Spectacular Info About Pro Forma Balance Sheet Meaning

A balance sheet containing imaginary accounts or figures for illustrative purposes.

Pro forma balance sheet meaning. 4 based on the pro forma balance sheet as at 30 september 2023 including the terra insights and cyanco acquisitions and the placement; Key takeaways pro forma financial statements illustrate how a company’s financial position might change in the future. As in, “what if my business got a $50,000 loan next year?”

In terms of section 3.4(b) of the jse listings requirements, the group guided that it expected its earnings, headline earnings and pro forma headline earnings for the financial year ending 25. Helping potential investors calculate their potential return on. We are pleased to present this publication, pro forma financial information:

June 14, 2022 | chelsie kugler | bookkeeping | strategy. Whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions. Pro forma statements look like regular statements, except they’re based on what ifs, not real financial results.

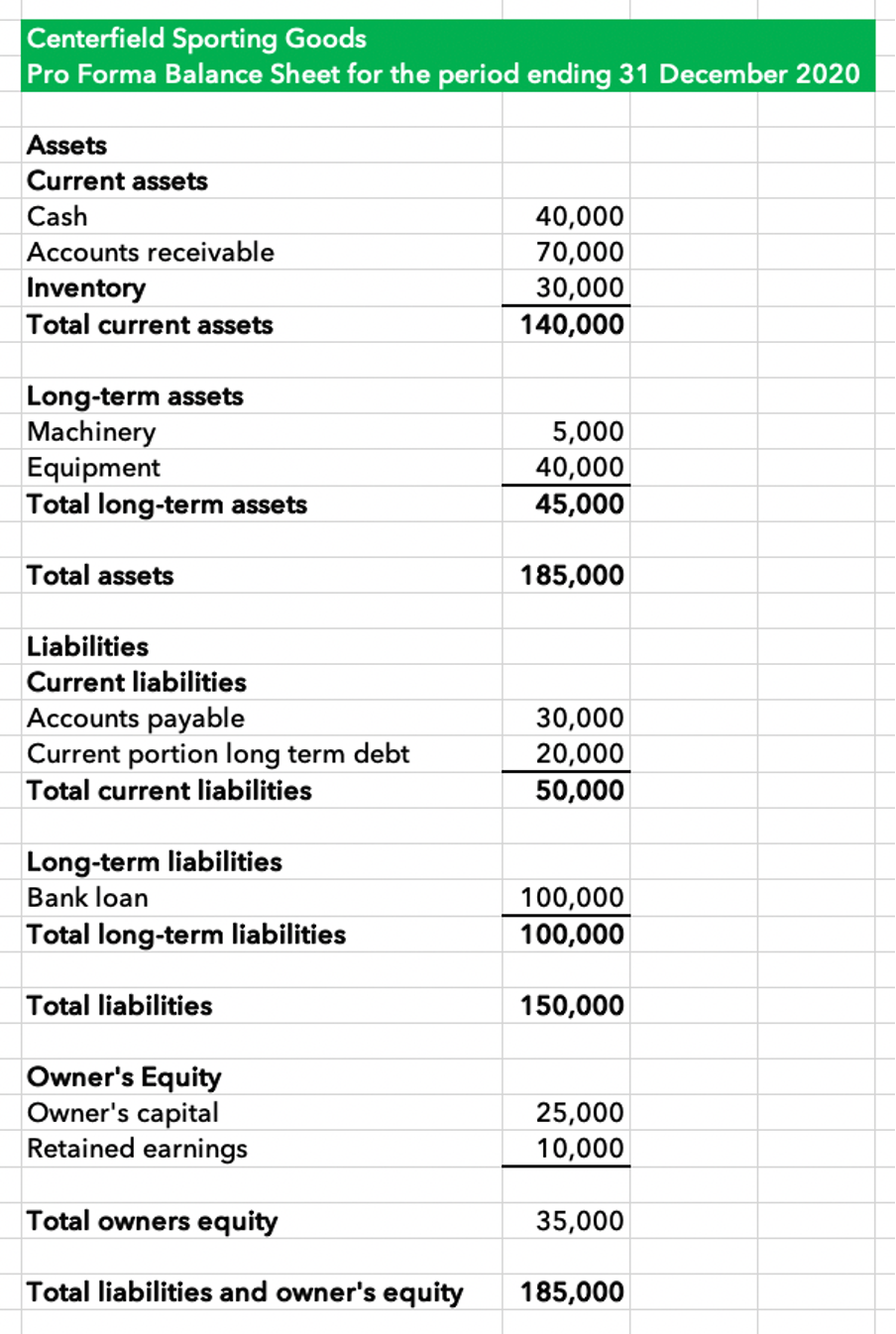

The claimed rationale should include the current income and the general schedule that follows the bill payment. It lists out your future assets, liabilities, and stockholders’ equity in the same format as your historical balance sheet. Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions.

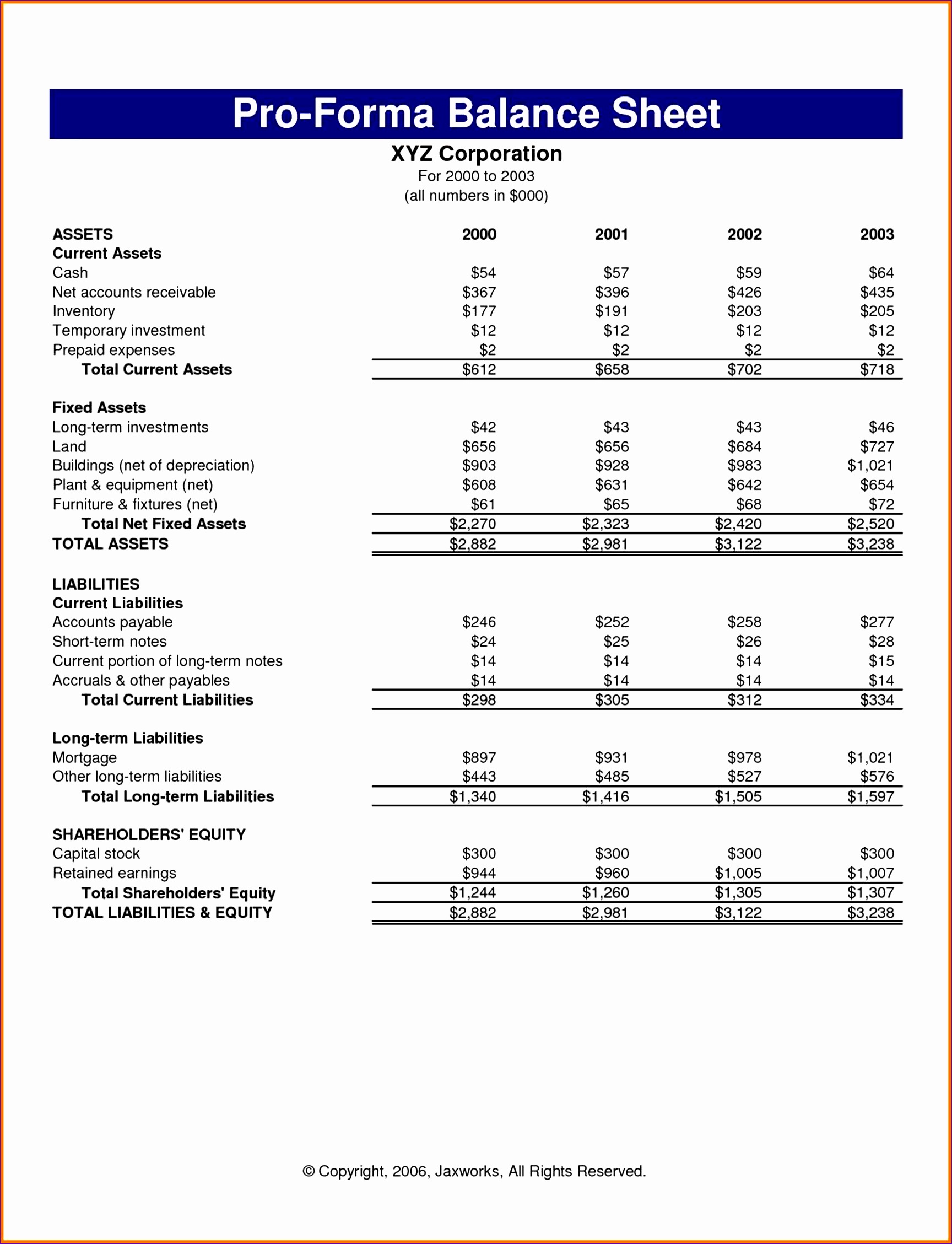

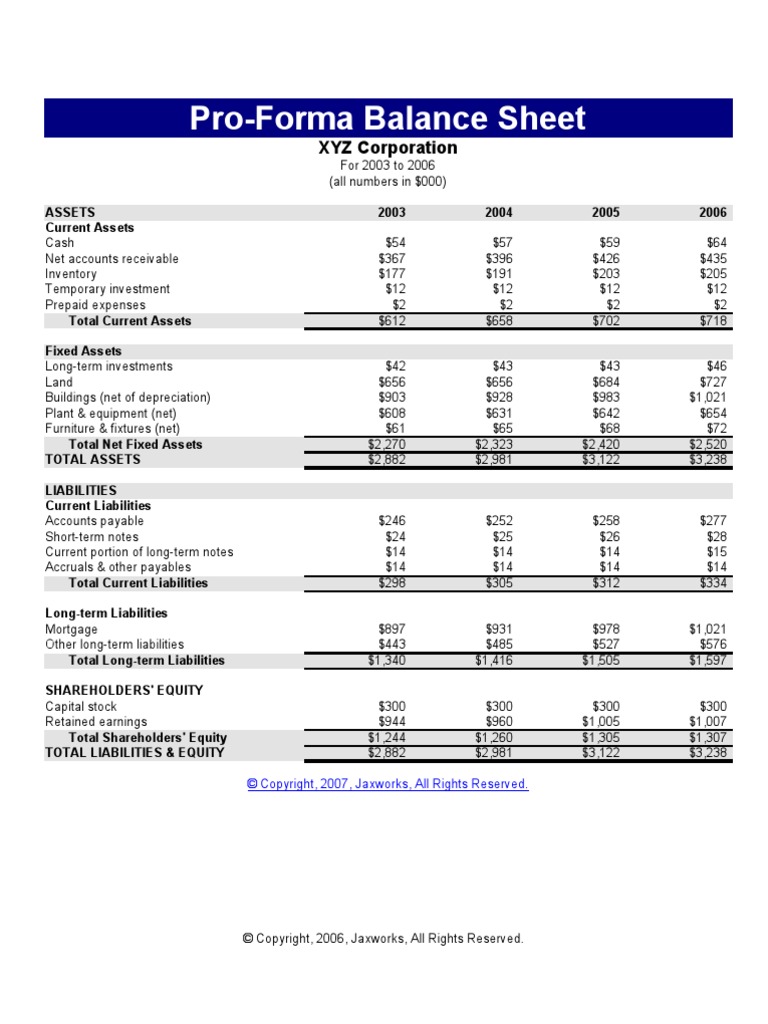

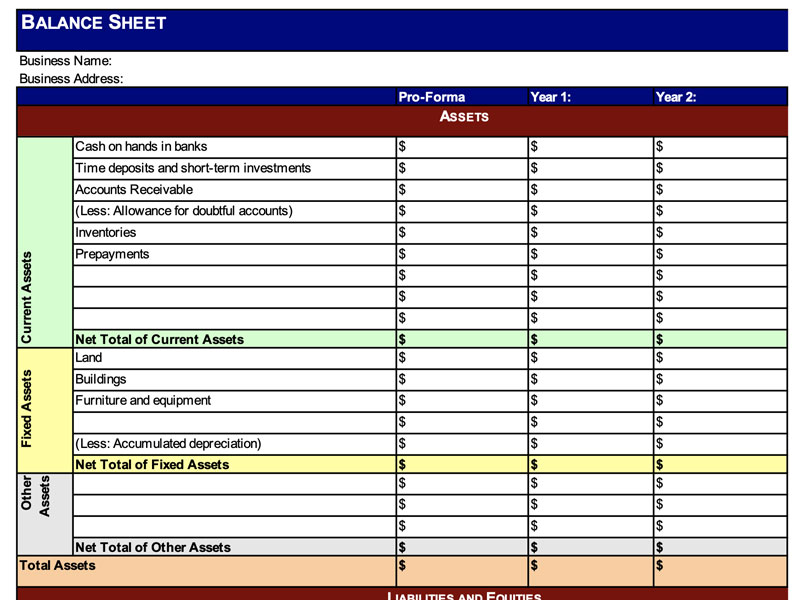

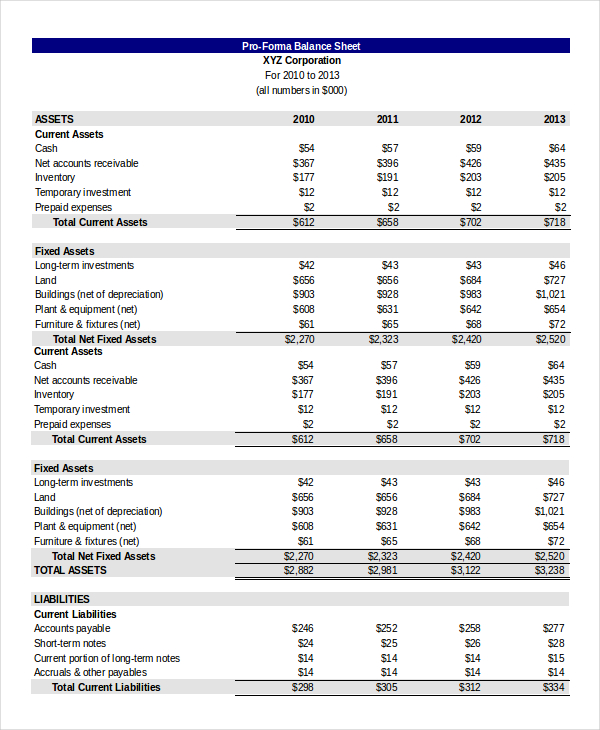

Together, the documents help you assess whether your business’s. A pro forma balance sheet is a financial statement that details a business's estimated balance sheet at a given future date. They can be constructed using percentage changes from the previous year.

The most common pro forma financial statements are projected balance sheets, income statements, and cash flow statements. Pro forma balance sheets. For business owners, the term pro forma means “what if”.

A balance sheet that gives retroactive effect to new financing, combination, or other change in the status of a business concern or concerns. Pro forma balance sheets provide a look into a company's future. Hence they should be an integral part of any business plan.

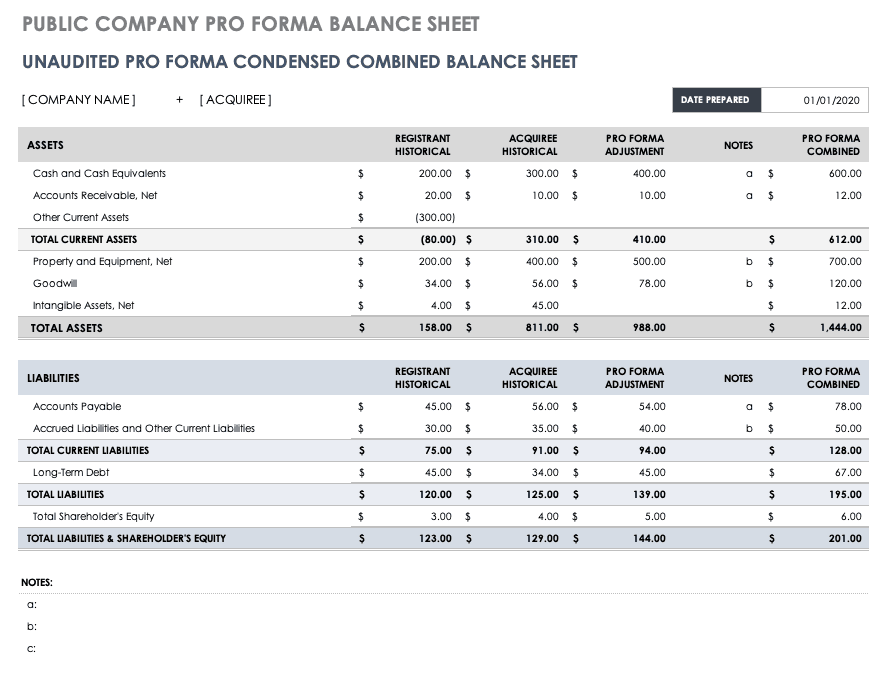

Pro forma cash flow statements; Helping management teams manage and plan the organization's future assets. Pro forma financial information (pro formas) presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an earlier time.

The pro forma part of the balance sheet is a projection that looks ahead, assuming certain things will occur. For example, a pro forma balance sheet can quickly show the projected relative amount of money tied up in receivables, inventory, and equipment. Pro forma is a latin term that roughly translates to “as a matter of form,” and is most often used to describe a document that is based on financial assumptions or projections, such as a pro forma balance sheet.

Pro forma financials may not be. It is helpful in a variety of circumstances and, by providing a projection of future company assets, liabilities and equity, allows people to assess the health of a business. When it comes to accounting, pro forma statements are financial reports for your business based on hypothetical scenarios.