Amazing Tips About Personal Balance Sheet Of Proprietor

Owners' equity sections for corporations are often.

Personal balance sheet of proprietor. In fact, there’s guidance in one of my accounting guidebooks on how to prepare sole proprietorship financial statements under generally accepted accounting principles for a proprietorship with mingled personal and business funds. Owner's equity consists of the owner's capital account and a drawing account. Make a list of your debts and where to get the most current values.

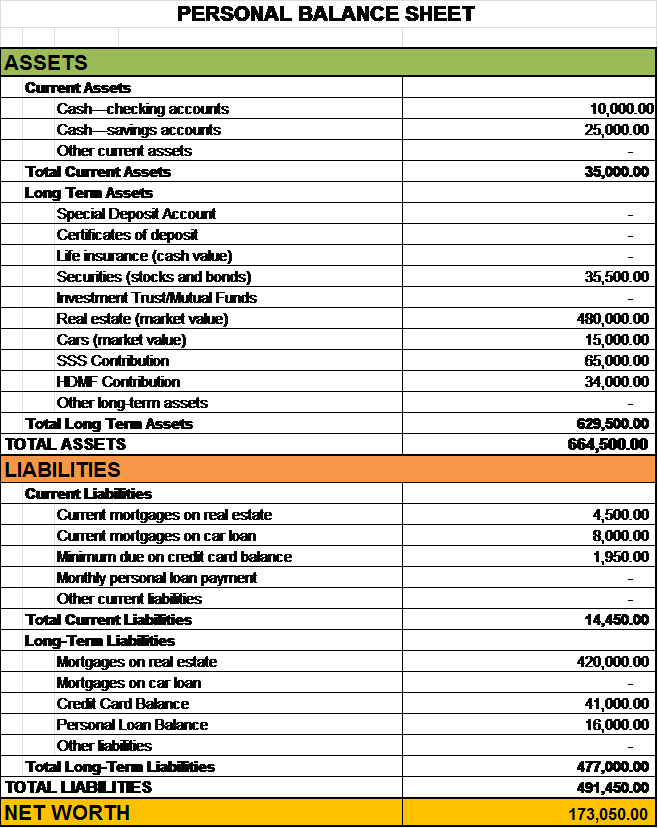

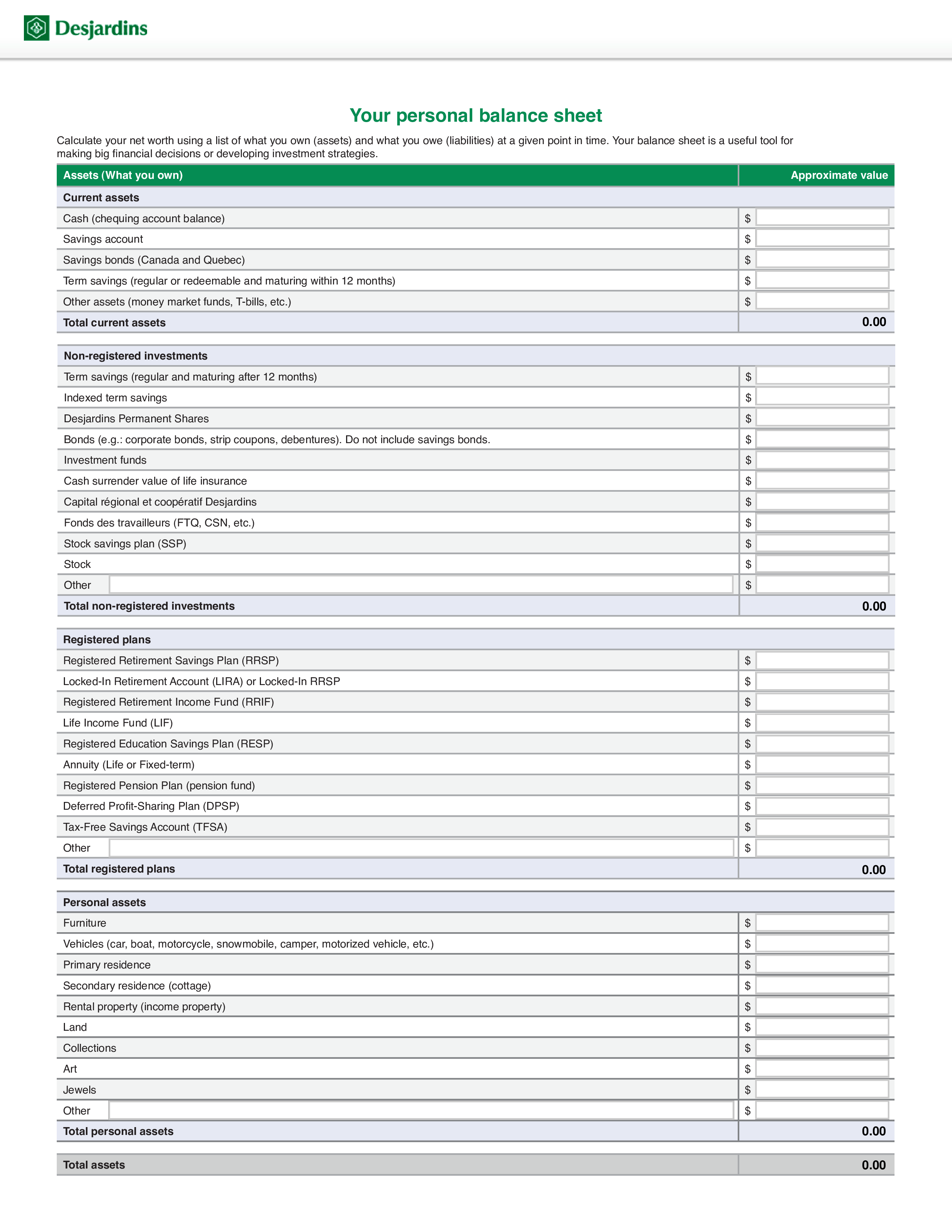

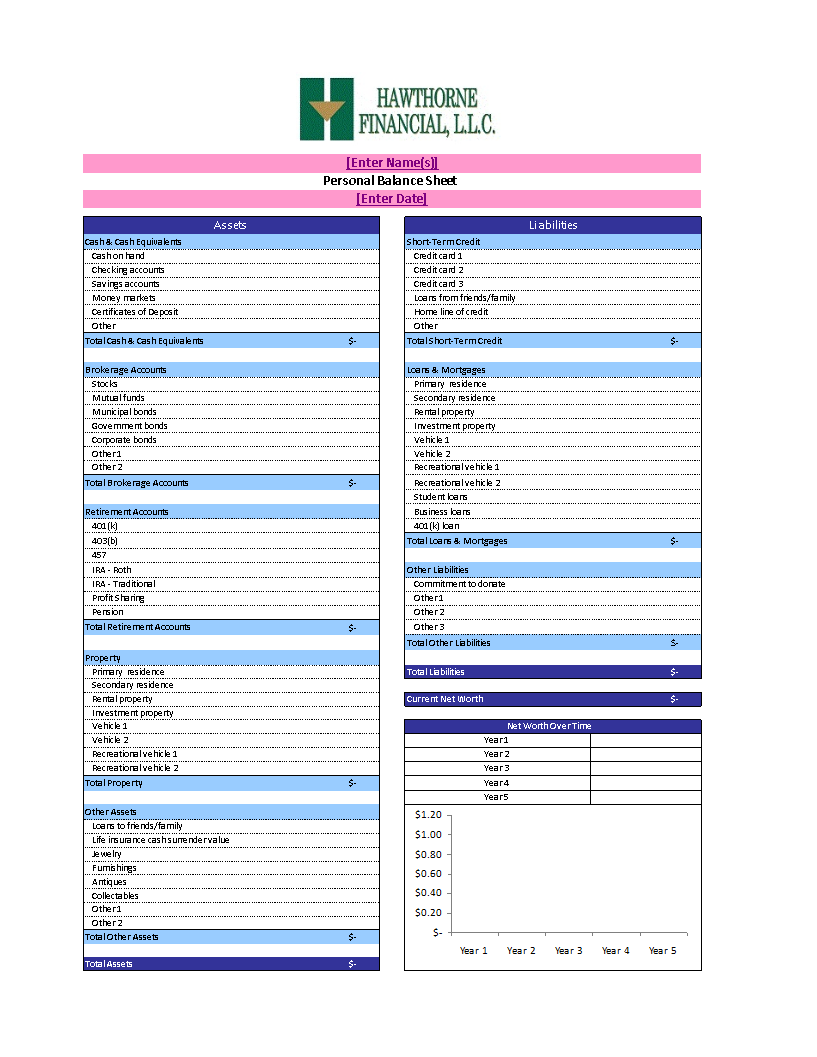

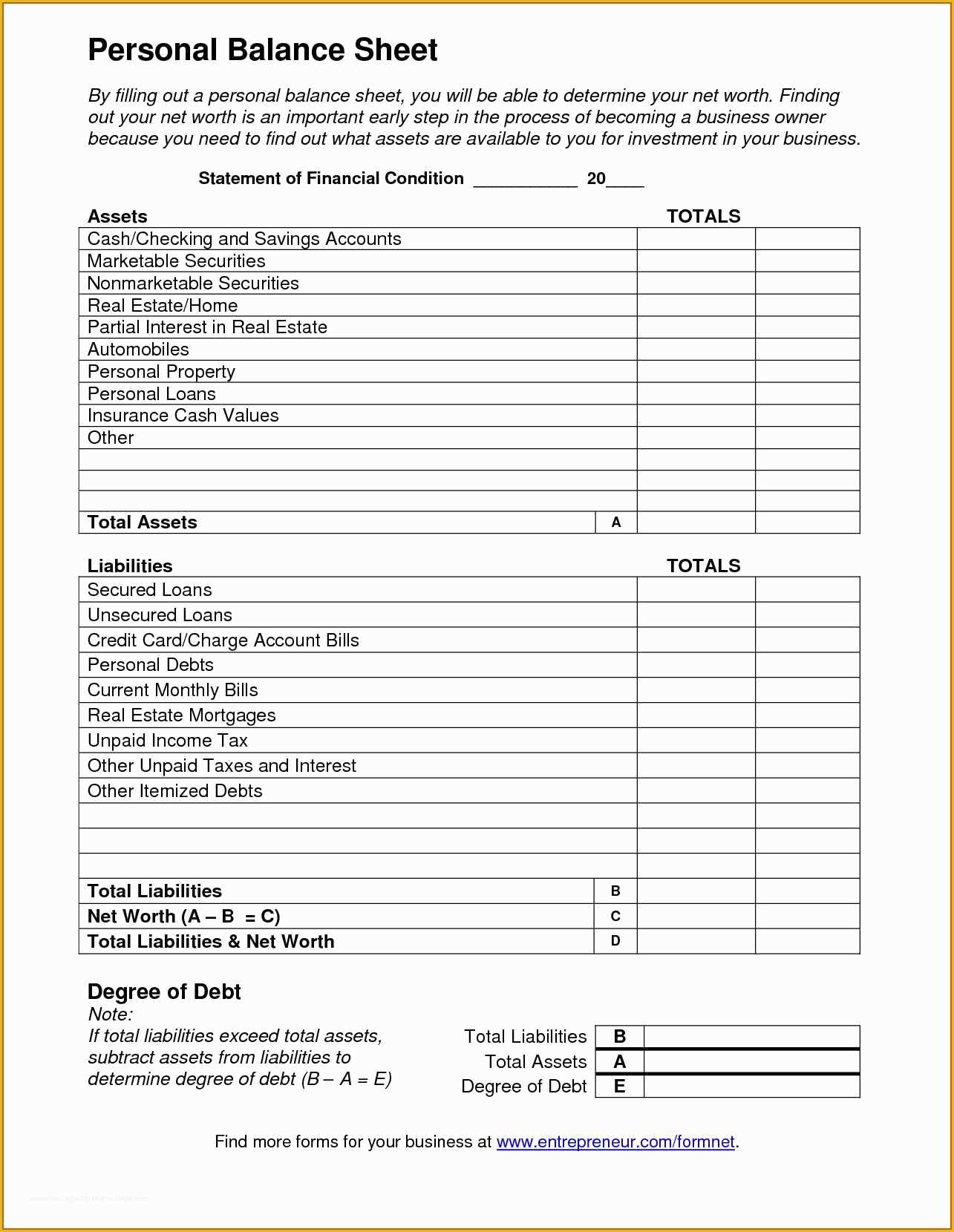

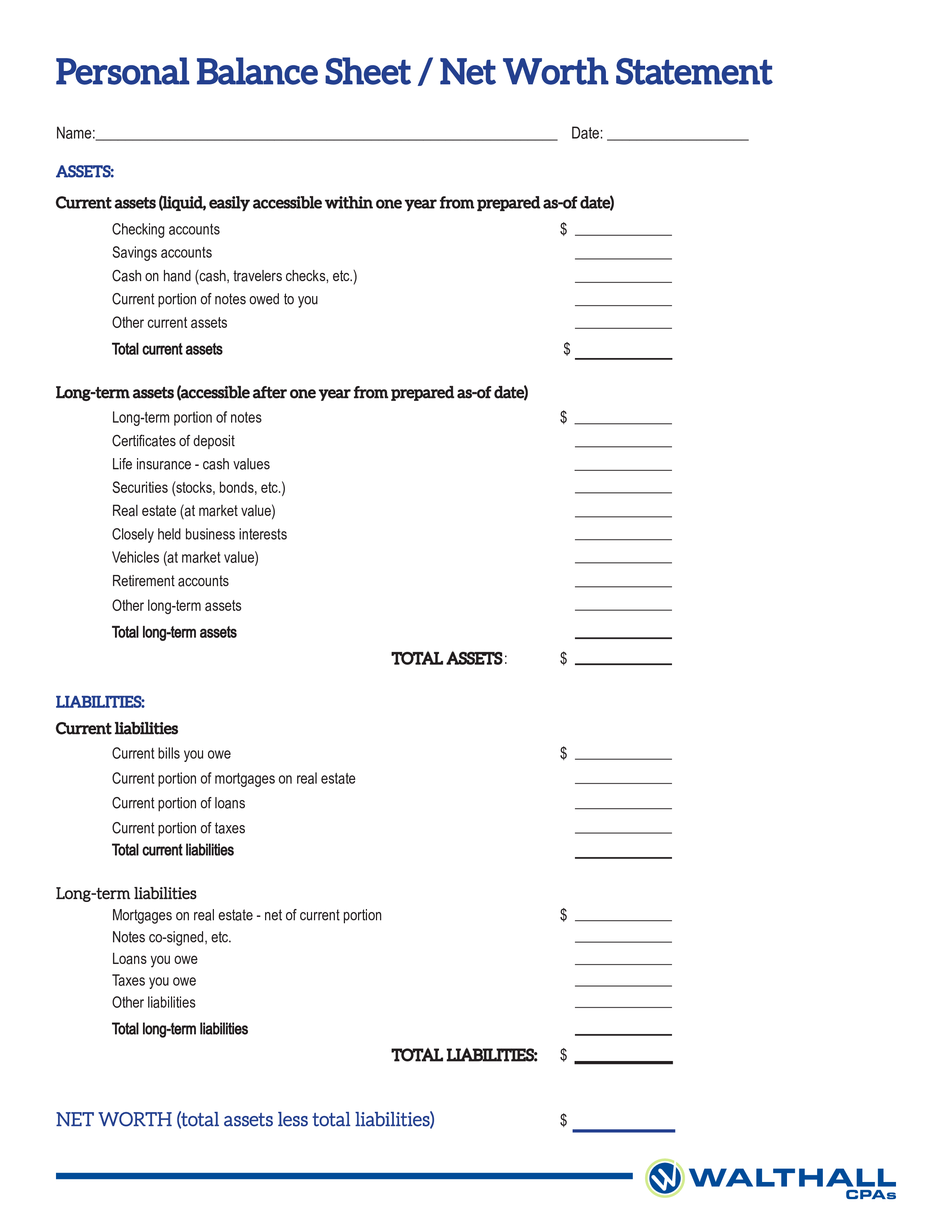

This may include your home, mortgage, car, auto loan, taxes, savings accounts, investment accounts, credit card balances and more. An individual must maintain a balance sheet for personal use. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity.

Because it will assist in keeping ones personal finance in order. For instance, most organization's use december 31st as the date of the balance sheet since it is the latest day of the year. After this, you must take a closer look at each column to find out which item you can change to help you achieve your financial goals.

We recommend only using software if you need to. Assess your personal balance sheet; Accounting for sole proprietorships.

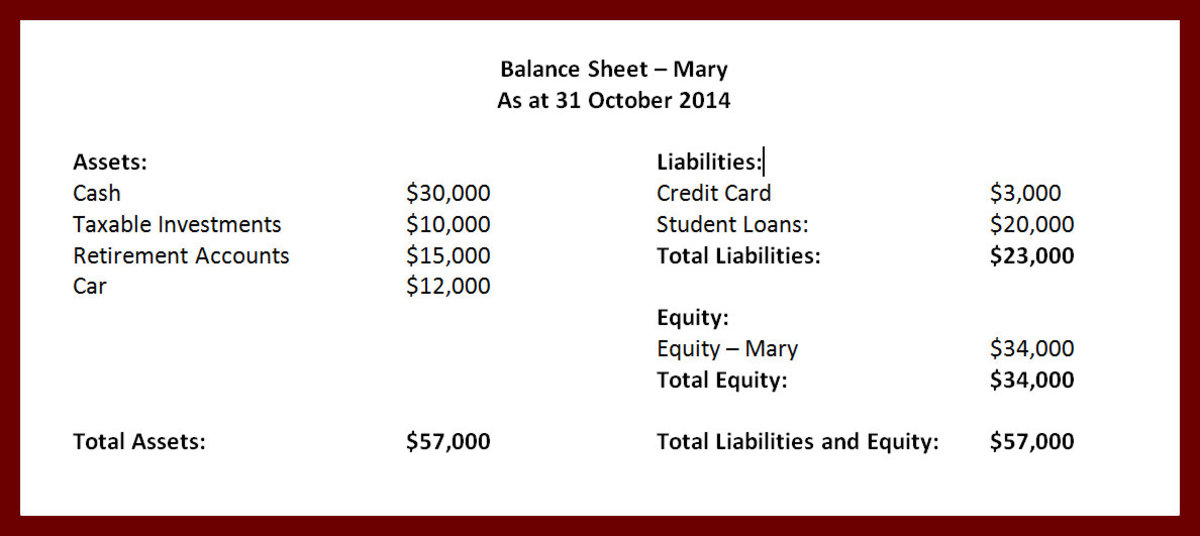

It shows a proper balance including assets, liability, and owner’s equity. A personal balance sheet is a financial document that provides a snapshot of an individual's financial position at a specific point in time. Your personal balance sheet is a useful financial statement that you can use to calculate your net worth.

How is the liability of owner in sole proprietorship? Our unique financial statement format for sole proprietorships in excel consists of automated reports including an income statement, balance sheet, cash flow statement, statement of changes in equity and the notes to the financial statements. Most sole proprietors don’t really need a balance sheet, since there is no separation between the person and the business.

Microsoft excel will provide you with a platform where you can easily create a balance sheet format for proprietorship. After listing all of your liabilities and assets, it’s time to get the totals of each column. A personal balance sheet helps you reflect on your net worth, whether positive or negative, and identify areas where you can work to improve it.

Assets = liabilities + owner's equity. If you're account is not audited then no need to show your fd details just show the interest details 2. A personal balance sheet provides an overall snapshot of your wealth at a specific period in time.

Yes, it can be done. Convey the specific date of the balance sheet. A balance sheet is really important when it comes to a proprietorship business or any type of business.

If you're account is not audited then no need to show expect show the details in house property sechdule 3.no need if account is not audited 4. It's also a way to organize your assets and liabilities in an organized format. Your balance sheet will include all your assets and liabilities.