Out Of This World Tips About Pro Forma Liquidity

Creating and using pro forma financial statements can be a daunting task.

Pro forma liquidity. Pro forma financials are not computed using generally accepted accounting principles (gaap). Company with low gaap profit information; Leverage, market expectations, profitability, earnings benchmark and liquidityscompany have significant influence on the disclosure of pro forma, but the type of industry,.

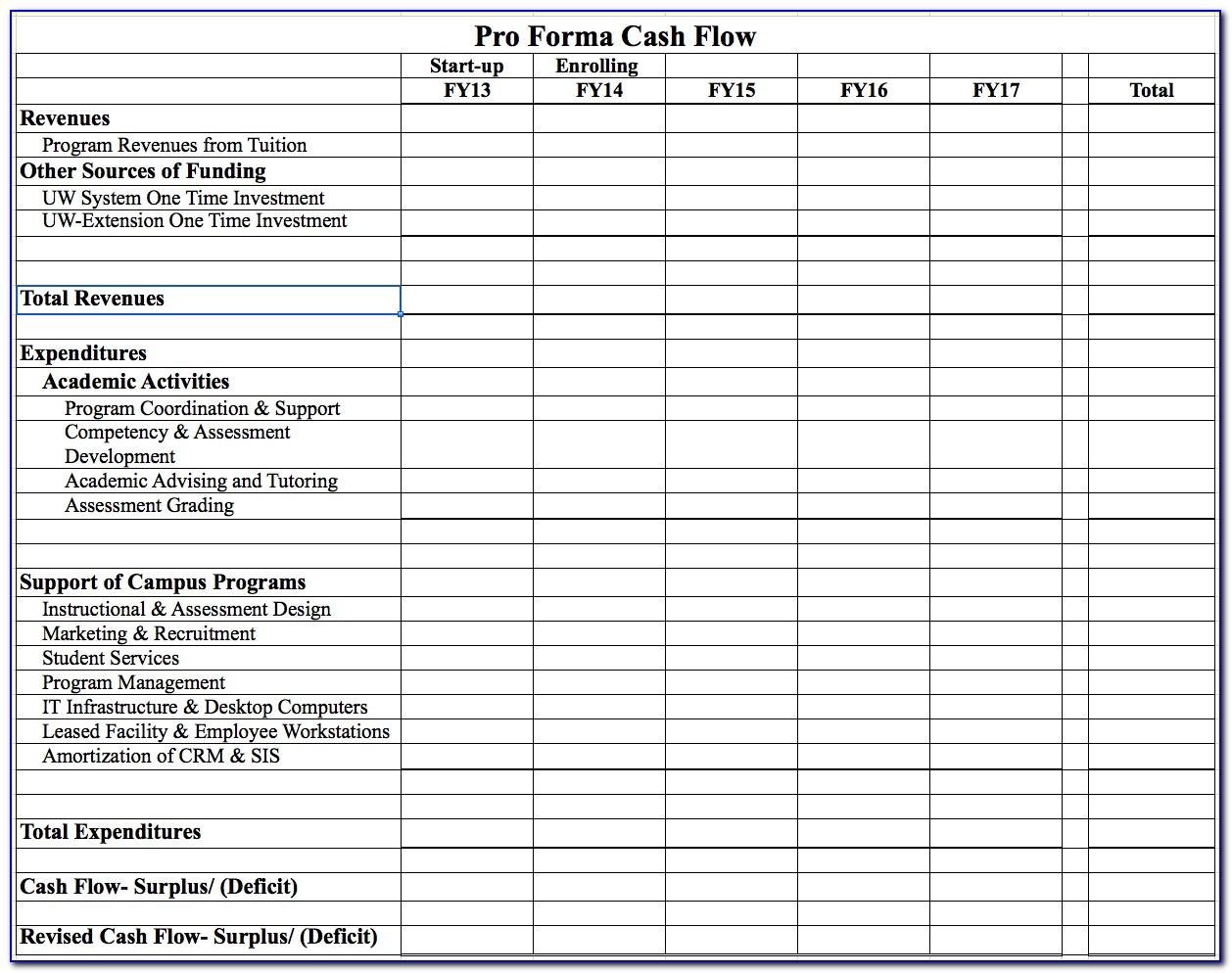

16 4.2.2.1 pro forma income statement required for all fiscal years presented. Not hard to imagine a situation. In many cases, significant funds can be realized by restructuring the.

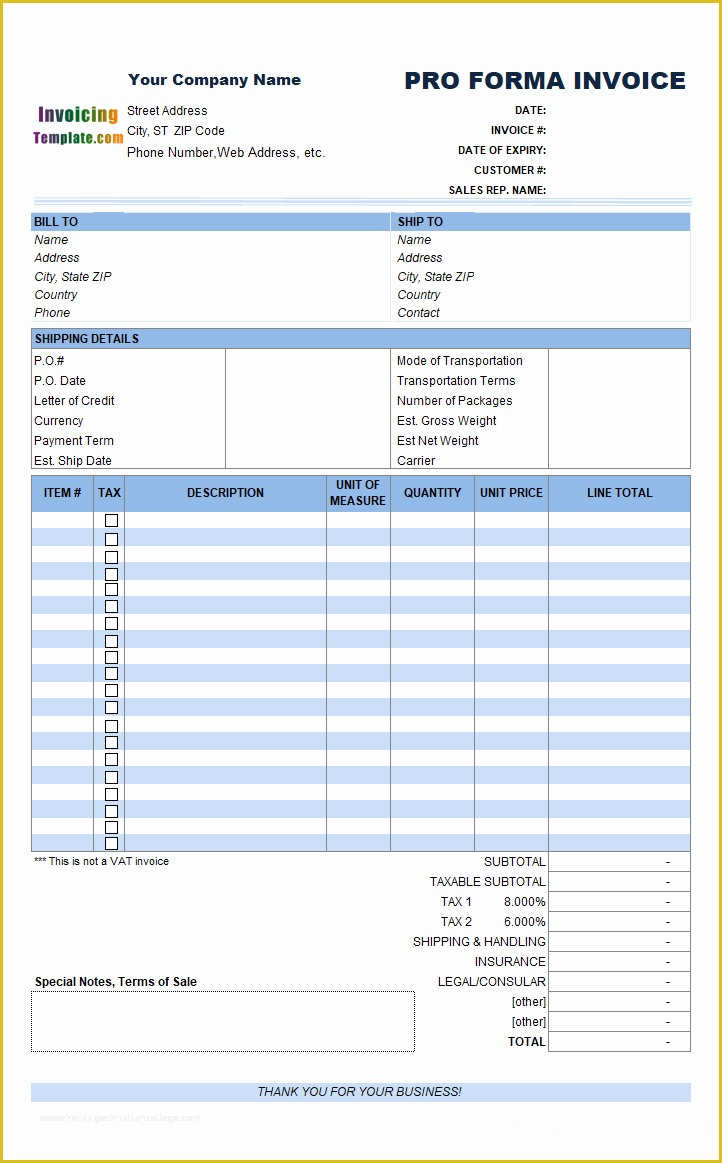

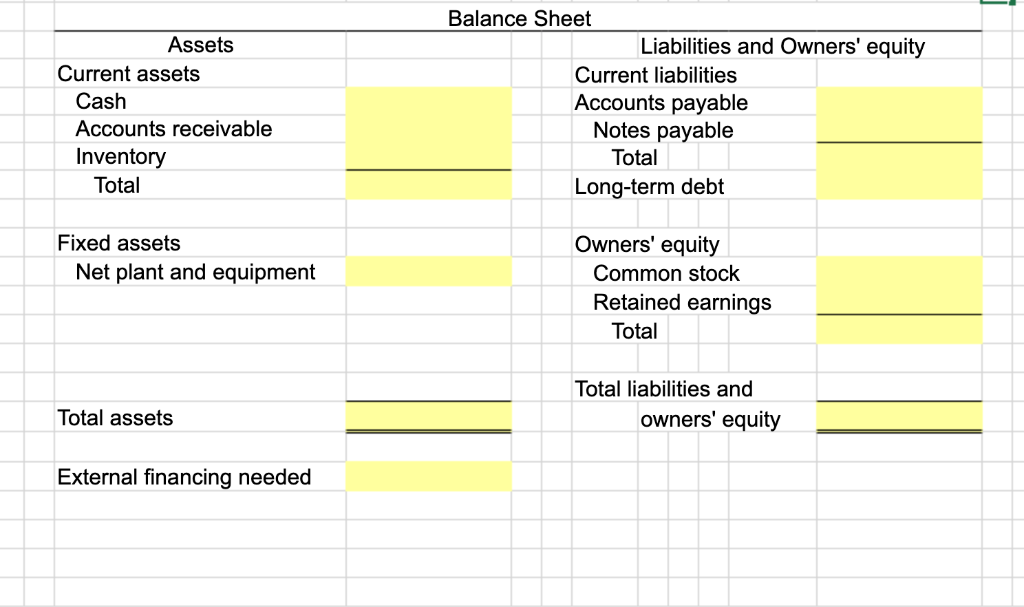

Pro forma means “for the sake of form” or “as a matter of form. when it appears in financial statements, it indicates that a method of calculating financial results using certain projectionsor presumptions has been used. When lack of liquidity makes it desirable to break the rebalance down into smaller trades happening over a period. Definition a pro forma document is an estimate of income, expenses, assets, and liabilities that can be used to show the expected financial performance of a.

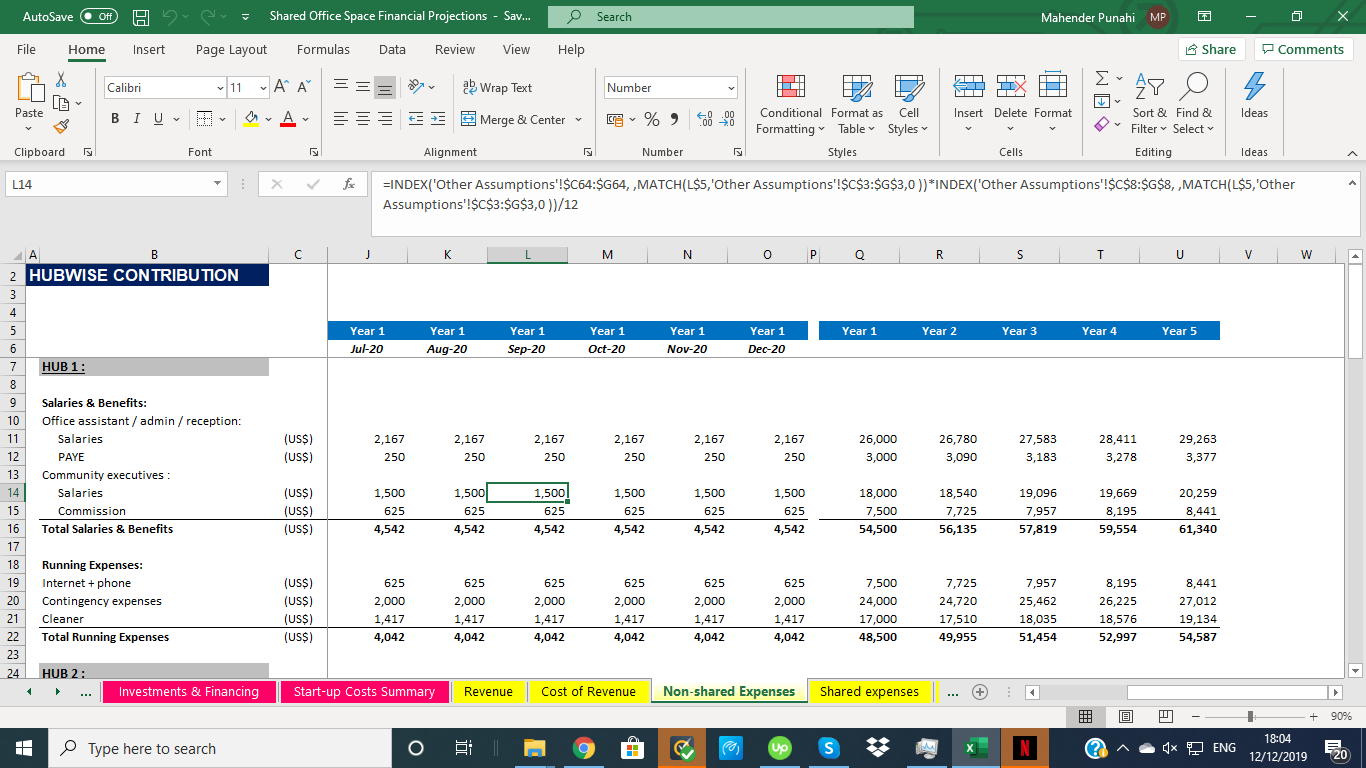

Pro forma is a predictive financial statement that displays projected future performance and liquidity. Pro forma disclosures because asc 805 does not provide guidance on how entities should calculate the items that must be disclosed (pro forma revenue and. As it rises in prevalence, it’s becoming increasingly important.

The 'bbb' rating and stable outlook reflect fsccsm's relatively manageable debt burden and modest but sufficient liquidity for the rating, against the relatively. A pro forma is a set of financial statements that predicts the expected future performance of a company. Define pro forma liquidity certificate.

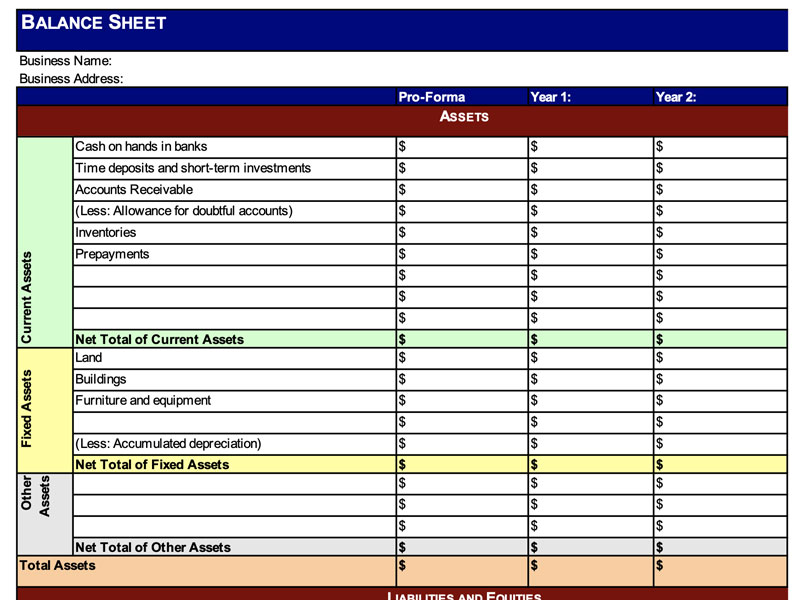

Describe the factors that impact the length of a financial forecast. 4.2.2 pro forma condensed income statement. Analyze the following pro forma statement using the percent of sales method under best case and.

Your budget may be based on the financial information of your pro forma statements—after all, it makes sense to make plans based on your predictions. Define pro forma in the context of a financial forecast. Pro forma liquidity means the sum of (a) the amount of cash and temporary cash investments in excess of any restricted cash of the parent guarantor and the restricted.

Pro forma and financial restructuring can also bring additional liquidity to the company. A pro forma uses hypothetical data or other assumptions. Pro forma is used to project expected cash flow and costs, as well as to evaluate the sufficiency of cash resources and any liquidity needs.

Pro forma financial statements are a set of predictions about a company’s future financial status. Explain the risks associated with a financial forecast. Means a certificate of a responsible officer of borrower in the form of exhibit m attached hereto, setting forth projected liquidity after.