Formidable Info About Debit To P&l

However, it is possible (and also partly recommended) that a p&l account is carried out more than once over the course of an ongoing financial year.

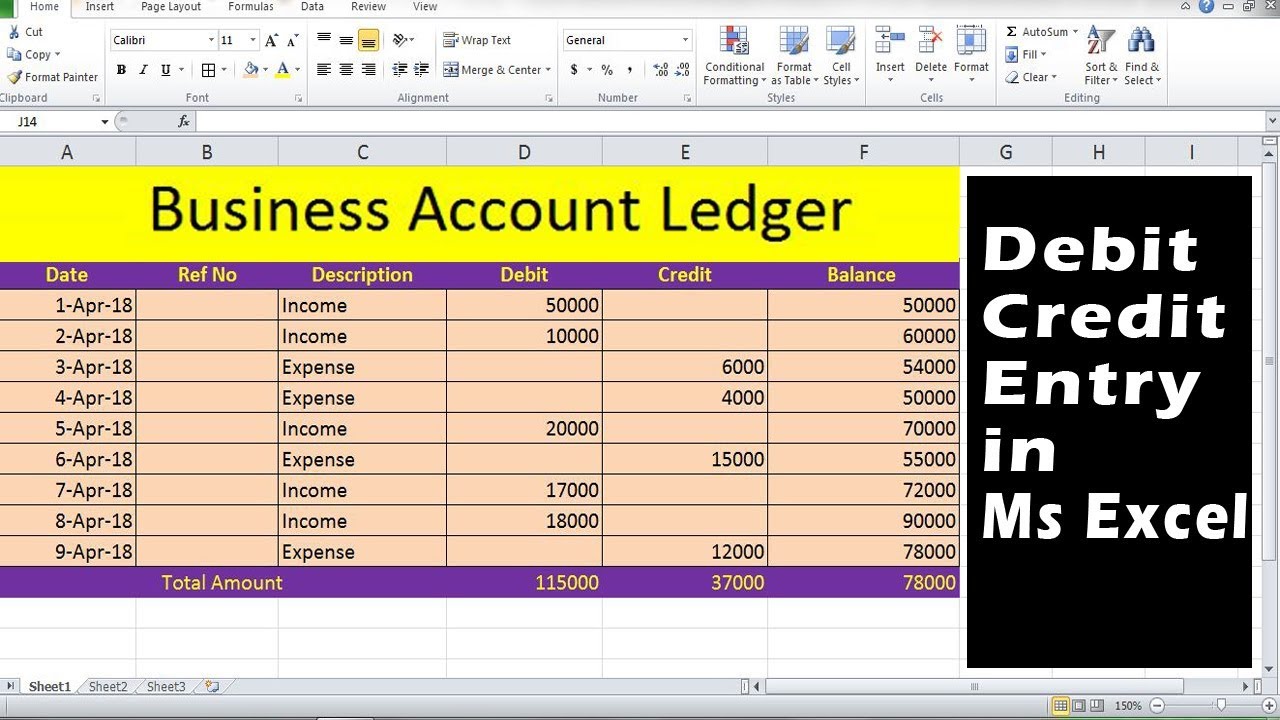

Debit to p&l. Debit balance of profit and loss account there are two sides to accounting: A profit and loss (p&l) report is a critical piece of information for a company that states whether a company is profitable. The p&l report lists revenue, expenses and other information to provide insight into the company's performance.

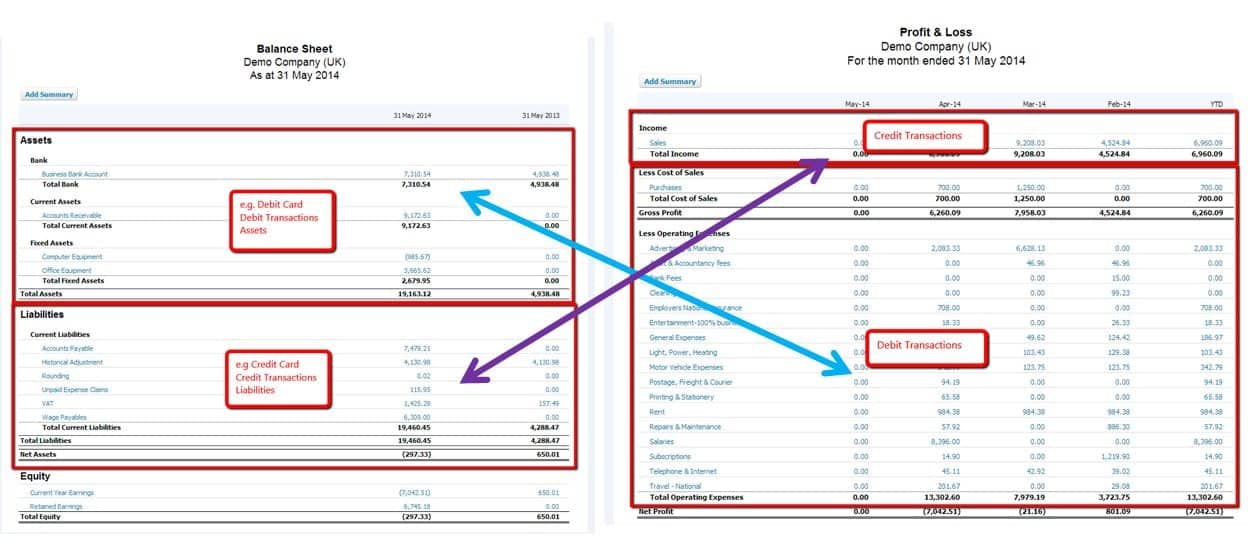

If a company prepares its balance sheet in the account form, it means that the assets are presented on the left side or debit side. January 25, 2022 a profit and loss statement (p&l) is an effective tool for managing your business. (incorporated as a public limited company in england and wales under the companies act 1948 with registered number 1290444).

23 of the uk prospectus regulation and is prepared in connection with the u.s.$40,000,000,000 debt issuance programme (the programme) established by bp. This report helps you understand what’s behind a company’s profitability by categorizing revenues and expenses. Debits/credits, p&l, assets/liabilities equity accounting, financial metrics dave ahern june 27, 2023 equity accounting, financial metrics updated 8/7/2023 recently, berkshire hathaway earned $81.4 billion in 2019, a 1,900% increase from the year before!

The p&l statement forms part of an annual financial account and must be recreated each financial year. The liabilities and owner's equity (or stockholders' equity) are presented on the right side or credit side. It gives you a financial snapshot of how much money you’re making (or losing) and can make accurate projections about your business’s future.

The p&l account is a component of final accounts. The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. How to read a profit and loss statement

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The p&l statement is one of three financial. (p&l or pl or pnl).

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. What is the profit and loss statement (p&l)? This is because we gain money, and in accounting terms, this is credit.

A profit and loss account is a primary financial statement, also known as an income statement, statement of profit or loss or statement of operations. Devising a profit and loss (p&l) statement has evolved, blending traditional accounting practices with modern tools for efficiency and accuracy. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

The two others are the balance sheet and the cash flow statement. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. A p&l statement, also known as an “income statement,” is a financial statement that details income and expenses over a specific period.

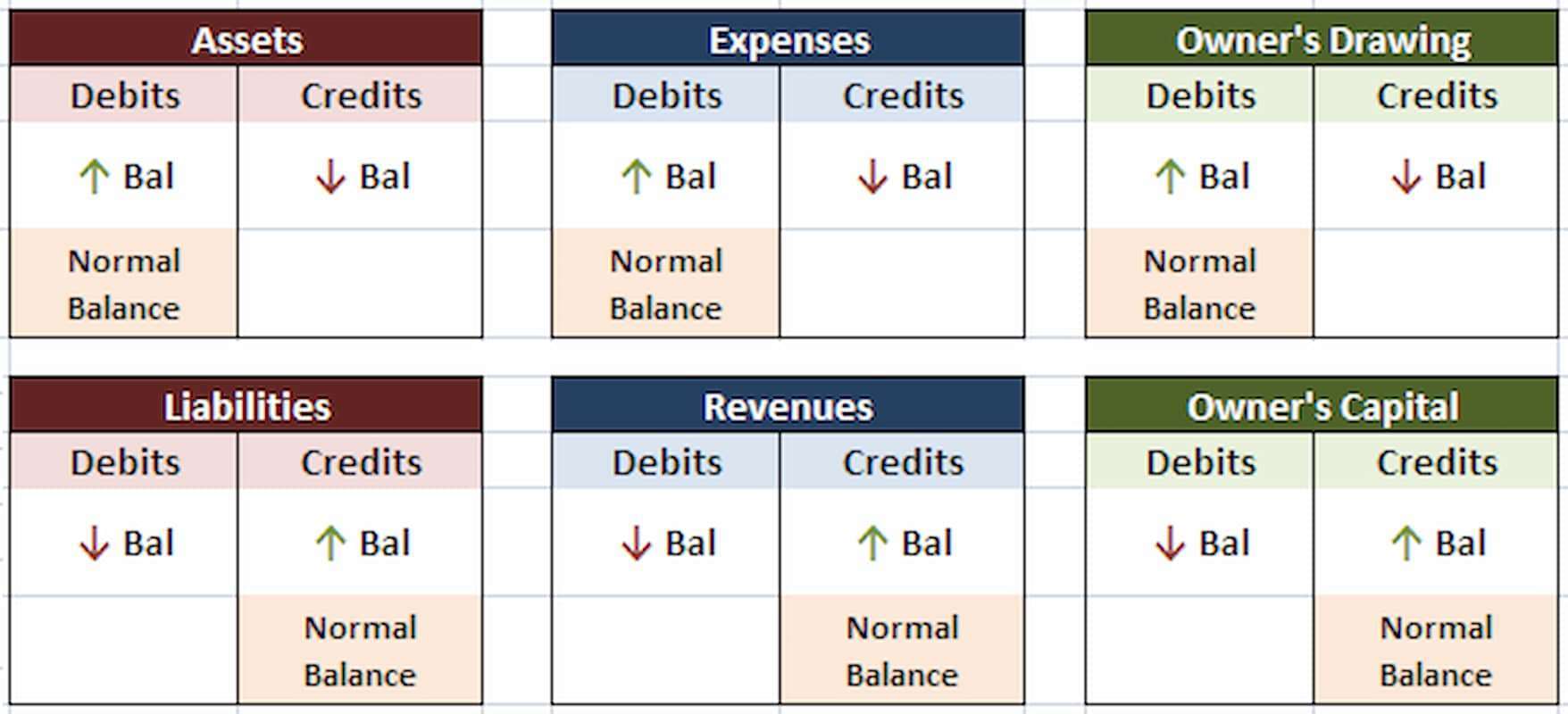

In fundamental accounting, debits are balanced by. The credit side of p&l a/c represents income, and the debit side represents expenditure. What are the terms usually appear on the debit and credit side of a profit and loss account?

.png)