Awesome Tips About Principles Of Financial Statements

The effect of accounting principles on financial statements now that you have been introduced to many of the underlying accounting principles and concepts, let's examine what they mean for a company's financial reporting.

Principles of financial statements. International accounting standard 1 presentation of financial statements. This chapter explains the relationship between financial statements. Katrina munichiello what are accounting principles?

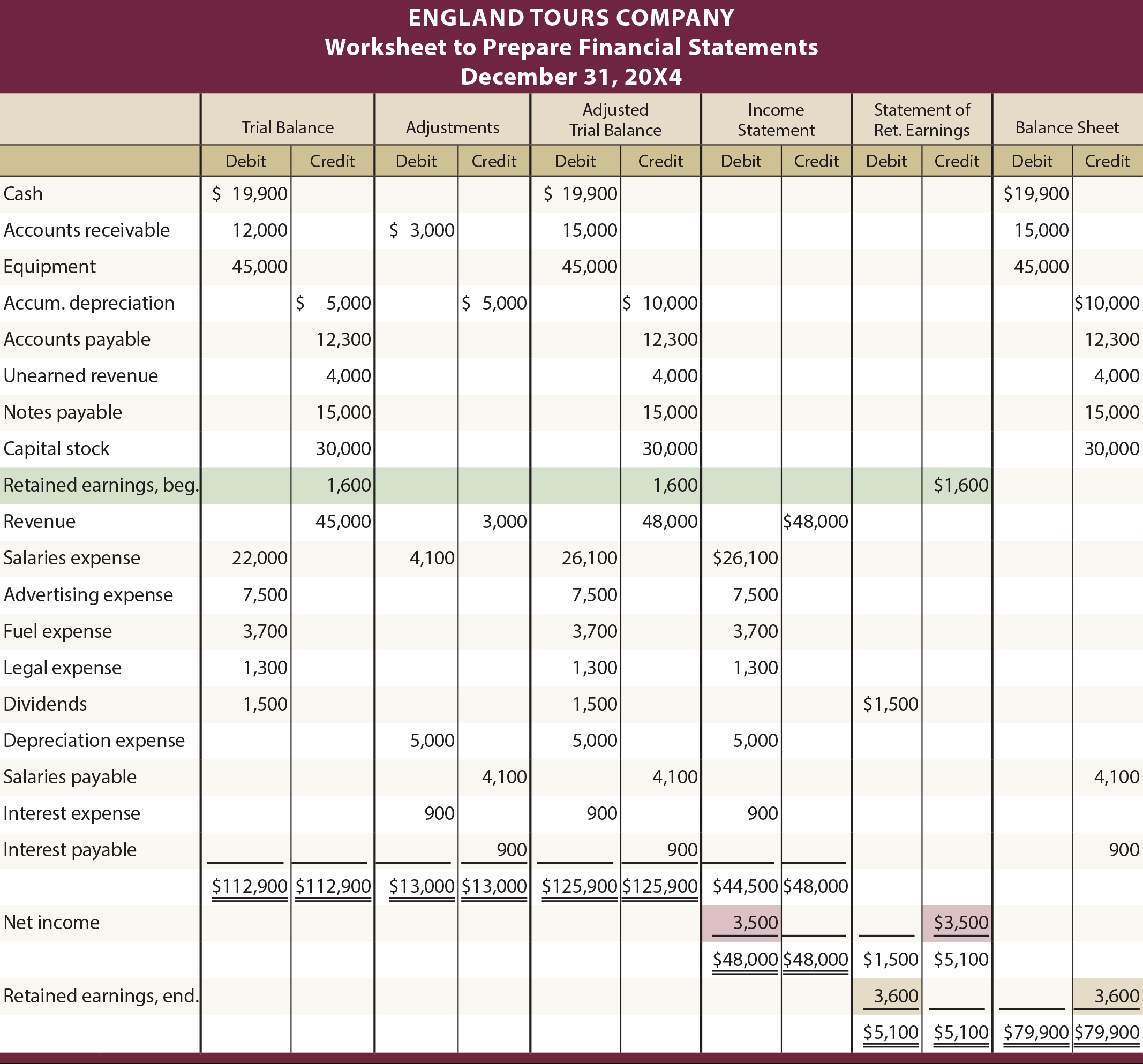

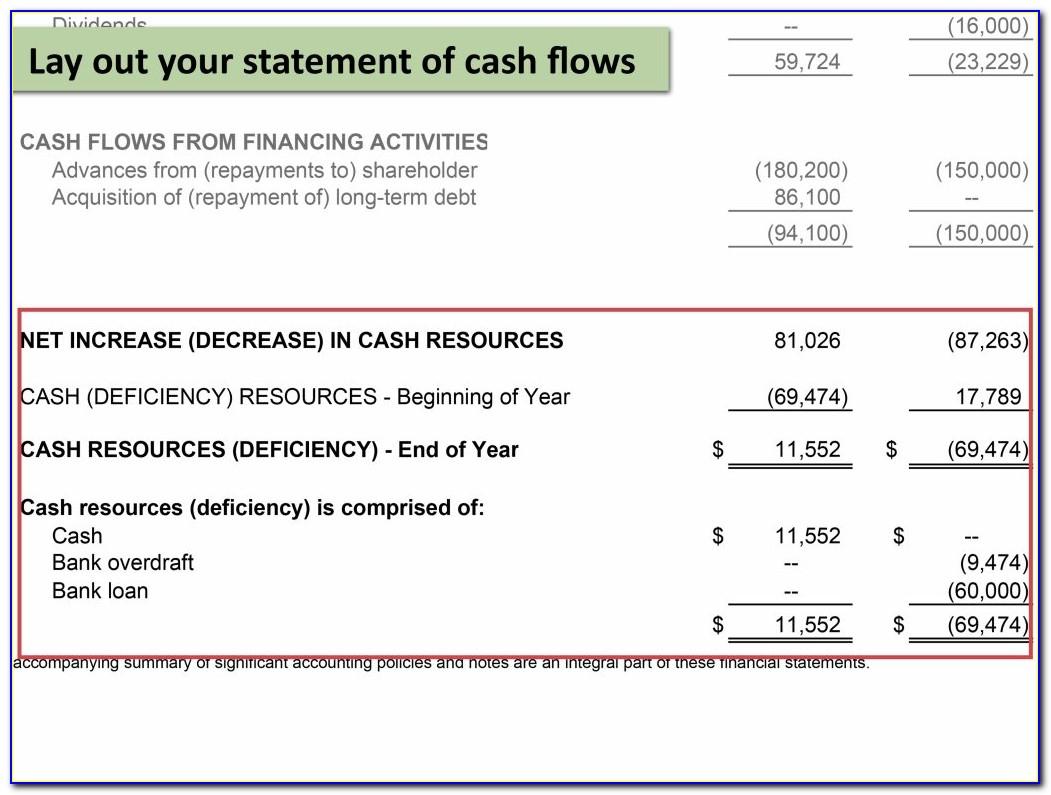

3.2 define and describe the expanded accounting equation and its relationship to analyzing transactions; Historical cost is often used in financial records; The balance sheet, the income statement, and the cash flow statement.

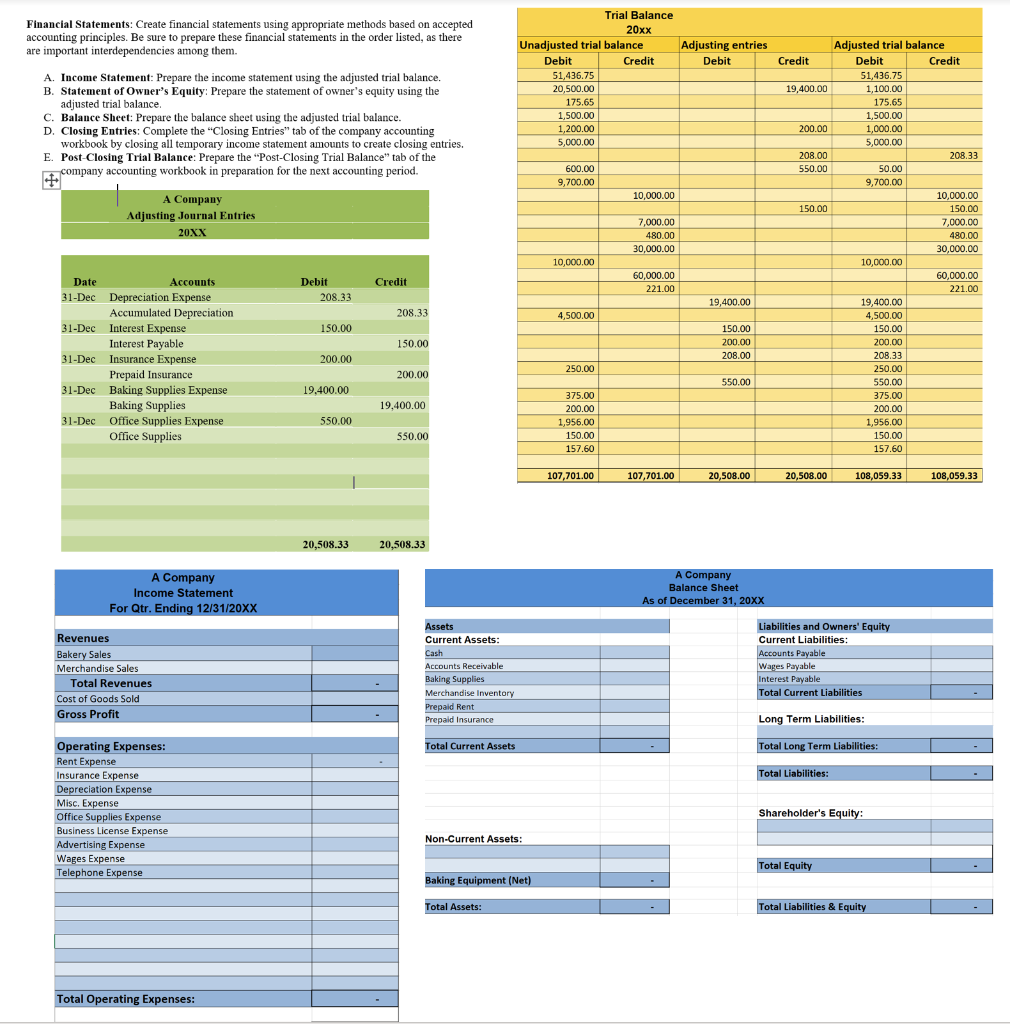

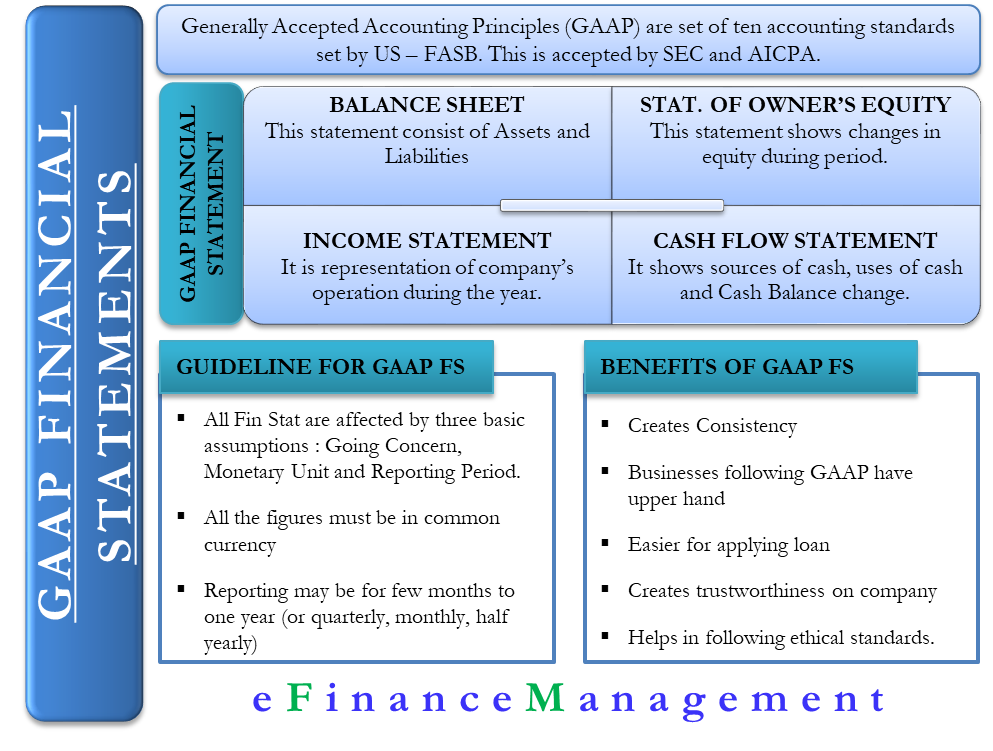

Statements required by generally accepted accounting principles are the balance sheet, the income statement, and the statement of cash flows, but you'll likely see more in reports. These statements are discussed in detail in introduction to financial statements. There are four financial statements:

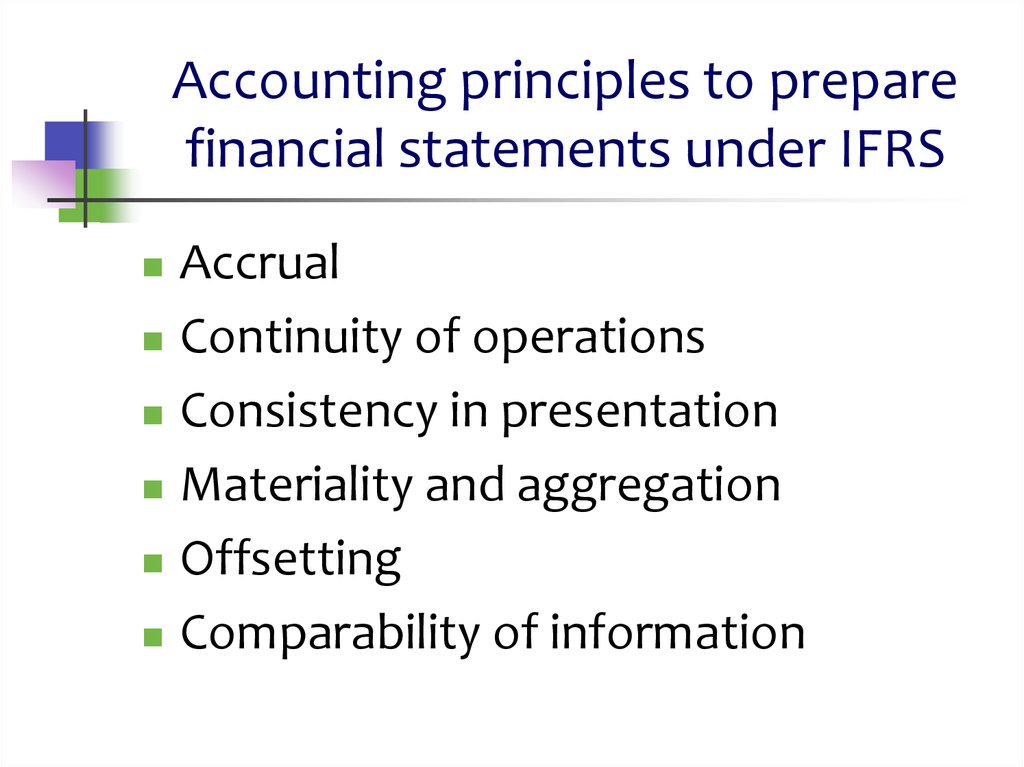

These principles require a company to create and maintain three main financial statements: Accounting principles are the rules and guidelines that companies and other bodies must follow when reporting financial data. The financial statements (eg revenue, finance cost, tax expense etc.) with the need for information that reflects a company’s specific circumstances.

It achieves this by setting out a series of principles for the presentation of financial information in ias 1. The main principles of financial statements are disclosing accounting policies and to judge the effectiveness of management. Five of these principles are the principle of regularity, the principle of consistency, the principle of sincerity, the principle of continuity and the principle of periodicity.

This standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities. In this essentials, we highlight two of the principles in ias 1: A set of financial statements includes the income statement, statement of owner’s equity, balance sheet, and statement of cash flows.

A company will look at one period (usually a year) and compare it to another period. Expenditures and liabilities are to be reported as soon as. 3.3 define and describe the initial steps in the accounting cycle

Unlock your true potential and transform your career with ms stem accounting. These principles should be followed to ensure that the documents are accurate, reasonable and provide useful information to the readers. Financial accountants balance the principles of relevance and faithful representation when selecting the basis.

Financial statements, such as the income statement, balance sheet, and cash flow statement, provide a comprehensive view of a company’s financial health. Gaap covers such topics as. Financial statements provide financial information to stakeholders to help them in making decisions.

Understanding gaap gaap is a combination of authoritative standards set by policy boards and the commonly accepted ways of recording and reporting accounting information. Cash flow cash flow —the broad term for the net balance of money moving into and out of a business at a specific point in time—is a key financial principle to understand. 3.1 describe principles, assumptions, and concepts of accounting and their relationship to financial statements;

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)