Divine Info About Prior Year Adjustment Disclosure

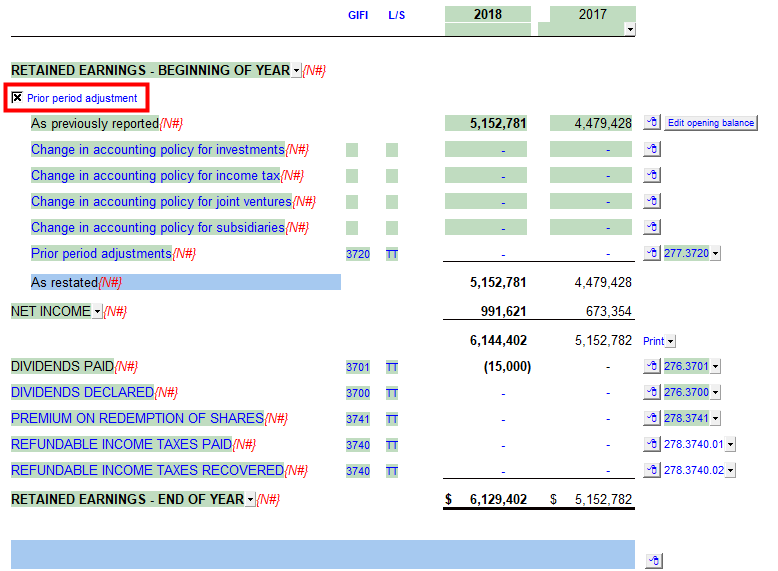

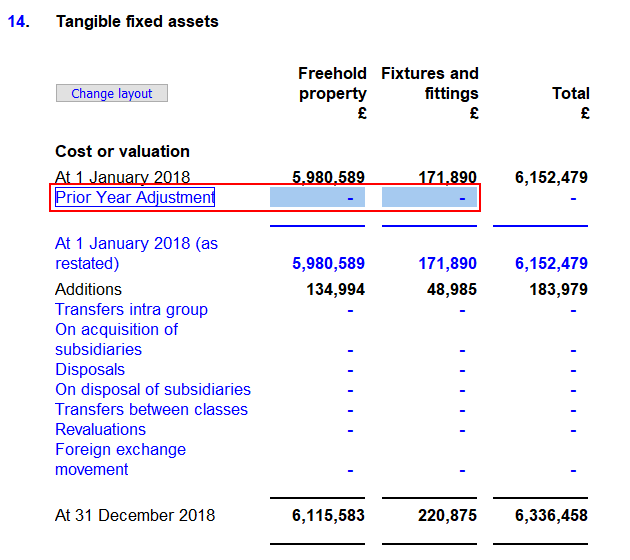

Resulted in prior year adjustments as disclosed in note 34 to the financial statements.

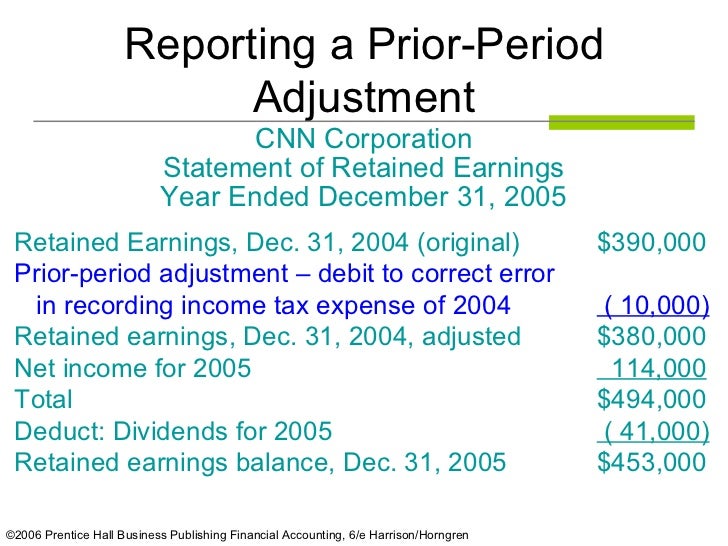

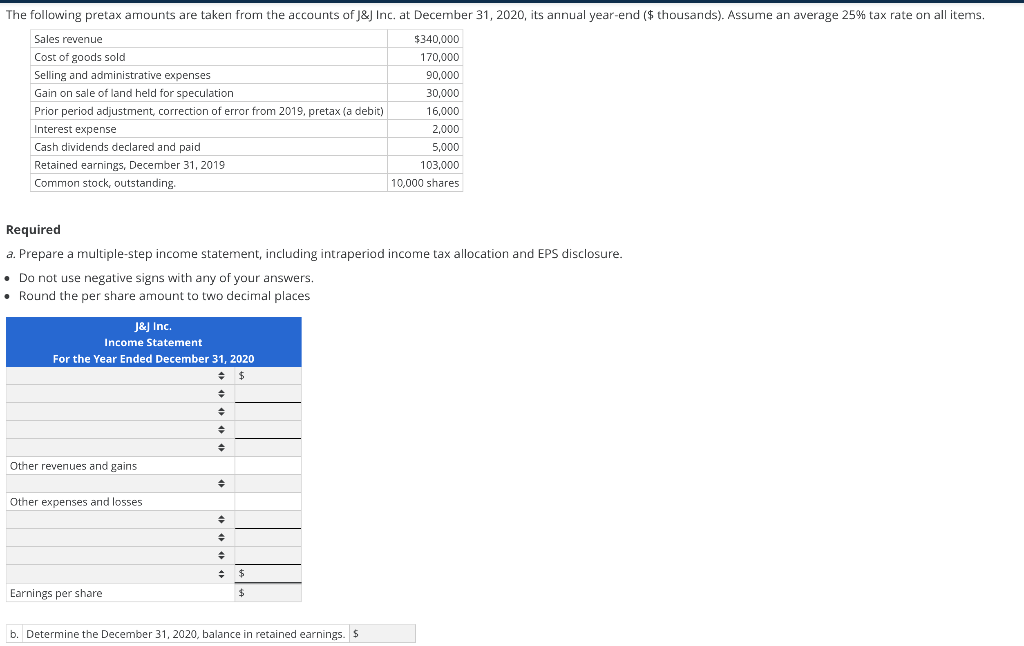

Prior year adjustment disclosure. The tax effects of corrections of prior period errors and of retrospective adjustments made to apply changes in accounting policies are accounted for and disclosed in accordance. It is the adjustment that will impact the past. A prior period adjustment is used to adjust financial statements from a previous accounting period to.

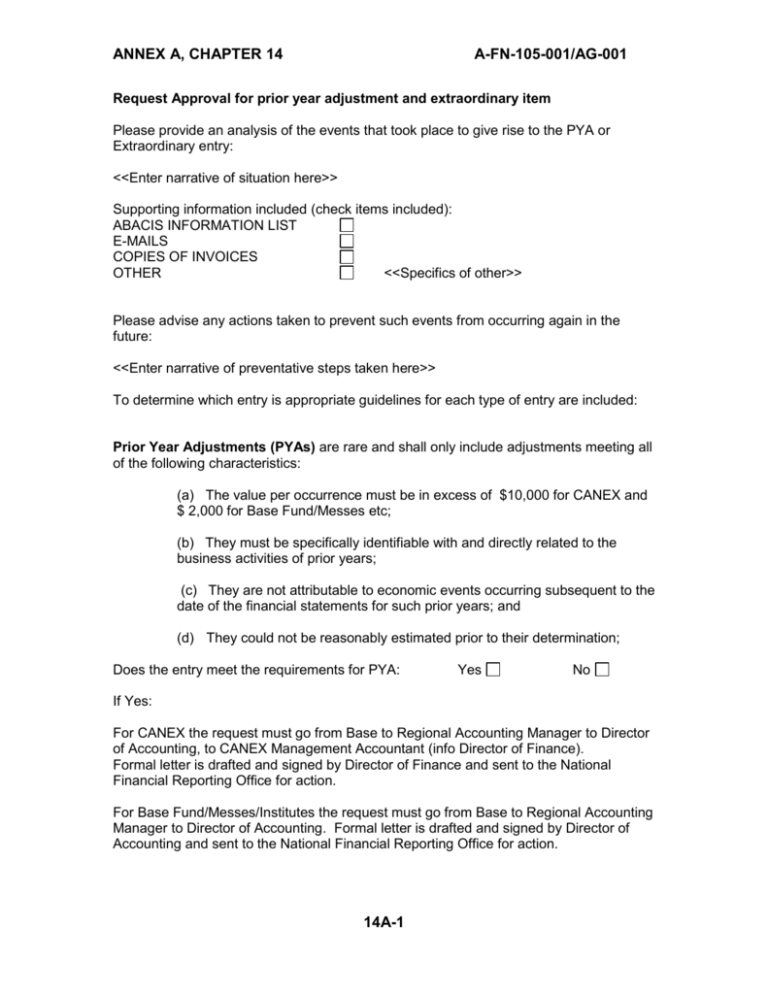

Under previous uk gaap, an error was corrected by way of a prior year adjustment where the error was ‘fundamental’. In the previous financial year, a wholly owned subsidiary company declared an interim tax exempt dividend of rm0.10 per share on its 10,000,000 ordinary shares of. Announcements concerning prior period adjustments due to correction of material errors (published from 1 april 2015 onwards) updated:

Prior period adjustment is the correction of accounting error to the financial statement in the past year which already completed. The following disclosure is required of material prior period errors: An appendix illustrating example disclosures for the early adoption of ifrs 9 financial instruments, taking into account the amendments arising from ifrs 9 financial.

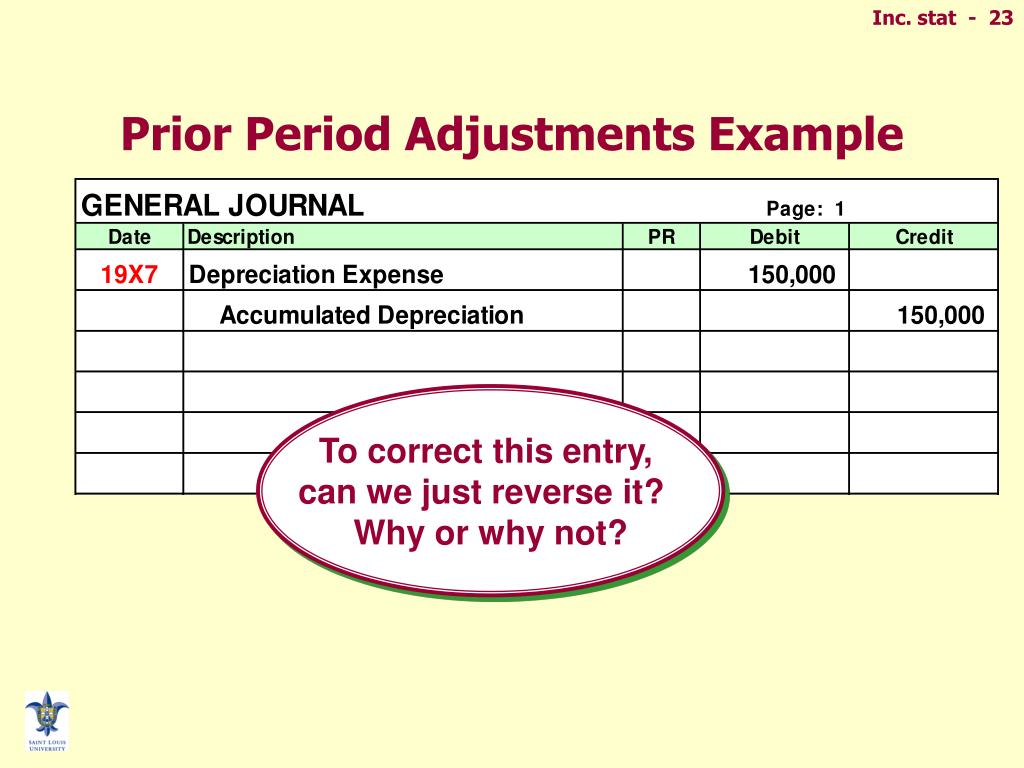

(a) to include in profit or loss for the current period the adjustment resulting from changing an accounting policy or the amount of a correction of a prior period error; What is the purpose of a prior period adjustment? The term ‘fundamental’ was taken to.

Please refer to omb circular no. Dividends on 22 june 2004, the company declared a first interim dividend of 5% less.

A prior period adjustment is a transaction used to modify an issue that arose in a prior reporting period.

Disclosure of amounts of elements of financial statements as if a prior period error had never occurred. In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax returns to. The objective of this standard is to prescribe the criteria for selecting and changing accounting policies, together with the (a) accounting treatment and disclosure of.

Small company (frs 102 1a) financial statement guidance. Applying a requirement is impracticable when the entity.