Underrated Ideas Of Tips About Prepare Common Size Balance Sheet

It is important to realize that the common size balance sheet is not required by accounting standards, and is used more as a management tool rather than a formal reporting.

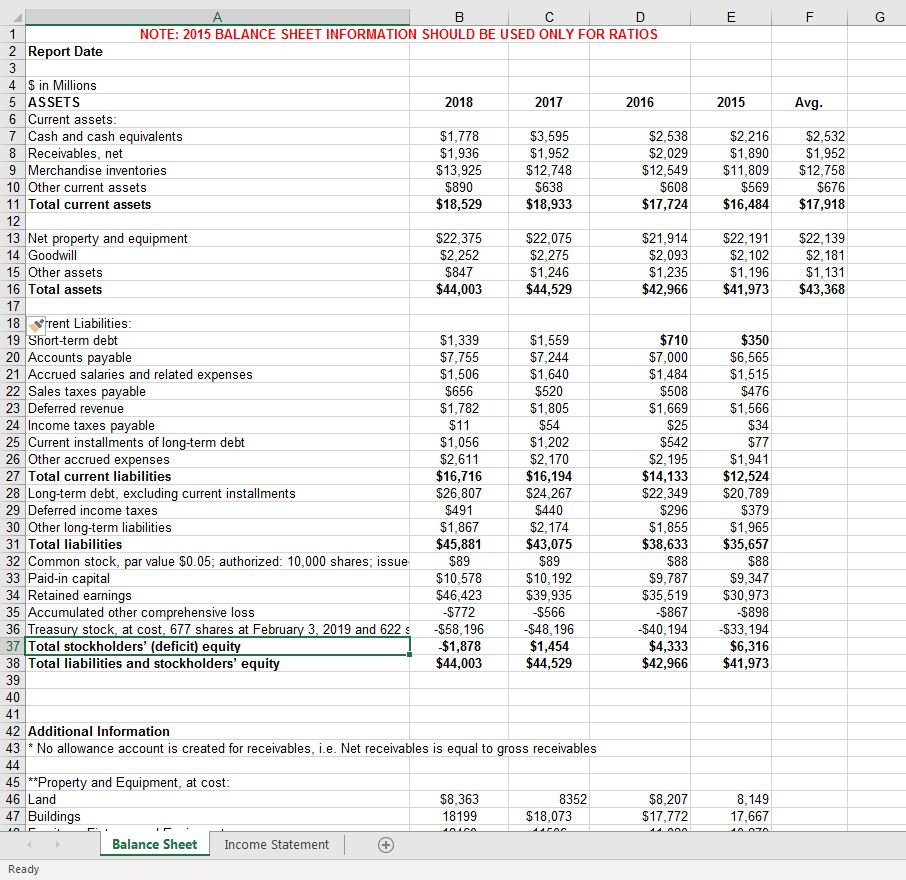

Prepare common size balance sheet. Top 10 essential excel formulas for analysts in 2024. 5.0 annual fee $0 read review learn more common size analysis formula accounting software will typically run a common size financial analysis for you, but it's still a good idea to. Example of common size balance sheet.

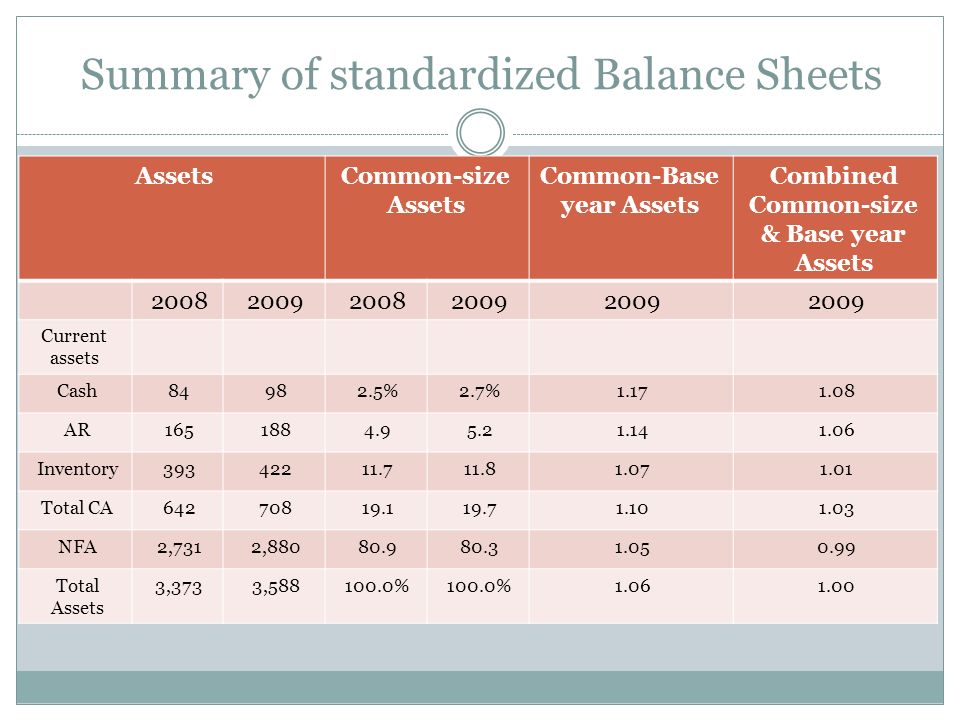

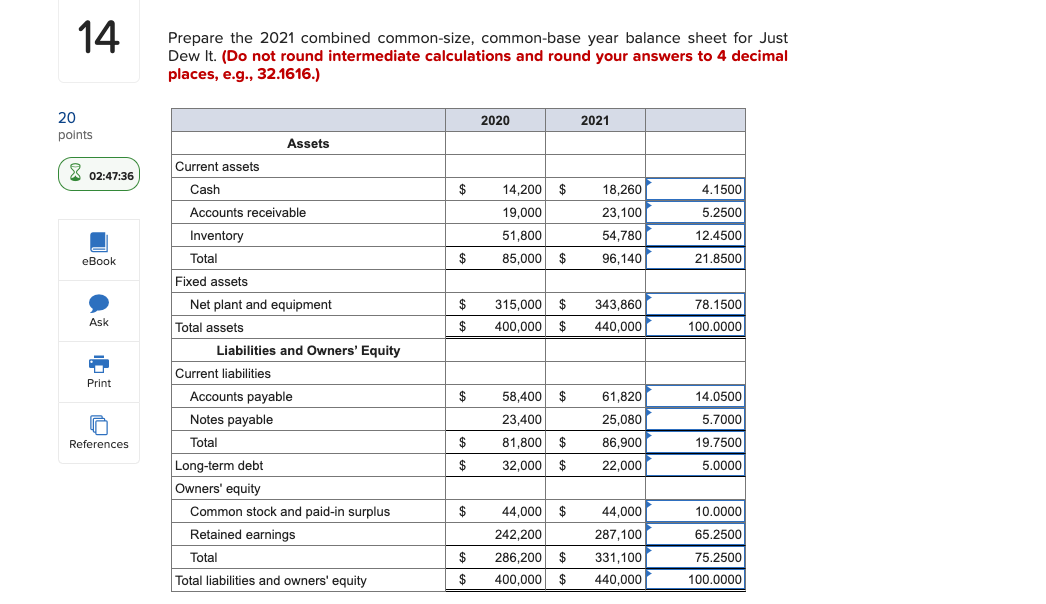

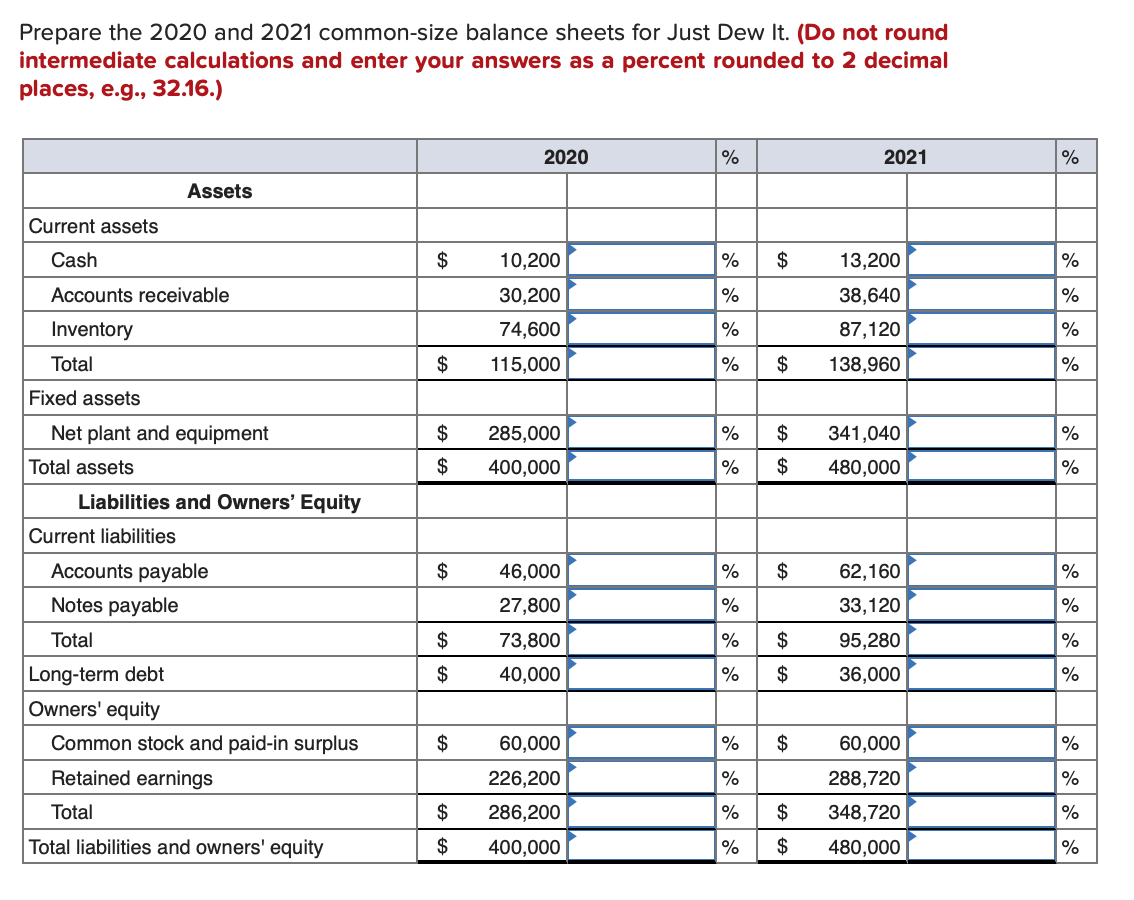

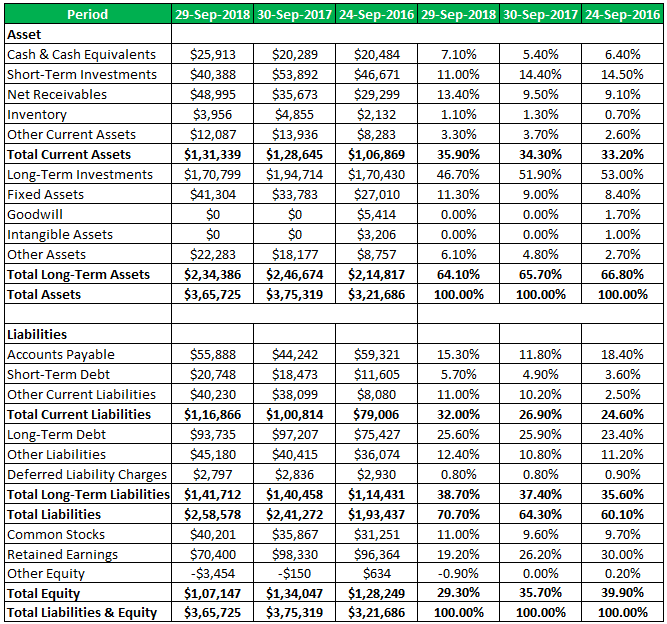

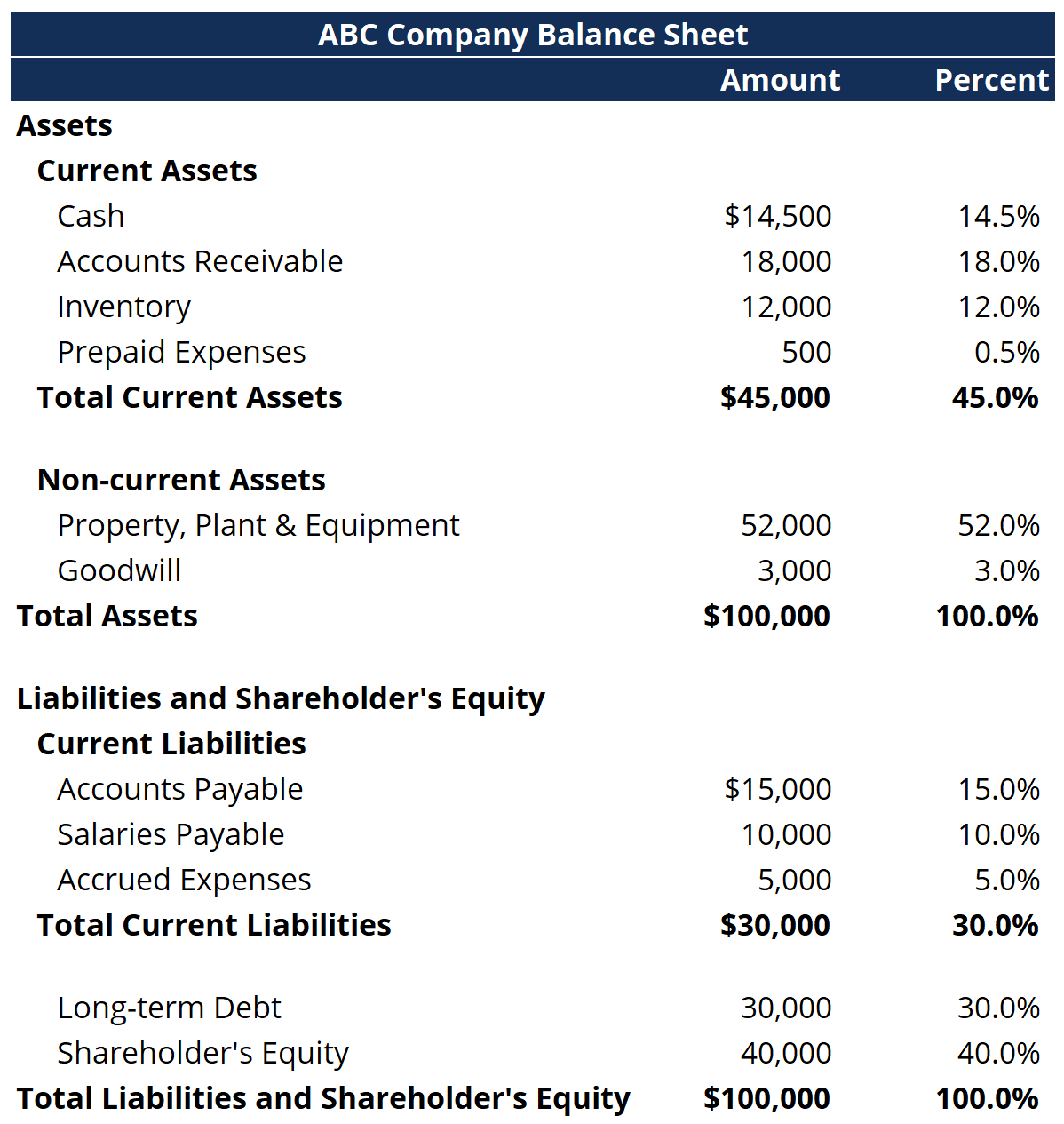

A common size balance sheet is one that has an additional column showing each monetary amount as a percentage of the total assets of the business. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Based on the accounting equation, this also equals total liabilities and shareholders’ equity, making either term.

Common size balance sheet is the balance sheet that prepares by management to show both values of each item in assets, liabilities, and equity in currency (usd) and percentages (%) at the end of the accounting period. Given against the line item is written. Common size analysis is a technique that is used to analyze and interpret the financial statements.

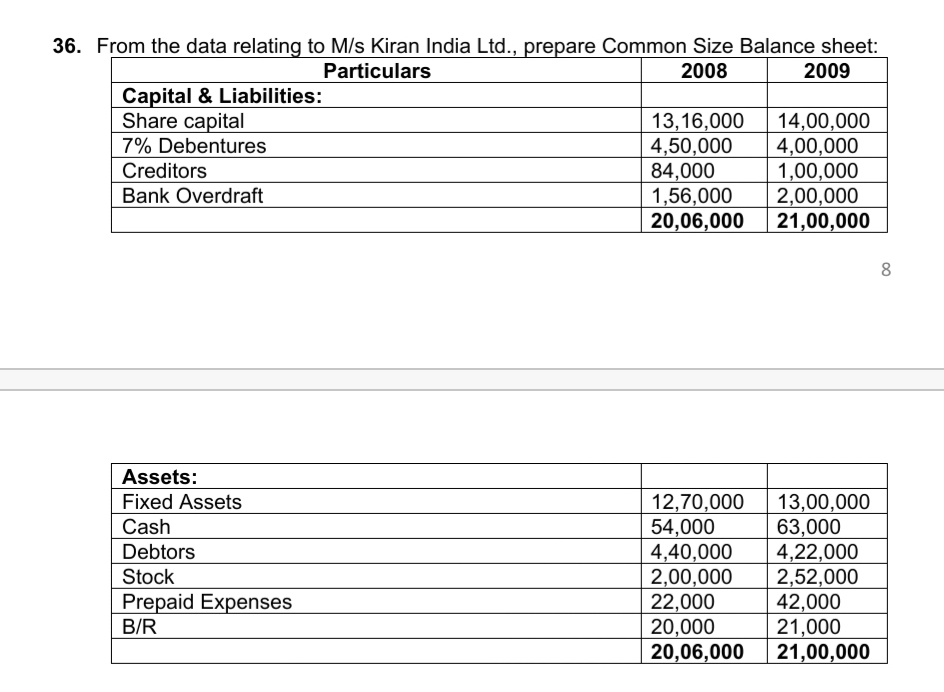

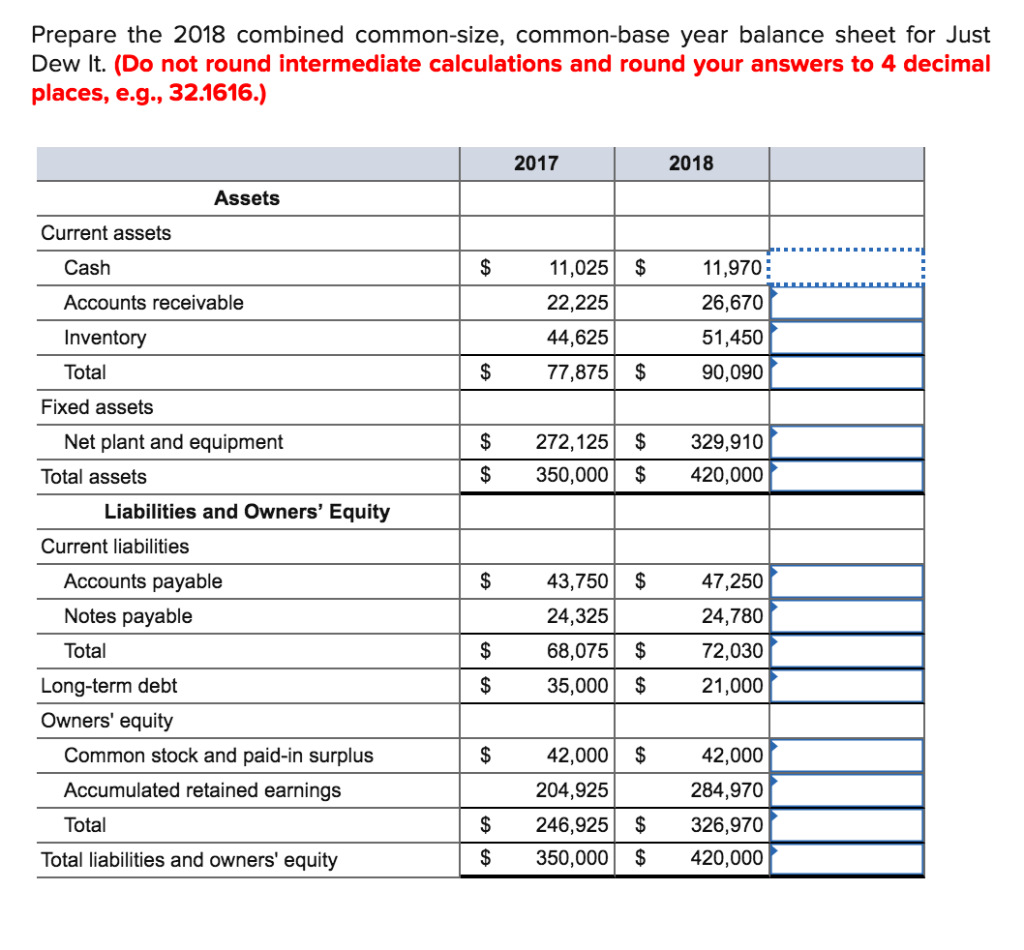

As at 31.03.2018 are given below : As at 31st march, 2018 and 2017, prepare a common size balance sheet: Common size balance sheet formula.

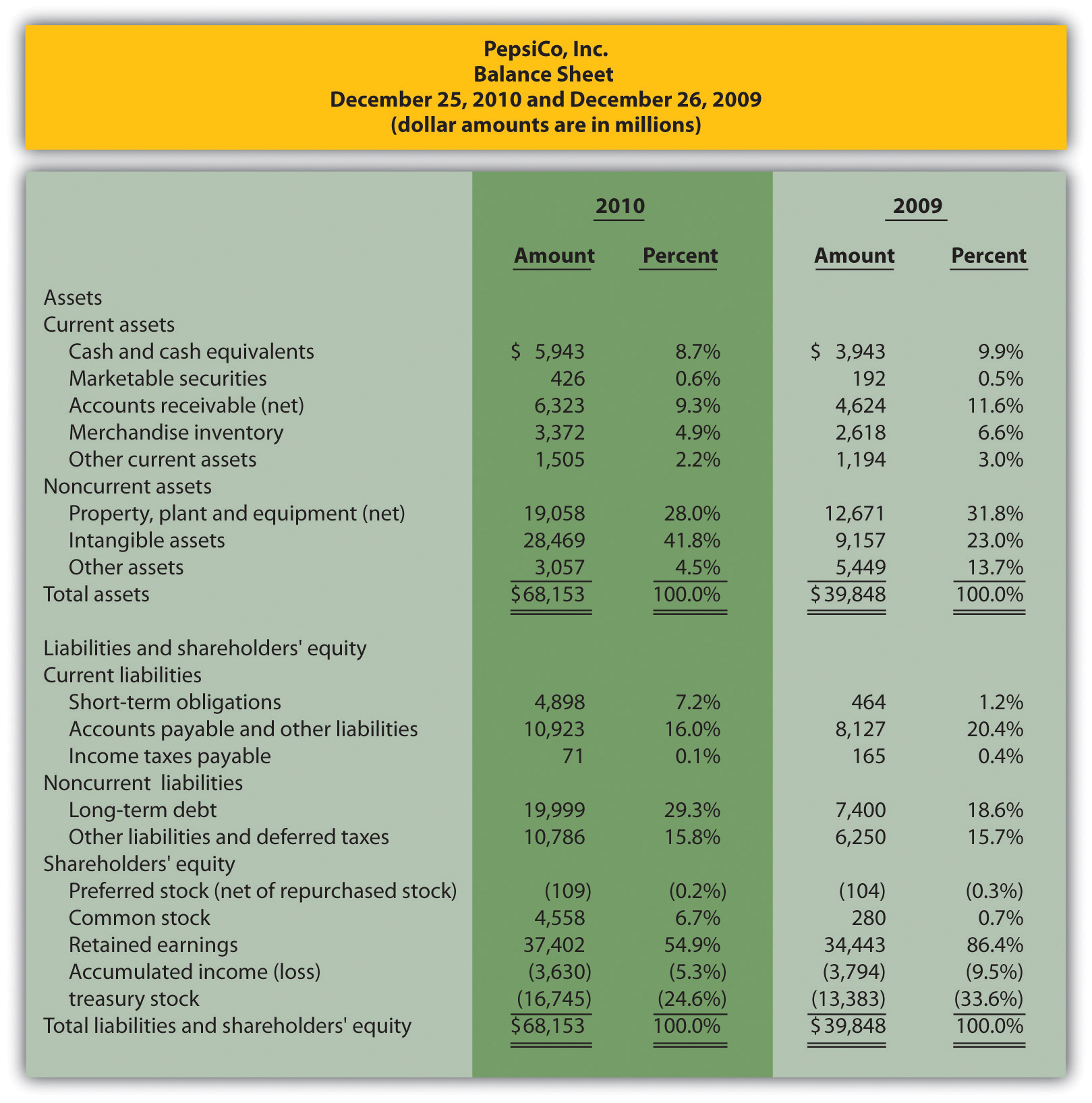

Prepare a common size balance sheet and comment on the financial position of g ltd. Assets are expressed as a percentage of total assets, liabilities as a percentage of total liabilities, and shareholder equity as a percentage of total shareholder equity. You can use it in financial analysis to compare the relative results of two or more companies.

Using this statement, users could quickly see the percentage of each item, cash or account receivable, compared to total assets. Advertisement solution common size balance sheet concept: Here is an example of how useful information is revealed by the common size balance sheets.

The formula for calculating a balance sheet into a common size balance sheet you must divide each line item by total assets. From the following balance sheet of vijay ltd. A common size balance sheet is a statement in which total of assets or equity and liabilities is assumed to be equal to 100 and all the figures are expressed as percentage of the total.

This type of analysis helps you see how revenue spending on different types of expenses changes from year to year. Each line item on the balance sheet is restated as a percentage of total assets. Key takeaways a common size financial statement displays entries as a percentage of a common base figure rather than as absolute numerical figures.

Common size balance sheet chapters00:00 introduction01:00 what is common size balance sheet02:00. The common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. The balance sheet of g ltd.

Each line item on the balance sheet is restated as a percentage of total assets. Summary common size analysis evaluates financial statements by expressing each line item as a percentage of a base amount for that period. In the first column, the items of the balance sheet are written.

![[Solved] Bethesda Mining Company reports the following ba](https://media.cheggcdn.com/media/5fc/5fc8058b-796b-40ea-8c85-4a806713ecac/phpWUfdW3)