortgages and loans. Current assets refer to the tangible capital a business has access to, such as incoming revenue, equipment, and real estate.

The column on the right lists the liabilities and the owner’s equity. Assets, liabilities, and owned equity. Dividend of € 1.80 per share;

To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. Your company will be ‘small’ if it has any 2 of the following: Balance sheets provide the basis for.

That’s higher than the level seen. Our simple balance sheet template includes the essential information you will need to determine your financial standing and find common financial ratios. The overall assets of a company (what it has or is owed) are balanced by the company's liabilities (what it owes) plus its equity.

Small business balance sheet template template begins on page 2. By comparing these three fundamental elements, businesses can assess their financial stability and make informed. A balance sheet reports a business’s assets, liabilities and equity at a specific point in time.

It provides a snapshot of financial health. Assets = liabilities + equity. The balance sheet is one of the three financial statements businesses use to measure their financial performance.

The balance sheet explained. Balance sheets are usually created using this basic formula: The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

A turnover of £10.2 million or less £5.1 million or less on its balance sheet 50 employees or less if your company is. Assets come in two forms — current and noncurrent. A balance sheet is a financial statement that provides a snapshot of a business’s financial position at a specific point in time.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)