Real Info About Sba Personal Financial Statement Disaster Programs

To confirm whether your business is located in a state eligible for loans due to severe storms, floods, drought, or other natural disasters, use the sba’s database of.

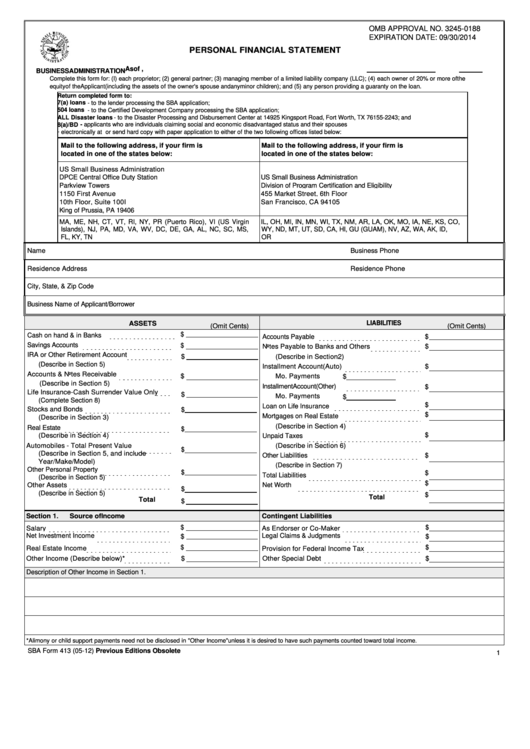

Sba personal financial statement disaster programs. Sba form 5 and/or form 5c; Fill, edit, and download sba personal financial statement disaster programs with pdffiller, simply. Checklist for cdc/sba 504 loan.

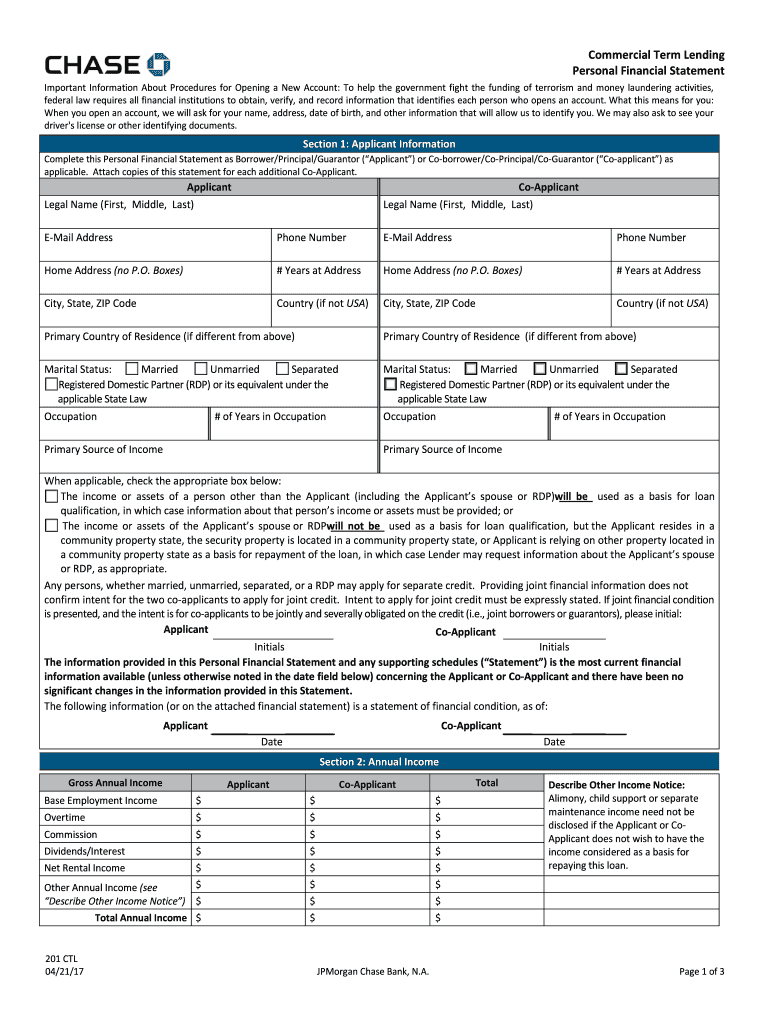

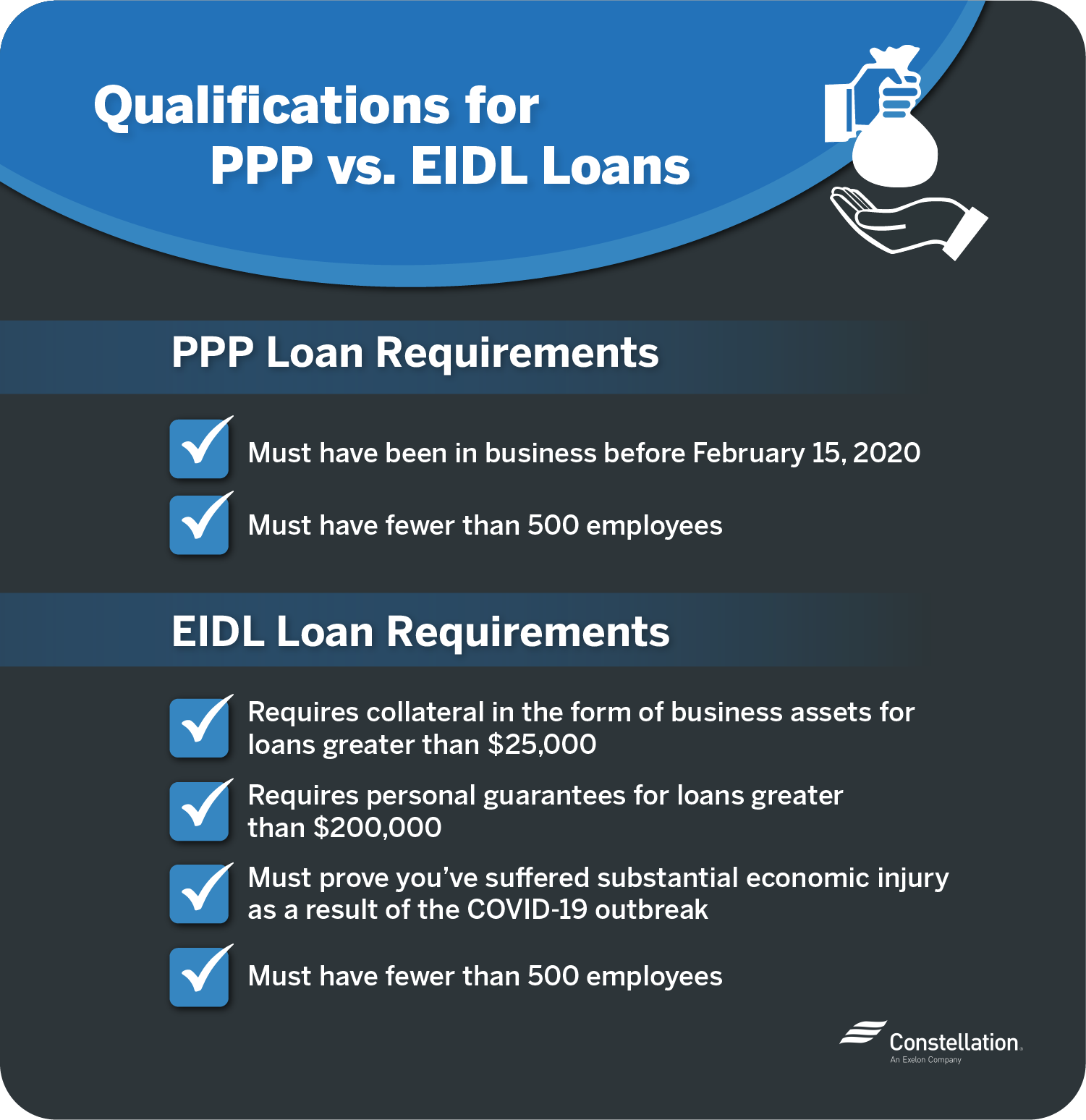

Whether you apply online or via a paper application, expect to provide the following documents for your economic injury disaster loan: This sop covers disaster assistance loans, including eligibility, use of proceeds, and the application process. The regulations for sba's business loans and disaster loan programs require loan guarantors and individual owners of the small business applicant to submit.

Sba personal financial statement disaster programs. All of the above information will be part of sba form 1368. July 13, 2021 the u.s.

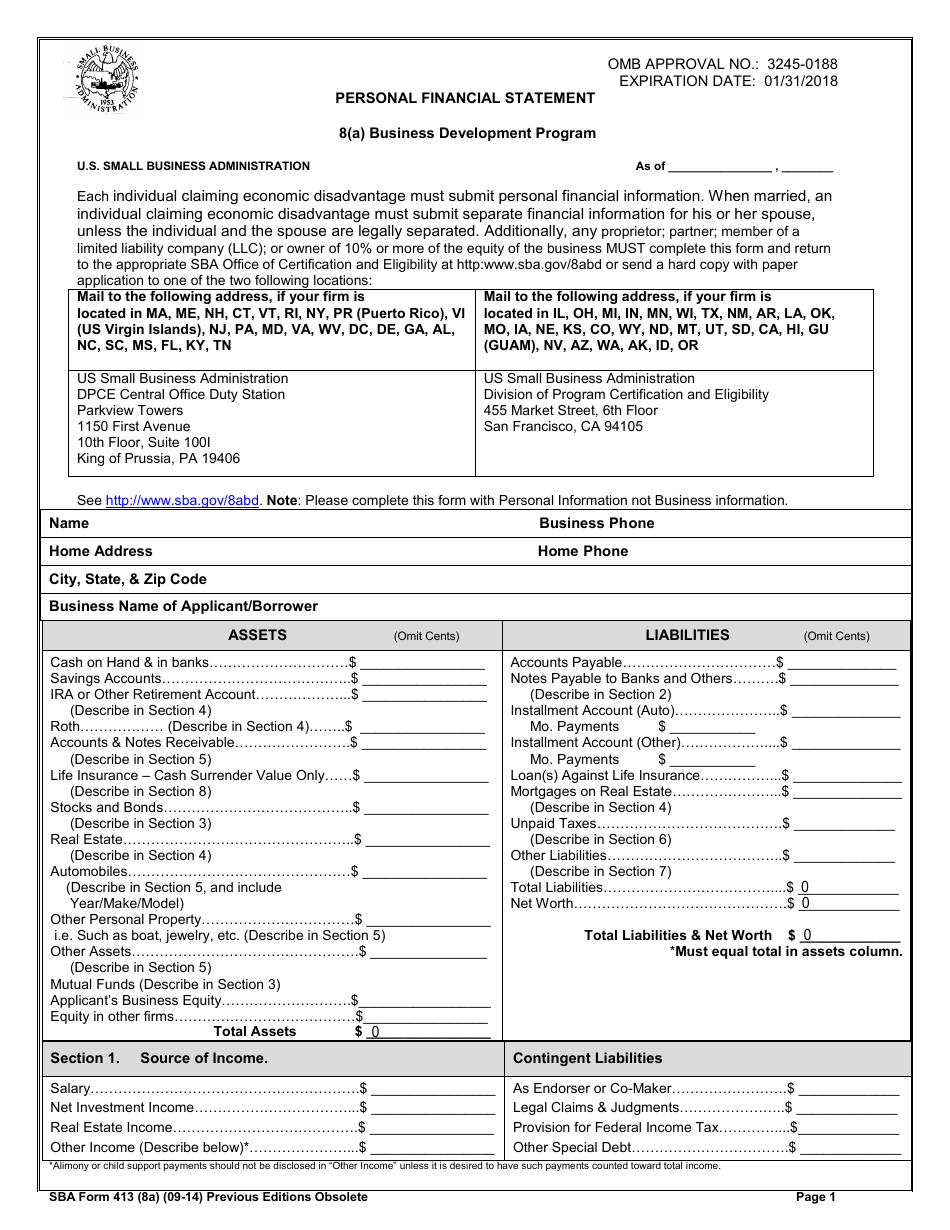

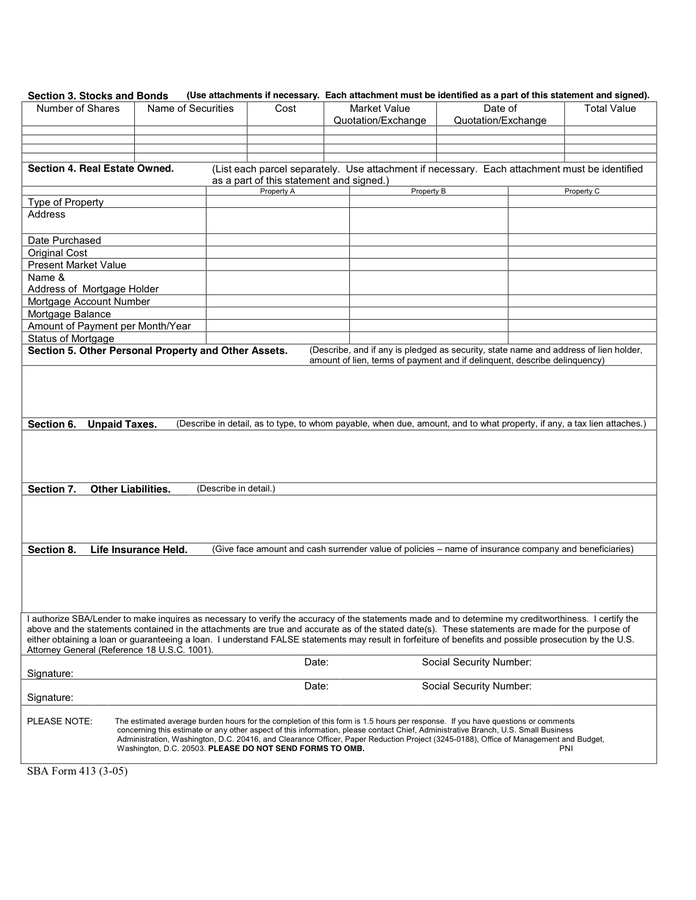

This form is used to assess repayment ability and creditworthiness of applicants for: 7 (a), 8 (a), cdc/504, disaster,. Sba form 1368:

Personal financial statement 7(a) / 504 loans and surety bonds. If you apply online, you’ll input much of this information. Sba form 413 updated and issued effective:

Sba’s regulations state that to be considered economically disadvantaged for purposes of the 8(a) business development program, an individual must have an. The regulations for sba's business loans and disaster loan programs require loan guarantors and individual owners of the small business applicant to submit. Anyone who is applying for the most popular sba loan programs, including sba 7 (a), sba 504 /cdc and disaster loans, will need to fill out the sba form 413.